Today’s issue is about musical instruments.

Everyone loves music, and two-thirds of us have learned to play an instrument. (Although 85% of those quit within two years…Gotta stick with it, guys!)

Regardless, most of us never consider instruments as financial assets. But like any hard asset, instruments can help diversify a portfolio, holding their value well while providing long-term appreciation.

Today, we’re waltzing into the world of crystal pianos and million-dollar violins. We’ll look at the world’s most expensive instruments, explore what makes a musical instrument a worthy investment, and how to buy well.

Let’s go 👇

Table of Contents

Invest in your favorite songs ♬

There are all sorts of ways to invest in music. Buying fine instruments is just one way.

Have you ever considered owning a song? Getting a share of the royalties? Making a bet on how much it’ll earn in the future?

With JKBX, (pronounced “Jukebox”) you can invest in music just like stocks.

Getting access to song rights was previously only for private equity firms and music publishers. Now you can invest in songs too.

But here’s why I’m most excited about JKBX: selection.

Yes, there are other music marketplaces out there. But the songs you can buy aren’t that great. JKBX is launching with $4bn+ of investable music rights. Their selection is going to be huge.

This company hits all the right notes. It’s a potential game-changer, and they’re launching soon.

You don’t want to miss this. Sign up for JKBX now.

Vintage vs new instruments

Lately there’s been some chatter on musical forums about the investment potential of rare instruments. Dr. Angela Ortiz Muñoz even wrote her PhD Thesis on this topic.

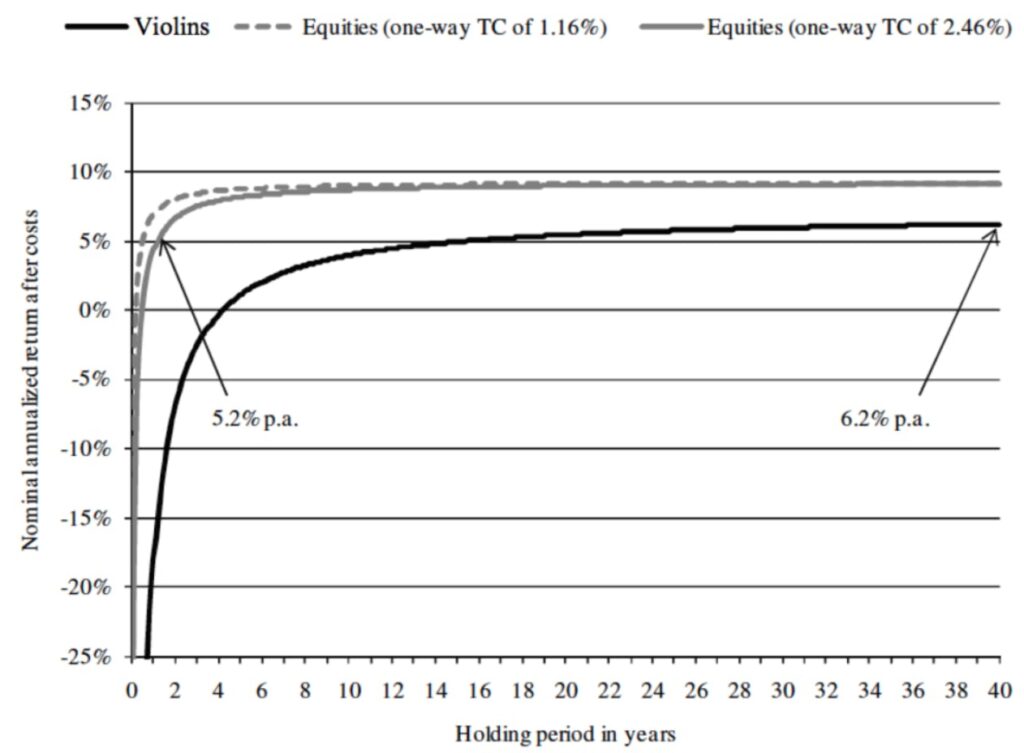

Focusing on stringed instruments, Muñoz found that over the past forty years, many instruments in the top tier have climbed up to 12% in value, with little downside or volatility.

But while many vintage instruments have gone up in value, newer models are unlikely to appreciate much.

Why?

Because right now, the number of top-quality instruments on the market is higher than ever before.

For example, in 1959, guitar maker Gibson manufactured about 643 Les Paul Guitars. But fast-forward to today, and Gibson produces that many guitars in about a day and a half.

In the short term, musical instruments are considered to have an expected useful life of seven years (but can be well over 20 years if cared for properly).

