Table of Contents

Welcome to the Big Deal.

What’s the Big Deal?

It’s one exclusive investment idea pumped straight into your inbox. It’s specific, actionable, and probably an investment idea you’ve never heard of or thought about.

Today’s idea builds off our last issue of the Big Deal, which showed you how to bet against the Mag 7.

Today, we’re looking at options (get it) to hedge against a market correction in 2024.

Let’s get to the Big Deal 🚀

What’s The Big Deal?

We’ve recruited Benedict Maynard, the guy who literally wrote the book on options trading, to produce fortnightly content that shows you how to trade options intelligently.

No stupid scams. No naked shorts. He’s going to teach you the techniques he refined over 20 years on the trading desk in London.

Each issue dives into a specific investment thesis and then shows you how to build a trade around it.

What’s today’s idea?

The prices of high-growth, large-cap stocks (comprising mainly tech names) have reached extremes relative to more value-oriented large-cap stocks.

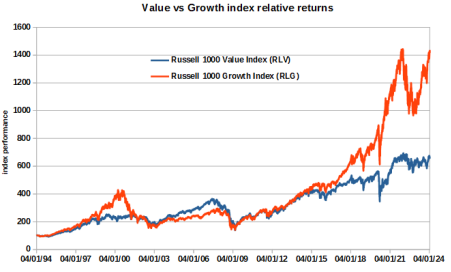

This is shown by the difference between the Russell 1000 Growth Index ($IWF) and the Russell 1000 Value Index ($IWD) over the last several years.

Growth stocks are at extreme valuations relative to value stocks as investors have gone all in on the tech story and eschewed much else.

This can be seen by plotting a ratio between the Russell 1000 Growth (RLG) and the Russell 1000 Value (RLV) indices, which is simply the RLG divided by RLV.

Current levels are in excess of the Dot-Com bubble that burst at the turn of this century. The chart has also created a triple-top formation, which tends to indicate a reversal.

As alluded to earlier, reversals from Growth to Value dominance are not gentle affairs. The peak that formed the Dot-Com bubble reversed swiftly, decimated portfolios, and ushered in a multi-year dominance of value investing, which lasted until the middle of 2006.

The sell-off that occurred in 2022 was the most recent and very swift decline. Today, we are back to the extreme.

Moreover, there is a close relationship between the RLG:RLV ratio and the volatility that Growth exhibits in excess of Value (chart above).

What’s in each index?

The Russell 1000 Growth Index is dominated by tech companies.

The Russell 1000 Value Index is more evenly distributed and contains lots of household names that you know and/or love.

The indices were constructed in the late 1970s, so there is a nearly 45-year trading history.

The dominance of one index over the other has alternated frequently, but they’ve always reverted to each other.

You can see that the growth index is significantly overvalued today compared to historic norms.

Potential Returns

The trade uses six-month options, and the outlay is relatively small.

Despite the small initial outlay, the magnitude of previous reversals has created very large returns in the past. The average return since 2020 (when the valuation discrepancy was not even as stretched as it is now) would have created an excess of a 15x profit using today’s option prices when a reversal has occurred – i.e., turning $500 into $7,500.

Since 2020, when a reversal didn’t happen, only the premium has been lost – i.e. your $500 bet.

The Strategy

By construction, Growth and Value factors target opposite and opposing fundamental stock attributes, and IWF and IWD do this within the confines of the 1000 largest US stocks.

Our trade is a put switch, which involves buying a put option on one instrument and selling (or shorting) a put option on another instrument – in this case, buying a put option on iShares Russell Growth ETF (IWF) and selling a put on iShares Russell Value ETF (IWD).

Both put options have

{% if subscriber.tags contains “Memberful: Active Subscription” %}

- The exact same expiration date of approximately six months

- The same notional value of underlying shares and

- Strike prices that are around 5% below the current prices of the ETFs.

Some definitions if you’re not familiar with options trading:

A put option is a financial contract that gives you the right, but not the obligation, to sell a certain amount of a stock (or other financial assets) at a predetermined price within a specific time period. This can be useful if you expect the stock price to go down because you can sell it at the higher price set in the contract.

A put switch involves buying a put option on one instrument and selling (or shorting) a put option on another instrument. Both put options have the same expiration date of approximately six months, the same notional value of underlying shares, and the same put option delta of around 0.3.

Diving in further

Looking back at our chart above, you can see the RLG:RLV ratio influences the level of three-month volatility three months in the future on each index.

As the smaller chart on the right shows, this implies that RLG will become much more volatile than today, rising from 2 to 15 volatility points in excess of RLV. This is important for two reasons:

- It implies that Growth will fall sharply in price relative to Value, which supports our trade.

