Today we show you five creative, legal ways to “hack” your retirement savings:

- The “Backdoor Roth”

- SDIRAs (aka the “Peter Thiel hack”)

- The IRA rollover loan hack

- Using HSAs as IRAs

- Other mini-hacks)

Note: This issue is US-focused, but folks from other countries should find it interesting too.

Let’s go 👇

Table of Contents

Alts are perfect for SDIRAs

In this issue, we’ll show you why self-directed IRAs (or SDIRAs) are the perfect vehicle for investing in alternatives.

Alto allows you to invest in alternative assets with your retirement funds. You can transfer funds from an existing 401(k) or IRA, or initiate a new contribution to fund investments in alternatives through the Alto IRA,and help you with all the administrative stuff.

They’ve recently launched Alto Marketplace, a platform that connects individual accredited investors to private alt funds and opportunities.

They also have a suite of integrated partners, including some names you might recognize:

- Startups (with AngelList)

- Real estate (with CalTier)

- P2P lending (with Prosper)

- Artwork (with Masterworks)

- Infrastructure (with InfraShares)

- See the full list

Optimize your retirement strategy, diversify your portfolio, and minimize your tax burden with tax-advantaged retirement accounts with Alto.

Create an Alto IRA today. Go to altoira.com/marketplace to learn more.

Disclaimer: Alto Marketplace offerings are currently available only to accredited investors. Private securities involve risk and may result in significant losses. Important disclosures apply. Alto does not provide investment advice. Consult an investment advisor to determine whether an investment is appropriate for your portfolio.

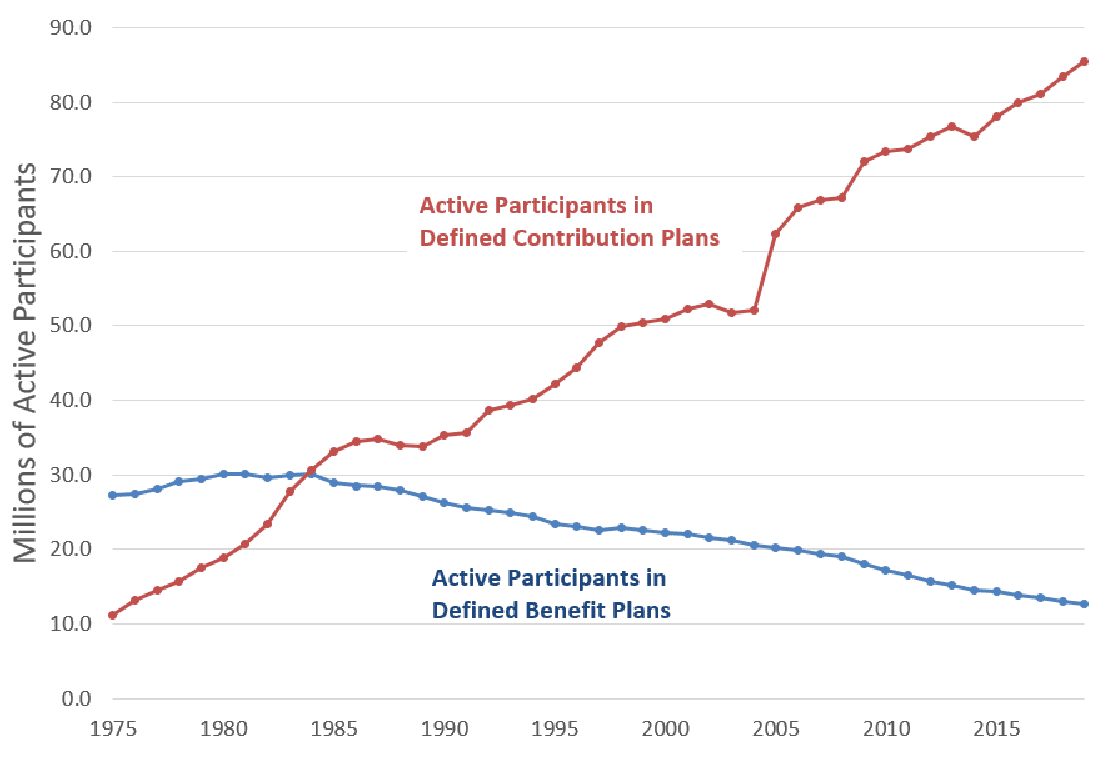

Retirement is no longer guaranteed

In years gone by, you could bank on a generous company pension to fund your retirement.

