Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

Did you catch Sunday’s issue on rare earth metals?

Rare earths aren’t something people think about very often. But they should, because they power our society, and China owns nearly all the refinement supply.

We got terrific feedback on that issue, and today we’re back with a deeper dive into this world.

Specifically, we’ll look at a critical subset of rare earths known as strategic metals.

In this issue, we’ll talk about the difference between the two, and how both accredited and non-accredited investors can get involved.

Let’s go 👇

Table of Contents

Why do metals matter?

Metals are nothing less than the measure of a society. Entire periods of human history are defined by the metals that civilizations could figure out how to manufacture.

Take the Bronze Age, for example. Access to bronze gave some ancient societies a significant advantage over others. Weaker societies suffered defeat at the hands of those with the superior technology.

Today, access to metals continues to determine political and economic power in the modern age. But as technology has matured, the key metals in question have changed.

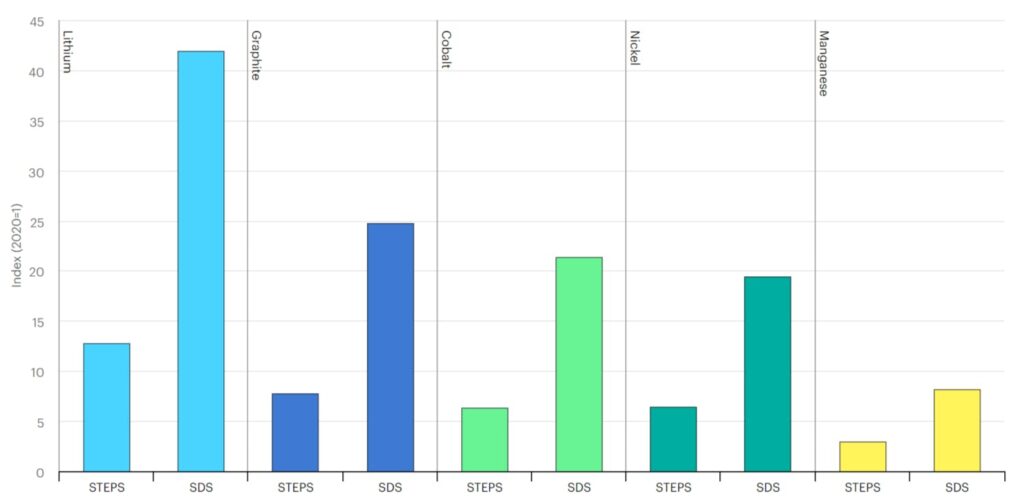

Some are well-known – including lithium, which is used to create the lithium-ion batteries found in electric vehicles.

But many others are under-appreciated, like terbium – which is a rare earth metal that’s essential to creating semiconductors and high-temperature fuel cells.

Rare earths are required to build advanced technology, and we covered the market for the 17 elements that make up the list of rare earths last Sunday.

But for a truly comprehensive view of the key metals for the 21st century, we’ll need to look beyond rare earths and dig into the wider universe of strategic metals.

What are strategic metals?

Strategic metals are the subset of metals that are key to national economic prosperity and military security.

Obviously, that’s a wide-ranging definition — especially given the myriad of metals that both civilian and defense technologies require to function.

- Steel, for instance, is used to construct everything from wind turbines to aircraft carriers.

- Gold, aside from being a status symbol, has a bunch of practical applications. It’s used in the wiring of semiconductors and as an electrical connector in computers and phones.

But while steel and gold may be somewhat strategic, they aren’t as relevant as scarce, physical assets in our tech-driven culture.

It’s not that steel & gold aren’t interesting, but that they’re not interesting for our purposes, since they both have robust supply chains.

Efficient steel production is a solved problem, and gold mining is diversified internationally, with many major powers having large reserves.

Instead, the most interesting and important strategic metals are those with limited supply.

Demand and supply of strategic metals

Calling a metal “strategic” starts with demand side of the equation.

Since the metal sits upstream of critical technologies, companies and countries will compete fiercely with each other for access to it.

But the supply is what really matters.

To use our previous examples, both steel and gold have strong supply chains that make accessing them trivial for powerful economic actors.

