Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

Happy Labor Day to all who celebrate in the US. Usually we’d hold off on sending this until Tuesday, but we’ve got a special issue of the Big Deal coming in hot for accredited investors tomorrow morning.

If you’ve not already self-certified as an accredited investor (assuming you are one), make sure to do that today so you get tomorrow’s full briefing.

What’s on deck today:

- The US consumer slides into more quicksand

- Zillow’s ill-conceived plan to solve the housing crisis / make money

- More trouble for China’s Country Garden

- The US moves toward legalising marijuana

- The Bitcoin ETF moves closer to reality

Table of Contents

Macro View

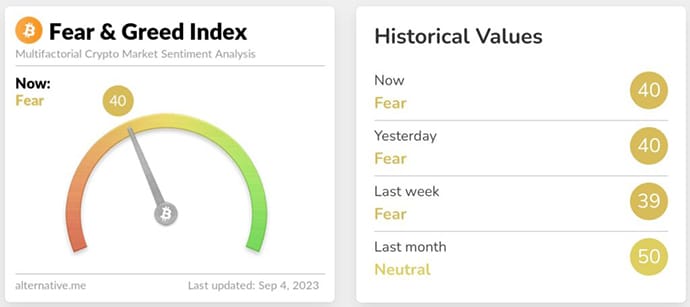

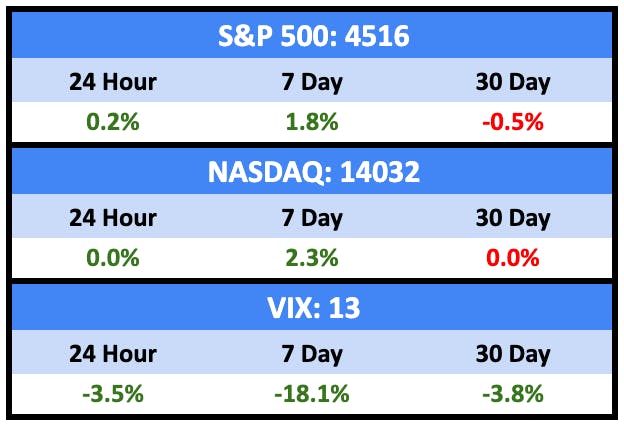

Great week for markets last week with prices up and volatility down.

Bullish News

- China’s manufacturing contraction eased slightly in August.

- US companies in August added the fewest jobs in five months.

Bearish News

- Inflation in Germany and Spain have the ECB eyeing further rate hikes.

- In America, 63% of employees are unable to cover a $500 emergency expense. It’s presumably lower for non-employees.

Forecasts

↔️

59%

Chance of Fed rate hike in 2023

📉

0.64%

📈

67%

Will US mortgage defaults rise in Q3?

Markets are pricing in a Fed pause in September then hike in October, which seems sensible. I’d take that bet at $0.59.

Inflation feels low to me.

And a new market this week — mortgage defaults. The market is pricing in a 2/3 chance defaults will rise in Q3 compared to Q2. This feels like easy money to me. Of course they will.

What are we doing?

ALTS 1 Fund news:

Holding

Real Estate

Bullish News

- Duplexes may be making a comeback.

- But it’s going to be a long road.

- US pending home sales rose slightly in July.

- Wall Street banks are pushing employees to come back into the office.

Bearish News

- Some 13k rent-stabilised apartments have sat vacant for at least two years, because landlords can’t afford to bring them up to code for new tenants.

- Zillow has offered a new 1% down payment option to homebuyers in Arizona. You can short Zillow Class C shares here.

- Canada is trying to solve its housing crisis in the stupidest way possible.

- Apartment insurance rates in the US are up 33% YoY for landlords.

- And more American homeowners are going without home insurance.

- About $1.2 trillion of debt on US commercial real estate is “potentially troubled.”

- Average apartment asking prices are down 1.2% YoY

- And they’re down for the third straight month.

- Freddie Mac is auctioning off $628 million worth of non-performing mortgages.

- China’s Country Garden, a real estate developer, posted a record $7 billion loss and warned of default.

- But it’s selling $34 million worth of equity to pay off loans if you want to get involved.

How to invest in real estate right now:

Wait.