But these days, defined-benefit plans are nearly extinct (at private companies. Public sector is another story.)

Meanwhile, government support for retirees is increasingly uncertain — especially as populations age and deficits rise.

These days, the burden of funding a successful retirement is increasingly falling on individuals — especially in America. In light of that, the US government has set up a maze of retirement account rules allowing for tax-advantaged saving and investing.

While these rules can be complicated, they also mean savvy individuals can boost their retirement savings and lower their tax bill with some creative (but completely legal!) strategies.

Let’s start with a hidden way to access a unique tax shelter, even for those who aren’t eligible.

The “Backdoor Roth IRA”

A “tax shelter” might sound like something reserved for billionaires, but that’s not true.

A tax shelter is just any legal structure that shields assets from standard tax rules. And regular people have access to quite a few of them.

The main tax shelter the US government offers people saving for retirement is IRA (Individual Retirement Account). Investments held in an IRA are not subject to income or capital gains tax, resulting in significant compounding benefits over time.

But not all IRAs are created equal!

The two main types of IRAs are known as the Traditional IRA and the Roth IRA, which treat taxes in the exact opposite way.

- With a Traditional IRA, you don’t pay income taxes on money that goes in, but you pay when it comes out.

- A Roth IRA is the opposite. You pay taxes when money goes in, and don’t pay tax when it comes out.

I won’t say a Roth IRA is “better,” but there are a few reasons why Roth IRAs are particularly attractive.

Roth IRAs lock in your tax rate

Do you think taxes will go down in the future? Do you think they’ll be lower by the time you retire?

If so, a Traditional IRA is right for you.

Since pre-tax money goes in and post-tax money comes out, a traditional IRA is basically a bet that your tax rate will drop in the future.

But with the federal deficit expected to climb in the coming years, plenty of people are nervous that tax rates will rise by the time they retire — putting them into a higher income tax bracket.

That’s where the Roth IRA comes in.

A Roth allows you to “lock in” your tax rate today. Since you pay taxes upfront, there are no surprises. You know exactly how much the government gets, and have already paid them.

Yes, you could end up paying more in taxes if taxes go down by the time you retire. But plenty of people are willing to pay a premium for certainty.

Roth IRAs give you huge withdrawal flexibility

Traditional IRAs have strict rules around withdrawals.

- Once money goes in, it can’t be taken out penalty-free until you’re at least 59 ½ years old (there are some exceptions, like paying for education).

- Those penalties are in addition to taxes, of course.

- Moreover, Traditional IRAs are subject to Required Minimum Distributions (RMDs). Once you reach a certain age, the government forces you to take money out.

But Roth IRA withdrawal rules are much more flexible:

- As long as it’s been five years since you started contributing, you can withdraw direct distributions penalty-free and tax-free

- There are no RMDs. You have the flexibility to withdraw the funds as you see fit.

But here’s the problem — not everyone is eligible for a Roth IRA!

Specifically, if you make more than $138,000 (or $218,000 for married couples) you probably can’t contribute the full amount to a Roth.

So, is all hope lost for high earners who want to enjoy the benefits of a Roth IRA?

Not necessarily – thanks to a little loophole called the Backdoor Roth.