The supply of certain strategic metals, though, is far more limited. Low supply of these resources generally exists for one of two reasons:

Demand is brand new

Some metals have been valued for millennia. Gold and silver coins, for instance, are mentioned in the Hebrew bible. Humans have had thousands of years to find deposits, establish mines, and create functioning supply chains.

But demand for other metals is far more recent. The first major source of demand for lithium, for example, was for the production of nuclear weapons during the Cold War.

Considering that a lithium mine can take anywhere from 4 to 7 years to start producing the element, there simply hasn’t been much time to establish robust supply chains for this and other metals which are surging in demand.

Lack of concentrated abundance

Even with enough time to develop supply chains, certain metals will likely always have low supply due to a lack of concentrated abundance.

These metals are often only present as trace elements in other minerals and must go through significant refinement before they can be used. Germanium, for instance, is produced as a byproduct of zinc mining.

The modern metals market

These supply issues shed light on how global metals markets are structured today.

Metals can’t simply be mined out of the ground and placed into a new iPhone. They have to go through a complicated refining process to bring them to a usable state.

Given the concentrated abundance constraint, refining capacity is more important than mining capacity when getting new supply to the market.

That explains why discoveries of major metal deposits may prove less consequential than they initially seem. Earlier this year, a Swedish company announced they’d discovered Europe’s largest known deposit of rare earths. But considering that Europe has zero rare earth refining plants, putting those deposits to use isn’t straightforward.

Europe currently satisfies its rare earth demands through imports, 98% of which come from one place – China.

China: The kings of strategic metals

China uses their metals dominance as a geopolitical strategy.

For many strategic metals, China dominates at least one stage in the supply chain, giving the country immense power over metals markets.

China accounts for 98% of global rare earth production, largely because they’re the only ones who have invested in refinement capacity! Europe depends on them. America depends on them. Australia depends on them. Everyone depends on them.

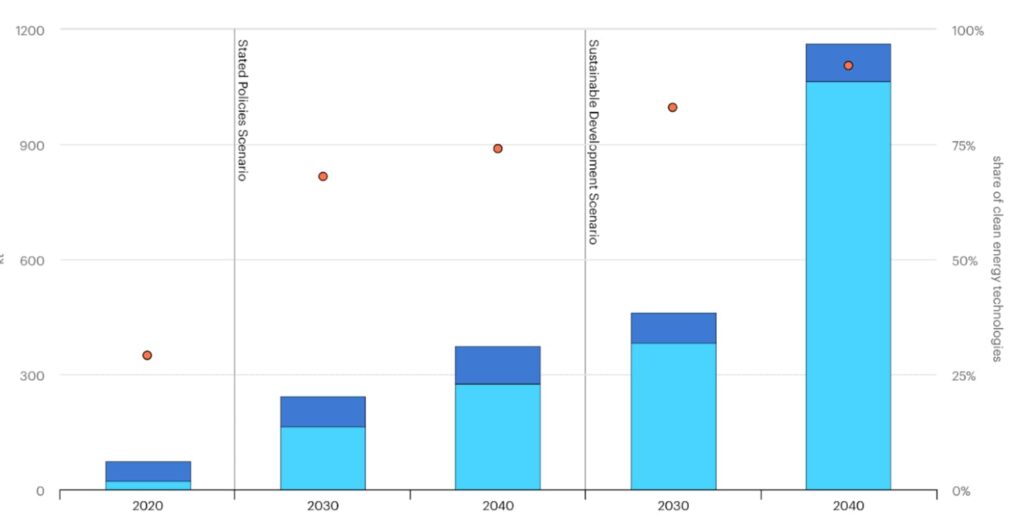

One of the biggest sources of demand for strategic metals in the coming years will be electric vehicles, which use more than six times the amount of strategic metals as conventional vars. China also owns most of the value chain for EV metals, producing 65% of the world’s graphite and 72% of the world’s refined cobalt.

Moreover, while China produces just 15% of the world’s lithium, the country makes about 80% of the world’s lithium-ion batteries, which power nearly every EV (and smartphone).

This reliance on China poses a significant problem for the United States and Europe, especially as geopolitical tensions have escalated over the past several years. And recently, China has shown an increased willingness to use its dominance of the metals markets as a geopolitical strategy.

