Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- The Global Sand Mafia

- Millennials and Gen Z Might Be Wealthier Than You Think

- The U.S. Economy’s Resemblance to the ’90s

- Major Real Estate Lawsuits

- Why Walmart Pays Six-Figure Salaries for Truck Drivers

- 3 Stocks To Consider

Have you seen a story our audience would love? Please share it, and I’ll send you some swag if we publish it.

Thanks for reading.

Wyatt

Table of Contents

The Global Sand Mafia: An Environmental and Criminal Crisis

The global demand for sand, a key construction material, has birthed a shadowy $350 billion illegal trade.

This hidden market, dominated by organized crime, is rapidly depleting river and coastal sand, posing serious environmental risks.

With legal and black market sands indistinguishable, this issue remains largely unchecked. More from Tyler Cowen.

Millennials and Gen Z Might Be Wealthier Than You Think

via A Wealth of Common Sense

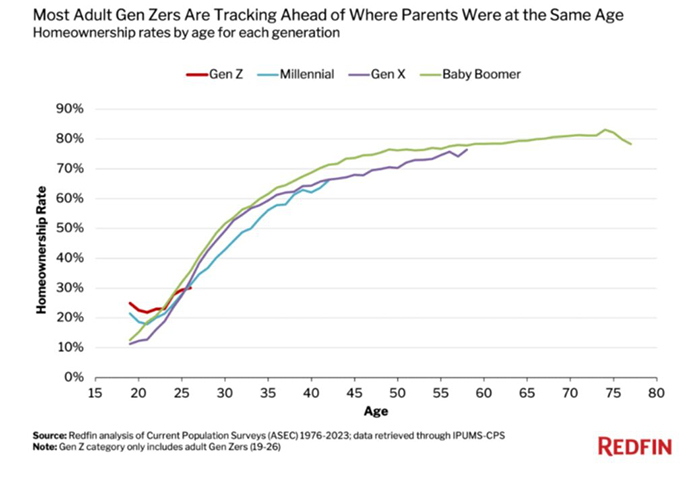

Despite common perceptions, young people today are faring better financially than many realize.

One in four Gen Z adults already owns a home. Millennials and Gen Z are even surpassing baby boomers and Gen X in terms of wealth at the same age, challenging the narrative that younger generations are financially disadvantaged.

Get Ben Carlson’s full breakdown.

The U.S. Economy’s Remarkable Resemblance to the ’90s

The U.S. economy is experiencing a resurgence reminiscent of the ’90s.

Rent prices are dropping due to increased apartment construction, affirming that boosting supply does indeed make housing more affordable.

Additionally, despite interest rate hikes, the economy is showing robust growth with a 3.3% increase in the fourth quarter of 2023, complemented by rising labor productivity, real wages, and high employment rates.

Major Lawsuits Could Change Real Estate

The National Association of Realtors and several top brokerage firms are facing lawsuits that could change how homes are sold in the US.

These legal challenges argue that current commission practices unfairly inflate costs. The outcome could lead to separate, negotiable fees for agents, potentially lowering overall costs for buyers and sellers.

What might this mean for the future of home buying?

Why Walmart Pays Six-Figure Salaries for Truck Drivers

via The Big Picture, Barry Ritholtz

Walmart’s high pay for truck drivers, up to $110,000 annually, is not just generosity but a strategic move to sustain its retail dominance.

Recognizing the vital role of truckers in their supply chain, Walmart offers salaries double the national median, along with exceptional benefits.

This approach ensures a reliable, skilled workforce crucial for efficient distribution. Get the full story.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Interviews, articles, memes & research reports from Twitter, Substack, YouTube & more. Get smarter about investing.

1440 – All your news. None of the bias.

1440 scours 100+ sources so you don’t have to. Culture, science, sports, politics, business, and more—all in a five-minute read.

The newsletter that helps entrepreneurs learn how to build wealth.

Stock ideas

Let’s check back in with Yellowbrick Road, which highlights 15 stocks every week. Here are three of my favourites from this past week.

Analysis provided by public.com.

Remember to always DYOR.

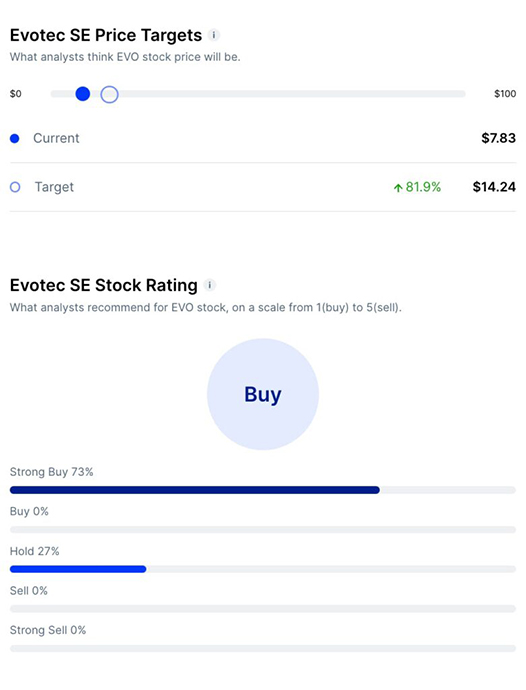

TCR ($EVO)

Bull Case:

- Growth Potential: Evotec’s core activities offer significant growth potential, with sales expected to increase by 46% by 2025.

