Today we have a very special issue for you. We’re covering a company called Band Royalty — a company at the intersection of music rights and NFTs.

You may recall seeing Band Royalty in some previous issues. They’ve been an occasional sponsor of ours over the past few weeks, and we decided to take a deeper look.

This issue is coupled with a bonus podcast we did with co-founders Noble Draklon and Barnaby Andersun.

We decided to cover this company because lots of people theorize about the future of music NFTs, but these guys are actually doing it.

This is an under-the-radar company with two founders who know their stuff.

Let’s explore

Editor’s Note: This issue is a sponsored deep-dive, meaning Alts has been paid to write an independent analysis of Band Royalty. Band Royalty has agreed to offer an unconstrained look at their business & operations. Band Royalty is a sponsor of Alts, but our research is neutral and unbiased. This should not be considered investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We think you’ll find it informative and fair.

Table of Contents

The problem with music rights today

We’ve written many times about the music industry — specifically how studio contracts are stacked against artists. For each dollar an artist takes in royalties, they receive between just 12 and 16 cents.

And this cautionary tale isn’t from the distant past.

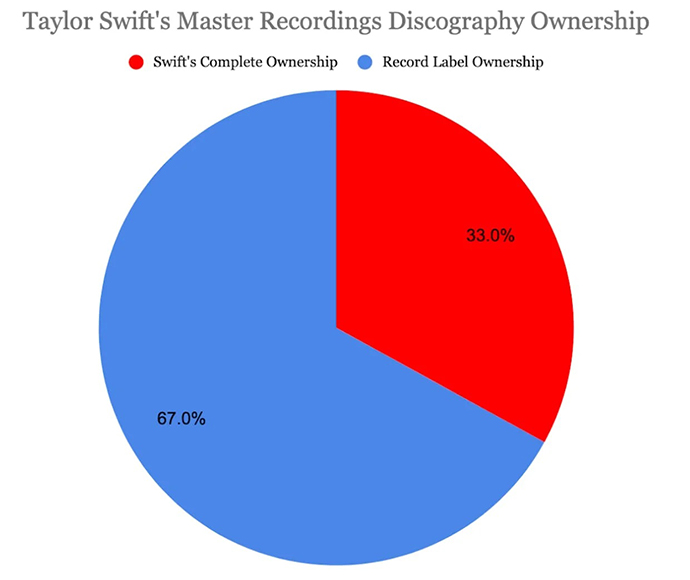

Taylor Swift had to re-record two of her six original records, because she had a terrible contract that gave her zero ownership over her masters. Swift’s first record company, Big Machine Records, sold the rights to her music to Ithaca Holdings. After the sale, a man named Scooter Braun got $300 million. Swift got nothing.

Want another example?

In the 1990s, TLCs record, CrazySexyCool, sold 14 million units. After splitting artist royalties three ways, this amounted to $2.6 million per TLC member. Not bad.

But here’s the catch: All that money had to be repaid to the studios for promotions, flights, hotels, and music videos. The $2.6 million each member of TLC made was gone before they could see it. Because of the terms in their contract, the minute their album became a hit, TLC was already in debt.

See, studios are a bit like venture capitalists, but instead of giving money to the artist directly, they do nearly all of the heavy lifting; paying for almost all expenses except touring. In return, they get an overwhelming percentage of royalties from album and streaming (about 80%!)

Part of the problem is that studios structure contracts to offset the losses of the 9 out of 10 studio artists that don’t make a hit album. The good part for those artists is they don’t pay anything back because they have nothing to pay back. It’s like artistic bankruptcy.

When one artist or group makes it big, the studios pounce to make their money back. It’s a flawed system where successful artists can actually be punished for being successful.

But the good news is the industry is slowly changing.

The decline of physical music sales

Artists have become more aware of predatory contracts, technology has democratized music production, and social media platforms have allowed artists to build huge fanbases. As a result, artists are less dependent on studios than ever before.

What’s more, how we consume music has changed to reflect our shift toward becoming digital natives:

