Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

TLDR:

- More rate hikes to come (probably).

- Why has search volume for “Chinese economy” gone up 82% over the last week?

- Mortgage rates touch a new high not seen for over two decades.

- SPACs are back, but they’re still terrible.

- Things keep getting worse for Binance.

Like these emails? Support our sponsors!

Wyatt

Table of Contents

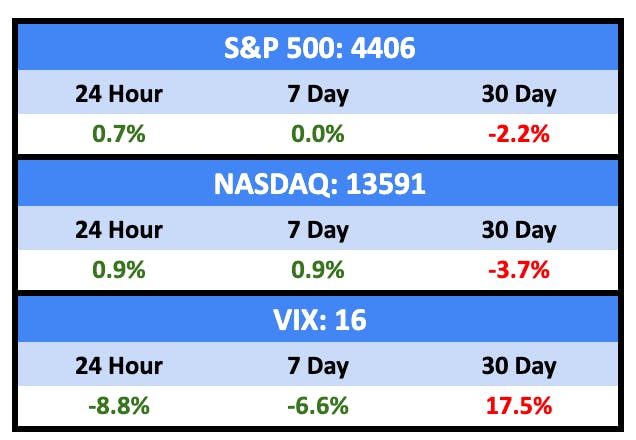

Macro View

It looks like rate hikes aren’t done, but we’re probably getting close.

Bullish News

- Lotta bad news that’s good news for rate cuts:

- Forecasts show a September pause for European rates.

- It looks like Q1 US payrolls were actually 306,000 lower than previously estimated.

- Salary inflation is retreating.

Bearish News

- Fed Chair Jerome Powell indicated more rate hikes may be necessary.

- S&P downgraded a bunch of banks

Forecasts

📈

59%

Chance of Fed rate hike in 2023

📈

3.23%

↔️

3%

Chance of a US recession in 2023

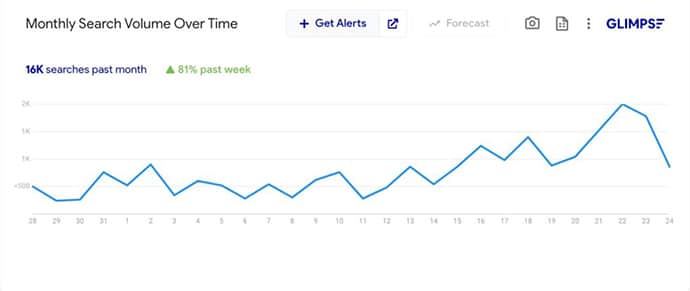

What’s up with China?

This won’t be a regular Alts Cafe feature, but chatter about the Chinese economy is increasing, and it’s worth keeping an eye on — as much as is possible with a country that’s not always super transparent.

The Economist led with this last week:

How bad is it? Our cover this week tackles this important—and much debated—question about China’s economy. Our leader argues that things are very bad indeed. The blame lies with Xi Jinping and China’s increasingly autocratic government. Mr Xi’s centralisation of power and his replacement of technocrats with loyalists is leading to damaging policy failures, not least a feeble response to tumbling growth and inflation. This week my colleagues provide detailed coverage on the consequences inside China and for the rest of the world.

A couple other stories that caught my eye this week:

- China cut its one-year benchmark lending rate on Monday as authorities seek to ramp up efforts to stimulate credit demand.

- China is considering stronger action to address risks from local government financing vehicles, with Caixin reporting on a plan to give the businesses cheap funding as debt concerns mount.

- China is escalating its defense of the yuan, pushing up funding costs in the offshore market to squeeze short positions and setting a new record with its stronger-than-expected reference rate for the currency.

- China’s biggest developer, Country Garden, will be removed from the Hang Seng Index. Shares of Country Garden have plunged over 70% so far this year, hitting record lows

- after the company failed to meet bond coupon payments, issued a profit warning and

- suspended trading in 11 of its onshore bonds.China’s population declined for the first time in decades in 2022.

Could this be a case of slowly then all at once?

What are we doing?

ALTS 1 Fund news:

Nothing here

Real Estate

Bullish News

- California and New York finance firms are moving south. Bullish for southern high-end real estate, bearish for CA and NY.

- Foot traffic in top-tier malls was up by 12% in 2022 compared to 2019. Occupancy is 95%.

- And traffic in lower-tier malls was up 10% with 89% occupancy.

- 92% occupancy is considered very good.

Bearish News

- Mortgage rates hit their highest level since 2000, touching 7.5% last week.

- And credit is getting tighter for larger mortgage buyers.

- The US median home sale price dropped 2.4% YoY

- But prices were up 8.5% from last quarter

- And 128 metros (54%) featured YoY price increases in Q2.

- US existing home sales in July were the lowest since January.

- And inventory was the lowest for any July on record.

- US Rent growth is back at pre-pandemic norms — growing about 1 to 3 percent per year

- Commercial multi-family lending was down 53% in Q2.

- Even senior living operators are filing for bankruptcy.

How to invest in real estate right now:

Wait.

Startups

Bullish News

- New SEC rules have made it easier for LPs to negotiate side letters.

- In-space manufacturing could be the next big thing.

- Or is it making new drugs via generative AI?

- Africa’s biggest startup, Flutterwave, is moving ahead with an IPO.

- Salesforce is leading a financing round in Hugging Face, one of the most highly valued startups helping businesses use artificial intelligence, at a valuation north of $4 billion.

- In the wake of another ludicrous earnings report, The Information has eight startups targeting a share of the pie.

