Today, for the first time, we’re exploring rare earth metals.

Also known as “rare earth minerals” (or just “rare earths”), these trace elements have become absolutely critical to modern technology. They power smartphones, semiconductors, industrial magnets, flat-screen TVs, LED lights, and electric car batteries.

In short, they’re used for all sorts of things most of us don’t even realize we need. And demand is rising.

This isn’t a world we know very well, so we got help from Alts community member Louis O’Connor of Strategic Metals Invest. Louis is a walking, talking rare earths expert.

By the end of this issue, you’ll understand why these are so important, and which ones to invest in.

This is an important, fascinating, complex world.

Let’s dig in 👇

Table of Contents

Rare Metals vs Strategic Metals

In terms of powering modern technology, rare earths are practically irreplaceable.

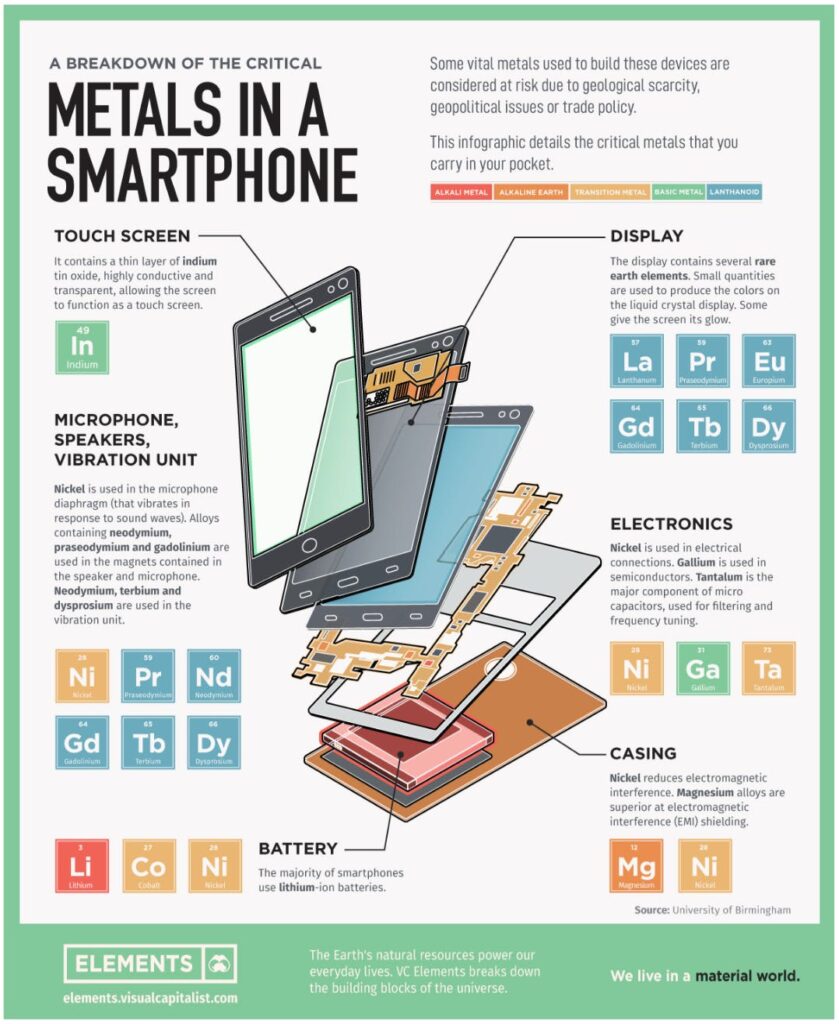

For example, iPhones require 8 different rare earths. The LCD display only glows thanks to terbium, and the speaker and vibration wouldn’t work without neodymium.

Rare earths are an example of strategic metals, which is a broader category referring to elements which are especially critical to economic and military security.

In fact, 16 of the 17 rare earth metals were deemed critical to national security by the US Department of the Interior.

Until recently, purchasing these metals hasn’t been an option for regular investors. Guaranteeing the quality and selling the metals back to the market requires intricate knowledge, which very few people have.

One firm is determined to solve these problems for investors, though — a company called Strategic Metals Invest. They’ve partnered with a broker to give investors access to strategic metals, data, storage, and liquidity.

Everyone is eligible to invest. This is open to both accredited and non-accredited investors anywhere in the world.

It’s an interesting company. Keep an eye out for our Deep Dive on them later this week.

Rare earths 101

Question: What do a smartphone and an F35 fighter jet have in common?

[Yes, there’s a joke here about how it’s easy to lose either of them, as the US Marine Corps learned last week]

But the answer is that both machines require rare earths to function.