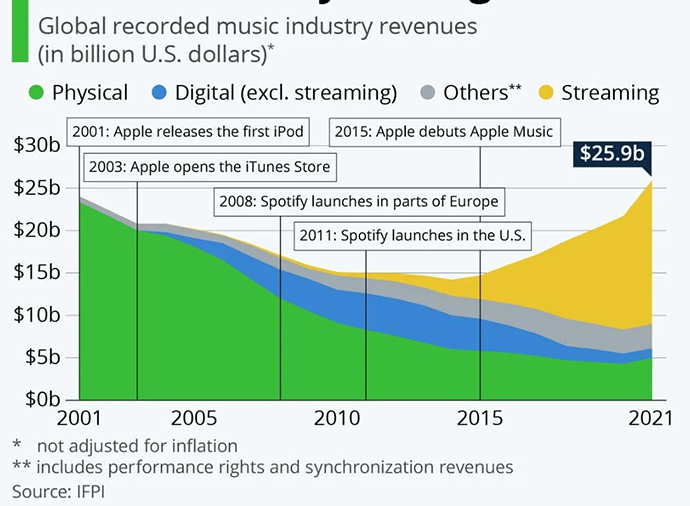

- In 2001, the music industry generated $23 billion in revenue from physical sales. Streaming was non-existent

- By 2020, physical sales had fallen to $4.2 billion

- Also in 2020, streaming revenue was $13.4 billion

But streaming also has its issues:

- Pharrell’s “Happy” was streamed 43 million times on Pandora, yet his payouts totaled just $2,700 (!)

- Artists typically need a quarter of a million streams to make $1,000 (on Pandora it’s 750,000 streams!)

These numbers are insanely high, and extremely difficult to achieve. Most artists won’t get anything close to this.

Web3: The future of music?

BAND Royalty co-founders Noble Drakoln and Barnaby Andersun are betting on the blockchain to lead the music industry into its next chapter.

I’ve had the pleasure of chatting with Noble and Barnaby a few times, and let me tell you, these guys are the real deal.

Drakoln has been investing in music royalties since the 1990s and is on the Board of Directors for Music is Viral, LLC, a music royalty acquisition group. He has also been a Principal at multiple hedge funds and brokerages.

Andersun is CEO and founder of BlockAlchemy, an ICO venture fund, and has gained global recognition as an expert on cryptocurrencies and blockchain. Together, Drakoln and Andersun have teamed up to create a platform they believe has the potential to lead the change in the music industry.

Drakoln initially invested in music royalties to diversify into new revenue streams. But the more he learned about the space, the more he realized the way studios compensated musicians was a bit corrupt. Artists were blatantly taken advantage of, including the producers, songwriters, and engineers that contributed to an artist’s success.

Drakoln and Andersun then teamed up to create Band Royalty: A Web3 platform that harnesses proof of provenance and ownership:

- It pays artists fairly for their work

- It gives musicians greater control over their music

- Allows fans to earn revenue alongside their favorite artists

This isn’t just a pitch deck: They have already made $800k on music NFTs, are already creating more value for underpaid musicians, and are giving fans and investors the ability to share in the artists’ success.

Drakoln and Andersun are hosting an upcoming webinar to tell their story. Register now to secure your spot.

Let’s dive into BAND Royalty and how it differs from anything else.

What is Band Royalty?

Band Royalty is one of the world’s first true Web3 music labels.

The company is looking to cement its status as a leading Web3 music platform by changing how artists and fans consume and profit from music.

Band Royalty’s goals

Band Royalty has two main goals:

- Create a platform tailored with artists in mind, and

- Get music fans to invest in music royalties.

Earning, participating, and influencing are at the ethos of Web3. Band Royalty envisions its platform as a meeting place where fans and artists interact to enjoy music, share experiences, and profit together.

Artists come first

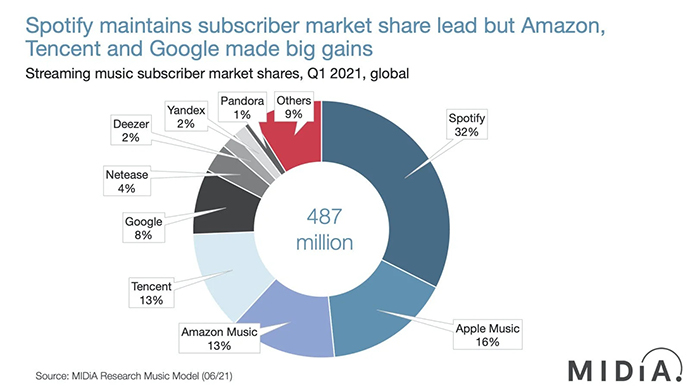

The music streaming industry is expected to grow to $103 billion by 2030 (recall it’s at $26 billion today), most of which is from Spotify.

It’s important to understand the sheer size of Spotify’s influence:

- Spotify has 364 million users, including 165 million premium (paying) subscribers

- 12,500 tracks are streamed on the platform each second!

- Spotify has more paying users than Apple Music and Amazon Music combined

As previously mentioned, Pharrell was streamed 42 million times on Pandora and had $2,700 to show for it.

