Today we’re looking at unused office space, which is becoming a real problem. Even with hybrid work, many offices remain empty. At the start of 2023, the office vacancy rate stood at 18.1% — a seven-point jump from before the pandemic.

If there’s one question that’s keeping both politicians and investors up at night, it’s this:

What the hell are we going to do with all these office buildings?

Instead of bouncing back post-covid, it’s becoming clear that vacancy rates may never return to normal. And that means lots of office buildings are a ticking time bomb. Unless effective solutions are put in place, investors are going to take it on the chin.

One potential solution lies in office-to-residential conversions. The idea is simple: Cities have too much office space and insufficient housing. Why not just convert all these office buildings into apartments?

Well, it’s not that easy.

In this issue, we explore the issues plaguing office space. We’ll evaluate how the market got to this point and the situation in various markets. Finally, we’ll evaluate the feasibility of office-to-residential conversions, the big solution exciting politicians and investors alike.

First, though, let’s look at the history of office CRE. In doing so, we’ll learn about an important technicality that helps determine whether residential conversions make economic sense

Let’s go 👇

Note: This special issue was co-written by Alts community member Brad Cartier. Brad is the author of The Briefcase, a real estate newsletter we enjoy. If you enjoy this issue, I encourage you to subscribe to The Briefcase.

Table of Contents

A short history of office real estate

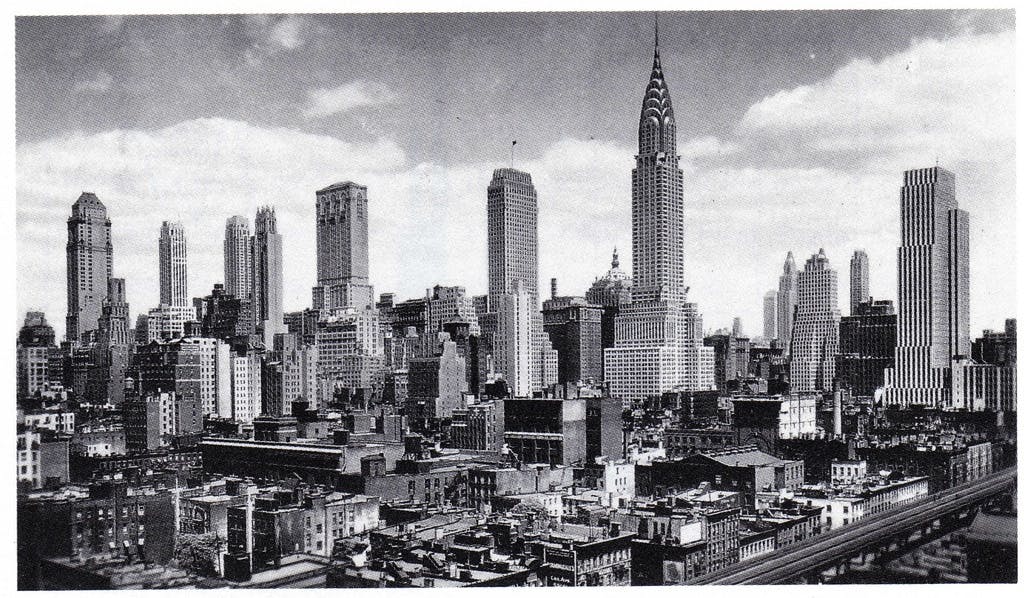

The story of the modern office begins during the roaring 20s, when Manhattan’s skyline took shape amidst the skyscraper boom.

The new buildings taking shape in Chicago and New York were made necessary by the explosion in managerial and administrative work during this period. Corporate complexity, along with the rise of the professional class, required concentrated office space in easy-to-access downtown locations.

As the nature of work and technology continued to evolve, so did the nature of office space. In particular, the rise of air conditioning and improved artificial lighting during the 40s and 50s had a significant impact.

Earlier buildings ensured that interior space was just a short distance from an operable window, both for natural light and to cool things off during the summertime. However, buildings created in the mid to late 20th century were free from these constraints. This was advantageous to businesses, who could now cram more workers into each office building. (Hooray!)

In the 2000’s, the rise of the tech industry accelerated this trend. Open floor plans became the norm. This is exemplified by the rise of the modern steel-and-glass office building, with sweeping open areas flanked by inoperable windows.

Now, clearly not all offices are created the same. Each building is a product of its environment and time.

It’s critical to remember this as we think about the sector’s future.

What’s happening with office CRE today?

During covid, office CRE (Commercial Real Estate) underwent a once-in-a-lifetime paradigm shift.

With many employees unable to come to the office, companies discovered that plenty of jobs could be done from home. In fact, the pandemic proved that a good chunk (about 50%) of America’s 140 million jobs could be done partially or fully remotely.

