Welcome to the Game Trading Cards Insider – FREE VERSION.

Today I’ve done a deep dive into the 1999 Pokemon 1st Edition Complete Set (PSA 10) that will IPO at Rally Road on April 30th, 2021 at noon EST. Follow me on Twitter for my latest insights and analysis.

Table of Contents

What is the 1999 Pokemon 1st Edition Complete Set (PSA 10)?

This is a full set of the 1999 Pokemon 1st Edition Base Set, which includes 103 cards — 16 holos and both Pikachu variants. The entire set is graded at PSA 10. The most valuable card in the set is the Charizard holo, which I wrote about here.

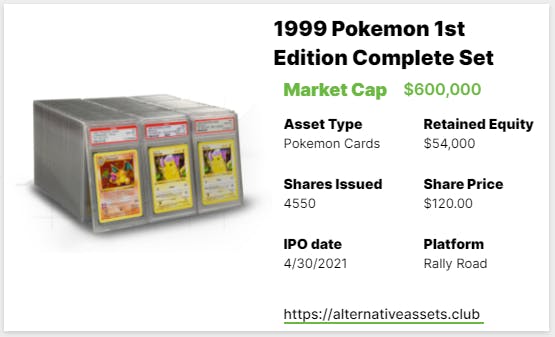

Rally bought this on February 21st, 2021 for $552,000 including $54,000 in equity to the seller. Interestingly, the full payment is due May 1st, so they must be hoping the IPO sells out quickly! Keep in mind that Rally has already IPO’d the exact same asset and it was trading for $600,000 in its last window. Rally also recently IPO’d a sealed box that has funded very slowly and which I wrote about here.

It IPOs on Rally Road at 12 PM EST on Friday, April 30th for $600,000. The seller retained $54,000 in equity.

Add IPO to calendar

Cultural Relevance

Pokemon, not surprisingly, ranks very well in our social media metrics given the massive presence online and popularity with younger generations. The first edition base set is the most desirable of all, by far, and the Charizard card is the standard bearer in the asset class.

Inferred Value – $450K+

[Detailed Valuation available to Insiders Only]

Category Strength

The Game Trading cards category returned -1% ROI in Q12021.

Subcategory Strength

Risk Profile

Asset Growth TTM

Growth Outlook and Future Catalysts

While the complete set doesn’t get auctioned frequently, the underlying cards do and the value of the set is going to track the market for Pokemon cards pretty closely. I don’t see the prices getting back to the peak for awhile, though I don’t know where the bottom of this decline will land.

I don’t expect anyone to bid on it given the inflated price, but there is an Ebay auction for the Charizard that ends in a few days. If it does sell, that would be an interesting data point. When the other set opens for trading at Rally, I’d expect its value to drop dramatically, so keep an eye on that.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade quarterly.

Platform Risk

Intangibles

There’s no reason to buy into this IPO when you can almost assuredly get it cheaper when the other set trades again. In addition to that, the share price is high at $120/share, which will discourage people in the secondary market.

Share Alternative Assets, Get Rewards

Enjoying Alternative Assets? Now you can share your personal referral link and get rewarded.

Get hoodies, tees, and other cool swag. When someone signs up through your link, your referral count goes up.

It’s a generous program. Rewards start at just 2 referrals!

- Your referral count: {{subscriber.rh_totref}}

It’s easy. Click the button below to access your rewards hub:

Or copy & paste your referral link here: {{subscriber.rh_reflink}}

Share on Twitter | Share on Facebook | Share via email

Thanks for spreading the word!