Today we have a special issue for you – we’re diving deep into the fractional farmland investment platform AcreTrader

We’ve already covered how to invest and value farmland and why it’s such an attractive asset class. Today’s piece focuses on AcreTrader — the company, their offerings, and why we like them for farmland exposure.

Editor’s Note: This issue is a sponsored deep-dive, meaning Alts has been paid to write an independent analysis of AcreTrader. AcreTrader has agreed to offer an unconstrained look at their business & operations. AcreTrader is a sponsor of Alts, but our research is neutral and unbiased. This should not be considered investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We think you’ll find it informative and fair.

Let’s explore

Table of Contents

Farmland as an alternative investment

As a quick refresher, here’s why farmland is a terrific long-term investment:

- Inflation hedge. Mostly non-correlated to equity markets.

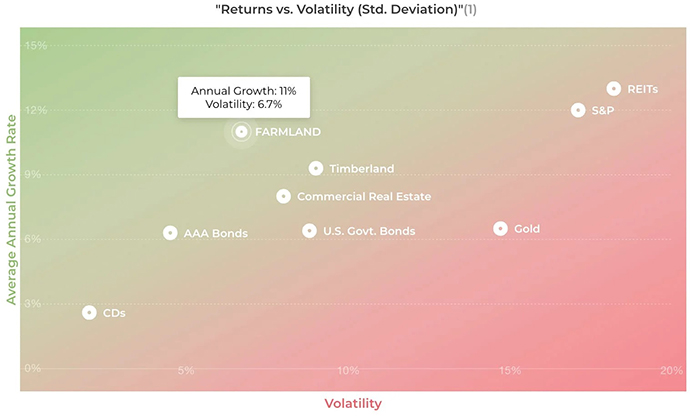

- Strong historical returns with low volatility.

- Essential in the global economy. Demographic trends mean ever more mouths to feed.

- Finite supply. They ain’t making any more land.

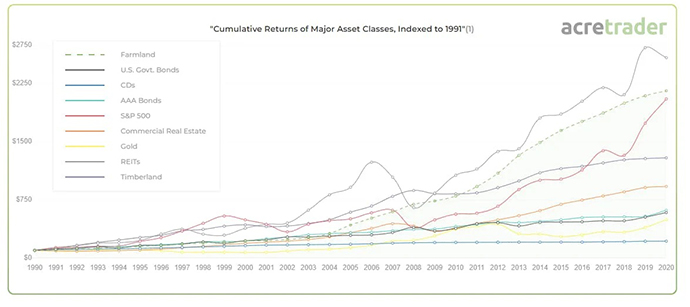

Over the last 30 years, farmland has consistently been one of the safest asset classes. A $10,000 investment in farmland in 1991 would be worth over $215,000 today.

Performance-wise, farmland bodes very well among other historically safe asset classes. It sits right below REITs and the S&P while offering much lower volatility.

Who is AcreTrader?

AcreTrader is a modern platform for investing in farmland (including row crops & permanent crops) and they recently expanded into timberland 🪵

They’ve also recently expanded into Australia. 🇦🇺 You may recall last November we did an analysis of their down-under offering: The Mareeba Avocado Orchard in Queensland.

There are a few farmland investment platforms out there, but AcreTrader is the oldest and largest. Over the past 2 years, they’ve grown from 10 to 100+ employees, and have completed more deals than all of their competitors combined.

AcreTrader’s Founder

Carter Malloy founded AcreTrader in 2017. Growing up in an Arkansas farming family, his father was an acquirer of farms and passed on this mentality to Carter. Carter stayed close to his roots when he started AcreTrader’s operations in the Razorback state.

AcreTrader allowed Carter to combine two of his passions: farming and investing. A recurring theme for AcreTrader is its use of data. Carter used financial information daily in his prior equity research and investment roles.

This focus on numbers means AcreTrader ensures only the best opportunities make the cut.

Carter saw what savvy accredited investors have known for a long time: that farmland is a great opportunity. But there were high barriers to entry: Access to farmers, high capital requirements, time researching opportunities, and of course the expense of running it.

There were also obstacles on the seller’s side. Before platforms like AcreTrader, sellers had a limited buyer pool, which hurt farmers’ negotiating power. Some farmers also wanted to continue operating the land after selling it. (If you’re a farmer, the love of the land is strong in your veins.)

AcreTrader provides an elegant solution for both investors and farmers.

Investors get pre-vetted opportunities, a low minimum investment, and turnkey management of the farm. Farmers get a huge new pool of buyers. Oh, and they could continue working the farms. Everyone wins.

What makes AcreTrader different?