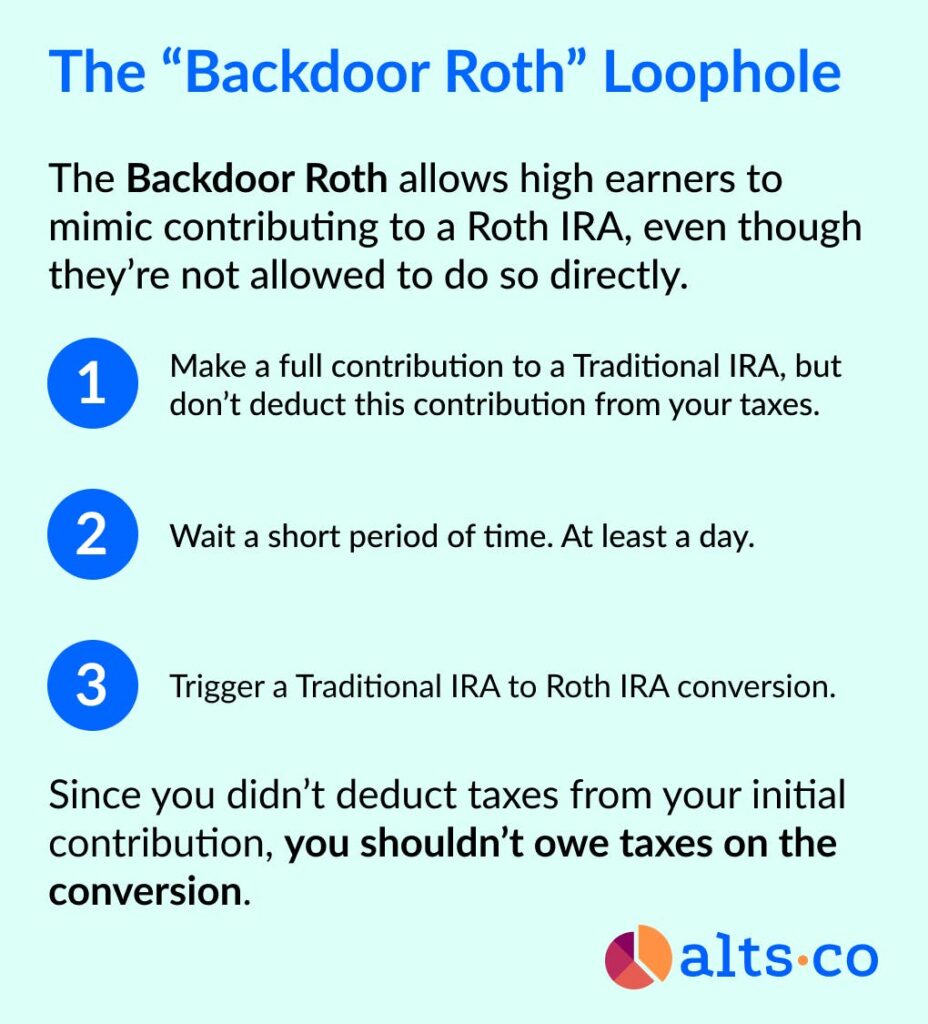

How the Backdoor Roth IRA works

The Backdoor Roth is a surprisingly simple hack that allows high earners to avoid the income limits traditionally associated with a Roth IRA.

Here are the steps:

- Make a full contribution to a Traditional IRA, but don’t deduct this contribution from your taxes.

- Wait a day (or maybe a bit longer — opinions vary)

- Trigger a Traditional IRA to Roth IRA conversion. To do this, contact your custodian. Each custodian has a different procedure, but you just fill out a form. It’s not tough; just ask.

- Since you didn’t deduct taxes from your initial contribution and waited a short period before converting, you shouldn’t owe any taxes on this conversion.

That’s it!

The Backdoor Roth is basically a little loophole that allows high earners to mimic contributing to a Roth IRA, even though they’re not allowed to do so directly.

There used to be a lot of questions about the legality of this tactic – specifically, due to the IRS’ step transaction doctrine.

But in 2018, a couple of small footnotes in the 1,000+ page Tax Cuts and Jobs Act seem to have blessed this procedure as valid.

There is one caveat to the Backdoor Roth. Crucially, due to the pro-rata rule, it might not be suitable for people with existing IRAs containing post-tax money.

Still, depending on their particular situation, this can be a useful tool for many high-earners to access a unique retirement account they’re traditionally banned from.

Use a Self-Directed IRA to invest in alternatives

Given all the rules and regulations surrounding IRAs, you’ll need to set one up through a custodian.

Critically, each custodian has their own set of “approved” investments. But since most custodians are built to serve average investors, these approved investments are often, well, boring. (Think stocks, bonds, ETFs, and mutual funds.)

The funny thing is, IRAs are actually quite permissive regarding allowable investments! There are a few restrictions, sure. But there is no law stating that an IRA cannot invest in alternatives.

But you won’t be able to use a “traditional” custodian. Instead, you need to opt for one of the few custodians that offer what are known as self-directed IRAs.

