Hello and welcome to Alts Cafe 👋

Highlights from the full issue:

- Macro: US added 303,000 jobs in March

- Real Estate: Detroit’s housing market beat Miami’s

- Startups: Nvidia chips are up for rent

- Private Credit: Barclays jumps into Private Credit

- Crypto: Optimism is high for Ethereum

- NFTs: Binance is out of the Bitcoin NFT game

- Art: EU regulations are hurting traders

- Vintage Autos: Burt Reynold’s Firebird is up for auction

- Coins: A yard sale shopper got lucky

- Farmland: Organic farmland is hot

- Luxury: Resale market reaches $50 billion in value

- Wine, Tequila, and Spirits: Celeb-whiskey on the rise

- Film & Music: KISS cleans house

- Precious Metals: Gold and Silver had great weeks

- Collectibles: 90’s Apple sneakers hit auctions

- Websites: Google domains move to Squarespace

Let’s go.

Wyatt

Table of Contents

Macro View

Bullish News

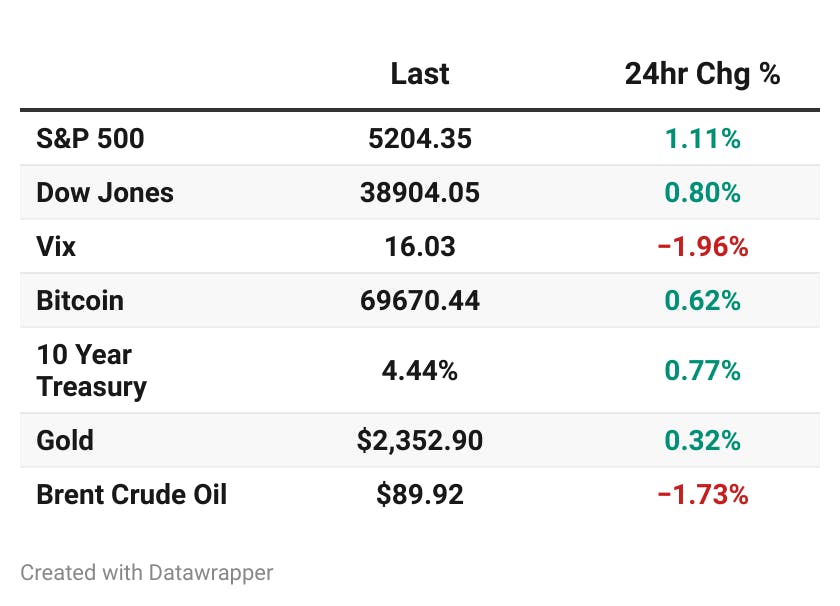

- The US economy added 303,000 jobs in March, the unemployment rate declined to 3.8%, and the labor force participation rate rose to 62.7%.

- New ISM manufacturing data in March showed US factory activity has expanded for the first time since September 2022.

- The IMF expects Asia to contribute two-thirds to global growth in 2024, with economic growth projected at 4.5%.

- The National Retail Federation forecasted a 3% growth in 2024 retail sales, after a 4.1% increase in disposable income year-over-year in February.

- China is expected to grow at twice the rate of the US, with China’s GDP 20% bigger in 2023 than in 2019.

- Corporate profits of $2.8 trillion in Q4 2023 allowed companies to avoid massive layoffs and keep the economy afloat.

Bearish News

- The Fed kept interest rates steady in March against inflation, with construction spending dropping 0.3% in February.

- US jobless claims rose to a two-month high, with the trade deficit widening 1.9% to $68.9 billion in February.

- Minneapolis Fed President Neel Kashkari said the central bank may not cut rates in 2024.

- Mortgage rates rose to nearly 7% as loan applications decreased by 0.6% this week.

- The Bank of Japan hinted at a near-term rate hike, pushing yields higher.

What are the odds?

