Hundreds of investing and finance newsletters hit my (and maybe your) inbox every week. This is the best of the best.

This week, we bring you

- The Oscars, But For Wall Street

- Tip: Avoid Over-Diversification

- Canada’s New Carbon Credits Plan

- The Oracle of Omaha, Literally

- The 1st Nuclear Reactor in the U.S. Since 2016

- JPMorgan Wins, Everyone Else Loses

- 3 Stocks To Consider

Table of Contents

The Oscars, But For Wall Street

Inspired by the yearly film awards, the Buysiders created their own “best of 2023” winners list—this time, for business nerds 🤓

- Best M&A deal: Chevron’s acquisition of Hess.

- Bed PE deal: Roark Capital’s $9.6Bn acquisition of Subway

- IPO of the year: Cava

- Best Private Credit deal: Finastra ($5.3 billion in funding).

ETF Pro Tip: Avoid Over-Diversification

While the all-in-one approach of Vanguard’s Total World Stock ETF (VT) is a hit on social media, it might be skimming your returns.

With over 9,600 stock positions, VT’s vast coverage dilutes the potential of its top holdings.

Surely there’s a better way.

Earning Carbon Credits From Cattle Burps—Canada’s Plan

The Canadian government is investing $12M CAD to reduce methane emissions from cattle through dietary changes.

Under the new policy, Canadian farmers will be able to earn sellable carbon credits for every tonne of emissions that are reduced.

The Oracle of Omaha, Literally

A “Memorex” is new database technology where documents can be explored by meaning instead of needing to know the exact keywords the author used.

And this guy decided to put an entire digital archive of Warren Buffett’s Shareholder Letters into one.

Some example searches we tried:

“what were berkshire’s biggest mistakes?”

“How do you calculate insurance float?”

“what is circle of competence?”

First Nuclear Reactor in the U.S. Since 2016 Now Operational

The U.S. has successfully brought its first nuclear reactor online since 2016, adding further fuel to the uranium investment frenzy.

At a cost of $30 billion, the new 1,114 megawatt (MW) reactor joins two existing reactors at Plant Vogtle in Georgia.

It was a tough year for every bank not named JPMorgan

Despite a challenging year for the banking industry, JPMorgan thrived.

Attracting nervous depositors and posting record-breaking profits, its stock surged 26%.

What I’m reading

I get a lot of mail asking where I find all this good stuff. Here are a few of my favorite newsletters, all of which are free to subscribe to:

Chartr

Visual insights into business, tech, entertainment and society. Takes 5 minutes to read.

Interviews, articles, memes & research reports from Twitter, Substack, YouTube & more. Get smarter about investing.

One of my go-to’s for great stock ideas (including this week’s picks).

Stock ideas

Here are my three favourites from this past week from Yellowbrick Road.

Analysis provided by public.com.

Remember to always DYOR.

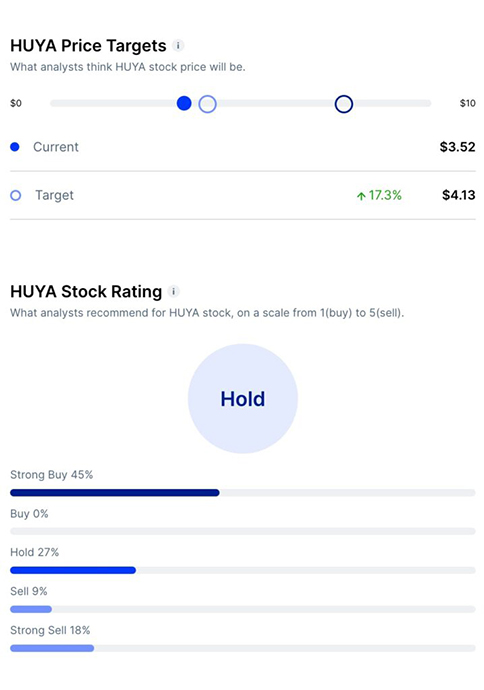

Huya ($HUYA)

Bull Case:

- Exclusive Content: Huya leads in China’s game livestreaming with 80 million monthly users due to exclusive esports content.

- Cash Reserves: Huya reserves cash for shareholders via a $100 million share repurchase program.

- Non-Esports Growth: Huya could diversify into non-esports content, unlocking additional revenue streams.

Bear Case:

- Fierce Competition: Intense competition from Kuaishou and Bilibili limits Huya’s expansion into leisure games and entertainment, challenging market share.

