Welcome to The WC — your weekly shot of awesome.

Today we’ve got:

- Free money to flip homes

- UFOs aren’t aliens

- The return on hassle spectrum

- A shortcut to doing great work

- Ineffective altruists

Table of Contents

Free money to upgrade your home(s)

As part of the Biden administration’s Inflation Reduction, the Department of Energy will begin giving rebates — usually around 30% — to homeowners that invest in energy efficient upgrades.

DOE has also asked states and territories to prioritize households that stand to benefit the most from these funds, including allocating at least half of the program funds to reach households with incomes at or below 80% of their area median income (AMI).

It strikes me there’s an opportunity here for a real estate investor to partner with their state development agency to hoover up a bunch of these out-of-date, low-income homes, make them energy-efficient, then flip them for a significant profit.

If you want to give this a go, please let me know.

Are UFOs aliens?

Probably not.

There’s been a lot of talk about UFOs and aliens lately with a bunch of former national security folks testifying that UFOs are real and there’s a big government conspiracy.

I’m not saying the government doesn’t know more than it’s letting on — of course it does. But I don’t think all this space junk is aliens.

This Twitter thread from Eliezer Yudkowsky does a good job of explaining why and aligns well with my views.

P/S/B: UFOs are almost certainly not aliens, and this is knowable with study and thought.

— Eliezer Yudkowsky (@ESYudkowsky) July 21, 2023

Perhaps you've heard that before. But it's not just empty words, this time; I've bet $150,000 to $1,000 against past UFO sightings being revealed within 5 years to have a…

If you don’t want to scroll through, it comes down to this:

Any life form sufficiently advanced to get themselves here isn’t going to be stupid enough to get caught / seen unless they want to.

I do believe (strongly) there is life in the universe, and I have since I took Astronomy 5 back in the day at UCLA.

But they’re not abducting or probing your cousin.

Where are you on the return on hassle spectrum

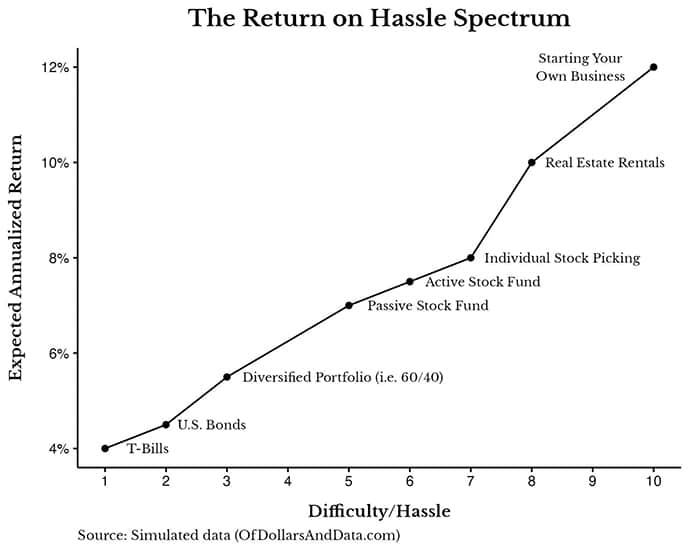

Nick, over at Of Dollars and Data, put together a chart outlining a variety of investments and their respective returns on hassle.

Basically, easy stuff is on the left and produces a low return.

Hard stuff is on the right and pays better.

It makes a lot of sense to me, though I do have some quibbles:

- There’s no way this is linear — the delta in hassle between T-bills and bonds is not the same as stock picking and real estate rentals

- We need a Z axis to account for variance (basically β) somehow. The variance of returns for Bonds is tight, whereas founding a company could take you to zero or billions. A Sharpe ratio etc.

Regardless, this makes sense, and it’s helpful to think about. A much more detailed and well-researched version of this could be immeasurably helpful for those on their own personal investing journeys.

Where do you fall on this spectrum?

How to do great work

Paul Graham isn’t always right on, but his essays tend to be both useful and part of the zeitgeist. So they’re usually sort of required reading in Silicon Valley.

But his piece on How to Do Great Work is excellent.

It struck me at a fortuitous point — I’m considering my future and the role I want to play in the world — and I got a lot from it.

It’s also very long. Like 12,000 words or around 40 pages.

As a favor to both my future self and you, I jotted down some of the most useful quotes and points.

I used Mem, because I like how it brings my different thoughts and ideas together. If you’ve got an account, you can read it here. If you don’t / don’t want to create an account, here’s a google doc.

Keen to hear your thoughts on this!

How not to do great work

Gabe Bankman-Fried, the brother of SBF, tried to buy the island of Nauru to create a new species of genetically-enhanced humans. The bunker was intended to protect effective altruists in the event of a catastrophic event where a large portion of the population would be lost.

Best to avoid the entire Bankman-Fried clan if you can.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- This issue was sponsored by Augusta Precious Metals and FundHomes.

- Our ALTS 1 Fund doesn’t have a stake in anything here.

- This issue does not contain any affiliate links