Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- Devastating news from Israel

- US mortgage rates hit a 20-year high

- Visa is launching a generative AI venture fund

- A new private credit fund available to individual investors

- SBF on trial

Wyatt

Table of Contents

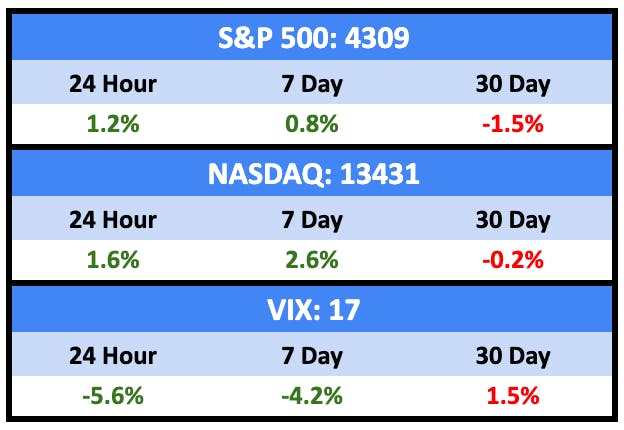

Macro View

All eyes are on the heartbreaking massacre in Israel over the weekend.

Bullish News

- The US labor market is weakening, which could bring rate cuts forward.

Bearish News

- Student loan payments are back for 40 million Americans, which will suck $7 billion out of the US economy per month.

- Pershing Square’s Bill Ackman said the economy has begun to decelerate on the back of aggressive rate hikes.

Forecasts

Get $25 to play around with invest on Kalshi using this link.

📈

13%

Chance of Fed hikes rates in November

📉

72%

Chance mortgage defaults will rise in Q3

📉

2.27%

National average house price increase in 2023

It’s looking less likely that the Fed will hike rates in November, and the likelihood of mortgage defaults increasing has also come down.

The market is forecasting a 50/50 chance the US government shuts down at some point in 2023. [disclosure, I’m long on this position]

What are we doing?

ALTS 1 Fund news:

No change

Real Estate

Bullish News

- 26% of Americans are looking to relocate, which could juice demand for home sales.

- And nine of the top ten markets will be significantly (negatively) affected by climate change.

- And Florida has overtaken NY as America’s second biggest housing market.

- The US housing market is now worth $52 trillion, double its pre-pandemic value.

- But Wall St thinks housing is overvalued.

Bearish News

- US mortgage rates have hit 7.49%, the highest in 20 years.

- And the median payment for new applications rose to $2,170 per month.

- More than 50% of listed homes have cut their prices in markets like Austin, TX, Waco, TX, and Carson City, NV.

- The US Supreme Court threw out a legal challenge to NYC’s rent stabilization law.

- And more than 13k rent-controlled apartments in the city are empty because landlords can’t afford to bring them up to code without increasing rents.

- Regional banks are pulling back on CRE lending big time.

- Evergrande’s Chairman was detained and is now under surveillance due to alleged “illegal crimes.“

- Adler, a German real estate developer, just raised debt at 21%.

How to invest in real estate right now:

avoid

Startups

Bullish News

- Visa has launched a $100 million venture fund focussing on generative AI for some reason.

- Alphabet subsidiary Waymo is expanding its service area in San Francisco.

- PitchBook analysis shows ten enterprise SAAS startups with more than a 90% chance of IPO’ing.

Bearish News

- CEOs of the Israeli tech startups Armis and Pentera said that around 10% of their Israeli employees were drafted into Israel’s military reserves.

- Braid, a four-year-old startup that aimed to make shared wallets more mainstream among consumers, has shut down.

- US-based venture capital funds’ IRR fell to -16.8% in Q4 2022, the lowest in a decade.

How to invest in startups right now:

Don’t buy AI secondaries.

PE & Private Credit

Bullish News

- Brookfield has raised $12 billion for its largest-ever PE fund.

- T. Rowe Price and Oak Hill Advisors are launching a new private credit fund open to individual investors in the US.

- Carlyle is backing a spin-off PE fund focussing on Africa.

- Sixty-three major North American sports teams valued at $205.9 billion have PE connections.

Bearish News

- Wells Fargo is selling its PE investments.

How to invest in PE and Private Credit right now:

Wait, probably.

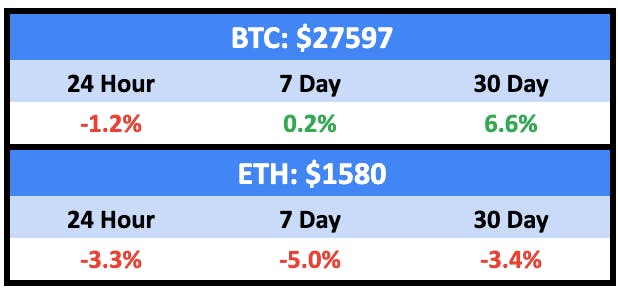

Crypto & NFTs

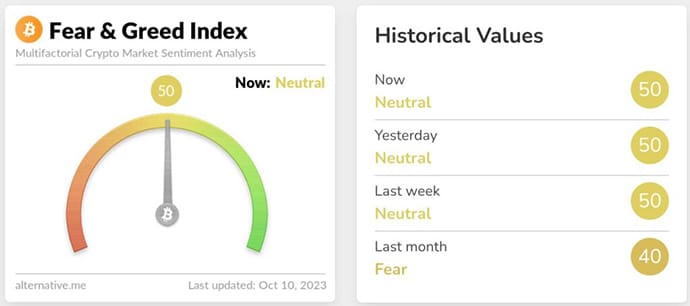

Here’s what you need to know:

Nothing to see here

Straight down the middle.

NFTs continue to tumble.

Bullish News

- Ripple has obtained a full license to operate in Singapore.

- SBF’s trial is in full swing, and it’s not going well for him.

Bearish News

- Yuga Labs, creator of Bored Apes Yacht Club, is laying off staff.

- Ledger, the crypto wallet hardware maker, is laying off 12% of its staff.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

That’s all for this shortened week

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at WebStreet and CalTier.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple bucks.