Hello and welcome to Alts Cafe

[Remember, I’m off on holiday week, so you’ll be treated to a special issue focussing on climate change’s impact on residential real estate]

This is a quick-fire look at what’s driving your alts week.

TLDR:

- Consumer sentiment continues to rise in the US

- Lending is getting tighter

- Chinese real estate is in Big Trouble

- Indian startup investing is down 75% YoY

- The Ripple ruling might be in trouble

Wyatt

Table of Contents

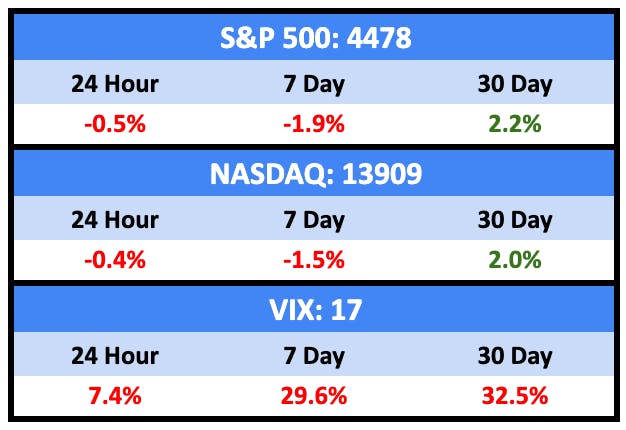

Macro View

Rough week the US got Fitch slapped by the ratings agency, losing its AAA status.

Bullish News

- Annual U.S. inflation rose at its slowest pace in more than two years in June.

- US consumer sentiment rose in July to the highest since October 2021 as inflation continued to ease. Pundits agree things are pretty good.

- The NASDAQ was positive for the fifth straight month in July.

Bearish News

- Credit ratings agency Fitch downgraded the US from AAA to AA+

- And NASDAQ posted its worst day since February while the S&P saw its biggest daily loss since April.

- US job openings fell to its lowest level since April 2021 in June.

What are we doing?

ALTS 1 Fund news:

Nothing here

Real Estate

Bullish News

- Mortgage payments have been flat for the last three months (down 0.1% last month)

- Immigrants could save American homeownership.

- Strip malls are the new self-storage facility.

Bearish News

- US residential mortgage lending is getting tighter, which will further depress demand.

- Blackstone’s $68 billion flagship property fund is holding a fire sale in order to meet redemption requests and fund the purchase of AI data centres.

- The wage gap between various US metros is at its widest point ever with Philadelphia seeing a 6.6% YoY growth compared to only 2.6% in Houston.

- Chinese home sales are down a third year over year.

- Possibly because Chinese millennials spent 46% more on Starbucks lattes this year.

- Chinese property manager Evergrande Services plunged $1.6 billion when trading resumed Wednesday.

- Property insurance prices in Florida continue to climb. Rates are up 28% YoY in Miami.

- And the city faced its first net migration loss in decades.

- Salt Lake City is in the top five for both property tax increases and home insurance hikes YoY.

- Foreign purchases of US homes was down for the sixth straight year

- But last year’s 14% decline was lower than the overall purchase rate in the US.

- Local shopping malls continue to be worth much less than they used to be.

- The US construction industry needs 650k workers to keep up with demand; their lack is slowing down project completion and increasing prices.

How to invest in real estate right now:

Read next week’s Special Edition on how to invest in residential real estate against the apocalyptic spectre of global climate change (it’s not all bad news).

Startups

Bullish News

- Uber has now lost a bit less than $32 billion. Shares were down on the news.

- Goldman thinks AI investments will top $200 billion by end of 2025. Surprised we’re not there already.

- Vietnamese EV maker VinFast will IPO in the US at a $23 billion valuation via SPAC.

- North American banks are winning a global race to transform banking into an AI-first industry.

Bearish News

- Funding for Indian startups was down 75% YoY in the first quarter of 2023.

- And the Indian startup ecosystem did not mint a single unicorn in the first three months of 2023

- And 84% of Indian VCs surveyed said that growth-stage startups faced difficulty in raising funds.

- But VC, CVCs and PE investors have announced 40 funds worth more than $3.6 billion so far this year to support Indian startups.

- European IPOs are at their lowest level since 2009.

- Investing in climate-tech is cooling down.

- But China is investing in record amount of metals and mining.

How to invest in startups right now:

Semi-conductors, baby.

Crypto & NFTs

Here’s what you need to know:

Crypto held steady in a choppy week.

Likewise sentiment. Looks like another steady week.

NFTs continued their slide and are only slightly up on 2023.

Bullish News

- Tether said its assets rose 5.7% to $86.5 billion in the second quarter of 2023, while it made more than $1 billion “operational profit”, a 30% increase on the previous quarter.

- Even though crypto is illegal in China, Binance manages to do $90 billion worth of transactions there anyway.

- The crypto arm of Japanese investment bank and brokerage Nomura won a crypto operating licence in Dubai.

- Terraform Labs and its founder, Do Kwon, will face fraud allegations.

Bearish News

- The SEC asked Coinbase to halt trading in everything except bitcoin.

- Several stable pools on Curve Finance using Vyper were exploited on July 30. The thieves stole $47 million.

- SBF may have been behind the BALD rug pull. Because of course.

- Robinhood’s crypto earnings were down 18% last quarter.

- Worldcoin may share your iris scans with government agencies.

- Nifty’s has shut down.

- A US judge has backtracked on the Ripple ruling, which has negative implications for alt coins.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Percent and Fundhomes

- We hold BTC and ETH in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.