What is a self-directed IRA?

“Self-directed IRA” isn’t actually a legal term like “Roth IRA.” Rather, it’s a term that refers to IRA accounts held at custodians with non-standard investment restrictions.

Depending on the custodian you choose, these non-standard restrictions can still be…well, restrictive.

For example, a few self-directed IRA custodians specialize in offering IRAs that just contain real estate or gold, etc.

But some modern platforms do offer a significant selection of alternative investment options – including Alto, a self-directed IRA custodian we’ll cover in-depth later this week.

This is great news for investors since it turns being selective about your IRA custodian from a little hack to a full-blown superpower.

Alternatives can be a great fit for IRAs for a few reasons:

- Alts can have huge upside potential, which can result in nasty capital gains tax. Wrapping alternative investments in an IRA (which is capital-gains-tax-free) sidesteps this issue completely.

- Alts can sometimes throw off tons of cash, particularly in real estate or private credit. Again, since IRAs don’t need to pay income tax, boom. Problem averted.

- Finally, alts can have long holding periods, especially when compared to liquid public markets. (For example, our ALTS 1 Fund is a 10-year fund.) These can be a great fit for account funds that usually can’t be withdrawn for decades anyway.

What are the advantages of using an SDIRA?

The advantage is simple. Taxes, taxes, taxes.

An SDIRA can be set up as either a traditional IRA, or a Roth IRA. If you set your SDIRA up as a traditional IRA, funds you contribute are considered tax-free contributions.

So basically, you can reduce your taxable income by up to $6,000/year, while investing in the world of alts we all know & love.

If you set up a Roth IRA, the income is taxable upfront. But while you don’t get an immediate tax break when you contribute to a Roth IRA, your contributions and earnings grow tax-free.

And you can even get qualified tax-free distributions. It’s basically a question of whether you want to pay tax now, or pay it later.

In 2012, PayPal co-founders Peter Thiel and Max Levchin used SDIRAs to realize astronomical tax-free gains.

- Thiel bought $510,000 in PayPal shares with his SDIRA, which grew to over $30 million when eBay purchased PayPal.

- Levchin’s early Yelp stock purchases in his SDIRA ballooned to $95 million.

All tax-free.