Once they left the office, employees didn’t want to come back. While the remote work wars are far from over, hybrid work arrangements do seem to be becoming standard. While this is better for office CRE, it still means there is a significant oversupply of office space.

Couple this with high debt servicing costs (thanks to increased interest rates) and you have the perfect storm for pain. In fact, a recently released report from Moody’s showed that office properties account for about 61% of newly delinquent loans.

The final nail in the office coffin is the leasing cycle. The lifecycle of an office lease is generally anywhere from 3-7 years. This creates a lagging effect on the asset class, meaning the current difficulties are just a leading indicator.

Of course, these are aggregate figures for the entire office CRE sector. While the market looks ugly, some types of office space are holding up surprisingly well.

Class A offices are doing okay

Here’s a thought experiment: Suppose your boss tells you that you need to start coming into the office three days a week. Would you be more inclined to push back if you were returning to an old, stuffy office, or a modern, luxurious one?

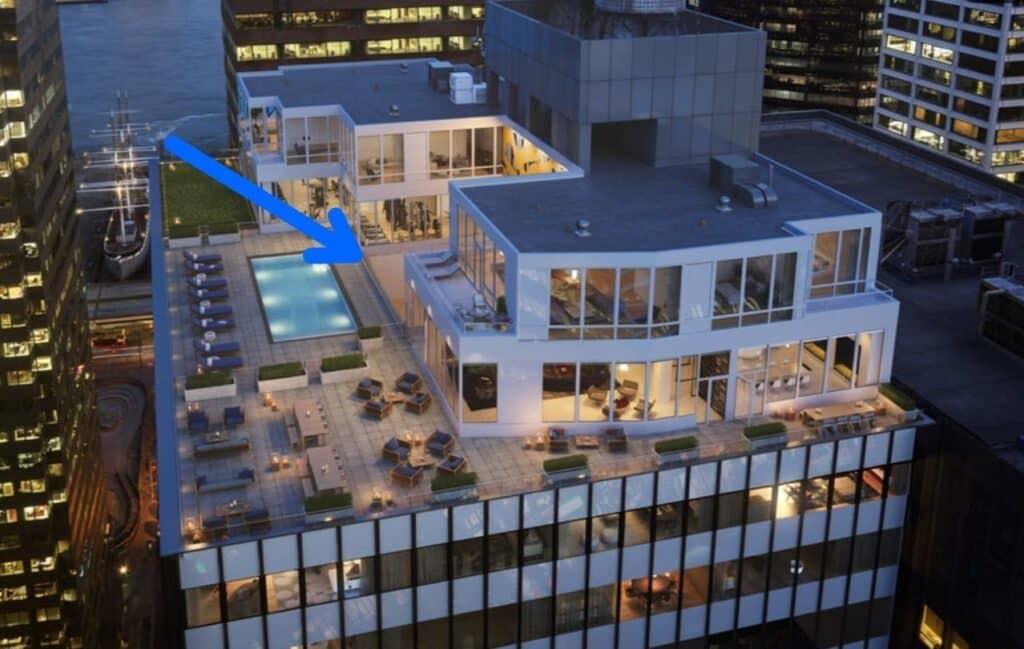

Unless you’re a masochist, it’s going to be much easier to accept a return to that high-quality office. Companies realize that if they want any chance of workers returning to the office, those offices need to be best-in-class. Light, airy, clean, in great locations, and chock full of amenities.

This type of CRE is known as Class A office space, and amidst the broader downturn, Class A office buildings are actually selling for $50 more per square foot (15%) than they were pre-pandemic.

Experts in the CRE trenches agree. In a recent discussion with Bloomberg, Joey Chilelli, a managing director at the CRE-focused Vanbarton Group, commented on this exact dynamic playing out in Manhattan.

There is a large demand for Class A office space right now… The existing tenant base wants brand new space, state-of-the-art space…whether it’s brand-new buildings at One Vanderbilt or Hudson Yards, these buildings are leasing up. – Joey Chilelli

Of course, if class A spaces are doing okay, then other market segments must be feeling the pain. Indeed, office delinquencies are most concentrated in places with lots of Class B and C office space. (Think cities with older stock, like New York and Chicago.)

Major cities, major problems

There are also regional differences here. But surprisingly, the split has been more complex than east coast/west coast, or north/south.

Rather, it looks like major cities are struggling the most, while non-major metro areas are doing okay.

A 2022 report from the National Association of Realtors showed office vacancy rates of just 3% (!) in smaller cities like Charlotte, NC, Savannah, GA, Olympia, WA, and Chattanooga, TN.

Meanwhile, New York City, LA, Chicago, San Francisco, and Washington DC all have office vacancy rates between 13% – 16%.

