As 2021 draws to a close, most portfolios are up on the year despite a slight downturn over the last week or two. It’s easy to feel smart during a bull run, but what about the less fortunate among us who managed to screw it up?

Today we’re looking at five of the worst investments of 2021 to see what we can learn from others’ mistakes.

While we’ve had the good fortune to be up over 430% this year, others have had to learn some difficult lessons.

Let’s get the obvious bit out of the way first. If you’re looking for a feel-good story about the best investments in 2021, this ain’t it. We’re here to learn, and failure is the best teacher.

But we don’t have to fail ourselves to learn lessons. Unifier of Germany and noted mustache aficionado Otto von Bismarck said it best, “Fools say that they learn by experience. I prefer to profit by others’ experience.”

While none of these investments went to zero, they each teach a different lesson about investing.

Let’s go

Table of Contents

The Guy Who Sold a Bored Ape for 0.75 ETH

What Happened?

Bored Ape Yacht Club is an NFT profile pic project (PFP) that gives owners access to parties, events, and a certain amount of social capital. There are 10,000 of these avatars, and their floor price is around $200k each. They trade frequently on Opensea.io, where buyers can scoop them up in a few clicks.

Well, someone named Max accidentally sold his for $3,066 when he listed his ape on Opensea for 0.75 ETH instead of 75 ETH.

A bot immediately purchased the ape and relisted it for more than 100x the purchase price, spending more than $30k to expedite the transaction. He told CNET:”How’d it happen? A lapse of concentration I guess. I list a lot of items every day and just wasn’t paying attention properly. I instantly saw the error as my finger clicked the mouse but a bot sent a transaction with over 8 eth [$34,000] of gas fees so it was instantly sniped before I could click cancel, and just like that, $250k was gone.”

As with all things in the world of NFTs, there are no do-overs, no refunds, and no mulligans. Once it’s gone, it’s gone.

What Can We Learn?

So what lessons can we take away from Max’s fat-finger disaster?

Obviously, the first thing is to take care when you’re making six-figure transactions. Decimal points matter, and you should perhaps someone review your work before hitting send (something I’m familiar with myself!).

The second lesson is in user experience (UX) design for platform creators. A user is listing an item for 99% less than they should be? Maybe throw up a confirmation window?

But there’s another lesson here that’s perhaps more important.

Sh-t happens. Once it’s done, it’s done. Top performers learn from their mistakes but don’t dwell on them.

Max himself said it best.

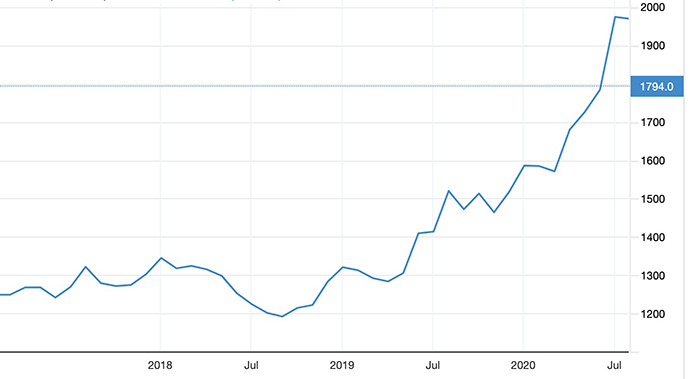

Gold

What Happened?

Gold investors have this cult-like following and obsession with the rare metal, especially in the United States. It’s somehow tied to individualism, small government, and safety.

But mostly it’s meant to be a hedge against inflation. Something real and tangible with utility that won’t be affected by something like hyper-inflation when the government decides to pump $5T into the economy.

And the rationale sort of makes sense in theory. And that theory pretty much held during the early days of Covid.

But then people remembered that gold is actually pretty useless relative to its high cost, Bitcoin is superior in every way that matters, and gold managed to lose money in 2021.

To be fair, gold wasn’t the only metal-based loser in 2021. Silver’s off 15%, steel is flat, and iron is down nearly 30%.

But gold gets the most attention.

What Can We Learn?

Stop investing in gold? Gold is stupid? Put your money in Bitcoin? Or literally anything else?

All a bit extreme and inflammatory, but if gold can’t thrive during the highest period of inflation in the US since 1982, what the heck is it good for?

Don’t take my word for it; listen to one of the most successful, conventional, and conservative investors of all time, Warren Buffett:“(Gold) gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Buffett goes on to say:“You could take all the gold that’s ever been mined, and it would fill a cube 67 feet in each direction. For what it’s worth at current gold prices, you could buy — not some — all of the farmland in the United States. Plus, you could buy 10 Exxon Mobils (XOM), plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?”

NBA Top Shot

What Happened?

NBA Top Shot was one of the first on ramps to NFTs for normies. People get basketball. They get sports cards. They get highlights. This is like a combination of all those things in the best possible way, right? And the value is only going up!

New pack drops would sell out in seconds. Queues formed. Systems crashed. Interviews with “Top Shot Whales” were all over CNBC. NBA Top Shot was in such high demand that owner Dapper Labs started started producing more supply to keep up with demand. Then more supply.

Then, the NFT winter happened in March. A mini ice age, where the initial hyper enthusiasm around NFTs cooled for a bit.

The enthusiasm came back of course, but by then, standards were higher for NFT projects. People realized:

- You don’t own the commercial rights to the IP

- There’s no utility to NBA Top Shots. You just look at them, and looking on the blockchain isn’t better than looking at them on YouTube.

- Supply was starting to outstrip demand

- Other, better, similar projects like SoRare were evolving

And so this happened..

What Can We Learn?

Pumping and dumping is real, expensive, and dangerous.

Pumping and dumping is when insiders or significant stakeholders talk up a project or investment to attract more and more buyers so the insiders can sell their stake to those new buyers and get out with a profit.

Pumping and dumping is illegal when applied to securities and can land the perpetrator in prison. But NFTs aren’t securities (yet), so the rules are much looser.

We also learned that projects don’t go up and to the right forever (more on this later). There are only so many people and so much money that can get into a project or investment before the big money gets out.

Usually it’s retail investors who are left holding the bag while the whales move on to the Next Big Thing.

Savings Accounts

What Happened?

Savings accounts have always been bad investments over any decent length of time. Sure, in most countries during most time periods, you won’t see the value of your savings account plummet by 30% to 50% like you could with Bitcoin, equities, or some random NFT project.

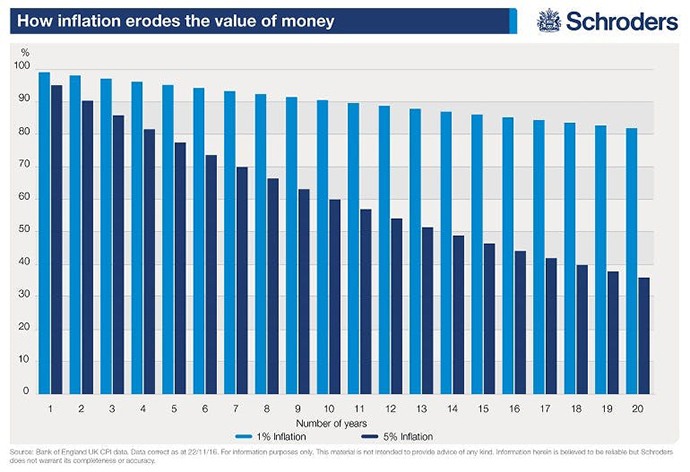

But you are guaranteed to lose money over time, because of one pernicious and persistent foe – inflation.

Left alone, $1,000 today will be worth somewhere between $36 to $82 twenty years from now. And given today’s inflationary climate (6.8% at last check in the US), $36 may be optimistic.

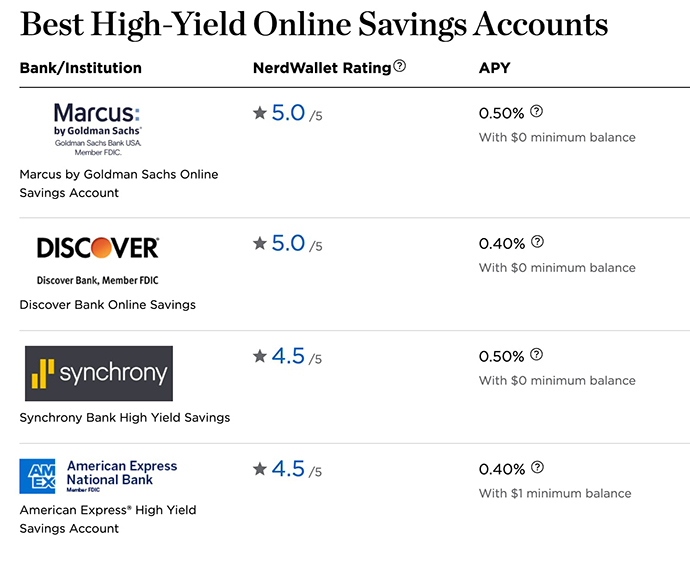

Of course, savings accounts generate interest, though, and that softens the blow a bit. So let’s see what our best options are for High Yield Savings accounts, according to NerdWallet.

The absolute top-rated savings account returned -6.3% this year with no hope of any upside at all.

What Can We Learn?

So we know that savings accounts are guaranteed to lose you money, but at least they won’t lose all your money, right? And other stuff is super risky (???? Top Shot and Gold).

And that’s why we don’t put 100% of our portfolio in digital apes and NBA highlights.

A well-diversified portfolio including equities, alternative assets, and ~10% cash as dry powder and working capital yields far better results and is actually far safer than chucking your money into a bank account that’s guaranteed to lose you money.

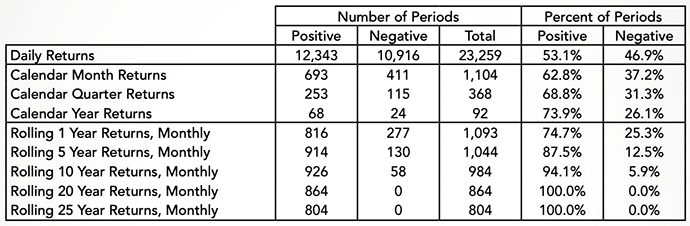

Over short periods of time, any investment can go down (or up), but if you’re able to extend your time horizon far enough, and you’ve got the mettle to hold when everyone else is selling, you’re historically guaranteed to turn a profit.

Cutting through the noise above, 87.5% of the time, the S&P 500 was positive over any given five year span. That jumps to 94.1% over a decade and 100% for twenty years or more.

This one’s for millennials specifically — a generation that was historically unenthusiastic about investing until Robinhood came along. Here’s how lifetime wealth shakes out for someone pursuing three different paths over the next 40 years.

Putting your money into a savings account rather than a generic ETF over the next 40 years will cost you somewhere north of $3.3m

Replace that investment with a more balanced portfolio including alternative assets, and the gap widens even more.

Put your money to work.

Collectibles at Their Peaks

What Happened?

Collectables – sports cards, memorabilia, comics, video games, and more – were on fire late 2020 and through early 2021.

We were ahead of the game on this.

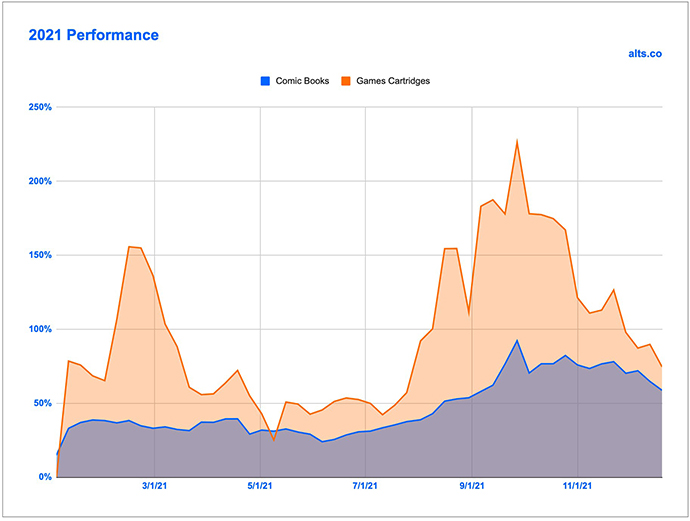

Alternative assets comic books and video games have had a great run in 2021.

— Wyatt Cavalier (@itiswyatt) August 18, 2021

???? 51% ROI

???? 100% ROI

Happy to say we were ahead of both trends at @altassetsclub

*Trading data from fractional platforms @OnRallyRd and @withotis pic.twitter.com/Kr9CAbKmcF

Every week another record fell. $2m for a video game. $6.6m for a baseball card.

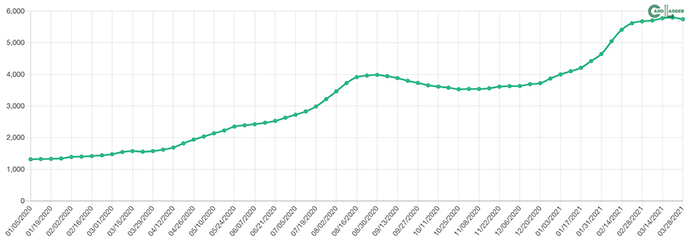

CardLadder’s Low-End sports cards index rose 5x from January 2020 to March 2021.

Charts for video games and comics looked the same, though they were shifted back three or four months.

IPOs on fractional marketplaces like Rally, Otis, and Collectable were selling out in seconds. Investors knew they’d be able to flip their assets for 2x to 3x gain a few months later.

But then this happened.

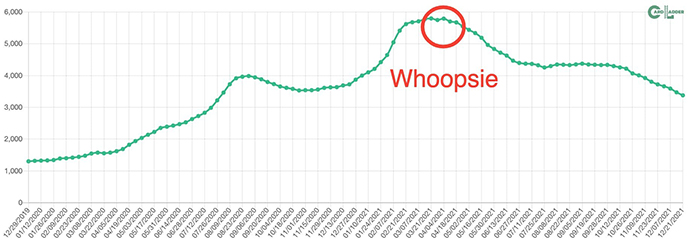

That’s a 42% drop since this spring.

Indices for video games and comics didn’t exist until we created them this year, and they look much the same as sports cards — just shifted to the right a few months.

Money flowed out of sports cards and into comics and video games, then it all flowed back out.

If you bought sports cards in March or video games in September, it’s been a very tough year.

What Can We Learn?

A lot, actually, and we here at Alts have learned a lot this year.

The first thing is that asset classes like sports cards, comics, and video games aren’t all that different to each other. They follow similar patterns in terms of valuation, momentum, and returns.

That helped us read the tea leaves and return over 430% this year with our picks.

What lessons can we apply to this year, though?

First, nothing goes up and right forever. If you’re invested in an asset class that’s 2x to 5x up on the year, it’s probably time to take some money off the table.

Second, once everyone knows about it, it’s too late. If your taxi driver is talking about the intricacies of Super Mario Bros cartridge grading while taking you to the airport, or your auntie is pitching you a PFP at Thanksgiving, it might be time to get out.

Third, this stuff is really hard! I spend all my time on this, and I don’t always get it right. If you don’t have time to look at this stuff yourself, consider investing in a fund that will do it for you.