Today, Brian explores the hidden world of data brokers.

When it comes to data collection, it’s Amazon, Meta, and TikTok that usually grab all the headlines.

At this point, tech giants’ collection practices are well-understood. If you use Amazon Prime, they use your data to try and sell you stuff. This is hardly shocking.

But what you may not know is there’s an entirely legal industry whose sole purpose is to gather as much of your data as possible, and selling it off.

Welcome to the shadowy world of data brokers — the personal info aggregation companies that are beginning to get serious public scrutiny.

Let’s go 👇

Note: To read the whole issue you’ll need the All-Access Pass. 🎟️

Table of Contents

Data deletion requests

As you’ll see in this issue, data removal services are on the rise, giving individuals the chance to take back control of their data.

Later on in this issue, we’ll take an honest look at the service offered by Incogni.

For now, what you need to know is:

- Yes, you can file data deletion requests from data brokers yourself. But it’s a huge pain.

- It would take an individual 66 years to manually process their own requests

- Incogni files deletion requests on your behalf

- They handle broker objections so your info gets wiped clean.

An Incogni subscription keeps tab on new entries and takes care of ongoing removals. Alts readers get 55% off.

What is a Data Broker?

The term data broker is actually a bit misleading.

In business, a broker acts as a middleman, connecting buyers and sellers together to make a trade (and earning a commission for themselves.)

But data brokers don’t just buy and sell data. They also aggregate individual data points into a complete digital representation of a human being. This is known as a shadow profile.

This transformational process makes the underlying data far more valuable than it ever could be on its own.

For example, knowing that an individual lives in a certain city might not be that useful by itself. But if you also happen to know their age, gender, income, and level of education, you can start to target them with very specific ads.

In fact, packaging and selling these shadow profiles to companies for marketing purposes is how data brokers earn their money. (And it’s also why they prefer to call their lines of business “marketing analytics” or “targeted advertising” companies.

Think of it like this:

- Companies collect your data (we’ll get into how later on)

- Companies sell your data to brokers

- Brokers use the data to build your shadow profile

- Brokers package & sell shadow profiles to other companies

To be fair to the brokers, not only is this practice perfectly legal, but it actually means people get served ads which are genuinely more relevant to their interests. (Without these companies, perhaps we’d all get spammed with random ads.)

But that doesn’t mean everyone’s on board.

Where do data brokers get their data?

Data brokers use three main sources to fuel their shadow profiles:

Public records

- Plenty of your personal information is a matter of public record

- Court report

- Property deeds

- Birth & death records

- Voter registration data

- Business filings

But the biggest is social media. People share plenty of information about themselves, and brokers are happy to save it all for future use.

Buying from apps

Mobile apps are a surprisingly lucrative source of data.

A few years ago, reporters discovered that family safety app Life360 was selling precise location data on its users to a dozen data brokers.

By the way, this was perfectly legal, since Life360 disclosed it in their privacy policy. (Which of course everyone read.)

Again, in the US, this is legal. It’s sort of the wild west out there (though states are starting to get their act together). But really, as long as this stuff is disclosed somewhere, companies can kind of do whatever they want.

The EU works a bit differently, which I’ll expand on further down

Rewards cards

Company rewards cards are also a huge source of info.

While loyalty programs may offer you a discount on purchases, they often fund those discounts by sharing your purchase habits with data brokers.

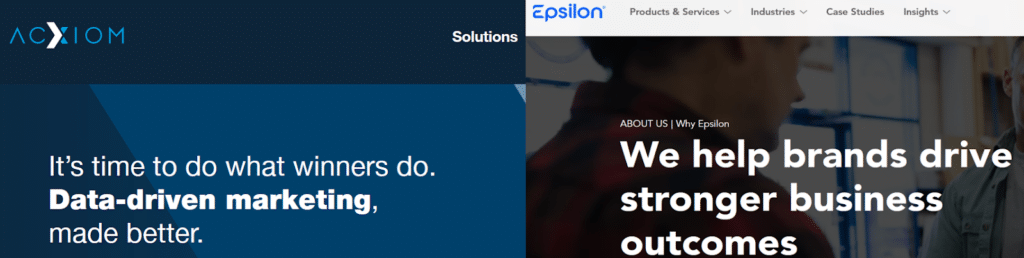

How can you quickly see if your data is being sold?