This makes sense when you consider the types of work taking place in each area. Industries that are most conducive to remote work (tech, finance, consulting) are concentrated in major American cities.

Given all this, many building owners are considering a solution that would kill two birds with one stone: office-to-residential conversions.

Potential solution: Office-to-residential conversions

Since most empty offices are concentrated in cities that struggle with housing shortages, one creative solution to the office CRE nightmare is to just turn all those offices into apartments.

In theory, office-to-residential conversions are hugely attractive for building owners & investors, who might otherwise be stuck with delinquencies and defaults. Renters, of course, would love it. And the strategy is even a winner for politicians, who can tout housing supply increases, and the revitalization of dreary downtowns.

Pretty simple, right? It’s a dream solution for everyone!

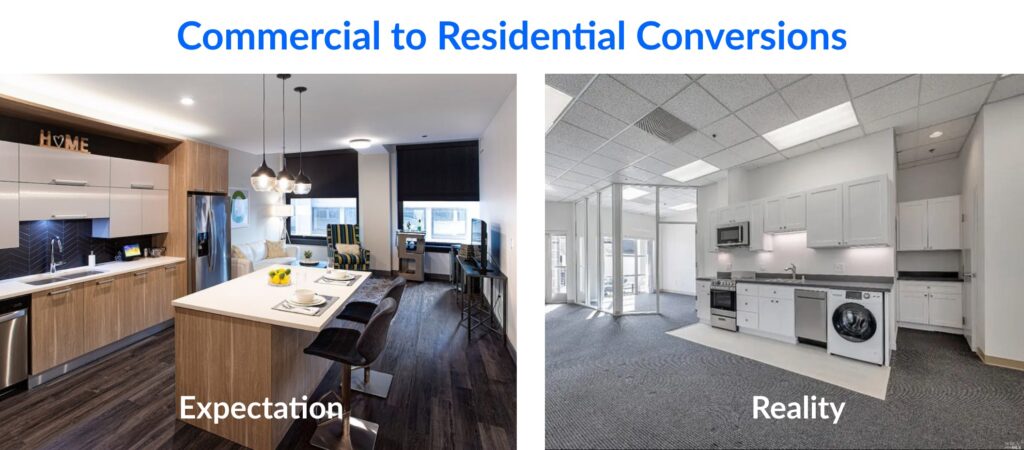

Well, unfortunately it’s far easier said than done.

Office-to-apartment conversion projects are rife with issues:

- Retrofitting. HVAC, mechanical, electrical, and plumbing systems aren’t designed for residential use. All the interior stuff needs to be retrofitted, which becomes very expensive.

- Floorplans. Office layouts are completely different from apartment building layouts. Everything is in the wrong spot. Bathrooms are bunched together, and there is often no kitchen infrastructure. Office buildings seldom have balconies, whereas for apartment buildings, having a balcony is par for the course.

- Building codes. Residential building codes (fire, energy efficiency, minimum room sizes, etc) are different and often stricter than commercial codes.

- Pricing. Residential space sells for significantly less per square foot than office space.

Despite these issues, there have been a number of successful projects to convert offices into multifamily housing.

For instance, 180 Water Street in New York’s financial district was successfully converted to apartments back in 2017.

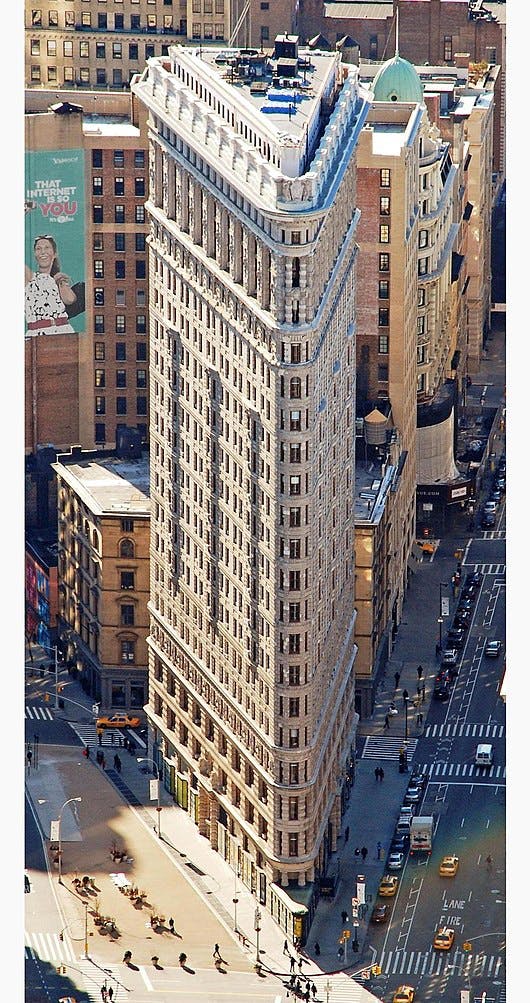

180 Water Street is somewhat rare because it was a newer, postwar office building that was successfully converted to housing. As we mentioned above, prewar buildings are much better suited for residential conversion. Namely, the fact that each office had to be near an operable window (in lieu of air conditioning) resulted in a very similar layout to how apartments fit in a building.

