September 12, 2022

Read time: ± 6 minutes

Hello and welcome to Alts Cafe!

This is everything you need to know about what’s going on in the world of alternative assets, best enjoyed with your morning coffee.

Let’s go!

Table of Contents

Pulse check: What are the markets doing?

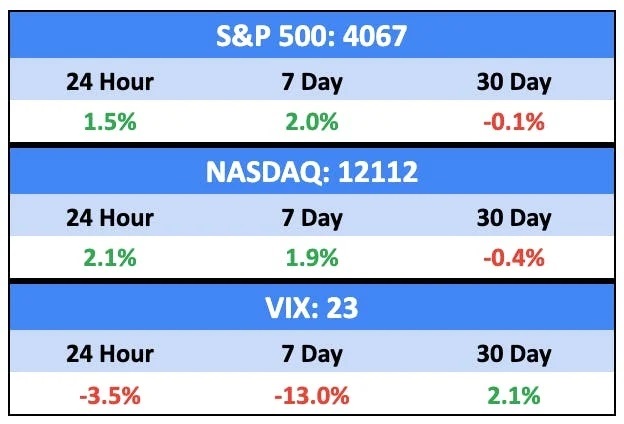

The US equity markets were in the green last week as the US dollar continued to march higher against worldwide currencies.

It’s at a 24-year-high against the Japanese Yen and a 37-year-high against the UK Pound.

The global macro environment is looking bad going into the final quarter of 2022. Interest rates keep rising, inflation refuses to decline, jobless rates are up, and a currency crisis is brewing in Asia.

There’s not a lot to like right now, unfortunately.

Bullish News

- Ukrainian forces mounted a successful counteroffensive against Russian invaders over the weekend. Some pundits are calling this the beginning of the end of the war.

- The Fed’s latest survey of business conditions — known as the Beige Book — found five of its 12 regional banks reporting a moderation in the pace of the economic decline.

- U.S. wholesale inventories increased less than forecast in July.

Bearish News

- US household wealth fell by a record $6.1 trillion in the second quarter as the equity bear market outpaced real estate gains.

- The Bank of Canada hiked interest rates to their highest level in 14 years on Wednesday. Meanwhile unemployment rose to 5.4% with 39,700 jobs lost in August.

- The ECB is likely to increase rates by 75BPS.

- Poland’s central bank forecasts double-digit inflation through 2024.

- Britain’s economy grew by less than expected in July while inflation forecasts rose to 11.7%. Further rate hikes are expected.

- Chinese demand for oil is forecast to shrink for the first time since 2002 due to Covid restrictions.

What are we doing?

Fractional Alts picks:

No changes here.

ALTS 1 fund news:

Nothing to report.

Crypto

Here’s what you need to know:

Big rebound last week, as both Bitcoin and Ethereum jumped in synch with the equity markets (but more, as ever):

The fear and greed index ticked upward in near lockstep –

All eyes are on Ethereum this week, as the clock ticks down. The merge is currently forecast to happen sometime Wednesday afternoon, EST. You can keep track of the countdown by Googling Ethereum merge.

Bullish News

- The Ethereum merge is on track to go live slightly ahead of schedule.

- Binance-backed WazirX says India has unfrozen its bank accounts.

- GameStop will start selling FTX gift cards at some of its stores.

- The American SEC will set up an office for crypto filings.

- Dubai continues to reinvent itself as a crypto hub.

- American law enforcement seized $30m from North Korean crypto hackers.

Bearish News

- Online checkout company Bolt has scrapped its $1.5 billion deal to buy cryptocurrency infrastructure provider Wyre.

- El Salvador’s Bitcoin experiment is not going well.

What to do with that info:

Right now, crypto looks a lot stronger than the overall economy, but US equities and Bitcoin (and ETH, etc) are still super correlated. I’m watching to see when/if the two diverge given their underlying fundamentals.

Real Estate

Here’s what you need to know:

We did a deep dive into the current real estate market last week, and I encourage you to check it out if you’re interested in this space. And if you can’t be bothered, the highlights are below.

