Funding Circle IPO | Crypto Startups Pull Back On Raising Big ICOs

Big news this week is the announcement of the IPO of Funding Circle, one of the largest P2P platforms in Europe. Will this lead the way for more IPOs for Alternative Finance platforms?

This week I will focus on Alternative Finance in Slovakia. The Slovak government announced they are working on crowdfunding regulation. Ivan Filus will provide a detailed overview of the current status of alternative finance in this country.

Articles this week:

- The Slovak Ministry of Finance considers the need to regulate crowdfunding

- Funding Circle plans to raise £300m in IPO

- Seedrs partners with Republic to enable European businesses to co-raise from U.S. investors

- Crypto Startups Pull Back On Raising Big ICOs

- Expert of the week: Ivan Filus (Slovakia)

Table of Contents

The Slovak Ministry of Finance considers the need to regulate crowdfunding

The Ministry of Finance of the Slovak Republic intends to open a debate on whether or not regulation is needed for crowdfunding as the entities operating in this area feel that there is a lack of legal certainty.

Center for Financial Innovation

This year, the ministry opened the Center for Financial Innovation, which aims to bring together the National Bank of Slovakia (NBS), financial institutions and other entrepreneurs with the ministry to discuss innovative practices penetrating the financial market. One of them is crowdfunding, an alternative form of financing that is not yet regulated in Slovakia.

The Center for Financial Innovation (CFI) was established in February 2018. The main objective of the CFI is to create a platform for regular exchange of information and experience for the relevant state administration bodies, market participants and interest groups. CFI’s priority activity is to map the environment influencing the introduction of new technologies in the financial market, identify deficiencies or opportunities to improve the environment, and actively remove barriers to the emergence and operation of the FinTech companies in Slovakia.

More details by Ivan Filus

Later is this newsletter a more detailed description of the status of Alternative Finance in Slovakia by expert Ivan Filus from BIC Bratislava.

Funding Circle plans to raise £300m in IPO

Funding Circle, the UK’s biggest online loan provider, plans to proceed with an initial public offering (IPO) on the London Stock Exchange. The IPO shows the quick growth of the Alternative Finance industry. The eight-year-old company expects to raise funding in the IPO at a $1,65 valuation.

$1 billion funding for US loans

Just before the IPO announcment, Funding Circle announced a $1 billion deal with Alcentra, part of the Wall Street banking giant BNY Mellon, to purchase $1bn of US loans over the next few years.

Seedrs partners with Republic to enable European businesses to co-raise from U.S. investors

Interesting news from UK equity crowdfunding platform Seedrs. They announced last week a partnership with U.S. based equity platform Republic to allow joint equity crowdfunding campaigns across Europe and the United States.

JOBS-act

While VC and angel funding are by far the largest in the US, the equity crowdfunding industry is not very strong developed yet. With the JOBS-act it became finally possible for unaccredited investors to invest in startups in 2016, but after 2 years only $127 million was in total raised by all platforms combined. Most people argue it is because of the complex regulation and the low maximum of $1 million per offering.

For UK platforms it is difficult to operate in the US, because of the strong regulation of the SEC. Therefore the collaboration between Seedrs with a local platform seems a logical step. It makes it easier for US investors to invest also in UK companies by using a platform regulated by the SEC.

£400m funded and AutoInvest

The partnership coincides with Seedrs passing the £400m mark of investment on the platform with over 670 deals funded. It also has recently annouced its automated investment service AutoInvest.

Crypto Startups Pull Back On Raising Big ICOs

What is the current status of Alternative Finance?

Although Slovakia is regularly ranked as moderate innovator in the EU Innovation Scoreboard, the innovation performance is increasing, especially in SME in-house product innovation. This creates a high demand for financing development and introduction of new products into market and growth.

Access to finance has been improved but alternative sources of financing are rarely used by Slovak innovative companies. The most recent EU Country Semester Report (2018) reveals that while 11% of start-up projects in Slovakia are financed through crowdfunding, venture capital financing only accounts for 2% of funding and was used by 15% of Slovak start-ups.

Limited offer of relevant platforms for equity and loan crowdfunding is far below the actual demand from innovators. The overall annual investments to crowdfunding for Slovak companies are estimated about 5 M€.

Currently (June 2018) the Slovak Ministry of Economy (Centre for Financial Innovation) is considering the necessity of regulation of the crowdfunding arguing with the lack of legal certainty for all involved parties.

Can you give us an inspiring case from your country?

Crowdberry is the biggest crowd-investment platform in Slovakia offering customers, fans and other relevant parties to become co-owners of Czech and Slovak business ventures and participate in their growth. Crowdberry is offering online platform for investments, transaction management, business advisory, investors club and forum.

The investments are targeting not only traditional businesses :

- IT platforms : Boataround – Yacht booking portal

- Highly innovative companies operating in medical diagnostics : MultiplexDX – Personalised Cancer Diagnosis

- Mixed reality technology : Matsuko – 3D technology for remote online communication

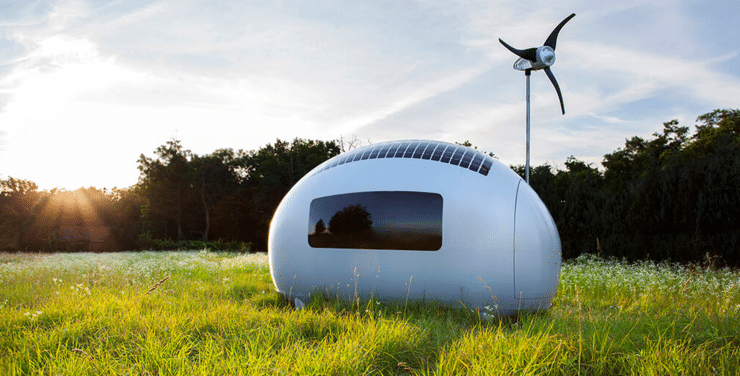

- Ecological solutions for better living : Ecocapsule – Designer mobile micro-house

- Waste management system : Sensoneo – Smart waste monitoring system

In Crowdberry was established in 2015 in Slovakia and in June 2017 has announced expansion into the Czech Republic.

What are the biggest obstacles for growth?

Currently, main barriers in development of the alternative financing market in Slovakia are :

- very limited number of platforms and funding for equity and debt crowdfunding

- general awareness and cultural readiness for new forms of financing

- rather restricted investors’ access to companies after investment (decisions, equity)

- uncertain situation in the regulation.

However, Slovakia also holds promising opportunities for alternative financing growth such as number of potential innovative companies (ideas) for investments, availability of funding from potential co-investors, low availability of traditional funding for higher risk innovative SMEs and availability of good practices and solutions for platforms abroad.