However, this sort of depreciation is mostly a tax concept. After an initial depreciation period, instruments from top-tier manufacturers tend to hold their value, and then very slowly appreciate.

Take the Fender Jazzmaster guitar. You can buy Jazzmasters from the 2000s directly from Fender for $1,400.

On guitar marketplace Reverb, there are five used Jazzmasters from the 2000s on sale, and prices range from $1,400 – $1,800.

In the long run, as blue-chip instruments become vintage, your investment starts to become pretty safe. Instruments are a $43 billion per year market with evergreen demand. (Although liquidity is problematic for larger instruments like pianos and cellos, which are very expensive to ship and require a local buyer).

But gains will be easy to find if you know what makes an instrument valuable.

The world’s most valuable fine instruments

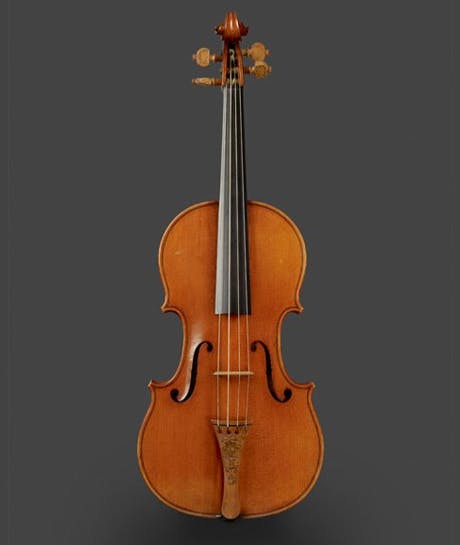

Violins 🎻

Fine violins are among the most stable musical instrument investments out there.

Since the 2008 crash, the market for violins has performed similarly to other hard assets.

Toronto violin dealer Ric Heinl says a $10,000+ violin will typically double in value over two decades. London-based competitor Florian Leonard disagrees, arguing it’s closer to a 60% ROI.

(There’s just one way to resolve this: Violin duel!)

Regardless, this Brandeis University study found that between 2007 – 2012, rare violins outperformed the S&P 500 (yes, the crash had a lot to do with this.)

As with so many other markets, the high-end has held up the best:

The higher end has gone up quite a lot in the last five years, despite the economic downturn. I think people turned to them as an alternative asset. – Frederick Oster, the proprietor of Oster Fine Violins

Europe’s two violin-producing capitals are Germany (specifically in a small Bavarian town called Mittenwald, which happens to be just 15km away from my current location this week, Garmisch-Partenkirchen) and Italy (specifically the city of Cremorna).

But Italian violins have appreciated far more quickly than German ones.

Antonio Stradivari is the undisputed King of the luthiers (stringed instrument makers). Every violin this man touched turned to gold. Only 650 remaining Stradivarius instruments exist, and of the top five most expensive violins ever sold at auction, three were carved by Stradivari.

The best of the lot is “The Messiah Stradivarius“, a four-hundred-year-old masterpiece that is, incredibly, still in perfect condition.

The violin last sold in 1827. Experts estimate its value now sits around $20 million.

Guitars 🎸

The vintage guitar market is often dictated by fads.

For example: In the 70s, Crosby, Stills and Nash debuted a Gretsch White Falcon. Within weeks, the guitar started selling for more than a pre-war Martin D-45 (one of the first “luxury guitars”)

Today, the White Falcon can be snagged for around $10k. But that Martin will set you back $200k.

Unlike violins, electric guitar prices dropped ~30% during the financial crisis and never really recovered.

Today, there’s a big difference between acoustic and electric:

[The acoustic] market may have flattened, but it didn’t really go down. The most well-made and best-sounding [acoustic] guitars have held their value. – Frederick Oster

The two most expensive guitars in the world both belonged to Kurt Cobain.

An original 1969 Fender Mustang is already a valuable instrument. But a Fender that was played by the godfather of grunge? You’ve got the recipe for a sale of $4.5 million.

This figure was smashed in 2020, when Kurt Cobain’s 1959 Martin D-18 went under the hammer. It was purchased by Aussie Peter Freedman, founder of RODE microphones, for $6 million.

Pianos 🎹

You may recall reading about the world’s most expensive piano in our issue on movie props & memorabilia.

The award belongs to “As Time Goes By” (yes, just like boats, instruments have names), the grand piano used in the 1942 classic Casablanca.

In 1988, Donald Trump tried to get his hands on the piano at a Sotheby’s auction, but he was outbid. The winner got it for $154,000.

As it turns out, this was a terrific investment: The seller sold the piano in 2014 for $3.4 million.