Now imagine an artist with a small but dedicated audience. If that artist were on Spotify, they’d need 70 million streams to make $100k. But if the artist sold just 5,000 NFTs at $20 each, they could rake in $100k on primary sales alone.

On top of that, an artist can program each NFT so that they receive a commission (say 10%) of each subsequent secondary sale. They would be incentivized to add utility (think backstage passes, virtual meet & greets, and of course merchandise) to drive secondary sales.

The benefits are clear. As I wrote previously, this model places artists at the top of the pecking order. It cuts out the middleman, and is ultimately a fairer revenue model.

Drakoln and Andersun’s bet is that a new generation of musicians and fans are ready to transact in an entirely new way. In fact, they want to teach artists how they can create profitable, utility-driven NFTs.

(Again, I encourage you to register for their upcoming webinar and hear from these guys live. I’ll certainly be there.)

Cultural capital

But this begs the question: Why buy a music NFT when you can stream it for free on Spotify?

The reason is cultural capital. NFTs can include original artwork, access to meet-ups, concert tickets, and airdrops. It’s one thing to update your social media feed with mentions of your favorite artist or song. It’s another to own unique artwork that you can display online while generating revenue directly tied to the artist you support.

BAND Royalty made history with the first multi-track music NFT when singer Andie Case recorded two versions of her song, I Think I’m God on the same NFT. Unlike Kings of Leon’s album, these NFTs can be played on any NFT-hosting platform.

Let’s get into the weeds on how it all works.

Note: If you’re a crypto newbie, this part may get a bit confusing. But as always, we do our best to explain everything as simply as possible.

How does Band Royalty work?

BAND Music NFTs: The key to diversification

Selling music royalty rights is nothing new. Companies like SongVest and Royalty Exchange have helped bring the buying and selling of music royalty rights to the mainstream since the early 2010s.

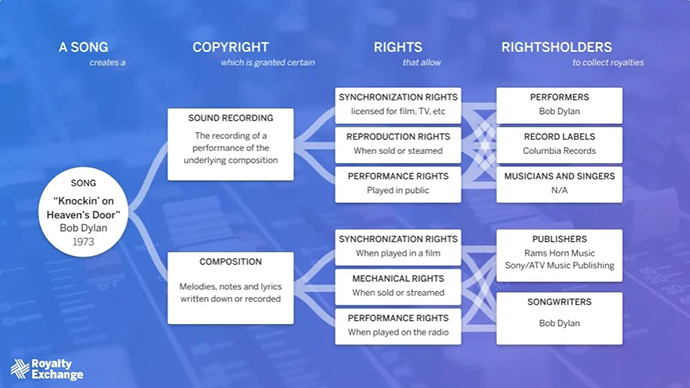

But royalties can be a very complex landscape to navigate. They often have multiple tiers, can be packaged in various ways, and split among various stakeholders

But many of these platforms’ offerings include single songs, or an album of a single artist. Plus, most songs earn the majority of their streaming revenues in the first 18 – 24 months after being released. As we all know, with any investment, diversification is key.

With Band Royalty, however, you’re investing in a catalog of songs by multiple artists. This lets you diversify your music portfolio without the hassle (and risk!) of self-selection.

To date, Band Royalty’s catalog includes nearly 60 songs from big-name artists, including Justin Timberlake, Rhianna, Beyonce, Jay-Z, Demi Lovato, Cher, Timbaland, and more.

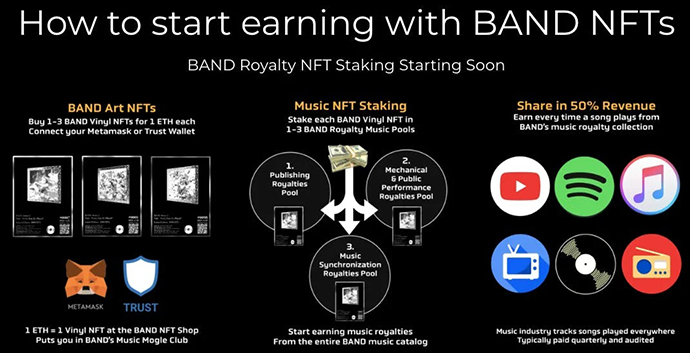

Fans invest in the royalties of a catalog of songs through BR1-NFTs, also known as the limited foundation BAND NFTs. More on this in a bit.

NFT staking

“Staking” is a term you may be familiar with, but need to understand.

When you stake an NFT, you are essentially “locking it up” for some time in exchange for receiving additional tokens.

Band Royalty’s platform allows users to stake their NFTs for anywhere between 90 days and 5 years. The longer you stake, the greater the percentage of rewards you earn. Just remember that staking means you cannot sell the token during the period you agreed to without paying a penalty.