AcreTrader has two main competitive advantages:

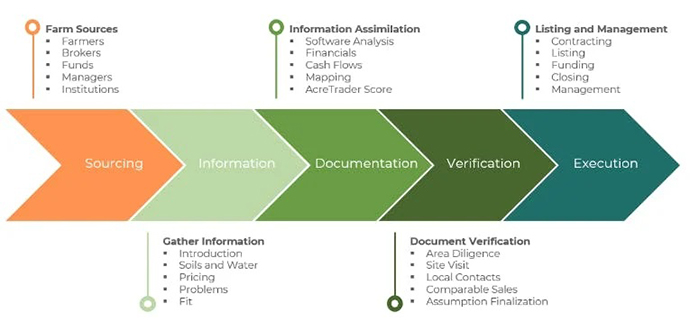

- Data-driven due diligence. Their intensive due diligence process helps find the best farmland investment opportunities.

- Professional land management. They find the best deals for investors and then manage the farms to optimize returns.

Research process

Experienced investment managers will tell you that the best deals don’t happen in the public markets. The best deals are off-market deals based on personal connections in the industry.

In running the ALTS 1 fund, we’ve learned this first-hand: great assets at discounts to their intrinsic value are rarely found in public marketplaces and auctions.

AcreTrader’s location in Arkansas, an agricultural-heavy state, allows them to make natural connections in farming communities. They don’t wait for deals to come to them. A team at AcreTrader is constantly reaching out to landowners to gauge their interest in selling.

They use geospatial data to crunch the numbers and identify the best off-market opportunities. Then they get boots on the ground (literally!) to get a first-hand view of the land. They analyze soil quality and irrigation sources to ensure that each farm is top-notch.

All farms acquired are vetted by management, and most initial candidates don’t make the final cut. Only the best of the best are given a chance to be part of the AcreTrader portfolio.

As of May 2022, 100 farms have been offered on AcreTrader — just a fraction of the farms the AcreTrader team reviewed.

Farm management

Farms don’t manage themselves! Finding the best managers for each farm is a big part of what AcreTrader does.

In many cases this means simply continuing the relationship with the existing owners. But if the owners want to sell and move on, AcreTrader uses their network of contacts to put a new farm management team in place.

Farm investing is all about long-term value creation. Short-term gains are not pursued at the expense of the longer-term care of the farm. Most of the AcreTrader properties have a five to a ten-year holding period, and properties are managed with this timeframe in mind.

AcreTrader also looks for innovative ways to add value to its portfolio. Wind turbines help offset the farm’s expenses and generate clean energy on this Illinois corn/soybean farm. On other farms, AcreTrader has worked to transition their crops to USDA organic, resulting in higher sales prices and lower environmental impact

The main types of offerings

The offerings on AcreTrader and other farmland platforms tend to focus on the staples of the global food supply chain: corn and soybeans. Together they make up 65% of all cropland in the US!

Think of corn and soybeans as portfolio bedrocks. These staples form a solid base for a farmland portfolio.

The steady returns of basic crops are reflected in the farmland returns by state. The top 5 are primarily concentrated in the Midwest, which leads the nation in returns.

Alternative crops

Once an investor has built a solid portfolio base, AcreTrader also offers unique opportunities. These alternative crops offer the potential for higher risk/higher return.

Examples include:

- Mixed vegetables

- Potatoes

- Cotton

- Peanuts

- Alfalfa

- Onions

- Sugar beets

As mentioned above, AcreTrader has also started to feature timber tracts. Timber provides a higher risk profile (relative to other types of farmland) due to the potential for tree destruction through (from fires and disease). But it also offers attractive returns through land and lumber appreciation.

We also like that AcreTrader’s offerings have a low concentration of water-intensive crops such as walnuts and almonds. Nut farms such as these could struggle in the future as climate change and drought continue to impact their growing regions.

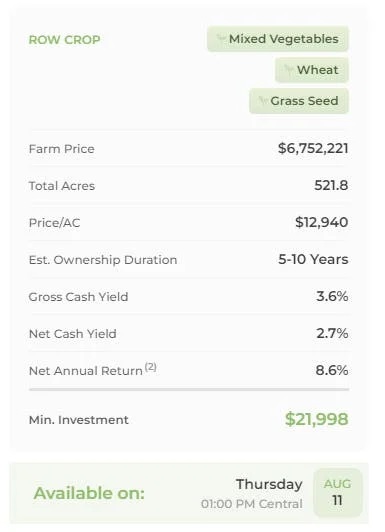

AcreTrader has active land operations in 17 states plus Australia. They tend to have one or two offerings live on their site at any time. As our reviews of other farmland platforms noted, the minimum investment can be high. Minimums range from a low of approximately $8k (timber) to $22k or higher.