Just ctrl+f the word “share” or “sell” on any T&C/privacy policy.

Try it for Walmart, ShopRite, or Target. You can see right there in their privacy policy that they share (i.e., sell) personal data to marketing analytic/advertising technology companies

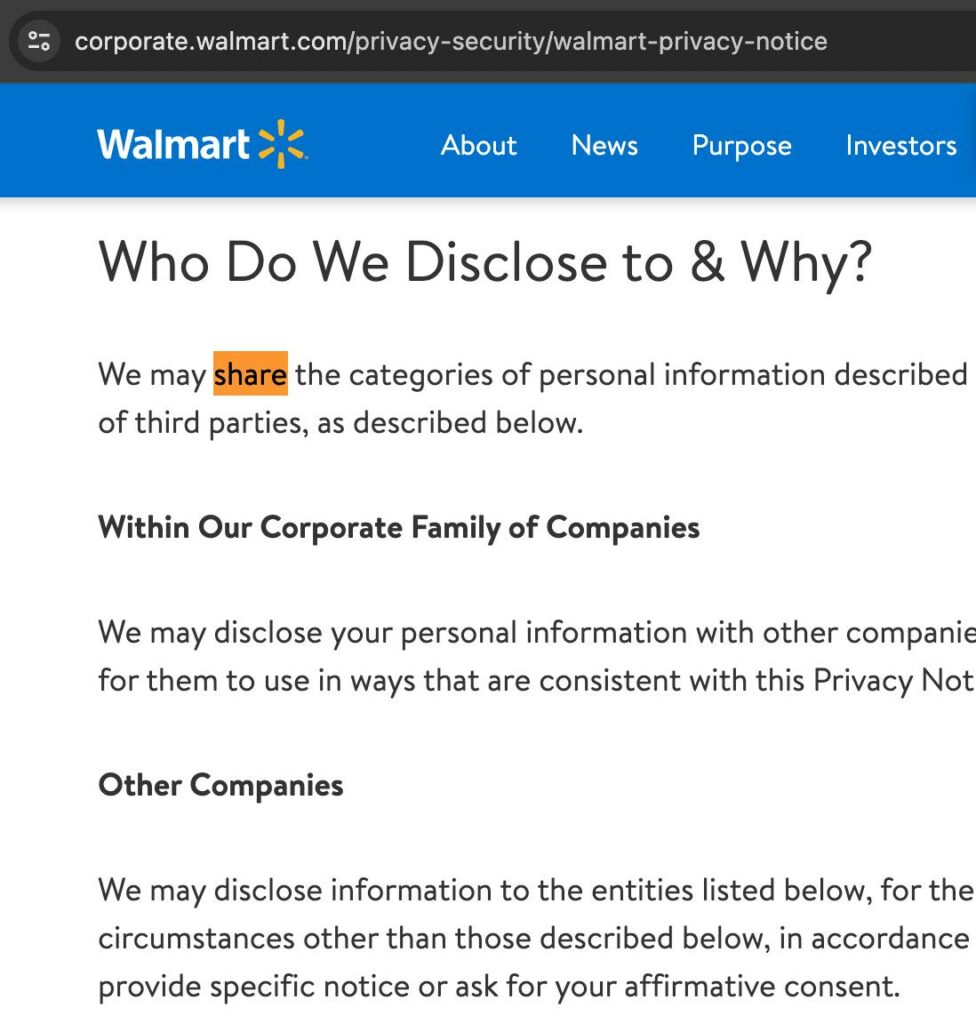

Third-party cookies

You probably know cookies: the small pieces of data used to identify your computer as you use a website.

Third-party cookies are a specific subset of cookies that identify you to someone other than the website operator — usually an ad network.

Here’s how it works:

- When a network serves up an ad on a website, they also insert a third-party tracking cookie in the background

- That cookie tracks data both on the site and between sites

- Along with measuring ad performance, the cookie can be used to document browsing history and other data.

- Data is used to tailor online ads, AND (you guessed it) gets sold to data brokers.

The world’s biggest Data Brokers

All this data brokering is big business.

The global data brokerage industry is estimated to be worth almost $300 billion this year (for reference, that’s just slightly smaller than the global footwear market).

Who are the key players in this shadowy market? And how much data do they really have?

The pure-play brokers

Pure-play brokers are those where aggregating & selling is their main line of business.

The biggest name here, the original firm that got this whole industry started, is called…