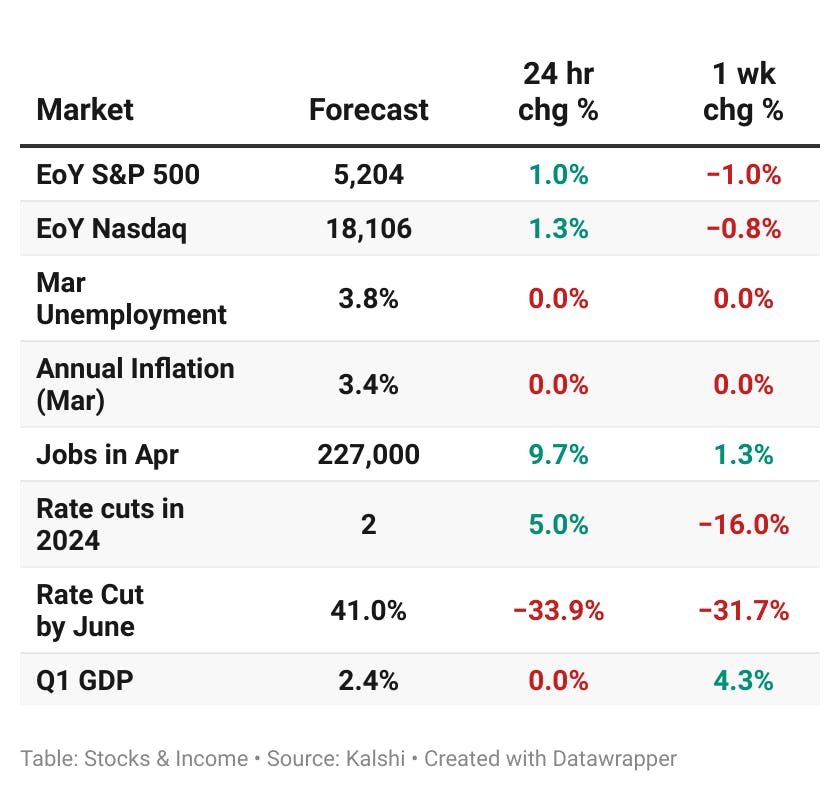

Kashi is showing a 41% chance of a June rate cut, down from nearly 93% a couple of months ago.

Get $25 to play around with using this link.

What are we doing?

Altea Highlights

Check out the full roundup.

Live Deals

- Investment size: $10k minimum

- Hold period: 3 – 5 years

- Potential IRR: 35% to 40%

- Fees: 2% management | 20% carry | nominal one-time subscription TBC

What’s the deal

Altea will acquire 50+ barrels of 100% agave tequila through this SPV to buy and hold for at least 3 years as the spirits age.

The barrels will be acquired, stored, and disposed of through our network of tequila brokers, private collectors, and exclusive brands in Jalisco, Mexico, over the course of 3 to 5 years.

Funding Status: $350k firm commits | $200k soft commits

What’s changed since last week

If you’re still on the soft commits list, this is your last chance to get in on this deal.

One Frank Auerbach Charcoal

- Investment size: up to $560k

- Duration: 3 – 10 years

- Potential IRR: 15% to 20%

- Fees: 1.5% management | 20% carry

Through the same London art connection that brought us Art Bundle I, which was oversubscribed by 25% and has returned 19% in three months, we have the opportunity to acquire a unique piece by legendary German/British artist Frank Auerbach.

What’s changed since last week:

I’m meeting with our new platform’s compliance team to push this ahead.

Upcoming Deals

South Island, New Zealand NRL Expansion

What’s the deal

We’re working with an organization looking to expand NRL rugby to New Zealand. They’re raising a small working capital round of $200k to $300k to finalize the bid (which already has wide support).

What’s changed since last week:

Stefan met with the crew in New Zealand this week. Check out his deep dive.

Investor Field Trips

We’ve locked in Nashville 🎸 for a music-themed investing adventure to Music City, USA.

Get your boots spit-shined and your guitar tuned.

Est. dates: October 21 – 25

We’ll discount the first few members who make a deposit. Let me know if you’d like to join.

ALTS 1 Fund news

K1s w

Real Estate

Bullish News

- Detroit’s housing market outpaced Miami with the highest year-over-year price increase of 8.7% as of November 2023.

- The US now has a record 550 “million-dollar cities” where a typical home is valued at over $1 million, up 59 from last year.