AcreTrader investments are limited to accredited investors. An accreditation requirement is common for high-dollar minimum alternative investments.

AcreTrader prides itself on transparency. Each offering has a wealth of information. Farmland writeups include detailed financial projections, maps of the property, and various other documents. They also offer a rating on each property and assign a letter grade. The rating provides a great snapshot of the major characteristics of the farmland.

Investing details

Holding period

An investment in farmland through AcreTrader should be viewed as a long-term investment. These investments are illiquid, and AcreTrader notes a typical ownership duration for each offering (normally between 5 to 10 years).

AcreTrader does look to sell farms when market conditions are favorable. In the last year, AcreTrader has sold three farms. Returns ranged from 15% – 30%, well above the projected annual returns of 7 – 9%!

Expected returns

Think of fractional farmland like a high-yielding bond with a long-term maturity.

Investors can expect periodic cash distributions based on two factors:

- Annual cash yields. This can be thought of as the rent from the farmers working the farm. The tenant contracts are structured with a base rent that is not impacted by commodity prices. These terms help ensure a steady, predictable return. Some contracts include a “flex” component that allows investors to benefit from higher commodity prices and crop yields. Annual cash yields average between 3 and 5 percent for the lower-risk farms.

- Net Annual Return. The overall annual return an investor can expect at the end of the holding period. It includes the tenant farmer’s rent and the expected sale price of the land. The returns from the land appreciation will occur throughout the holding period, but investors will only see the cash distributions from these after the sale.

The typical overall return goal is 7-9%. This projection is a conservative estimate below the historical trend of 12% annual farmland returns. AcreTrader doesn’t forecast commodity price improvements.

However, as we’ve recently seen with soaring food prices spurred by COVID and the Ukraine war, more favorable commodity markets are a realistic assumption. As the world’s population continues to grow and advance economically, the demand for crops will only increase.

Management fees

Like us, AcreTrader believes low fees are where the investing world is headed. The new normal. They charge a very reasonable 0.75% annual management fee based on the value of the farm.

This fee is in line with fees charged by other alternative asset platforms.

Secondary trading

There is no current secondary market for shares. However, AcreTrader anticipates offering a secondary market in the second half of 2022 (subject to regulatory approval).

This secondary market would be the first for the fractional farmland platforms.

Current AcreTrader offerings

We wanted to highlight an intriguing offering debuting on AcreTrader on August 11 – the Willamette River Farm.

What we like

- First AcreTrader offering in Oregon (geographic, crop, and climate diversity for farmland portfolio)

- Diverse crop output; grass seed is a specialty crop used in construction/residential home applications.

- Row crops have a lower risk profile due to annual harvesting

- High rainfall. Average yearly rainfall in the Pacific Northwest is 55 inches

- Three wells are on the property, with access to additional water from two nearby rivers

- Fertile silt loam soil; the Willamette Valley is the center of Oregon agriculture (the region is known as the “grass-seed capital” of the world)

- Strong regional infrastructure (roads/packing plants) nearby

- The projected annual land appreciation of 5.9% is consistent with 20 years Oregon average of 5.3%

- The tenant farmer is a 4th generation farmer with an extensive history in the community (3,000 acres in production); the tenant identified and brought this opportunity to AcreTrader.

Potential risks

- Installation of water pumps/irrigation infrastructure ($105K); potential for cost overruns and project delays

- The land will be farmed by a new tenant (risk mitigated by tenant’s experience in region and crops and involvement in the acquisition of property)

Closing thoughts

Farmland is truly one of the great underrated, hidden gem asset classes. Its returns have consistently beaten inflation and equities over the last 30 years, all while having low volatility.

These are the early days of democratized farmland investing. Until recently, investing in farmland was restricted to institutional capital and high-net-worth individuals. But the last five years have seen platforms such as AcreTrader emerge to bring this opportunity to more investors.

Institutions have not yet crowded into farmland they way they have with other real estate. For example, while shopping malls are heavily institutional owned, institutional ownership of farmland is just 1-2%.

Farmland is generally a safer investment, and AcreTrader is a great option for those considering exposure to it. The company is well-capitalized with $70m+ in funding. We’ve gotten to know the team quite well over the past few months, and trust that they are honest operators on the right path.

Data plays a huge part in AcreTrader’s strategy. Their website has a wealth of information on each offering, as well as extensive data on the farming industry. AcreTrader uses this data and other proprietary data to select and present to investors the best of the best opportunities. (Oh, and they may be making this data available to the public soon! We’ll keep you posted.)

We encourage you to visit AcreTrader today to set up an account. This will allow you to access their full farmland library, and critically be notified of new upcoming offerings.

Want more content like this? Subscribe to farmland investing.

Until next time,

Stefan