BR1-NFTs

As stated above, fans invest in the royalties of a catalog of songs through BR1-NFTs.

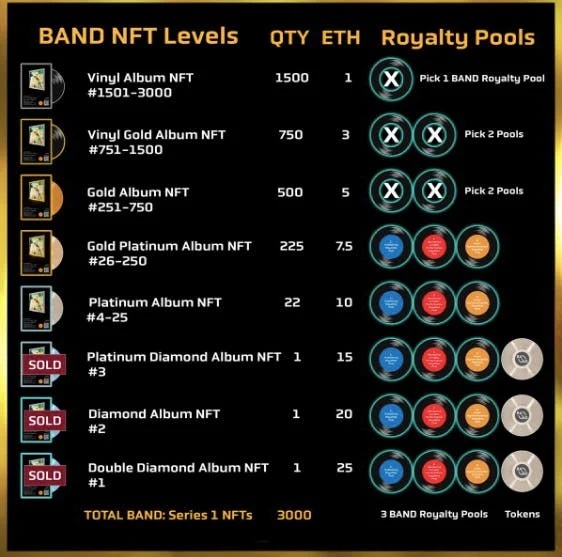

There will only ever be 3,000 foundation BR1-NFTs, and just 1,000 remain for sale. These first 3,000 NFTs are the most important, because they reward early adopters with a higher rate of royalties.

More BAND NFTs will be released in the future, for a total of 12,000 tokens. But again, these BR1-NFTs are the most important ones.

The video below shows how to buy NFTs from their NFT shop:

BAND NFTs also have tiers, or levels. With each level, investors gain access to more royalty pools and a larger share of governance tokens.

Revenue sharing through royalty pools

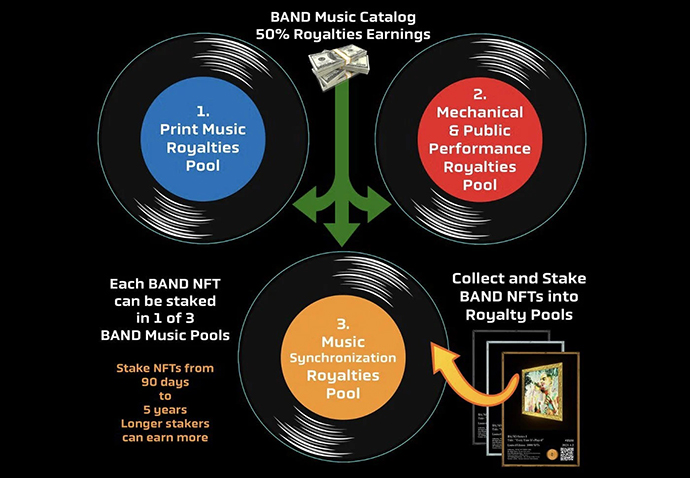

After staking the BAND NFT, you’ll get to stake into three royalty pools based on the NFT tier purchased:

- Print music royalty pool

- Mechanical and public performance royalty pool

- Synchronization royalty pool.

Confused? Read our quick primer on the different different types of music royalties.

BAND NFT stakers receive 50% of all royalties earned from either one of the chosen pools. Every time a song from their music catalog is streamed, and anytime a royalty is earned from a public performance, 50% goes to the royalty pool, where it is split among NFT holders.

Holders that are staking also receive 5% of all ETH trades when these NFTs are sold on the secondary market.

As the music catalog grows and the returns from each royalty pool become clearer, there could be a limit on the number of people staking in a particular pool. Keep in mind that Band Royalty is also diversifying through the different kinds of royalties that songs can generate.

Again, if this is all confusing, don’t feel embarrassed! Music rights are one of the most complex alternative assets out there. If you’re interested in this world, I encourage you to register for Noble and Barnaby’s upcoming webinar:

How are royalties paid out?

Okay, now we’re really gonna get into the nitty-gritty.

