Welcome to a Very Special issue of The WC

Instead of filling your head with five random bits, this time you’ll be treated to what I think to be the five of the worst investments of 2022. Feel free to review the worst investments of 2021 first.

Let’s go!

Table of Contents

Gold

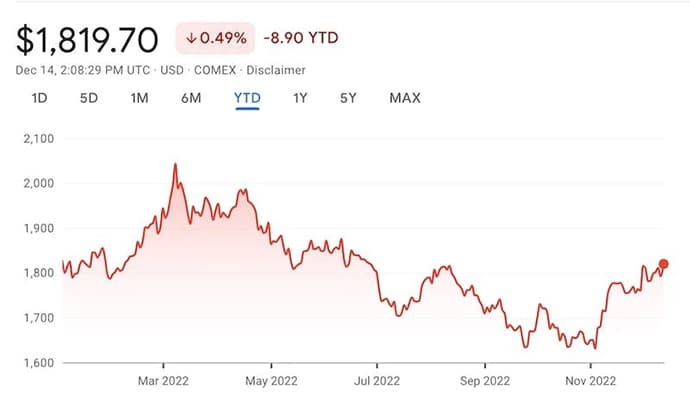

Gold was on the list in my ‘Five worst investments of 2021’, and it makes another appearance in 2022.

It’s actually not had an awful year. In fact, it’s pretty flat through 2022, only down 1%. But the whole point of gold is to hedge inflation and store value. And with inflation topping 9% in the US in 2022, you’d sort of hope gold would match that.

If you held gold this year, you’re flat in dollar terms but down 9% in real terms.

In fact, gold’s price has actually moved inverse to inflation in 2022.

Nominally flat isn’t the worst thing in 2022, but gold has one job and can’t do it.

Crypto

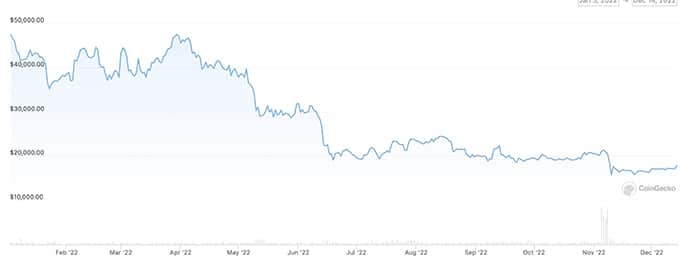

In last year’s issue, I said Bitcoin is superior to gold in every way, and is a better/more logical store of value.

Whoops.

It turns out one big way crypto is inferior to gold is the number of scams and scandals it attracts, and that played out big time in 2022. Here are some of crypto’s greatest hits in 2022:

- March 30: North Korea hacked $550m from the Ronin network

- May 7: Terra and LUNA collapsed

- June 12: Celsius filed for bankruptcy, taking Maker, Compound, Aave, Genesis, Galaxy Digital, and Three Arrows Capital down with it.

- August 8: The US Treasury banned Tornado Cash

- November 9: FTX

Not a great look.

But the reason behind crypto’s bear run in 2022 was two-pronged.

During Covid, crypto became more mainstream, which made it a part of everyday investor accounts, which made it more correlated to the broader equity markets.

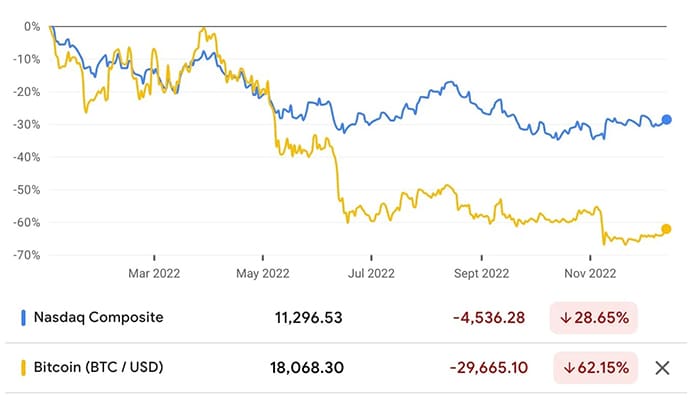

In 2022, whatever the NASDAQ did, BTC did too, only more so.

The FTX mess actually decoupled crypto from equities but probably not in the way crypto investors would have liked.

Tech IPOs

Speaking of equities…

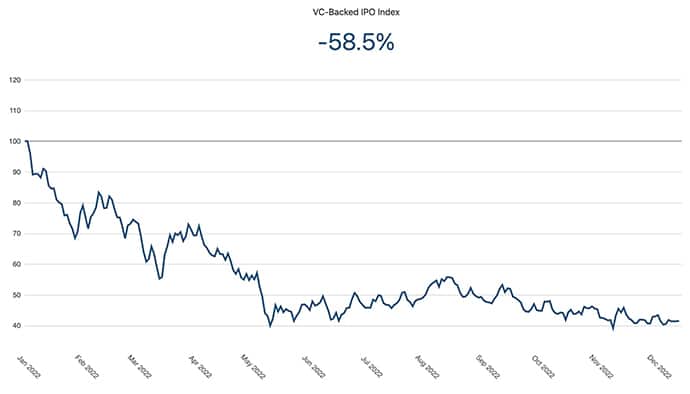

It was a rotten year for loads of tech stocks (META and TSLA top the list), but let’s look at how 2021’s hottest IPOs did in 2022.

