Now it’s clear that Zillow is better at advertising than property investing. What is iBuying and why did it fail? Also, give it up for Proptee Apollo!

Zillow, an American online real estate marketplace company, is closing down its iBuying business as well as shutting down its Zillow Offers division. Once a pandemic winner, Zillow has lost two-thirds of its value since February and is now trading at its lowest in 16 months.

Facts:

- The stock dropped from an all-time high at $202.94 in February to $65.86 a few days ago.

- Zillow bought 9,680 homes in the quarter and sold only 3,032.

- They have reported a third-quarter net loss of over $328 million.

- 25% reduction in its staff.

Today is a tough day at Zillow. We made the difficult, but necessary decision to wind down the Zillow Offers operations and lay off 25% of the workforce. You can read more about our decision below: https://t.co/S454rPcLbZ

— Rich Barton (@Rich_Barton) November 2, 2021

“We’ve determined the unpredictability in forecasting home prices far exceeds what we anticipated and continuing to scale Zillow Offers would result in too much earnings and balance-sheet volatility,” said Rich Barton, Zillow’s co-founder and CEO.

Zillow share price

If you want to know more, you can read Zillow’s Q3 Shareholder Letter here.

Before we dig into how this happened, let’s learn more about iBuying.

Table of Contents

What is iBuying?

iBuying is a modern way of doing real estate flipping. Using Automated Valuation Modelling (AVM), Zillow and its competitors (e.g. Opendoor) can (in theory) accurately estimate the price of a home without viewing it or sending out a valuator.

Sounds good right? Assuming it works…

In public markets, liquidity is provided by so-called market makers. Fundamentally, market making is done by providing bid and ask quotes simultaneously for one particular stock. Market makers provide liquidity and depth to markets, profiting from the difference in the bid-ask spread. This is the model that Zillow wanted to replicate for the real estate market.

In its role as an iBuyer, it would be serving as a real estate market maker; providing liquidity for transactions.

Why didn’t it work?

Well, there are many potential reasons (Please keep in mind that this is just my opinion and might be totally wrong):

- Zillow couldn’t build a good AVM which can tackle the complexity of valuing a home in a rapidly changing market.

- Operational heavy business, since Zillow had to add value to the homes. Starting from small cosmetic upgrades to more serious work. Doing this for 10 thousand homes in 3 months is a logistical nightmare.

- Crowded market results in smaller safety margins. For instance, if Zillow offers a price 10% below their estimated value and then the seller goes to Opendoor which offers 7%, then Zillow has to either match or undercut Opendoor to stay in business. Ultimately, this results in tiny margins.

“We’ve made many investments towards Zillow 2.0, one of the biggest being Zillow Offers as a way to provide a compelling product offering for home sellers. When we decided to take a big swing on Zillow Offers three and a half years ago, our aim was to become a market maker, not a market risk-taker, and this was underpinned by the need to forecast the price of homes accurately, 3 to 6 months into the future.” – says Zillow in their press release.

Consequently, the failure of Zillow iBuyer has caused Opendoor shares to soar initially, but as of today, Opendoor is losing value.

Nothing Fancy bits

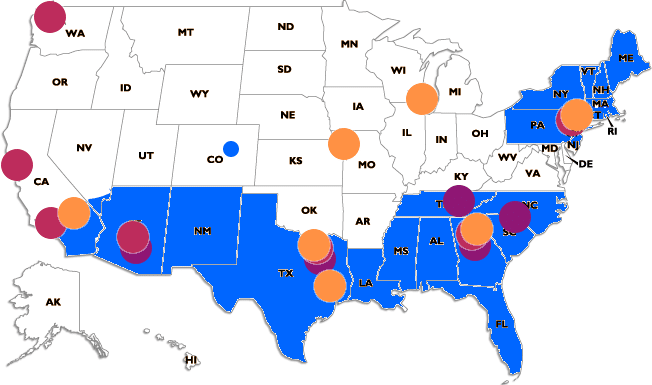

Touching on a different topic. Investor interest in alternative asset classes is rising quickly.

The alternative assets industry is predicted to grow to $14 trillion by 2023, according to a new report by data intelligence provider, Preqin. It’s a hefty rise from the industry’s size of $8.8 trillion in assets valued in 2017.

Proptee Apollo is here.

We’re incredibly proud to announce that we’re launching Proptee Apollo, a freely available knowledge base for real estate investing. This is where we’ll post educational content regarding our services, useful investor tools, buying guides and anything that is relevant to real estate investing.

We’re inviting You to participate and contribute to building the most trusted real estate knowledge base on the planet.

Wondering why you should contribute? More info coming soon to keep an eye out on our community.

See you next week!