Over the long term, the US and Europe will need to wean their dependence on China, developing their own parallel supply chains for strategic metals. But that process will take decades, and will likely increase metals prices due to higher labor costs and more sustainable/environmentally-friendly practices.

So in the meantime, the West is stuck dealing with China, and all the supply risks that come with depending on it.

Strategic metals as an investment opportunity

China’s export restrictions on strategic metals are a nightmare for policymakers, diplomats, and manufacturers.

But for investors they could be a dream, as the political landscape results in decreased global metals supply.

The fundamental investment thesis for strategic metals relies on intensifying demand (driven by advanced technology) paired with sluggish supply growth (driven by the slow pace of creating industrial infrastructure to refine difficult-to-extract materials). Supply restrictions resulting from geopolitical tensions will only add to this imbalance, driving prices even higher.

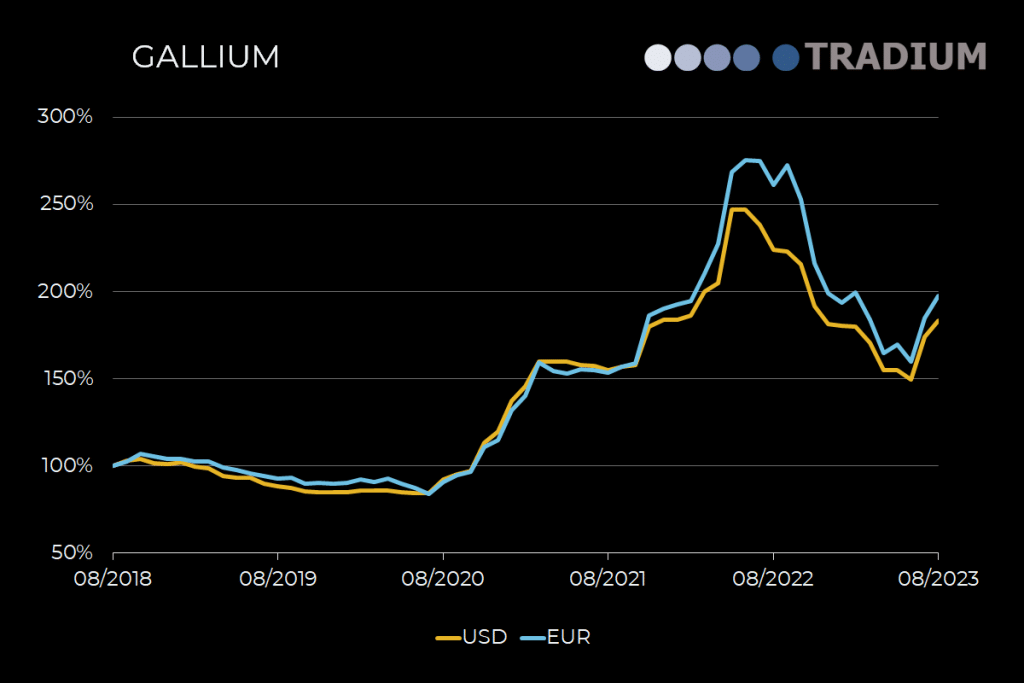

At present China is restricting the export of two critical strategic metals, Gallium and Germanium.

Industry experts agree this is just a warning shot and China has plans already in place to restrict the exports of other strategic metals before the end of this year.

While this thesis seems sound, investing in metals is no easy task. The space hasn’t always been kind to individual investors.

For a long time, directly investing in these metals appeared almost impossible for individual investors. But with the introduction of Strategic Metals Invest, that’s all changed.

The firm is the first and only company offering everyday investors access to direct ownership of key strategic metals.

What is Strategic Metals Invest?

Strategic Metals Invest (SMI) was formed to help give investors access to the raw materials that ultimately provide trillions of dollars in economic value.

The firm was built for investors who believe in the strategic metals investment thesis and want direct exposure to the asset class. Through SMI, investors can purchase the upstream raw materials that ultimately become trillions of dollars in downstream GDP.

SMI is the only operator in this market. They have 25 years of experience supplying the market with these metals, and have annual turnover of over $100 million a year. SMI has 2,400 clients in 70 countries, through which they can source exits for their investors.