- The NYC real estate market surged in Q1 2024, with Manhattan seeing a record 40 contracts for $4 million+ homes.

Bearish News

- Proptech venture capital investment tumbled 80% last quarter from its 2022 peak, hitting below $1.5 billion in Q1.

- Manhattan’s office availability rate hit a record high of 18.1% in Q1 2024, up from 10% in March 2020.

- Fitch predicts the upcoming commercial real estate crash could surpass the 2008 crisis, with office values down 35%.

- Homebuilder stocks dropped following a Wedbush Securities downgrade to “underperform”.

- To afford a median-priced home of $402,343, Americans need an annual income of $110,871, up 46% since 2020.

- Developers nationwide reduced new home starts in 2023, with building permits dropping 12%.

How to invest in real estate right now:

Detroit, the Miami of the Midwest.

Startups

Bullish News

- AI startup Cognition Labs, founded in November, seeks a $2 billion valuation.

- In Q1 2024, 37 startups crossed the $1 billion valuation mark, a 48% increase from Q4 2023.

- Lightspeed Venture Partners unveiled three US funds totaling $6.6 billion and a $500 million India early-stage fund.

- In 2023, investors pumped $29.1 billion into nearly 700 generative AI deals, a 260% increase from the prior year.

- Venture capital investment in crypto increased by over 50% in March.

- 53% of venture capitalists expect to deploy more capital in 2024 than in 2023.

- Germany created a $12 billion fund to accelerate the growth of tech startups.

Bearish News

- Venture capital investments fell to a near five-year low in Q1 2024, according to PitchBook data.

- US venture capital fundraising is struggling, with only $9.3 billion raised in Q1, nearly a 54% decline from last year to the lowest since 2013.

- Direct-to-consumer brands like HelloFresh and Peloton have seen their stocks drop by 75% from peak market prices.

- AI startups that bought too many Nvidia chips may have to rent them out to generate revenue.

How to invest in startups right now:

HelloFresh and Peloton struggle following the advent of biking to the store.

Private Equity and Private Credit

Bullish News

- Private debt fundraising activity is predicted to pick up this year, with assets under management nearing $1.9 trillion.

- Thoma Bravo announced plans to raise about $20 billion for its next flagship buyout fund.

- Barclays entered the private credit market with AGL, receiving an anchor commitment from an Abu Dhabi Investment Authority subsidiary.

- 35% of insurance companies have looked to increase credit risk over the next 12 months.

- Dallas-based Arctos raised over $4 billion to invest in sports teams and leagues.

Bearish News

- Limited partner investments fell 28.7% to $40.30 billion in 2023 with distributions falling to 11.2% of NAV.

- PE stakes are being unloaded at a discount as investors look for a way out.

- A Senate hearing tackled PE’s impact on healthcare with senators proposing legislation to stop PE from “looting one business after another“.

- Real estate fundraising fell about 41% year-over-year to $98.8 billion in 2023, the lowest since 2012.

- Private asset performance stayed below historical averages for another year, with fundraising down 22%, the lowest since 2017.

- PE investments in India fell to a six-year low of $29.8 billion in 2023, down 33% year-on-year across 315 deals.

How to invest in PE and Private Credit right now:

All eyes on Bravo

Crypto

Bullish News

- Coinbase said the crypto market looks positive for Q2, with the Bitcoin halving in mid-April as the standout event.

- Litecoin surged 24% over the past 7 days, rallying past $100 after the CFTC classified it as a commodity.

- VanEck predicted Ethereum layer 2 networks could rocket to a $1 trillion base valuation by 2030.

- The top crypto exchange insurance funds surged in value by over $1 billion with Binance’s SAFU surpassing $2.03 billion.

Bearish News

- Binance founder “CZ” Zhao was sentenced to 18 months in prison after pleading guilty to violating the Bank Secrecy Act.

- A federal jury found Terraform Labs and Do Kwon liable for fraud in the collapse of the TerraUSD and LUNA tokens.

- New reports revealed crypto’s use in the global arms trade, with a Russian smuggler moving millions via Tether.

