New here? Read up on our past Real Estate issues to get the most from this post.

HIGHLIGHTS:

- What’s going on with real estate in Europe?

- A short-term farmland investment, yielding 7%.

- A solid SFH in Cleveland, yielding 9.4%.

Let’s go!

Table of Contents

Real Estate in 2022

We’ve written about the US residential (and commercial) real estate sector a lot, maybe even too much. So, for a change, let’s take a look at what the market is doing across the pond:

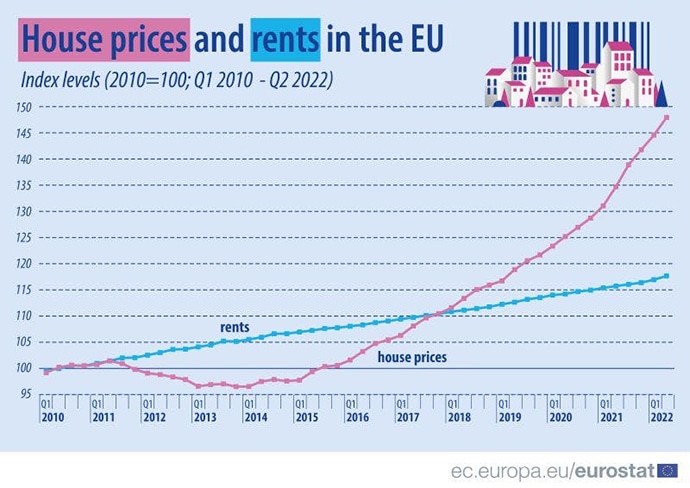

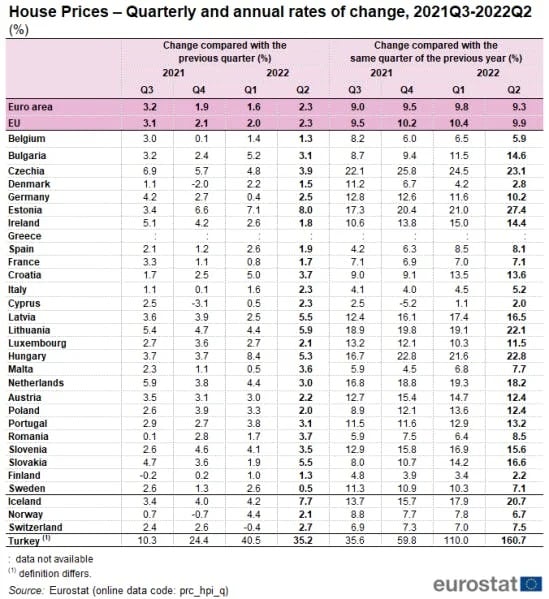

House prices are currently up by 9.3% in the euro region and up by 9.9% in the European Union in Q2 of 2022, compared to Q2 of 2021.

Home prices have blown through rental parity over the last ten years, and it feels ripe for a steep correction.

That smooth rise covers up a lot of variances, though. Some markets in Europe have been hotter than others, and it doesn’t factor in inflation.

Some, like Turkey , have suffered insane inflation in 2022, which is fudging the data.

While Turkey is the most egregious example at 85.5% annual inflation, other seeming high-flyers are getting an inflation bump as well:

- Estonia — 22.5%

- Czech Republic — 15.1%

- Lithuania — 23.6%

- Hungary — 21.1%

All real estate is local, especially when you’ve got different currencies, markets, central banks, and governments at play.

Opportunities this week

We’ve got two new opportunities for you to feast on this week as you recover from your annual Thanksgiving food coma (if you celebrated, of course):

AcreTrader

Offering at a Glance

- Name: Stockton Farm

- Platform: AcreTrader

- Available: 29 November 2022, 2pm ET

- Location: San Joaquin County, CA

- Crop type: Alfalfa

- Gross cash yield: 8.08%

- Term: 6 – 12 months

- Farm price: $4,304,792

- Total acres: 241.3 (216 tillable acres)

- Price per acre: $17,840

- Min. investment: $19,624

- Average net cash yield (after operating exp.): 7.0%

- Net annual return: 7.0%

Stockton Farm is a 241-acre alfalfa, wheat, and tomato farm in San Joaquin County, California. The farm has strong water rights (allows the owner to divert as much water as can be beneficially used on the land) and is located in a fertile agricultural region.

This offering is different from the traditional AcreTrader offerings in a couple of key points:

- Stockton Farm was an off-market opportunity identified by Delta Farm Management (DFM). AcreTrader has worked with DFM on previous almond farm offerings in the same geographic area.

- This investment opportunity is short-term (6 to 12 months) as opposed to the typical 3 to 5-year AcreTrader holding period. DFC is using the AcreTrader funds to have AcreTrader buy the farm now, but DFM will work to obtain long-term financing. Once DFC secures financing, they plan to buy the farm from AcreTrader and convert it to almond producing.

- In the interim, winter wheat will be planted on the acreage. The cash yield of 7% is higher than the typical AcreTrader cash yield of approx. 3%, since DFM will be charged higher market rental rates. Rental distributions are expected to start in June 2023.

This investment opportunity can be considered a bridge loan for DFM with a 7% interest rate. Investors in this offering will not participate in any appreciation of the land’s value since the farm will be sold to DFM at the AcreTrader offering amount ($4,304,792). DFM has a Lease Purchase Price option that they can exercise after a minimum of 6 months.

The risk here is if DFM isn’t able to obtain long-term financing (or obtain it on reasonable terms) and isn’t able to exercise the purchase option. In this scenario, the farm could continue to produce alfalfa, wheat, and tomatoes, but the lease would likely be modified to reduce the annual rental rate and allow investors to participate in land price appreciation.

Lofty.AI

Offering at a glance

- Name: 1315 E 114th St, Cleveland, OH 44106

- Platform: Lofty.AI

- Buy in: $117k

- Minimum investment: $50

- CoC: 9.4%

Lofty bought this home for $92,319 and is holding back a little over $17k in reserve. Realtor.com values the home at $89k.

Sensibly, Lofty is only forecasting 2% appreciation over the lifetime of the investment. It last sold two years ago for $83,500, so 2% per annum is probably about right.

It’s in a rough neighbourhood (even by Cleveland’s standards). Local schools are below average, and crime is higher here than in 86% of the other blocks in Cuyahoga county.

Lofty thinks they can get $1,275 a month for the home, but there may be room to the upside. Comehome.com thinks $1,409 is achievable, which would push cash on cash to nearly 11%.

That’s all for this week.

Have you seen a real estate deal, fund, or opportunity you’d like to share with the community?

Cheers,

Wyatt