We spoke with SMI CEO Louis O’Connor recently. He emphasized that facilitating private investment could actually be described as their “side hustle” (although that may be too small a term for it!) See, the firm’s core focus is in buying and selling metals for industry use.

But it turns out this side hustle is incredibly valuable to individual investors! By partnering with a firm that operates directly in the metals industry, SMI has effectively solved two of the main problems of investing in strategic metals.

First, investors get expert guidance to help navigate this opaque market, including price transparency and information on evolving supply dynamics.

Second, SMI can guarantee investor liquidity by sourcing purchases and sales as an industry supplier. When it comes time to sell your investment, you’re tapped right into the global metals supply chain, rather than trying to make a deal happen while sitting on the sidelines.

How it works

When you make a purchase through SMI, your metals are stored in a high-security bunker in Frankfurt, Germany (think “Fort Knox for metals.”)

Want a tour? Sure. SMI encourages investors to visit the bunker and inspect their metals.

The metals SMI offers have been increasing in value by an average of 34.25% a year for the past 5 years. Their website also offers a wealth of data on all the most important strategic metals, and their team is always helping educate investors on the dynamics of this market.

Louis recently made a CNBC appearance to discuss China’s export restrictions:

Investment options

SMI’s offerings include direct investment exposure to nine key strategic metals.

The rare earths on offer are dysprosium, neodymium, praseodymium, and terbium. Other metals include gallium, germanium, hafnium, indium, and rhenium.

Purchasing any combination of these metals requires a $10,000 minimum.

All of these metals are critical to the clean energy transition, and demand isn’t expected to peak until the 2040s. Moreover, China has a dominant position in all of these metals, making them particularly susceptible to supply restrictions.

Below, we briefly break down the top five that have the strongest investment case today.

Gallium

- Production: Obtained as a byproduct of mining aluminum, to which it is very chemically similar, requiring high-grade refining to separate.

- Supply: China accounts for 98% of refined gallium supply.

- Demand: Used most notably for advanced computer chips, but also for solar panels, electric vehicles, and specialty batteries. Demand is expected to grow nearly 25% per year through 2032.

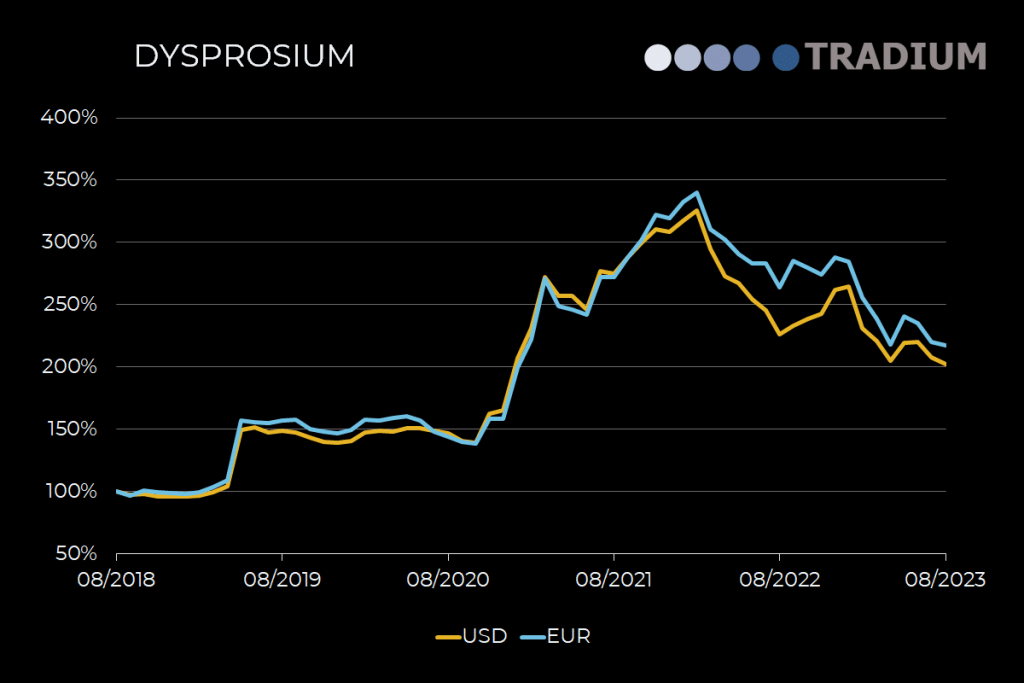

Dysprosium

- Production: Usually obtained as a trace element of the mineral monazite, which contains other rare earths.