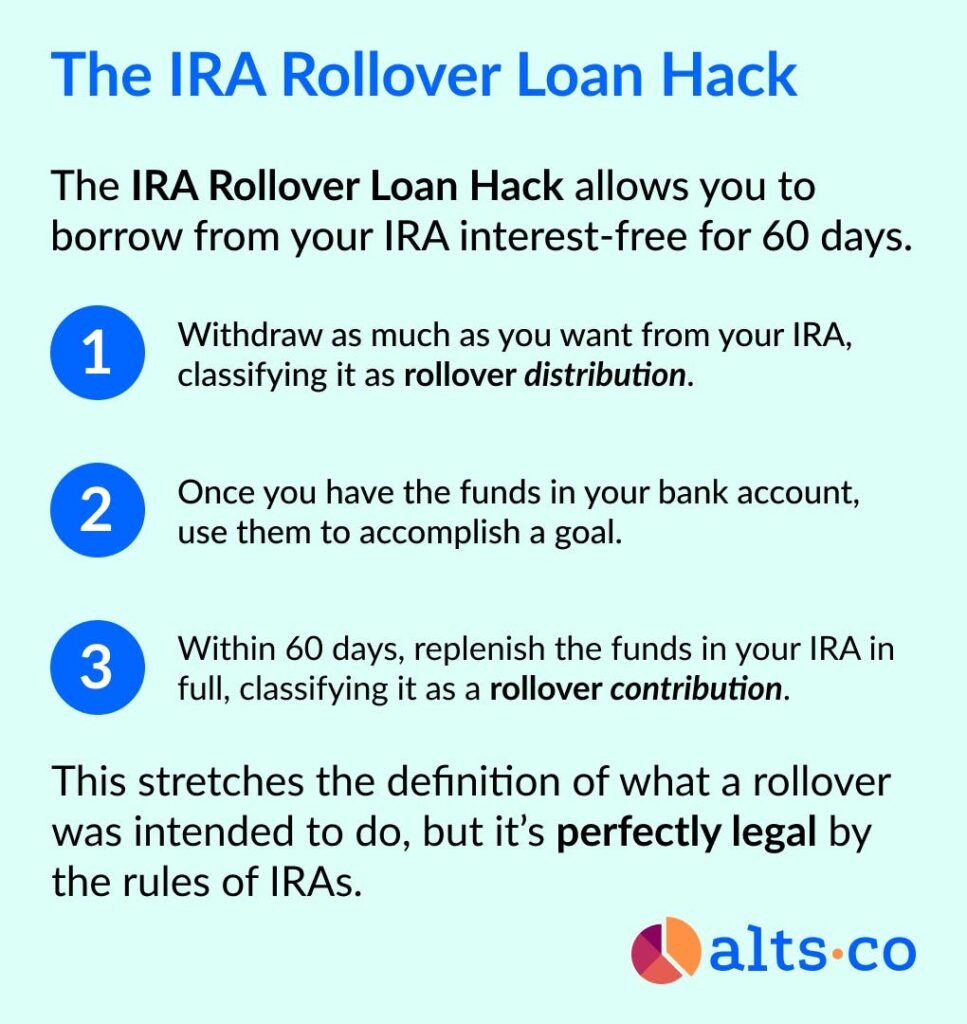

Borrow from your IRA with a rollover

Technically, you’re not allowed to take a loan against your IRA.

That rule stands in contrast to 401(k)s, which are employer-sponsored retirement plans that allow you to borrow up to $50,000 or 50% of your account balance.

But there’s a big workaround that makes clever use of IRA rollover rules.

What is an IRA rollover?

A rollover refers to the situation in which one retirement account is transferred to another account of the same type.

For example, it’s possible to roll over a 401(k) into a Traditional IRA, since both vehicles are funded with pre-tax money.

There are a couple ways to do a rollover:

- You could have a direct rollover, where the assets in the account are transferred directly into the new account.

- But it’s also possible to do an indirect rollover, where you receive the funds first, and deposit them into the new account yourself.

The IRS knows it can take some time to sort everything out with your new account. So when you do an indirect rollover, they give you 60 days to deposit funds into your new account.

How the IRA rollover loan hack works

Now, here’s the final piece of the trick…

You can “roll over” funds from an IRA into the exact same IRA!

This stretches the definition of what a rollover was intended to do, but it’s perfectly legal by the rules of IRAs.

This allows you to borrow from your IRA interest-free for 60 days.

Here are the steps:

- Withdraw as much as you want from your IRA, classifying it as rollover distribution.

- Once you have the funds in your bank account, use them to accomplish some goal (like covering an emergency medical expense, repairing your car, paying a child’s tuition, etc…)

- Within 60 days, replenish the funds in your IRA in full, classifying it as a rollover contribution.

There are strict rules regarding this 60-day timeframe. So if you don’t think you can replenish the funds in time, this move is risky.

If you don’t meet the deadline when rolling over a Traditional IRA, you’ll have to pay income taxes on the amount, plus a 10% penalty tax if you’re younger than 59 ½.

Further, the tax code was updated in 2015 to limit individuals to one rollover per year, so you cannot use this as often as you want.

Use your HSA as an “extra” retirement account

This hack is surprisingly overlooked given how impactful it can be.

By using a special account type in a different way than it was originally intended, you can potentially boost your tax-advantaged retirement savings by over 50% each year.

Enter the Health Savings Account (HSA).

What is an HSA?

The original purpose of an HSA was pretty simple. Given the burden of high healthcare costs in America, the government set up these accounts to allow savers to accumulate extra funds for health expenses tax-free.

As long as you spend the money how you’re “supposed to,” HSAs are a rare triple-advantaged account:

- You pay no taxes on the money that goes in (similar to a 401(k) or Traditional IRA).

- The money accumulates tax-free, with no capital gains or income tax (like all retirement accounts).

- If you spend the money reimbursing yourself for eligible health expenses, you pay no taxes on withdrawals (like a Roth IRA).

Now, the government knew that if they locked up HSA funds, they risked making people too cautious about saving for health expenses.

So the government made a special provision: you can withdraw HSA funds for non-health reasons! As long you’re aged 65+ and paying taxes, this is totally legal.