- The IRS views crypto as property, complicating taxes for meme coin millionaires, with short-term gains taxed at 37%.

- Paraguay proposed a 180-day crypto mining ban to tackle illegal mining operations, costing up to $94,900 per farm.

How to invest in Crypto right now:

Bad day to be a meme coin millionaire.

NFTs

Bullish News

- The NFT market is set to evolve into a value-based ecosystem, focusing on democratizing art galleries and linking traditional markets with DeFi.

- Franklin Templeton reported that Bitcoin NFT activity is accelerating, with Ordinal collections dominating the market.

- Bitcoin NFT sales hit $514 million in March, the best month since December 2023.

- Pudgy Penguins soared 7.7%, becoming the second-largest NFT with a market cap of $461 million.

Bearish News

- NFT sales have plateaued at around $1.3 billion monthly, a significant decline from their January 2022 peak of $6 billion.

- OpenSea’s monthly NFT sales volume declined in March, with sales totaling $147 million, a 4% drop from February.

- On-chain sleuth ZachXBT revealed the alleged misuse of funds by the CTO of NFT project Nuddies NFT.

- Binance announced it would stop supporting Bitcoin NFT trading starting April 18.

How to invest in NFTs right now:

Who said penguins can’t fly?

Artwork

Bullish News

- Titian’s “Rest on the Flight into Egypt” is expected to fetch up to $31.6 million in July, its first appearance in 145 years.

- Lucio Fontana’s yellow, egg-shaped painting from his Concetto Spaziale, La fine di Dio series may sell for up to $30 million.

- Claude Monet’s “Moulin de Limetz” is heading to auction at Christie’s, where it’s expected to sell for more than $18 million.

- A drawing found on the kitchen wall of a Florentine villa, possibly by Michelangelo, has been put on the market.

Bearish News

- Sotheby’s increased seller’s fees as its owner faces pressure from Altice’s $60 billion debt.

- Two men were sentenced to prison for selling $3.2 million in fake Dalí and Picasso works to over 125 victims.

- The renowned Marlborough Gallery closed after 78 years.

- French antique art dealers have begun protesting EU regulations penalizing legitimate traders with expensive documentation requirements.

- An art forger was sentenced to four years for duping collectors by selling replicas as 15th-century masterpieces.

How to invest in Artwork right now:

Double-check your Dalís

Vintage Autos

Bullish News

- A 1979 Pontiac Firebird Trans Am stunt car from Steve McQueen’s final film sold for nearly $100,000 at auction.

- A $32 million Swedish car collection will be auctioned in Monaco in May.

- Supercar Blondie launched SBX Cars, a digital auction platform, with over $100 million in consignments.

- The last Pontiac Firebird Trans Am SE owned by Burt Reynolds is hitting the auction block at Barrett-Jackson.

- Five cars, including 1953-58 Studebaker Commander Station Wagons, posted notable value gains of up to 44%.

- Mecum’s Glendale auction exceeded $54 million in sales, with Elvis Presley’s 1969 Cadillac Eldorado selling for $253,000.

- The number of vintage cars with Dutch license plates increased by 28% in five years.

Bearish News

- An abandoned mansion in France hid a stash of decaying classic French cars that will likely rot away beyond salvation.

- Hagerty canceled the Detroit Concours d’Elegance for 2024 due to losing faith in the event’s financial viability.

- The Automobilia Monterey event was canceled this year due to vendor fatigue and rising costs.

How to invest in Vintage Autos right now:

Check out the listings on SBXCars.com

Rare Coins

Bullish News

- The only known 1822 half-eagle $5 gold piece in private hands sold at auction for $8.4 million, setting a new record.

- Rare Australian coins, such as the 1930 Proof Penny, fetched up to $1.3 million at auction.

- Stack’s Bowers & Ponterio announced their Spring Hong Kong Auction, featuring 9,600 lots of Asian numismatic items.

- Stack’s Bowers Galleries acquired World Banknote Auctions, integrating its founder into their specialist team.

- An avid collector landed rare Morgan dollar coins worth up to $200 for just $20 at a Massachusetts yard sale.

- The Prominence X Sale features a rare 1877 Indian Treaty No. 7 silver medal estimated at over $30,000.