Bullish News

- While home inventory is rising sharply to around 1.3m units on the market, that’s still miles off 2008 numbers, which peaked around 4m.

- The rental market is looking better than ever. Vacancy rates are the lowest they’ve been for 30 years despite rents increasing more than 10% year over year (👋 inflation).

- Both residential and commercial real estate mortgage defaults are well below historic averages still and are actually declining against both last quarter and last year.

Bearish News

- New American homeowners are now stuck with paying the highest average mortgage payment on record ($1,162 per month). This is an increase of 31% since 2021, the largest one-year increase in 22 years.

- The housing price-rent ratio, which compares home prices to rental rates is the highest it’s ever been.

What to do with that info:

I think the winners from the current market will be:

- Rental units

- Self-storage

- Mobile home parks

NFTs

Here’s what you need to know:

Our NFT blue-chip index was up nearly 14% last week as the digital assets followed crypto and the equities markets up.

Jim Carey unmasked himself this week, revealing that he’s the face behind the Germinations collection. While none of the five pieces have sold since the revelation, offer prices are around 10x each piece’s last sale.

Bill Murray was also in the news this week for more unfortunate reasons – hackers stole $175k worth of ETH from his wallet after he revealed the address during a charity auction. That’s low.

Bullish News

- Builders build during bear markets.

- NFT fantasy sports company SoRare announced an exclusive partnership with the NBA, which will expand its offerings beyond soccer and baseball. Get a free limited card via my affiliate link if you’d like to try it out.

Bearish News

- Just as it was in the development stage for a Viking NFT Game, Pixie Interactive, a GameFi studio, has folded up.

- NFT trading volume last week was the lowest it’s been since February 2021.

What to do with that info:

All the strength continues to come from blue-chips, with a tiny amount of volume going toward newer project.

It could be a good time to dip into cheaper projects with a lot of potential.

Startups

Here’s what you need to know:

Market weakness has finally flowed through to market data, as the ponderous VC sales cycle catches up.

Because funding rounds can take weeks or months to finalize, Q1 and early Q2 numbers were looking ok in real time, but things have started to crash down around the ecosystem.

Bullish News

- VCs invested $14.2B into crypto startups in the first half of 2022.

- Health tech startup Verily, which is part of Alphabet Inc, raised $1B.

Bearish News

- VC investment in crypto startups was down 42% in July while AI & ML funding was down 28% in Q2.

- Global VC funding hit its lowest point in two years last month.

- Softbank’s Vision fund will cut 20% of staff.

- Venture activity in Greater China dropped significantly in the first half of 2022, continuing a slowdown since late last year.

- Tiger Global Management, which participated in 20 deals in August 2021, and led and co-led deals worth $680m, did only one deal last month, leading none. Sequoia capital posted similar numbers.

What to do with that info:

Right now is a fantastic time to invest in capital-efficient startups with a proven revenue model.

Quick Hits

Sports Cards

Baseball legend Derek Jeter is launching a blockchain-based card grading and trading platform called Arena Club.

It’s not really clear to me how this differs from several existing services already in place, but Jeter’s name alongside the venture will surely help it stand out.

Rare Books

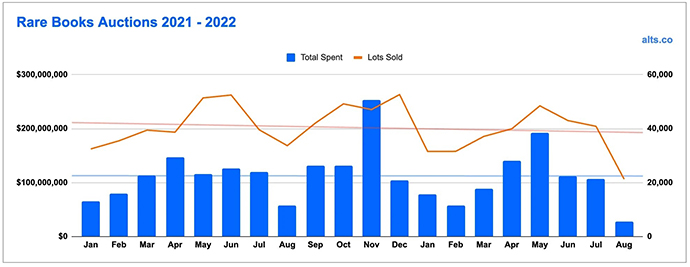

While summers are always slow in the rare books world, this August was an absolute disaster for auction houses.

With only $27m in sales last month, figures were down over 50% year over year. The culprit was twofold, as fewer items sold for less money.

- Number of lots: 21k vs 34k in 2021

- Average sale price: $1,289 vs $1,726 in 2021

Early September data isn’t encouraging.

That’s all for this week. Hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt