This week, we’re stepping back from the exotic to explore the redevelopment of single-family homes.

Big changes are coming to real estate markets around the world in the form of upzoning. Depending on where you live (or invest) these changes could represent some of the biggest opportunities for real estate investors in decades.

This special issue was guest-written by Alts community member Brad Cartier. Brad is the author of The Briefcase , a real estate newsletter we really enjoy.

Most real estate newsletters seem to follow the same blueprint. But Brad brings original thinking and reporting each week, and I find myself learning something new in almost every issue. It’s one of our absolute favorites.

For this issue, Brad dives into the world of single-family zoning, giving investors actionable tips to take advantage of this rapidly changing regulatory environment.

If you enjoy this issue, I encourage you to subscribe to The Briefcase .

Let’s go! 👇

Table of Contents

The history of single-family zoning

Zoning may not be the world’s sexiest topic. But the background of single-family zoning isn’t just a history lesson — it’s a social phenomenon rooted in racism.

Single-family zoning (aka “R1 zoning”) is a housing regulation that only allows one specific type of domicile to be built: a single-family detached home.

Single-family zoning is immensely popular. It makes up a whopping 75% of North America’s property use.

The idea for single-family zoning came from Germany, and was intended to provide low-density housing to blue-collar workers.

In America, single-family zoning started 1916 in Berkeley, California, in a blatant attempt to keep a black dancehall and Chinese laundromats out of white neighborhoods .

Over time, single-family zoning would become the primary way city planners maintained high property values in posh areas, and was a catalyst for racial segregation and housing inequality.

From the Journal of the American Planning Association :

“R1 arose, at least in part, from invidious motives. It was built on arguments about the sort of people who don’t live in detached single-family homes, and the harms that would arise if they mixed…with those who do…

Forcing consumers to buy land in bulk made it harder for lower-income people, and therefore most non-white people, to enter affluent places.

R1 (zoning) let prices discriminate when laws could not. Contemporary observers denounced this regime of backdoor segregation, but in 1926 the Supreme Court upheld it. ”

The problems with single-family zoning

Aside from its racist origins, there’s a lot wrong with single-family zoning.

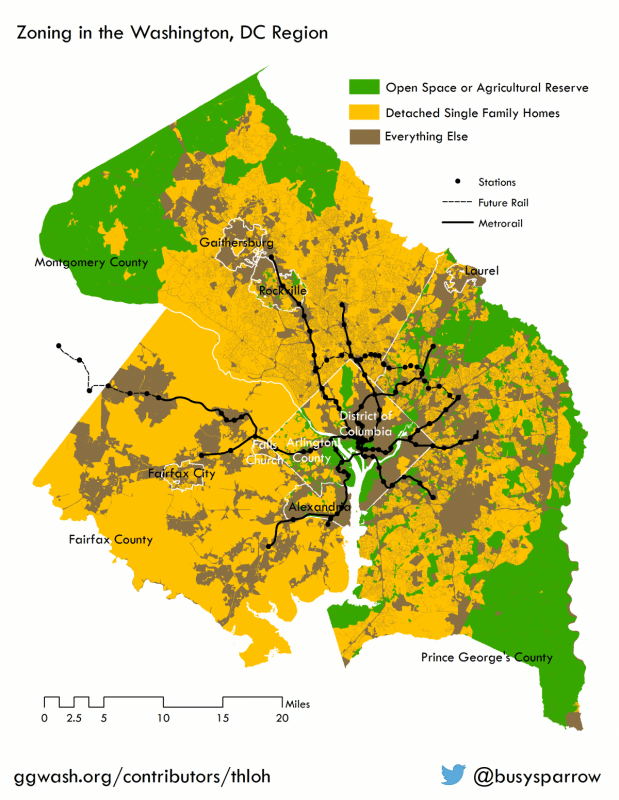

First, these laws apply to about 75% of North American land.

Yep, you read that right — only a quarter of American properties are allowed to be anything other than a detached single-family home.

The outcome isn’t pretty:

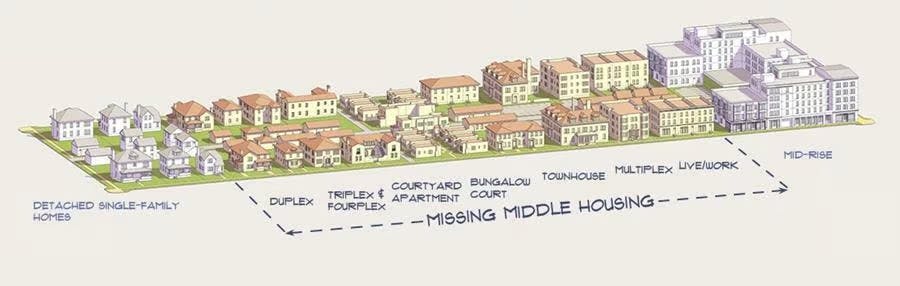

- The “Missing middle.” R1 zoning creates a binary housing market , full of detached single-family homes on one hand, and skyscrapers on the other. But what about multi-family duplexes? Townhouses? Or courtyard apartments? These are all considered part of the “missing middle,” and they tend to fall by the wayside in many parts of the world.

- Increased prices. R1 zoning increases the property values of single-family homes and reduces the amount of land available for housing development. Goodbye affordable housing, hello suburban sprawl!

- Decreased supply. R1 restricts the diversity and density of what can be built. No apartments, and no duplexes are allowed without expensive rezoning applications. Lower-middle-income families are basically locked out.

- Cultural elitism. Zoning laws can create a sense of exclusivity and entitlement among homeowners who often resist any change to their neighborhood “character.”

- Pollution. Single-family zoning encourages low-density developments and car dependency.

Governments are catching on

After a century of thinly veiled racism, and decades of unaffordable housing, a revolution is brewing.

Politicians, worried about the low supply and high costs of housing, are finally coming to terms with the fact that there is only one real solution:

Build more housing.

What a concept! Sounds simple enough. But what’s the best way to do it?

To promote the supply of housing, local and state governments have realized they can actually allow all sorts of new types of housing to be built on R1 land.

This effort is known as upzoning.

What is upzoning?

Upzoning allows property owners to legally build higher-density dwellings on R1 land.

Simply put, land originally intended for single-family detached homes can now host up to four individual units, with no rezoning or special permission required.

And the best part is, because they aren’t giant apartment buildings, these don’t typically cause a stink with local residents.

Building a skyscraper is one thing. But only the most ardent NIMBYists would object to someone converting a garage.

Where are upzoning laws changing?

To be clear, upzoning laws aren’t set at a national level. All real estate is local, and so are its laws.

Here are just a few places considering changes to their existing zoning regimes.

Texas

Houston, TX is ground zero for upzoning.

Under the city’s development code, no parcel of land is restricted for any particular land use , and in many cases, there are no density or height restrictions either.

The city famously introduced North America’s most permissive planning regime. And it’s been a massive success .

Arizona

Senate Bill 1117 will bring a full suite of zoning changes.

It includes scrapping minimum parking requirements, easing mandatory setbacks, and legalizing ADUs, duplexes, and triplexes across the state.

Montana

Governor Greg Gianforte proposed SB 245, which would legalize mid-rise multifamily buildings in all commercially zoned areas.

Another bill, SB 323, would legalize duplexes and triplexes in all residential areas.

Ontario

Not to be left behind, the Canadian province of Ontario passed Bill 23 , which upzones the entire province (15 million residents) to allow for up to 3 units on any lot and reduces development fees municipalities can charge builders.

British Columbia

B.C. Premier David Eby unveiled the Homes for People plan, a multi-billion-dollar effort to improve housing supply.

As part of the plan, the government committed to introducing legislation to allow three to four units on any single-family lot this fall.

New York

Gov. Kathy Hochul is pushing new rules that would allow the state to overrule local municipal bylaws to reduce barriers to construction and ultimately increase the housing supply.

Other cities

Following these trends, cities Like St. Petersburg, FL, and Arlington, CA, approved changes to allow duplexes, triplexes, and fourplexes on lots zoned strictly for single-family homes.

What does upzoning mean for investors?

Upzoning allows investors to subdivide R1 land into two, or even three units. This is a big deal.

In fact, developing a triplex is a popular move for property investors worldwide. (Editor’s note: Living in Australia, you can take my word for it – we love them down under).

The smart investment play here is to purchase an underutilized single-family home and convert it to a triplex.

