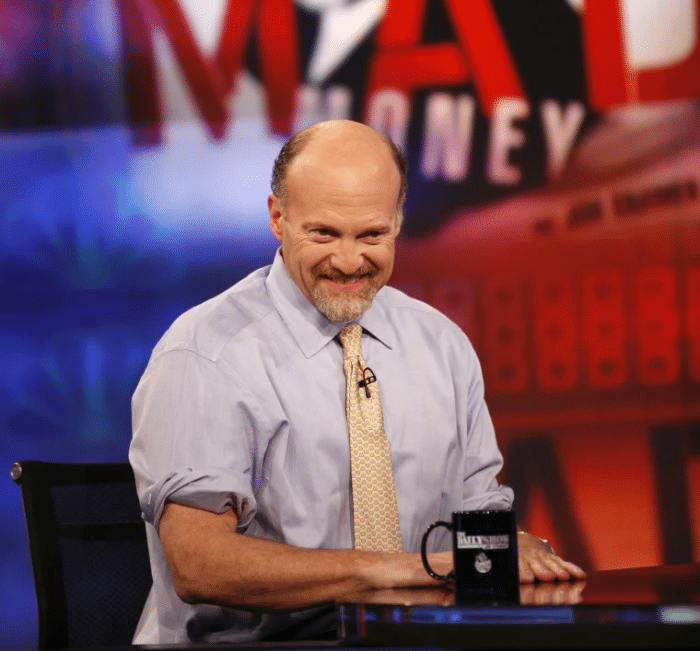

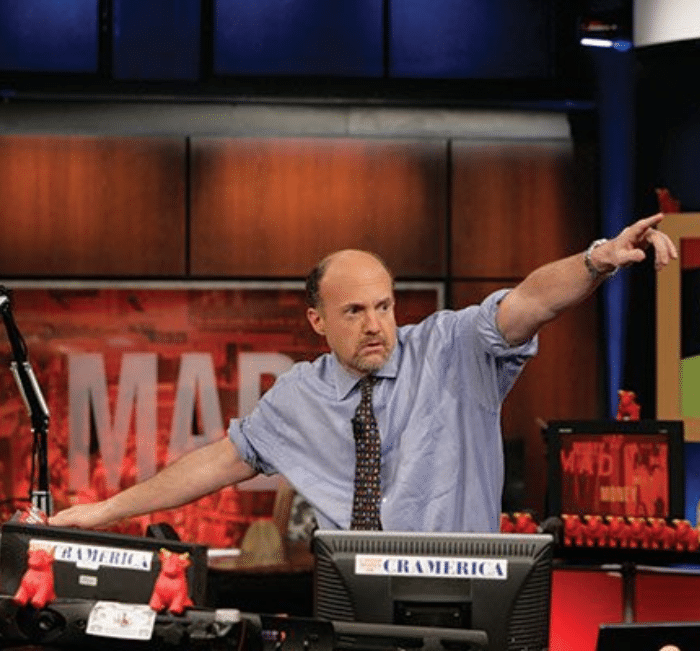

Inverse Cramer Weekly Update — Jan 28

I don’t trust it I’ve got to tell you. I checked in with Larry William again, now he has been saying, you’ve got to get out of Bitcoin. He’s been so right. I’ve called him and ask are we done going down, he goes ‘No, stay away.’ -On Riot Platforms ($RIOT)