People don’t realize this rule essentially turns the HSA into an extra Traditional IRA; albeit one that has triple-tax-advantaged health expenses, and a slightly older withdrawal age (65 vs 59 ½)

Why turn an HSA into an IRA?

IRAs are certainly great retirement tools, but you can only contribute a limited number of funds. In 2023, the combined contribution limit for Roth and Traditional IRAs was just $6,500. Ugh.

HSAs, meanwhile, have an entirely separate contribution limit.

But there are a few factors to be aware of.

- First, not everyone is eligible to open an HSA. To contribute, you’ll need to be enrolled in what’s known as a high-deductible health plan.

- Second, your insurance coverage status will determine contribution limits. You can contribute up to $3,650 if you’re just covering yourself. (This climbs to $7,300 if you’re covering your family.)

- If you use an employer-sponsored HSA, your investment options may be limited. Some employers will match contributions, so consider the tradeoffs here.

- California and New Jersey don’t treat HSAs as tax-advantaged for state income — which can create some administrative work.

Clearly, HSAs come with a few strings attached. But in the right situation, they can offer a powerful extra boost to retirement savings.

Mini-hacks

Delay your HSA reimbursement

HSAs come with another little built-in hack. You can reimburse yourself for health expenses at any time, even decades later (hang on to those receipts). This means you can let your money compound returns for years before actually being spent.

Use LEAPs to replicate margin trading

Since you cannot use margin in an IRA account, you can’t leverage retirement assets in the usual manner.

However, you can buy long-dated call options (also known as LEAPs), to replicate leveraged stock investing. Since each contract represents 100 underlying shares, these options contain inherent leverage.

This can be a risky strategy, but it’s an efficient workaround for your otherwise small contribution amounts.

Read a discussion on this strategy here.

The Mega-Backdoor Roth

You can supercharge the Backdoor Roth hack with a Mega Backdoor Roth.

This is a more technical process that requires access to a 401(k) account, but it could potentially allow you to save more than 10x the amount you’re usually allowed to put into a Roth.

Closing thoughts

The fact that Americans might feel pressured to optimize their retirement funds points to a couple broader trends in the retirement sphere.

First, retirement accounts have grown into the largest store of wealth for American households.

Like home equity, though, this is money that’s traditionally quite hard to access. By finding flexible uses for retirement accounts, individuals can more efficiently use the wealth at their disposal.

Second, the future of retirement looks very shaky indeed. Retirement systems were simply built for a different world.

The ratio of workers to Social Security beneficiaries, for instance, has fallen from about 5 in the 1960s to less than 3 today. Meanwhile, this year’s unrest in France shows what could await developed countries as they attempt to balance the books.

Unsurprisingly, an increasing number of Americans are saying they don’t expect to ever be able to retire. While truly retiring may be tougher than in the past, making the best use of retirement funds can help give you the best chance of enjoying your golden years successfully.

But this fact doesn’t excuse governments of the responsibility to support their citizenry.

As the population ages and traditional retirement programs face financial pressure, expect the national reckoning with retirement to become a key political issue in the decades ahead.

Further reading

- The National Institute on Retirement Security says retirement is growing more challenging for public sector workers as well

- For the past 15 years, the Mercer Global Pension Index (MCGPI) has ranked the world’s retirement systems. The Netherlands took the top spot this year, followed by Iceland and Denmark. Argentina was ranked last.

- Some savvy folks realized they could use rollover chaining to extend the 60-day IRA rollover deadline. But Congress caught on and banned the practice.

- Interestingly, to this day, the IRS does not explicitly outline what a self-directed IRA can invest in, only what it cannot invest in. There are a few types of prohibited investments.

- The most important IRS rule is “no self-dealing.” Basically, this means you can’t buy or sell property to yourself. If you’re buying a home through an SDIRA, you can’t live in the house, vacation in it, or even improve it. It must be a pure, indirect investment — usually through a REIT or other investment fund.

- Nuwireinvestor.com has compiled a nice list of Self-Directed IRA Custodians you can choose from.

- Or just open an Alto IRA.

Disclosures

- This issue was sponsored by Alto

- Neither the author nor the ALTS 1 Fund holds any interest in any companies mentioned in this issue.

- This issue contains no affiliate links