- Supply: China accounts for more than 90% of global production, with smaller amounts produced by Russia, Malaysia, and Australia.

- Demand: Especially used for magnets in wind turbines. Demand is expected to climb about 5% per year over the next decade.

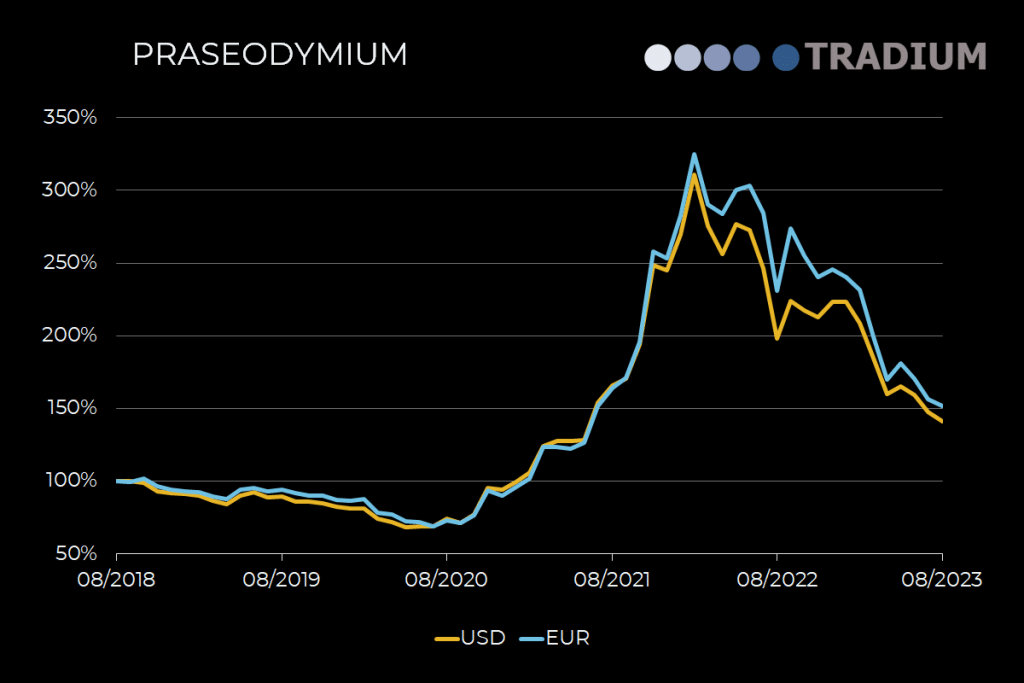

Praseodymium

- Production: Usually obtained as a trace element of the mineral monazite, which contains other rare earths.

- Supply: China accounts for about 85% of global supply, with smaller amounts produced by Russia and Malaysia.

- Demand: Used for magnets in wind turbines and in creating high-strength alloys for aircraft. Demand is expected to grow by more than 8% per year over the next five years.