Rare earths are a group of 17 metals with specific magnetic and electrochemical properties not commonly found in other elements.

While each of these 17 metals is distinct, they all have two traits in common:

- Limited supply, and

- Technology-driven demand

Limited supply

Rare earths are not concentrated in abundance.

Despite the name, rare earth elements aren’t all that rare. In fact, the US Geological Survey notes that rare earths “are relatively abundant in the Earth’s crust.”

But the key is concentration. Rare earths aren’t concentrated in one place, easy to access and dig up. Think of rare earths as trace elements. They exist within other ores, and are widely dispersed around the globe.

They occur naturally, yes. But rare earths are mostly byproducts of the refining process for other materials. This means the actual supply can be extremely low.

This lack of abundant supply sets rare earths apart from metals like lithium and platinum. While lithium-ion batteries are used all sorts of devices, lithium is found directly in nature.

As Wyatt discussed earlier this week, nearly a trillion dollars of lithium was recently discovered in an extinct Nevada crater. The discovery is so large that “it could change the dynamics of lithium globally, in terms of price, security of supply and geopolitics.”

This never happens with rare earths. You don’t just stumble upon a huge deposit of Dysprosium. It doesn’t work like that.

High demand from tech

Rare earths are critical to leading technologies.

There are often no substitutes for the unique properties these metals carry. They’ve become crucial to technology in both civilian and military spheres.

Including the new Las Vegas Sphere 🌎

The fact is, these raw materials are nothing less the backbone of modern manufacturing.

History of rare earth metals

Discovery in Sweden

While rare metals like gold have been used for at least six thousand years, the first rare earth element was only discovered in 1787, when an amateur geologist found an unusual black mineral formation in Ytterby, Sweden.

After a rigorous analysis, chemists determined that the mineral comprised an entirely new element, which they christened Yttrium after its discovery location.

This was quickly followed by the discovery of several other rare earth elements, all sourced from around the same area in Sweden. But in the 20th century, scientists realized we could use them for cutting-edge technology.

Rare earths in the atomic age

The 1950s and 1960s were a boom time for rare earths, as post-war demand for new military tech and civilian appliances went through the roof.

This led to increased investment in refinement operations, allowing industrial giants to produce sufficient quantities of these rare metals for the very first time.

In the 1960s, for instance, the adoption of color TV drove demand for Europium, a rare earth that TVs use to produce red and blue luminescent light.

Around the same time, the US Air Force developed a powerful new type of magnet that needed Samarium to function.

For decades, most of America’s mining and refining of rare earths was done at a remote place in California’s Mojave Desert called Mountain Pass Mine.

However, with the rise of globalization and the efficiencies of international supply chains, production quickly shifted across the Pacific.

The rise of China 🇨🇳

China’s rise in the rare earths market is no accident.

The Chinese government recognized how important these materials would become — how much they would power the world’s future technological innovations — more than any other country.

“The Middle East has oil. China has rare earths.”

– Chinese President Deng Xiaoping, architect of the China’s economic revolution, in 1987

America didn’t give up its industrial capacity unwillingly. Rare earths refining has some traits that make it particularly unattractive to do onshore, including:

- High costs. Refining rare earth metals is expensive. Lower labor costs in China helped keep the costs of refined materials much lower than they otherwise would be.

- Environmentally unfriendly. Without proper supervision, rare earth projects can pollute and contaminate the environment, leaking acids, heavy metals, and radioactivity. With their lax environmental standards, China could process rare earths cheaper and more efficiently than Western countries.

In addition, China accelerated its dominance of the metals market by leveraging subsidies to keep export costs low.

China has strategically flooded the global market with rare earths at subsidized prices, driven out competitors, and deterred new market entrants. – 2018 US Dept. of Defense report

That dynamic resulted in a steadily growing market share for Chinese refining of rare earths and other strategic metals.

The world continues to grapple with the geopolitical and economic fallout from this dynamic, as the role of these metals in everyday life has only grown in importance.

The rare earths market today

China dominates the market

Today, China is responsible for a whopping 70% of all rare earth element mining. And they have a near-monopoly on refinement, with 87% of the global supply of refined rare earths.

Want to manufacture some solar panels or fiber-optic cables? Cool. You’ll need germanium, and China refines 68% of it.

How about advanced computer chips? I hear that’s all the rage these days. Well, you’ll need something called gallium. Guess who owns 98% of the world’s supply (!) That’s right, China.

The fact is that China has been building up its market share for decades. This flex has blindsided Western policymakers, who’ve shrugged this off at best, and ignored it at worst. The result is that the world’s rare earths supply chain is now almost entirely in the hands of China.