2021 was a banner year for venture investing, with 296 VC-backed public listings generating $681.5 billion in exit value. That’s not IPO value, it’s just the profits to VC firms and their LPs.

Some of the biggest winners generated well over $30B at listing, but 2022 has been fugly, with the lot down an average of 58.5%.

But the biggest listings of the year have been some of the worst offenders.

The top ten VC-backed IPOs and direct listings of 2021 have lost 63% year to date.

That’s $295B worth of value up in smoke.

Some percent of Coinbase’s dramatic fall is due to 2022’s crypto winter, and Robinhood can blame a down market for some of their losses. But the rest?

*APPLOVIN SHARES DROP 11% AFTER EARNINGS REPORT pic.twitter.com/IBpdlZ0Lk0

— zerohedge (@zerohedge) August 10, 2022

To be fair, if you think something named as a parody of a Superbad gag is worth $29B, that’s on you.

And with catastrophic share prices declines and a realization that turning a profit at some point is important, many of these companies have laid off thousands of employees.

Which brings us to…

Commercial office real estate

Commercial office space is a ghost town these days, with vacancies higher than ever.

Across America, the average office vacancy rate hit 17.8% in the third quarter of 2022 and may top 20% by the end of 2023.

While that’s historically bad, many major metros look much uglier. Chicago, San Francisco, Atlanta, Austin, Cincinnati, Dallas, Columbus, Houston, Los Angeles, Minneapolis, New York City, Phoenix, and Tampa all topped 20% in the third quarter.

But it’s actually much, much worse than that, because a great many of offices listed as occupied are actually empty.

Sure, the company is still paying the lease (for now), but very few of its employees are actually turning up to the office. And that’s not likely to change. Remote work is here to stay, whether corporate landlords want it or not.

So, in San Francisco for example, when 50% of existing leases expire by 2025, a great many of them won’t get renewed. The official vacancy rate will continue to creep up over the next few years resulting in a slow-motion car crash.

But we don’t have to wait until 2025. This year was bad enough (this is a post about 2022’s worst investments after all).

Two stark examples:

SF’s Wells Fargo building

In June, Wells Fargo, San Francisco’s second-largest private employer, listed its 13-story building at 550 California St. for $160 million, about $450 a square foot.

While the guidance price was a good 25% below what the 355,000-square-foot building would have fetched before the pandemic, the bids submitted were much lower — about $250 a square foot, about 45% below expectations.

That’s 70% below likely 2019 values.

455 Market St

455 Market St. is a 374,000-square-foot complex that is 80% leased.

While the seller sought close to $280 million, or $750 a square foot — pre-pandemic values would have been $900 a square foot — bids received were closer to $500 a square foot, about $187 million.

In both cases, the broker pulled the buildings off the market.

Bonds

Good old bonds.

When everything else has shit the bed, you can rely on bonds to deliver slow and steady (positive) returns.

*record scratch*

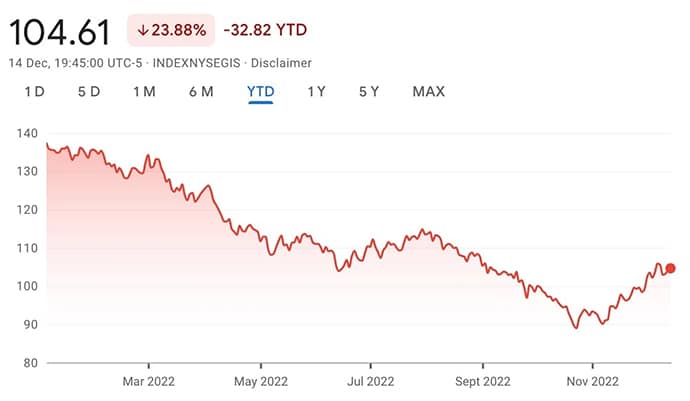

In 45 years, bonds have fallen in value only five times, and the most significant decline was 2.9% in 1994. In 2022, the bond index is currently down by more than 11%.

If you’re not familiar with bond values, generally speaking, when yields go up, prices go down. Why?

Say you own a 20-year US treasury paying 1.6% interest. If you want to generate $100k a year income from that bond, you need to own $6.25m worth of those notes. Eight months later, the going rate for those same notes is 3.5%.

A buyer comes along and has the option of buying your notes or fresh ones off the press. She also wants $100k income per year. For the new notes, she only needs to buy $2.85m worth of the notes. If you want her to buy your notes instead, you need to reduce them to match the price — a 54% haircut.

That’s precisely what happened this year. Inflation went up, so yields went up, so your slow and steady bond got smash-hammered.

And that, ladies and gentlemen, is why 2022 has been the worst ever. BlackRock thinks 2023 will be worse.

What were your worst investments this year? Care to share any howlers?

Happy holidays,

Wyatt