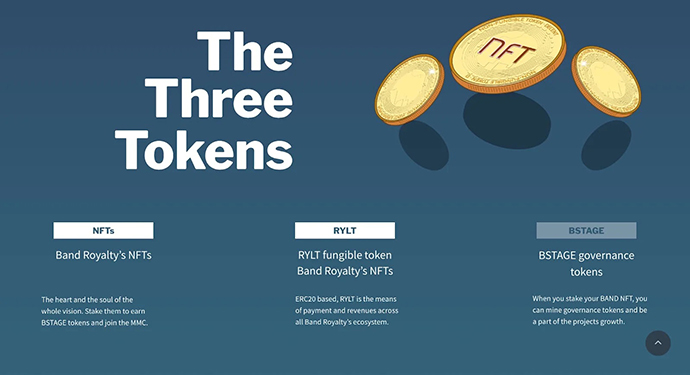

But the fact is, it’s critical to understand how royalties are paid because Band Royalty has two tokens on its platform, and each has a different function:

- The platform currency, called $RYLT

- Its governance token, called BSTAGE

We’ll explore them both, starting with $RYLT

$RYLT tokens

The other token, $RYLT, is at the heart of the Band Royalty ecosystem. RYLT is the transaction currency for the Band Royalty ecosystem.

Details:

- A fixed supply of 300 million tokens.

- Each coin is currently priced at $0.20 on the Band Royalty platform.

- Currently, only US accredited investors can buy RYLT tokens.

- Retail investors outside of the US can buy $RYLTY

How will RYLT be used?

- Music NFTs on the platform will be paid in $RYLT.

- Earnings by artists who use the platform will be paid in $RYLT.

- Future Band NFTs will need to be paid in $RYLT.

- Art and other products will have RYLT as the payment preference, with incentives, rewards, and higher probabilities of winning giveaways for using the coin

For artists, getting paid in RYLT is a major upgrade to how current business is conducted. Whereas some streaming payouts may take months, even beyond a year to process, artists can get paid in RYLT weekly thanks to low transfer fees.

BSTAGE tokens

Royalties are paid out in BSTAGE, the platform’s governance token. Owning this token means you get a say in deciding which songs to buy for the music catalog.

Why are royalties paid out in BSTAGE?

Because the royalties are used to prop up BSTAGE liquidity if someone decides to sell their tokens. So their ongoing revenue-generating music catalog backs BSTAGE, and this revenue stream constantly supports token liquidity.

Now, this may remind you a bit of Terra-Luna, which famously crashed. But the difference here is critical: Unlike Terra-Luna, which was a circular reference where each token supported each other, BSTAGE is backed by real music royalties & real money.

It’s one thing to create a token for any platform, but another to have a constant flow of real money supporting the token.

Can you buy BSTAGE tokens?

You cannot buy BSTAGE tokens directly. The only way to get them is by staking the BR1-NFTs. When all the BAND NFTs are sold out, BSTAGE will be made available on Uniswap so that users can buy and sell them.

But right now, the company’s focus is pointing investors toward the BR1-NFTs so they can begin earning royalties and getting paid in BSTAGE.

Closing thoughts

Much of Web3 so far seems like “a hammer in search of a nail.” Trading monkey pictures is fun, but it ultimately doesn’t solve any real-world problem. Metaverse real estate has roughly .001% the utility of a real home, so land prices are tanking. And despite being backed by big names, Axie infinity is a Ponzi (sorry, it’s time to call a spade a spade).

But the music industry is actually broken, and worth fixing. Streaming giants and major labels made the rules, and artists have been cut off from most of the upside. Musicians deserve their fair share of the value they create, and music NFTs can absolutely progress the industry forward.

Band Royalty has figured out a key piece of the puzzle — ensuring fairer compensation for artists, and increased engagement between musicians and fans.

With Band Royalty, music fans can continue doing what they already do — consuming music through Spotify. Except now, they get the added benefit of earning revenue (BSTAGE) through digital ownership of a song or album. Oh, and they also get a vote on what music assets to buy next!

Unlike traditional music royalty platforms which only let you buy one artist’s song/album at a time, Band Royalty lets you invest in a basket of artists across the landscape. This increases your diversification and reduces risk, both of which are critical for investing.

Meanwhile, Band Royalty is giving young artists an alternative to traditional studios, seen in the inclusion of rising artists to its NFT lineup, including Andie Case, Ny’Aira, Foolshine, and hip-hop duo Shaheed and DJ Supreme.

And yes, Band Royalty founders Noble and Barnaby understand that tokenomics are not viewed favorably right now. This stuff can be messy, liquidity can become an issue, and adoption requires that artists and music fans take a risk by adopting a new way of doing things. They discuss this openly in our recent podcast:

They admit that not everything is perfect — just ask them! But these two are veterans. This isn’t a sudden hobby for them — they’ve been immersed in this world for decades, and have real skin in the game. If anyone is going to crack the music NFTs nut, I’m betting it’s gonna be them.

Check out their upcoming webinar to hear from Noble and Barnaby live. I cannot stress this enough.

See you there!

A big thanks to Horacio Ruiz for his excellent podcast and research.

Want more content like this? Subscribe to music rights.

Until next time,

Stefan