- As volatility increases (decreases), the price of an option increases (decreases). Since we will be buying options on IWF (which tracks the RLG index), this will boost the value of those options up until expiration.

Focussing on IWF and IWD again, the current setup is the only complete peak in their ratio since the ETFs were launched in the mid-2000s.

One potential worry is that the market could correct, and our value ETF (IWD) declines in value more than the growth index (IWF).

Past performance is no guarantee of future returns, but in all cases but one since 2020, an elevated ratio (above) paired with a decline in index value has resulted in a profit on this trade.

During their nearly 45-year history, extremes of similar magnitude have always precipitated a sharp reversal. This trade is a low-cost way to hedge against this happening if you own large-cap tech. Or you can apply this trade on its own if you want to back a bear market.

A sensitivity analysis looks like this, with historic outcomes filled in.

While historic results have been quite good, don’t ignore the potential downsides inherent to an expansion in the indices’ current spreads. The numbers get ugly quickly.

How to build the trade

Step One – Let’s map it out.

All the data used in this table was taken prior to the market open on 22nd January 2024. It’s useful to do this prior to the market opening when things are quiet and stable.

The analysis was done using six-month returns, which would correspond to a June option expiration date. However, there is only a May or an August expiry available.

It seems best to opt for the August expiry – the trade should receive a boost from the increase in IWF volatility prior to expiration, and the trade can always be closed out for a profit in June if the analysis holds.

The analysis was also done using percentage moves in the ETFs, so we’ll use puts that have a similar percentage of out-the-money strikes.

I’m using 5% out-the-money put strikes because although Figure 6 suggests that an at-the-money put is equally valid, I want to have a little more optionality in the trade.

Crucially, the net notional exposure needs to be on the negative side of zero, with the negative IWF notional exposure (negative because we are buying IWF puts to get a short exposure) being larger in size than the positive IWD notional exposure (positive because we are selling IWD puts to get a long exposure).

We want to profit from the reversal in prices if it happens. I’ve used 3 long IWF puts to 5 short IWD put contracts to achieve this, but this can be scaled up or down to suit a tolerable notional exposure.

This premium spent in this example is $540, which is lost if the IWF reversal does not happen. There is a cost because IWF options are always more expensive than IWD options, but if this analysis holds, they’re going to get a whole lot more expensive.

STEP 2 – Place both trades using LIMIT ORDERS.

Keep the spreadsheet open and up to date with the theoretical option prices just before the market opens, and place LIMIT ORDERS for both trades.

Prior to the open and even throughout much of the trading day, the bid / ask spread might be too wide to reflect the true price of where the options should trade.

It is important to refer to the theoretical option price to get a truer indication of where the option should be priced within the bid / ask spread, even for some months after putting the trade on.

This is because longer-dated options naturally have lower liquidity and, therefore, wider spreads. These spreads will naturally narrow over time as the trade matures and the expiration date nears.

To place the IWF trade, load the ticker into your broker platform. This will bring up the expiration dates for options that you can trade.

Click on the August expiration date and find the relevant put option strike from the available list, as shown below.

Ensure that you are able to see the theoretical option price and, by clicking on the ASK price, use this to generate a LIMIT ORDER, as shown below.

Check that you have created a BUY order (BTO stands for buying to open) and that you have generated a LIMIT order at the correct price and for the correct quantity. Once satisfied, SEND the order.

Now repeat the process on the IWD option screen, first loading the ticker into your broker system and selecting the August expiration date.

Once you have clicked on the correct expiration date, find the put option that you wish to trade from the available strikes.

Ensuring that you can see a theoretical option price, select the put strike from the list and click on the BID price to raise a SELL order.

Satisfy yourself that the correct quantity of contracts have been entered and that it is a SELL order (STO stands for selling to open). Make sure it is a LIMIT ORDER and that the price has been entered correctly. Once happy, SEND the order.

STEP 3 – Manage the orders.

Once the market is open, unless you are tremendously lucky, you will be filled on one of your limit orders only.

Whichever side of the put switch is filled first, your role is now to trade the other side as effectively as possible and as close to your target limit as possible.

This may involve having to compromise and trade at a slightly inferior price to the one you have hoped for, but the main point is that you will want to complete the order within a reasonable timeframe without having just one side filled for too long.

Do not leave the order incomplete until the next day, as things can move drastically from one day to the next, and you don’t want to leave yourself too exposed with just one side completed.

That’s it. Happy trading!

That’s all for today. Special thanks to Benedict Maynard.

Cheers,

Wyatt

Disclosures

- No conflicts here that we know of.