Bearish News

- The Knight Frank Luxury Investment Index grew 7% versus an 11% equity index rise to June 2023.

- Austin Coins, owned by a former stockbroker barred for fraud, scammed a 95-year-old man out of $100,000 by selling overpriced coins.

How to invest in Rare Coins right now:

Time to hit a yard sale.

Farmland

Bullish News

- Illinois farmland values rose in 2023, with Class A land up 6%, Class B up 7%, and Class C and D up 14%.

- An organic farm in Wisconsin sold for $16,250 per acre in January 2024.

- Farmers’ outlook on the agricultural economy improved in March as interest rate expectations shifted.

- The USDA’s Farm Price Index for February showed prices rose by 7%.

- Nearly half of farmers expect prime interest rates to decline over the next year, according to a Purdue University survey.

- Anheuser-Busch announced the national rollout of its US Farmed certification.

Bearish News

- California’s agricultural land values declined due to rising interest rates and low commodity prices.

- The chances of farm bill reauthorization in 2024 grow dim, with an 80% chance Congress will not agree on the bill.

- Farmland value growth in Canada slowed to 11.5% in 2023, down from 12.8% in 2022.

- Arkansas’ net farm incomes are projected to drop by $500 million in 2024 due to lower crop and livestock prices.

- EU and national regulations have squeezed French farmers, now just 2% of the population.

- Ohio growers are set to plant fewer acres in 2024, with corn acreage decreasing by 8% and winter wheat by 16%.

- North Carolina ranked second in the most lost farmland in America, set to lose another 1,197,300 acres in the next 15 years.

How to invest in Farmland right now:

Organic farm value continues to rise.

After our trip to Mexico, there was significant interest in acquiring cash-flowing agave farmland. We may have found the right opportunity. There are ten hectares of prime roadside land available for around $1.1 million, which is a good price. There’s also room to build a distillery and accommodation for STRs. More to come on this.

Altea members get first dibs, but you can get on the waitlist in case there’s extra space.

Luxury Goods

Bullish News

- Kering spent $1.3 billion on a property on Milan’s Via Monte Napoleone, representing the largest asset sale in the Italian real estate market.

- India’s luxury market demand has been forecasted to reach $85 billion by 2030.

- Luxury watchmakers announced technology deals to hedge their bets in case the smartwatch market takes off.

- The luxury fashion resale market reached nearly $50 billion in volume in 2023.

- Film x fashion collaborations are now luxe, with LVMH launching an entertainment division in February.

Bearish News

- China dialed back spending on luxury in 2023, with HNW households’ average annual consumption dropping 11%.

- A former Yeezy employee sued Kanye West, alleging unsafe working conditions at Donda Academy.

- Farfetch cut its growth forecast, causing shares to plunge 22% after reporting a bigger-than-expected quarterly loss.

- Swatch warned of a difficult Chinese market through 2024, with watch exports to China dropping 25% YoY in February.

- A man admitted to stealing $1.8 million in luxury items from a Beverly Hills hotel and faces up to 10 years in federal prison.

How to invest in Luxury Goods right now:

It’s about time Rolex told me to stand up, breathe, and go on a run.

Wine, Tequila, and other Spirits

Bullish News

- Investors are backing eCommerce wine platforms as younger generations seek D2C subscriptions.

- Full Glass Wine acquired Bright Cellars and plans to generate more than $100 million in revenue in 2024.

- The US spirits market grew 6.1% in the past year, outpacing beer and wine.

- Amrut Distilleries saw increased interest from investors as demand rose for premium spirits in India.

- The number of celebrity-affiliated alcohol brands increased from fewer than 40 in 2018 to more than 350 in late 2022.

- The agave price crashed from MXP32/kg to MXP5/kg, offering tequila brands a chance to enhance quality at lower costs.

Bearish News

- Six-pack beer sales declined last year, with four-pack sales decreasing by 7.3%.

- California wine grape growers left 400,000 tons of grapes on the vine last year, struggling to compete with bulk imports.

- More people chose to abstain from alcohol, with 68.2% of adults having at least one drink in 2022, a decrease from 70.7% in 2017.