Startups

A few key bits from Carta’s Q2 report on pre-seed funding:

- SAFEs have taken over: Investment through SAFEs accounted for 80% of pre-seed invested capital in Q2 2023. However, certain industries such as medical devices, hardware, and biotech still see significant investment using convertible notes.

- Valuation caps have gently declined: The median valuation cap for post-money SAFEs was $10 million this past quarter, down from $15 million at the beginning of 2022. This median is highly sensitive to round size, dipping down to $6.5M for raises between $250K-$499K.

- Legacy venture ecosystems dominate the pre-seed stage: Of the 2,103 companies that raised some form of pre-seed financing in H1 2023, over half are headquartered either in California or in New York. Companies in these mature VC ecosystems were also much more likely to raise mega pre-seed rounds ($2.5 million or more on SAFEs).

Bullish News

- OpenAI is currently on pace to generate more than $1 billion in revenue over the next 12 months.

- And challenger AI21 Labs has nearly wrapped up funding at a $1.4 billion pre-money valuation.

- Mining companies are so hot right now.

- The US government is moving toward marijuana decriminalisation at the federal level for the first time.

- In their best quarter since 2021, VC-backed clean energy startups brought in $5.4 billion in Q2.

- Aquaculture and farm management software companies rebounded in force in Q2, both of them scoring their second-strongest quarters in total VC deal value on record.

- An Indian grocery delivery startup called Zepto has raised $200 million at a $1.4 billion valuation. Maybe this works better there than it does in the US?

- OpenAI has launched an Enterprise plan.

- Airtel Uganda is looking to IPO.

- But Thailand’s Big C is delaying their public offering.

Bearish News

- YC’s demo day features more than 50 AI companies.

- The first Hong Kong SPAC is here.

- More shady news about Chamath.

- Benitago, one of those stupid Amazon aggregators, has filed for bankruptcy two years after raising $325 million.

How to invest in startups right now:

Hey guy, don’t invest nearly 1/3 a billion dollars into a company whose entire business model relies on notably capricious platform.

Crypto & NFTs

Here’s what you need to know:

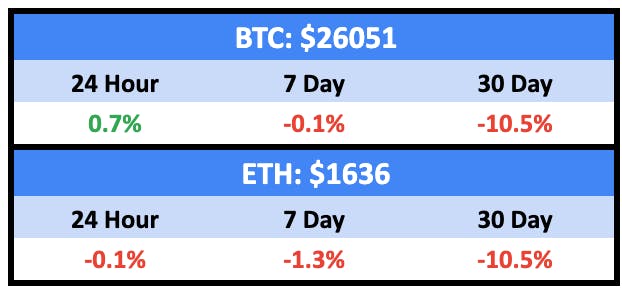

Crypto is holding steady despite positive macro news.

Steady….

Steady….

Bullish News

- SEBA has got approval to operate in Hong Kong.

- Grayscale gets closer to its BTC ETF.

- Binance is finally looking to exit Russia.

Bearish News

- It’s been a tough year for web3 gaming startups (fundraising is off more than 75% YoY). PitchBook does a solid deep dive into Mythical Games.

- The SEC is coming after NFTs.

- Binance has lost its Asia-Pacific head.

- France’s data watchdog carried out “checks” at Worldcoin’s Paris office last week.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Quick Hits

Carbon Credits

Shell, Europe’s biggest oil company, quietly nixed its plan to radically shrink its carbon footprint six months into Wael Sawan’s rule as CEO.

Shell’s not alone.

The tide keeping the carbon markets afloat seems to be going out.

“Voluntary carbon markets have shrunk for the first time in at least seven years, as companies including food giant Nestle and fashion house Gucci reduced buying and studies found several forest protection projects did not deliver promised emissions savings.”

This is bad news for the environment, of course, but also poorer nations like Kenya, which is seeking to become a hub for trading carbon offsets.

That’s all for this week. I hope you enjoyed your coffee and this edition of Alts Cafe.

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at RADD.

- We hold BTC and ETH in our ALTS 1 Fund. Apart from those, we don’t own any other assets or vested interests in the companies mentioned in this email.

- There are a couple affiliate links above. If you click them, we may get a couple bucks.