Woodwinds 🪈

Woodwinds (flutes, clarinets, saxophones) don’t get as much love as violins and guitars. But the high-end stuff can still be valuable.

Take the Q. Powell flute. It’s made out of platinum silver, and was owned by William Kincaid — the patriarch of American flutists (who bears a striking resemblance to Harry Styles).

The instrument was sold back in 1986 for $187k to famous art collector Stuart Pivar, who graciously loaned it to MOMA.

One of my favorite music newsletters

The music industry is at a crossroads right now. Music rights buyouts, AI developments, and a post-covid landscape that is changing every day.

Last year I signed up for a newsletter called Trapital, and it’s become one of my favorites. Each week, Dan Runcie breaks down music’s most important companies and concepts.

This is smart writing, and well-researched. It’s got a hip-hop focus, and covers all sorts of music topics in a sharp, fun way. (I especially loved his recent deep dive on the history of MTV)

If you love Alts, you’ll love Trapital. Sign up today.

What makes an instrument valuable?

Brand

Attribution (brand) is the most important factor in an instrument’s value.

No matter how nice an instrument is, if it’s by a no-name manufacturer, it won’t have the same luster as a Fender guitar or a Yamaha piano.

The closest comparison is probably the wine market. Unfortunately, it doesn’t really matter how good a wine tastes, or how good it makes you feel. The value lies mostly in the winemaker.

Manufacturing location

To further extend the wine metaphor, certain regions are known to produce the best products.

- Violins: Stick with Italy. The country is to violins is like Champagne is to, well, Champagne.

- Cellos: Italy reigned supreme in the 1800s. Germany is the best now,

- Pianos: Germany is the traditional piano haven. But the USA and Japan are hot on their heels.

- Guitars: The USA produces the most sought-after electric guitars. An American Fender Stratocaster is worth twice as much as the Mexican version.

Condition

This one goes without saying. If your cello has scuffs, scrapes and broken tuning pegs, say goodbye to value.

Age

In some alternative asset classes, older items are mostly valuable because of their scarcity (sports cards, comic books, etc). For others, older stuff means higher quality (aged wine, whiskey, tequila, etc)

But with musical instruments, it’s both.

Well-crafted instruments don’t have a use-by date. Cellos, violins and similar instruments tend to actually sound better with age. In fact, many believe the best-sounding violins were made in the 1600s.

Guitars and other digital instruments hold their tonality quite well. A piano, however, needs upkeep to not sound like a shrieking banshee after a decade.

So not only are older, vintage instruments rarer, they’re often as high-quality (and thus in-demand) as their modern counterparts.

Win-win for vintage.

Limited editions

Limited edition (LE) instruments can be more valuable. Fender, Gibson, and the big guitar manufacturers regularly re-release special editions of their best-sellers from the 50s and 60s.

The problem is that the prices are determined by the frills and “investor status” of the instruments, rather than their musical quality. It’s like Funko Pops, where they boost the supply to juice sales.

When hundreds of special editions are released every year, just how special can they really be?

Due to this, many modern LE electric guitars haven’t really appreciated in value.

There are, of course, exceptions. Take the Heintzman Crystal Piano. The instrument was designed specifically for use at the Beijing Olympics in 2008, and only one exists.

This one-of-a-kind piano, made entirely of crystal, sold for $3.22 million.