For instance, 1616 Walnut Street in Philadelphia was originally built in 1929 but converted to apartments in 2013. No office in the building was ever more than 26 feet from a window, an ideal distance to capture natural light and well-suited for apartments.

Since 2016, CBRE has tracked 89 completed conversion projects. Notably, the average age of the buildings was 80 years. This indicates a sizeable portion of the buildings were from the prewar period.

Ultimately, physically converting an office building from any era is possible. But the difficult conversion economics drives developers to target older buildings.

When office buildings are retrofitted, they need all the boring stuff nobody thinks about: HVAC, mechanical, electrical, and plumbing.

These types of service businesses aren’t sexy. But boy, do they make the world go round.

Invest in franchise service businesses like these through our friends at Franshares.

The economics of office-to-residential conversions

While office-to-residential conversions seem attractive, they only make financial sense in certain situations.

The core issue is that, from both a demand and regulatory perspective, offices have different requirements than living spaces.

According to CBRE, conversion costs rangs from $100 to $500/sq ft. This can easily exceed the cost basis for developing an average office building, which is about $320/sq ft.

Meanwhile, commercial real estate typically earns more per square foot than residential real estate. So even though it seems like landlords lose money when offices are empty, the higher yield per square foot means they’re often on par with apartments over the long term.

For instance, in 2022, the average multifamily building had a 96.5% occupancy rate compared with an 83.7% occupancy rate for office buildings. And yet, the net operating income per square foot was only $0.50 higher for apartments ($16 compared with $15.50.)

Constant Raise Dan Constant Raise Dan 10:53 AM • Jul 16, 202332Retweets427LikesRead 33 replies 10:53 AM • Jul 16, 202332Retweets427LikesRead 33 replies |

All of this varies by region. For example, New York’s limited housing supply creates more conversion incentives than in other areas.

But to earn a suitable return on investment for any office-to-residential conversion project, investors need to find office buildings with low conversion costs, an attractive original cost basis, and in an area where residential properties have high NOI (net operating income).

This makes older, prewar buildings attractive targets for two key reasons:

- Conversion costs are lower because the offices in them are already close in layout to how apartments should be organized

- Being older and smaller, they also tend to fall in the class B and class C market segment that has been hit extra hard

In part, this is why successfully converted office buildings differ so much from office buildings in general. The median year a converted office was built is 1941, compared with 1989 for office buildings overall. In addition, the average occupancy rate before conversion was 57%, compared with 14.3% overall.

Closing thoughts

Cities are struggling to build enough housing, while at the same time, they’re facing the highest office vacancy rates in nearly 30 years.

Yet there seems to be an assumption that just because office-to-residential conversions sound like the most logical solution, that means they automatically are.

There’s another assumption that the problem lies with regulation. This is partially correct. Zoning laws can definitely be an issue, and legislators are well aware that they have some ability to speed things up by removing legal barriers:

Unfortunately, red tape isn’t usually the big problem here.

In short, we cannot trivialize the financial aspect of doing a conversion. The amount of cash required to wholly re-plumb and re-wire entire buildings to residential code, plus the fact that residential space sells for significantly less than office space, makes building residential housing from scratch a far more attractive alternative.

The good news is this: The same prewar buildings full of Class B and C office space are exactly the structures most suited for conversions.

But even then, the economics can be ugly. To incentivize developers, governments will need to remove barriers and create subsidies to help make conversion economics more attractive.

This is starting to happen as we speak. Boston recently proposed new tax breaks for office-to-residential conversions. And New York, Wisconsin, Washington DC, and California have their own incentives.

We hope to see more of this. The pandemic is over, but the world has changed. Remote work is here to stay, and this problem won’t just solve itself.

It’s not just about empty buildings; it’s about empty downtowns.

The vibrancy of our cities is at stake. 🏢

Further reading

- The Brookings Institute had a great article about common myths surrounding conversions, and what can really revitalize downtowns

- Banks all around are preparing for serious losses in their office loan portfolios.

- Commercial loan distress increases in 70% of the largest metro areas.

- McKinsey’s models suggest there will be 13% – 38% less demand for office space in 2030

- Finally, we talked about office space, but remember that not all commercial real estate is created equal! (More on this to come in a future issue)

Disclosures

- This issue was sponsored by our friends at Franshares.

- I have no personal investments in any companies or entities mentioned in this issue.

- This issue contains no affiliate links.