- High Fixed Costs: Profitability is pressured by high content costs and revenue-sharing deals with streamers.

- Regulatory and Tencent Risks: Regulatory scrutiny and Tencent buyout risks introduce uncertainty and volatility.

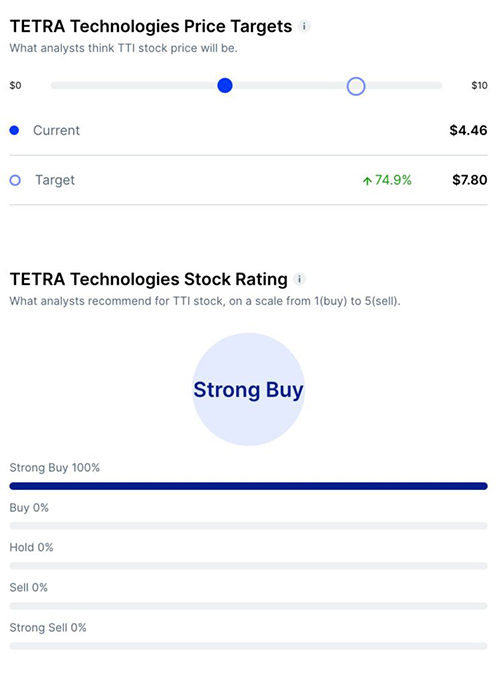

TETRA Technologies Inc. ($TTI)

Bull Case:

- Undervaluation: Analysts suggest TTI is undervalued with a 51% upside potential, driven by a recent 30% stock drop due to project delays.

- Dominant Market Share: TTI’s market leadership in completion fluids and the Permian Basin positions it for growth.

- Growth Initiatives and Diversification: TTI has promising growth initiatives like desalination tech, lithium reserves, and Zinc Bromide Battery Storage.

Bear Case:

- Project Delays: TTI’s recent stock drop due to project delays signals operational challenges.

- Dependency on Oil and Gas: TTI’s close ties to the oil and gas industry make it susceptible to industry fluctuations, and regulatory change.

- Execution Risk: Ambitious growth initiatives may face technical, operational, or market challenges, potentially hindering expected EBITDA.

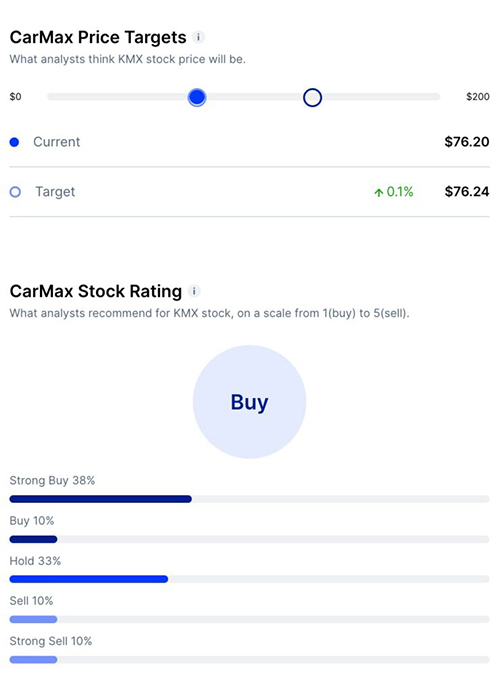

CarMax ($KMX)

Bull Case:

- Customer-Centric Model: CarMax’s customer-focused approach provide a competitive edge in the used-vehicle retailing industry.

- Overreaction to Amazon Partnership: Recent stock drops due to Hyundai’s partnership with Amazon are seen as excessive, given CarMax’s strong business model and unique selling process

- Economic Moat: CarMax’s narrow economic moat, market presence, and CarMax Auto Finance offer competitive advantages.

Bear Case:

- Interest Rates: Economic challenges and rising interest rates could reduce consumer spending on vehicles.

- Market Saturation: The competitive used-vehicle retailing industry and online platforms may pressure CarMax’s market share and margins.

- Execution Risk: Successful execution of growth plans is crucial for CarMax’s sustained performance.

That’s it for this week.

If you write amazing content and want to be featured, please send it through for consideration.

Cheers,

Wyatt

Disclosures

- There are affiliate links above; we’ll get a couple of bucks if you take action after you click.

- This newsletter was brought to you by our friends at Alto and pdfFiller.

- Nothing above is financial advice. DYOR, you filthy animal.