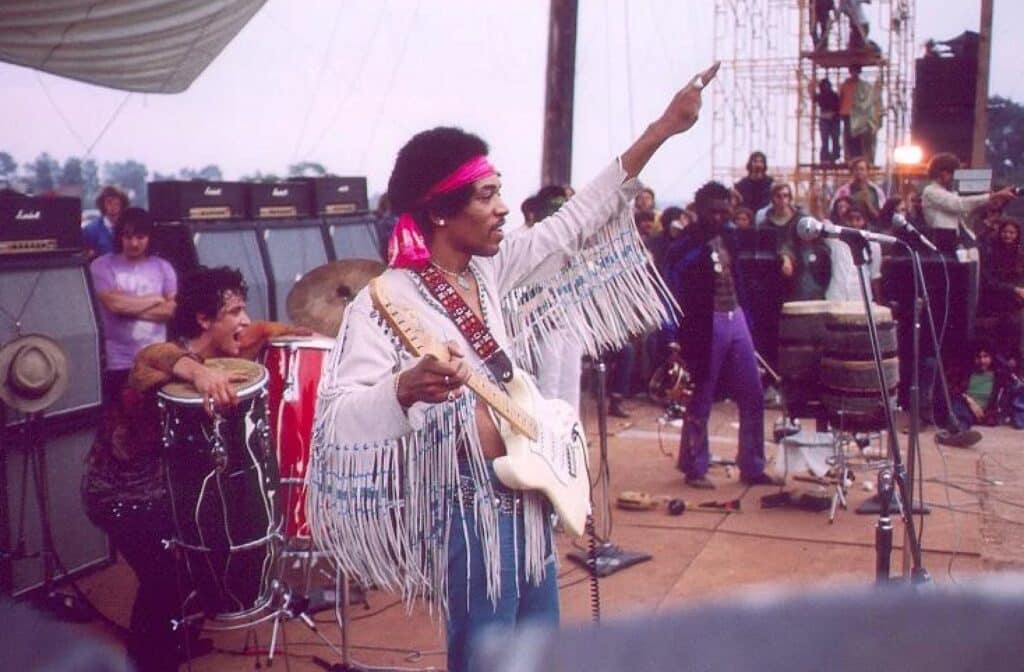

Provenance

Provenance, or who played (and/or owned) an instrument previously, is tremendously important in the art world (and was getting big with NFTs before that market shit the bed.)

Think of it like an unofficial sponsorship. If you can get your hands on an instrument played by a famous musician — for example, Jimi Hendrix’s 1968 Fender Stratocaster — you’ve got a winner.

Instruments “culturally linked” with a seminal musician, genre or era often have higher demand.

Examples:

- The 1963 Rickenbacker 360-12 made famous by George Harrison is basically impossible to find now. But even a replica is worth over $5,000.

- Jimmy Page’s 1959 Les Paul (called “Number One“) originally retailed for $350. Only about 600 were ever produced, which is why they’re so hard to find. Today, a 1959 Les Paul is worth $350k.

- Gibson SGs rose to prominence on the back of guitarists like Tony Iommi and Angus Young. Original SGs now routinely sell for $20 – $50k

How to invest in musical instruments

Auctions

If you’re going to invest in blue-chip musical instruments, you want to stick with the high-end. The big auction houses have the best supply.

Ingles & Hayday are the official musical instrument consultants for Sotheby’s. They hold two musical instrument auctions per year, selling mostly fine violins through Sotheby’s London galleries.

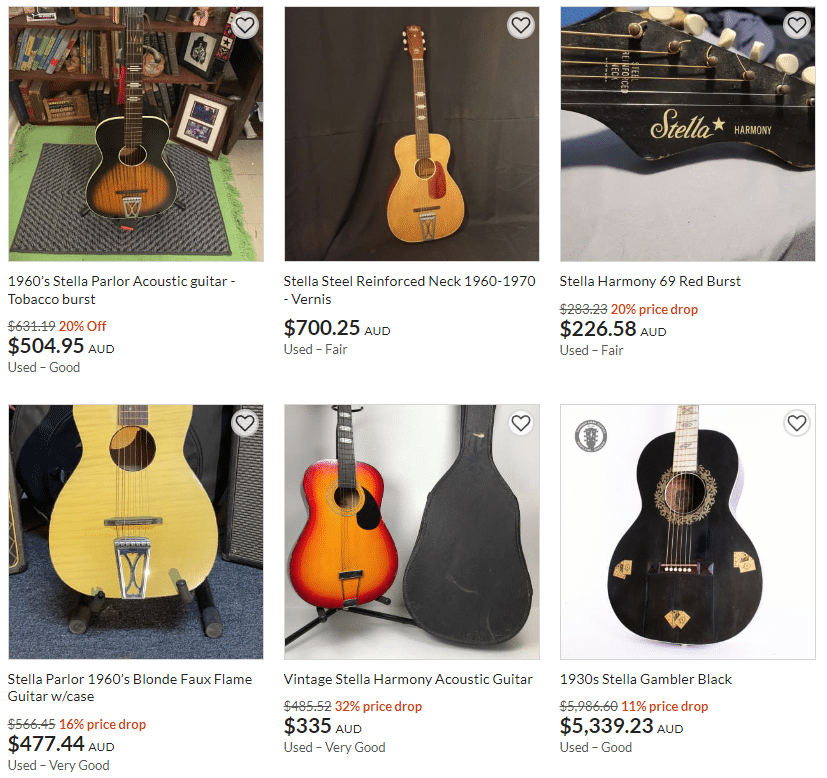

Used instrument sites

Other great used instrument shops include:

Vintage guitars, pianos and violins from any of these sites start at around $10k+.

But don’t fret (hah). There are still plenty of ways you can make money from musical instruments without ravaging your savings.