- Strategic Partnerships: Evotec forms strategic partnerships, accelerating its therapeutics pipeline and expanding research capabilities.

Bear Case:

- Profitability Concerns: Evotec struggles with profitability, and there are negative sales revisions.

- Revised Downward Profit Estimates: Analysts have revised profit estimates downwards.

- Challenges in Biotech Sector: The biotech sector poses inherent risks, and the CEO transition adds uncertainties in leadership.

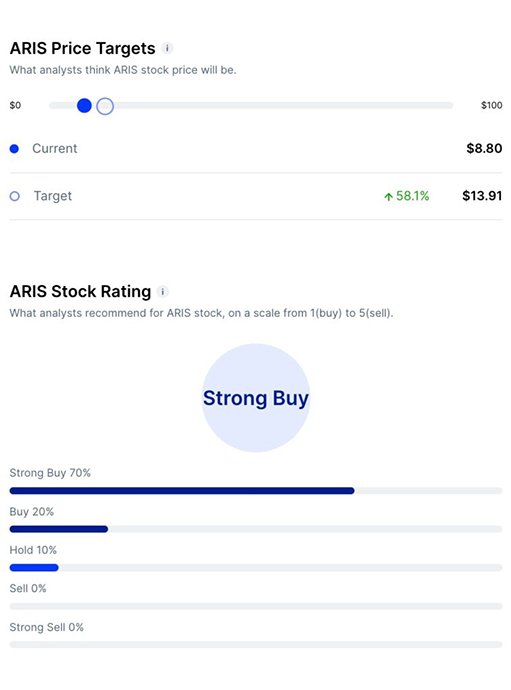

Ticker ($ARIS)

Bull Case:

- Growth Prospects in Water Handling: ARIS is experiencing growth in the water-handling business due to increasing demand for renewable resources.

- Strong Financial Valuation: Analysis suggests ARIS may be undervalued based on discounted cash flow.

- Earnings Forecasts: ARIS is expected to outpace the American market in annual earnings growth.

Bear Case:

- Overleveraging Risks: ARIS faces the risk of overleveraging.

- Dividend and Cash Flow Concerns: ARIS pays dividends, but there are concerns about low free cash flows and dividend yield compared to peers.

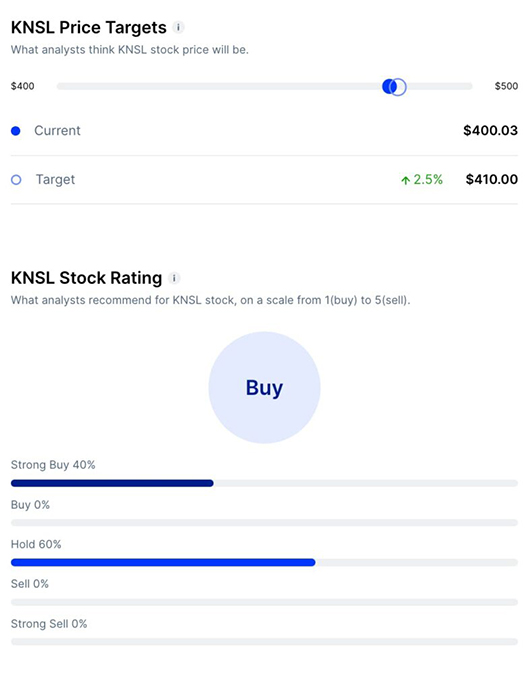

Ticker ($KNSL)

Bull Case:

- Strong Growth: Kinsale Capital shows significant earnings and cash flow growth.

- Outperforming Market Expectations: The stock has recently outperformed the Finance sector and the S&P 500.

- Positive Analyst Outlook: Analysts forecast increased EPS and revenue.

Bear Case:

- Recent Insider Selling: Executives and directors have sold stock, potentially raising concerns.

- High Valuation: Kinsale Capital’s Forward P/E ratio is relatively high compared to the industry average.

- Competitive Pressures: The property and casualty insurance industry is competitive and subject to external factors that can affect growth and profitability.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- Nothing above is financial advice. DYOR, you filthy animal.