- Speaking of The Information, they’ve highlighted three IPOs to watch including:

- StubHub: The ticket-reselling company has hired a new finance chief to try to take it public next year, following the departure of its previous CFO in 2022.

- ARM: The chip designer released its investor prospectus early this week, a key step before the initial public offering expected next month.

- Instacart: The company is expected to release its initial public offering prospectus as early as today. While the company’s core grocery-delivery business is barely growing, Instacart is still showing revenue expansion, in part from its fast-growing ad business. How investors react to that mixed picture will determine the valuation it scores in the public markets.

Bearish News

- SPACsareback, but they’re getting smashed at the open.

- And British companies are struggling in particular.

- Chamath’s reputation has–rightly–suffered.

- BNPL darling Affirm continues to struggle.

- BofA is predicting a tech crash in the second half of 2023 [note: we’re 33% through 2H already, guys]

- European VC investing is down 61% YoY.

- The DOJ is suing SpaceX for hiring discrimination.

How to invest in startups right now:

It’s about time to look at AI picks and shovels companies.

Crypto & NFTs

Here’s what you need to know:

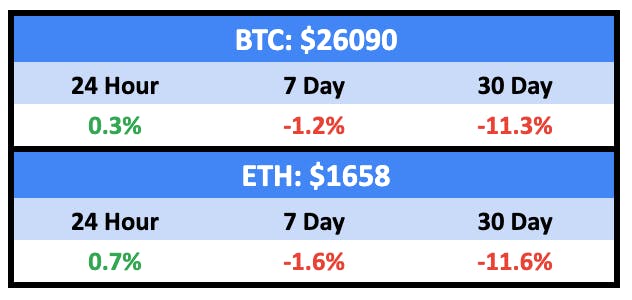

Crypto is slowly melting down.

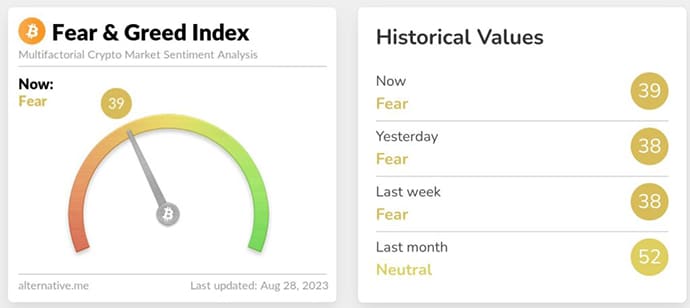

And sentiment remains low but stead.

NFTs had an ok week!

Bullish News

- JPMorgan sees limited downside for crypto markets in the nearterm.

- Token withdrawals out of the Shibarium bridge are now live and available to users.

Bearish News

- Things keep getting worse for Binance:

- BNB sunk to as low as $204, its weakest level since late June 2022.

- Legal troubles in Russia.

- Mastercard nixed their credit card partnership in Argentina, Brazil, Colombia and Bahrain.

- Titan will pay a $1 million fine over charges it misled crypto investors.

- Price-charts suggest more declines ahead even as large investors are adding on their bitcoin holdings.

- US officials allege Tornado Cash facilitated $1bn in money laundering transactions for North Korea’s Lazarus Group.

- Bitstamp will discontinue staking services from Sept. 25

- Crypto

entrepreneuralleged super criminal Moshe Hogeg was charged with fraud, theft, money laundering, and sex crimes after (allegedly) raising $290 million from investors in Israel and around the world under false pretences.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Quick Hits

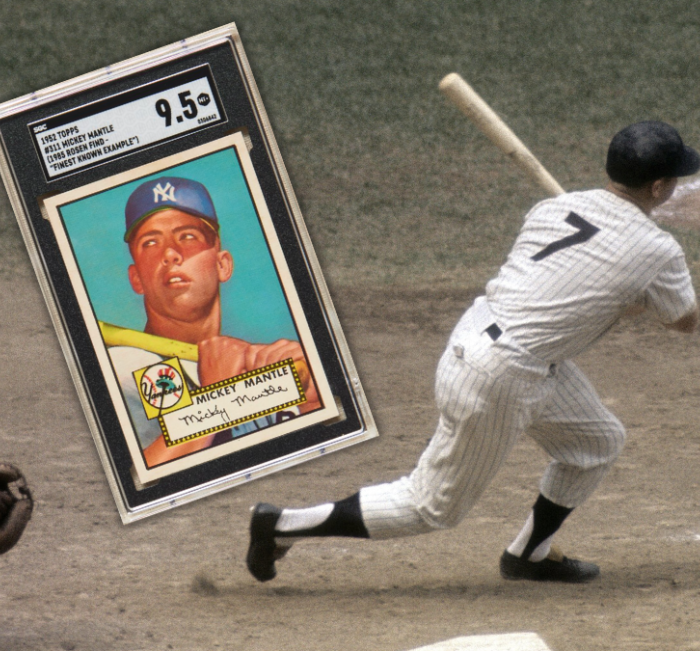

Game Trading Cards

For the first time in a year, a1999 Pokemon Charizard 1st Edition Holo (the Pokemon grail) sold at auction last week.

It fetched $240k, up 25% YoY.

It’s still well off Covid-mania highs, where it peaked at $420k, but it’s 10x pre-Covid numbers.

Wine & Spirits

Chicago-based Algoma Capital raised a $100 million credit fund to provide working capital to whisky brands and distillereys.

This sort of trade finance is necessary to whiskey brands, which have high initial capital outlays but must wait years — or even decades — for the spirits to mature enough to be sold.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe. ☕

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Climatize and zerocircle.

- We hold BTC and ETH in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.