You can find acoustic guitars from the 60s for well under $500.

You can really find a bargain anywhere, so long as you look hard enough. Marketplaces like eBay, Craigslist and Facebook marketplace are all good starting points. Antique stores and garage sales are excellent options too.

Many of the old-timey acoustic guitars you find will need a bit of work. It might be as simple as a re-string, or you might need to replace the tuning pegs or re-do the lacquer finish.

Specialized stores like Reverb and Sweetwater will have more expensive and niche instruments, but you’re less likely to stumble across an underpriced gem.

Pianos, organs and keyboards can be winners because they’re such a pain in the ass to move. People often give them away as long as you can organize transport. Stumble across a vintage Steinway here and you could be looking at a serious profit.

Expanding your horizons to include vintage studio gear – audio interfaces, mixers, DJs, mics, speakers, headphones etc. – will help significantly too. These pieces are less likely to go up in value like a vintage violin, but they’re easier to find on the cheap.

As a quick and interesting case study, I had a look at the instruments/studio gear I purchased second-hand and compared what I paid to what they’re worth now. (Prices are in AUD).

- Audient iD14 ($350 → $330)

- Audio Technica AT4040 ($450 → $650)

- Shure SM57 ($100 → $200)

- Yamaha MSP5S ($250 → $618)

- VOX AC15VR ($150 → $250)

- Total ($1,300 → $2,048)

These items were accumulated over a five-year period without any intention of flipping or turning a profit. They were just bargains I happened to stumble across.

To action this as a real money-maker, I think the key is to learn what the selling price is for popular instruments, microphones and studio gear.

That way, if you see a bargain on a marketplace like Facebook, eBay, Reverb, Sweetwater (etc.) you can pounce before someone else does.

Some useful brand/product RRPs to know:

- Microphones: Shure, Audio Technica, AKG, Neumann

- Electric guitars: Fender, Gibson, Martin

- Acoustic guitars: Yamaha, Taylor, Martin

- Studio gear: Yamaha, Focusrite, Universal Audio, JBL, Motu

- Pianos/keyboards: Steinway, Yamaha, Kawai, Roland

Hot rodding, modding and refurbing

Re-touching otherwise unnoteworthy instruments probably needs an article of its own. It can be expensive, frustrating and there’s a lot you need to know before getting started.

The premise itself is simple. You take a cheap, mediocre instrument and upgrade its parts. For example, you can install custom pickups on a replica Fender bass. Or, you can replace the capsules and transformers on a cheap microphone.

A Gibson SG Junior is worth around $1,400 at RRP.

I found a modded version on eBay. The guitar was converted into a left-hand grip, has completely new humbuckers and a new, custom finish. It’s selling for $3.5k – a pretty handy profit.

Closing thoughts

Personally, I think musical instruments should be instruments first and investments second.

But if you love music (and especially if you’re already a musician), acquiring a high-quality instrument will likely be a solid investment anyway. We have decades of evidence showing that blue-chip instruments hold up well over time.

It remains to be seen if the modern era of guitars, pianos and violins will appreciate in value the way 60s Les Pauls have. Given the high supply of modern instruments, it’s unlikely they’ll climb as high.

But even though supply is growing, so too is demand. A modern blue-chip guitar won’t fund your retirement, but you probably won’t lose money either.

In the meantime, the vintage pieces are where it’s at. Between the scarcity and centuries-old craftsmanship, these fine instruments will always be in demand among musicians.

And an enchanting, ancient violin can play to your soul in a way that stocks never will. 🎻

Further reading

- A 320-year-old missing Stradivarius cello was stolen from a porch, almost turned into a CD rack, was discovered in a trash bin, and returned to the LA Philharmonic.

- On Sep 15th, a grand piano that once belonged to John Lennon will be auctioned off through Alex Cooper Auctioneers. Lennon gifted the piano to a friend, who (idiotically) sold it for $3,000. Bidding starts at $1m, and is expected to fetch between $2m – $3m.

- Carter Vintage Exchange features a ton of old Gibson guitars for sale. Here’s a nice 1950s J-45 Gibson Sunburst for $2,500.

- Italy is still the violin Mecca, but a new musical instrument capital is opening up in Huangqiao, China, now the world’s largest violin production center.

- The Duport Stradivarius, played by legendary Russian cellist Mstislav Rostropovich, has a big dent supposedly made by Napoleon Bonaparte.

Disclosures

- This issue was sponsored by our friends at JKBX

- Our ALTS 1 Fund has no investments in any musical instruments

- I played saxophone in high school band

- This issue contains no affiliate links