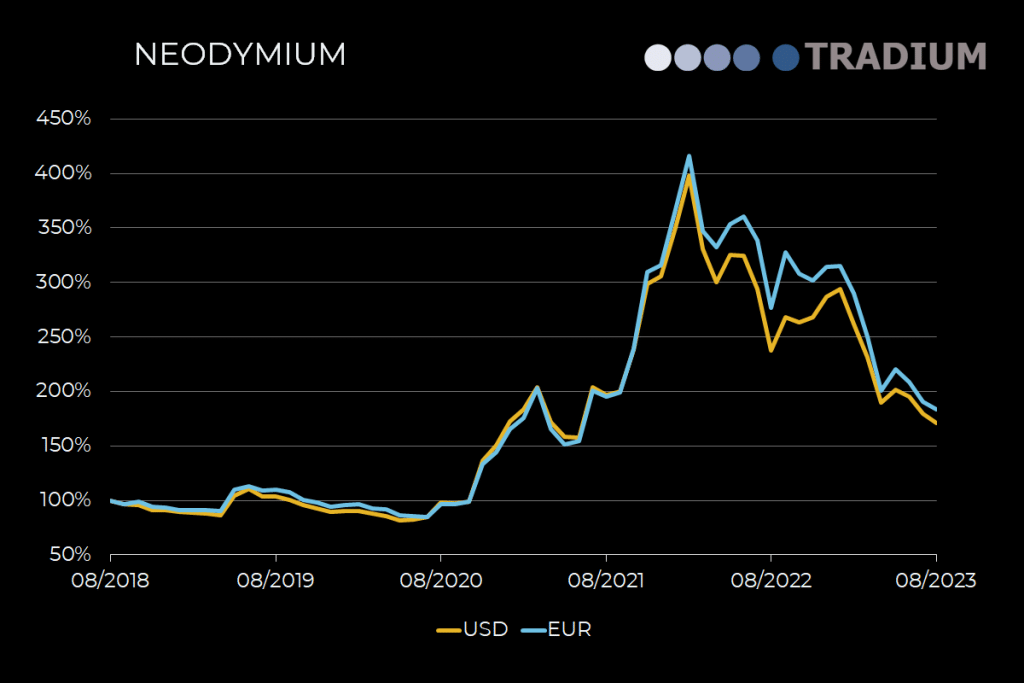

Neodymium

- Production: Found as trace element in ores like bastnasite and monazite.

- Supply: 85% of supply is estimated to come from China.

- Demand: Demand expected to grow a bit over 4% annually until 2040. Neodymium is notable for being used to create incredibly strong magnets, commonly found in electric vehicles and smartphones.

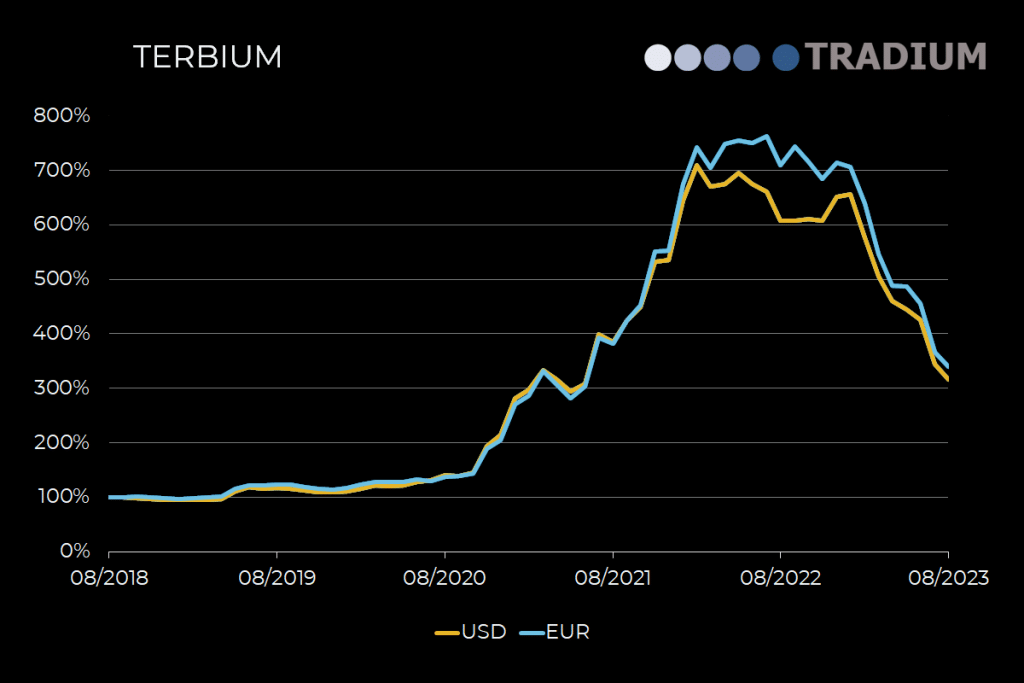

Terbium

- Production: Found in ores like monazite and xenotime. Notable for being very difficult to extract.

- Supply: More than 99% of the world’s supply of terbium comes from China.