Under previous rezoning rules, developers would have to meet with planning commissions and governing bodies to get the ball rolling. They’d then have to go through mounds of paperwork. The process took years and cost tens of thousands of dollars.

But with new upzoning laws, these nightmarish rezoning applications are a thing of the past. You can start building right away.

The upzoning game plan

If executed well, this game plan can be a winner.

Every real estate market has a sub-market, and that sub-market often has its own micro-market. So, the playbook for developing a triplex will vary from location to location.

But there are still some general rules we can follow.

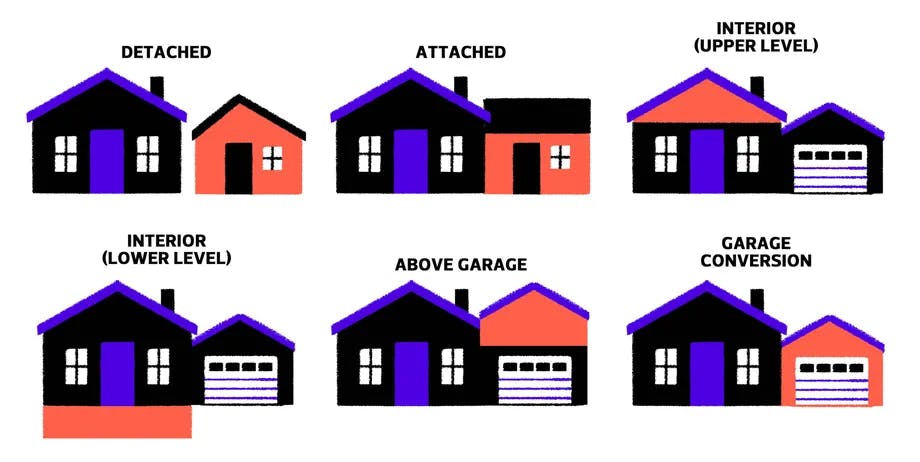

Start with a single-family dwelling that has a basement or a second floor. This can be converted into a legal duplex through renovations and putting entrances on each separate unit.

Next, ensure the property has enough room out the back to build an ADU (accessory dwelling unit). Boom — you’ve transformed one house into three units with just the cost of renovations.

Editor’s note: ADUs can have terrific economics . The ADU I built is, on a risk-adjusted basis, probably the single best financial investment I have ever made.

But redeveloping isn’t for the faint of heart. It can get quite pricey (we have a breakdown of costs below), and lots of construction and planning is involved.

Location

The most important part of the whole process.

You must select a province or municipality that has already passed upzoning laws. Otherwise, you’re working against century-old laws designed to keep multiplex developers (and minorities) out.

Property selection

Ideally, you can find a property with a basement and a side entrance. This will save you loads of time and money when converting one house into two. In this case, the basement would make for one unit, and the top floor another.

The units must be self-contained. You can’t have the bathroom door of the basement leading to the kitchen on the top level — that’s just asking for trouble.

Lot selection

There’s still a bit of zoning to do, it’s just a lot less painful. You have to check local zoning bylaws to make sure you can build the coach house (ADU) in the back.

You typically need 4-600 square feet of free space to build an appropriately-sized unit.

Construction planning

You can do this yourself if you’re experienced, but otherwise it’s best to find a highly-recommended construction company recommended by other local investors. Get an estimate of the work required to achieve your plans.

Project rents

Collect rent data from platforms like Rentometer in combination with expertise from a local agent to project your annual rental income. This will help determine RoI and ensure that the development is profitable.

Budgeting

Now the financial picture has become clearer, it’s time to make the final call – is a triplex the way to go? Or will embarking on this journey burn a hole in your pocket?