- France’s winegrowers faced declining sales in 2023, with exports dropping 7% in volume from August to December.

- Climate change hurt the wine regions of Chile, with wine production falling in four of the last five years.

How to invest in Wine and Spirits right now:

US spirits are high and getting higher.

Last chance to get in on our tequila SPV. Let me know if you’re interested.

Music and Film

Bullish News

- KISS sold their music catalog, publishing, and imagery rights to Pophouse for over $300 million.

- Lewis Capaldi, with nearly 36 million monthly Spotify listeners, signed with PPL, their first signing of 2024.

- Canadian musicians aim to revise copyright rules to gain TV and film royalties, inspired by Britain, where over $287 million was earned from 2020 to 2025.

- Amazon’s MGM+ struck a content deal with Lionsgate and Starz to offer their programming in the UK across 31 countries.

Bearish News

- Music AI company Suno may have trained its models on copyrighted work without permission, generating $120 billion annually.

- The US Justice Department investigated Sony, Universal Music, and ASCAP for potential music licensing price manipulation.

- Hipgnosis Song Management’s music fund saw its assets decline by 26.3% over two years.

How to invest in Music and Film right now:

Suno’s models are not classically trained.

Metals and Gems

Bullish News

- Metal prices rose, with gold futures up, now 9.7% higher year-to-date.

- Gold is heading towards the psychologically important $2,300 level as demand stays strong.

- Silver prices reached $27.25 an ounce, their highest since June 2021.

- It’s now cheaper to buy investment metals like gold bars and silver coins as more states are nixing sales tax for bullion.

- Chinese investors have sought gold as a safe place to store money, with gold consumption up 8.78% year-on-year.

Bearish News

- Technical analysis suggests gold may be overbought and due for a pullback.

- Alrosa plans to sell its entire 2024 diamond production to the Russian government in response to G7 sanctions.

How to invest in Metals and Gems right now:

If gold breaks $2,300, what “psychological number” will come next?

Collectibles

Bullish News

- An extremely rare Pikachu Illustrator Pokemon card, one of only 39 made, is listed for sale at $6.1 million.

- A pristine copy of Action Comics No. 1, featuring Superman’s first appearance, sold for $6 million.

- A Perone Beer quart cone top can from the 1940s set a new world auction record, selling for $51,500.

- Kobe Bryant’s 2000 NBA championship ring, gifted to his father Joe, sold for a record $927,200 at Goldin Auctions.

- The Toy Collectibles Market is expected to reach $38.2 billion by 2034, growing at a CAGR of 10.1%.

- Pokemon cards accounted for 40% of the total volume of cards graded in 2023, surpassing baseball cards.

- A pair of “ultra-rare” Apple sneakers from the 1990s, custom-made for employees, are up for sale at Sotheby’s for $50,000.

Bearish News

- Rumors are swirling that Collectors Holdings Inc. is trying to offload Goldin Auctions.

- Respected talent MD Bright passed away, known for his work on ‘Armor Wars’ and ‘Green Lantern: Emerald Dawn’.

How to invest in Collectibles right now:

If an old beer can got $51,500, I’d be upset by £30 too.

Websites and Domains

Bullish News

- Radix reported $4.8 million in premium domain sales in H2 2023, a 28% increase over H2 2022.

- Sandbagger acquired Sandbagger.com for $100,000 via Afternic.

- Youform acquired Youform.com for $7,500, negotiated down from an initial $25,000 asking price on Sedo.

- Unstoppable Domains partnered with POG Digital to unveil the ”.pog” top-level Web3 domain.

Bearish News

- Google Domains is officially handing over domain controls to Squarespace, removing domains from domains.google.com.

- Kaspersky revealed data from 24 million websites hosting “.PK” domains were stolen, with a 643% increase in data theft in the past three years.

- Domain Holdings Australia’s share price is down 33% in the last year.

- Onfolio Holdings‘ FY 2023 saw its net loss expand 89% to $8.37 million.

How to invest in Websites and Domains right now:

Welcome to the web, .pog

That’s all for this week

Cheers,

Wyatt

Disclosures

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.