- Demand: Mainly used to create the color green in LCD screens. Demand is expected to grow by about 7% annually over the next eight years.

Pros and cons of investing in strategic metals

Pros

- Demand exceeds supply. We’ve covered this imbalance in depth, but it’s the biggest draw to investing in strategic metals. As electric vehicles grow in importance, advances in computing continue, and the world transitions to a clean energy future, demand for strategic metals will climb. Supply may not catch up for decades, in part due to increasing geopolitical tension.

- Inflation resistant. Strategic metals are a real asset, not just a financial one. That means they can serve as a valuable hedge against inflation, much like other real assets such as housing or commodities.

- Uncorrelated. Metals are relatively uncorrelated to traditional assets like stocks and bonds. While metals can be influenced by broad economic factors, the real determinant of their price tends to be idiosyncratic supply and demand factors. This benefit is especially attractive given that increased correlation between stocks and bonds in recent history has made diversification harder to achieve.

Cons

- Opaque market. The metals market can be incredibly complicated, especially for individual investors. Even determining the current market spot price can be a challenge. Add to that the difficulty of verifying that you’ve actually bought metals of suitable quality, and it’s easy to see why this space has usually been the realm of specialists.

- Illiquidity. Closely connected with the market’s opacity is its illiquidity. Metals aren’t exactly easy to sell. Aside from having to actually find a buyer and negotiate a fair price, you’ll also have to arrange shipment and transport of the goods.

- Storage costs. Like other real assets, purchasing metals means you’ll have to store them as you await price appreciation. That represents an enormous headache, and can also eat into your anticipated returns.

Now, some of the cons can be avoided by taking some indirect routes to investing in metals. For instance, you could purchase stock in a metals mining and refining company, or continuously roll futures contracts on an exchange.

But neither of these options represents a pure way to bet on the price of strategic metals. A company’s stock will be affected by an array of factors, like the competency of management or leverage ratios. And even if you can find a futures contract for the metal you want to invest in, you’ll have to continuously manage your margin and may experience negative roll yield.

Q&A

We sat down with Strategic Metals Invest CEO to learn a bit more about the business and what investors can expect.

How did your company start out? Why was it founded?

Initially, I was interested in strategic metals as an asset class. I did not know private investors could own rare earths as physical assets. Strategic Metals was founded to offer strategic metals to private investors.

The most important thing to know is our core business is not the investment play. Our core business, 80% of our business activities is we are an industry supplier. We turn over $100 million dollars (plus) a year buying and selling rare earth metals.

We buy from suppliers and resell to industry buyers (2,470) in more than 70 different countries worldwide. If this was not our core business, then it would not be safe for investors as the only end buyer for these raw materials are industry buyers. We also provide the exit by mediating a sale to an industry buyer or purchasing back the metals for our inventory.

What is the problem you’re solving? Who is your target audience?

Private investors cannot purchase strategic metals from producers. We provide safe access to an industry that private investors ordinarily do not have access to. As it’s a relatively new asset class, there is no specific target audience. Our offer is open to all. .

What do you offer that nobody else does? What are a few things that differentiate you from your competitors?

Right now, we do not have any competition. We are the only industry supplier in the world that offers rare earth metals to private investors.

We also provide the exit. Right now, strategic metals are outperforming precious metals year on year. Our customers are making excellent gains.

What was the tipping point in your success? When did you know you were onto something special?

I knew from day one this would be a success. It was just a question of when not if. It is an asset class previously unavailable to private investors. I am lucky enough to have partnered with the only industry supplier in the world that offers rare earths to private investors.

What are your future goals and plans?

The business is growing. I don’t think anyone would argue the demand for these critical raw materials is increasing and will continue to increase. Currently, our storage facility in Frankfurt has over 200 metric tons of strategic metals in the inventory, the largest inventory of rare earths anywhere in the world outside of China. Plans are already in place for a 2nd storage facility in the next 3 to 5 years.

Disclosures

- This issue was sponsored by Strategic Metals Invest

- Our ALTS 1 Fund holds no rare earths

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Strategic Metals Invest. Strategic Metals Invest has agreed to offer an unconstrained look at its business & operations. Strategic Metals Invest is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.