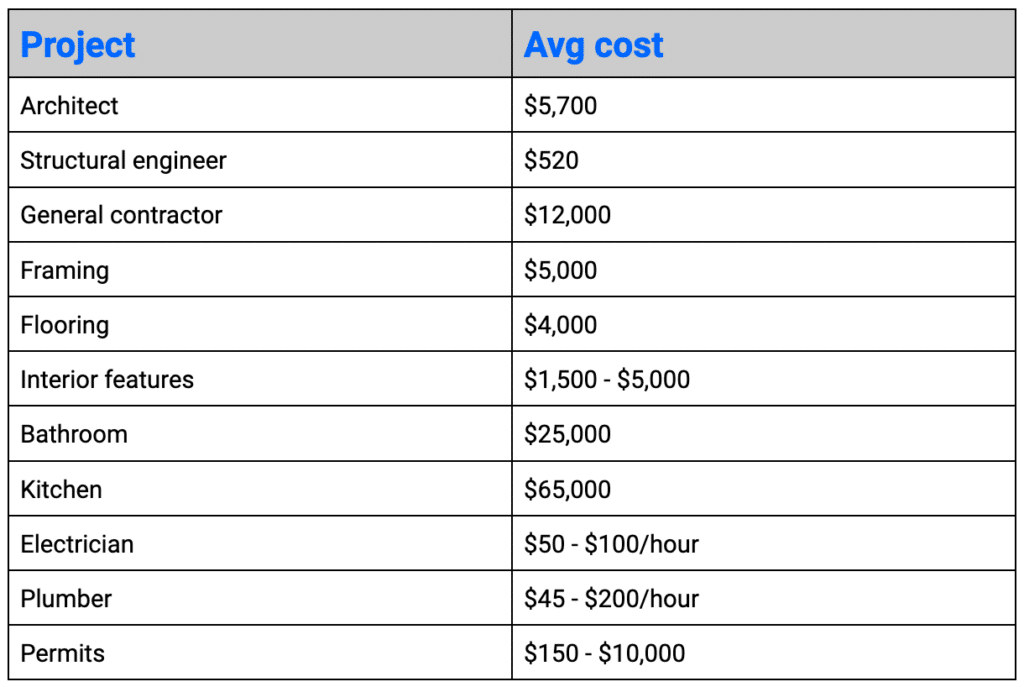

On average, converting a single-family to a duplex costs about $80k .

Here’s a breakdown from HomeAdvisor :

Add this to the $45 – 65k+ you’re spending on building an ADU, and your triplex redevelopment bill can easily soar past $200k.

Choose your team wisely

Team selection is just as important in sports as it is in property development. You must work with an experienced real estate lawyer who understands local zoning regulations.

You will need to work with a designer and/or architect to develop your coach house and the new interior/exterior. These will be handed over to the local municipality to obtain necessary building permits.

You’ll also need a trusted appraiser, real estate agent, and construction manager.

Editor’s note: An upzoning consultant can help you with all of this. I highly recommend you find one. I utilized a consultant when building our ADU, and she was a lifesaver!

Refinancing

Once construction is done and dusted and people have moved in, refinancing should be your next step. You’ve just turned a single-family home into a triplex, so your value has increased. You can access that equity and pay yourself back for construction costs.

Get in touch with a real estate agent or appraiser to give you an APV estimate on the property.

Other tips

- One cool option can be to live inside one of the three units. This will reduce your down payment because it’s technically an owner-occupied property.

- If you’re short on cash, you can do the simple single-family home-to-duplex conversion first. If that goes well, you can refinance and draw equity from the new APV to build your third unit.

Closing thoughts

After decades of developers explaining that high rents are a product of low supply, politicians have finally caught on. If this trend is similar to most populist trends, it will spread quickly and supply will boom.

Upzoning is the foundation of green, equitable cities. And it’s a dream come true for investors.

Developing a triplex is a relatively accessible way to legally maximize land value.

For novice investors, this will be challenging, but worth it. Non-fractional real estate investing has a high barrier to entry, and not everyone has a few hundred grand lying around to take advantage of this.

But you just need to start with one. If your triplex is successful, it becomes a case of rinse and repeat.

Pull off a few more successful builds, and before you know it your property portfolio will look mighty fine. 🏘️

Further reading

- The Briefcase has more interesting real estate ideas like this each week.

- The Missing Middle has been all over the upzoning trend since the beginning.

- So has Planetizen .

- Housing density creates more walkable places. WalkScore was the first to develop a quantitative score for walkability. They later sold to Redfin.

- Unrelated to real estate, Alts community member James Creech just hit 20k LinkedIn followers, and has a new LinkedIn mastery course

Disclosures

- This issue does not contain any affiliate links.

- We have no real estate in our ALTS 1 Fund .

John Belitsky (🏢,🏢)

John Belitsky (🏢,🏢)