Today we’re exploring pre-IPO secondaries — one of the most interesting alternative markets right now:

- Startup valuations melted down in 2022, but prices are stabilizing

- Meanwhile, demand is sky-high. Secondaries funds are raising tons of cash.

- And a slew of new companies now give direct access to pre-IPO shares.

You can’t just look at one graph and fully understand it. The secondary market looks nothing like it did a year ago — or at any point in its history.

But these five charts paint a good picture of what’s happening today.

Let’s go 👇

Note: This is Part 2 in our series on secondaries. If you’d like a refresher, read Part 1. This issue is free for everyone, thanks to today’s sponsor, Destiny.

The World’s First Exchange-Listed Portfolio of Pre-IPO Shares

The problem with secondary markets is that they’re all private, right?

Yeah, not anymore.

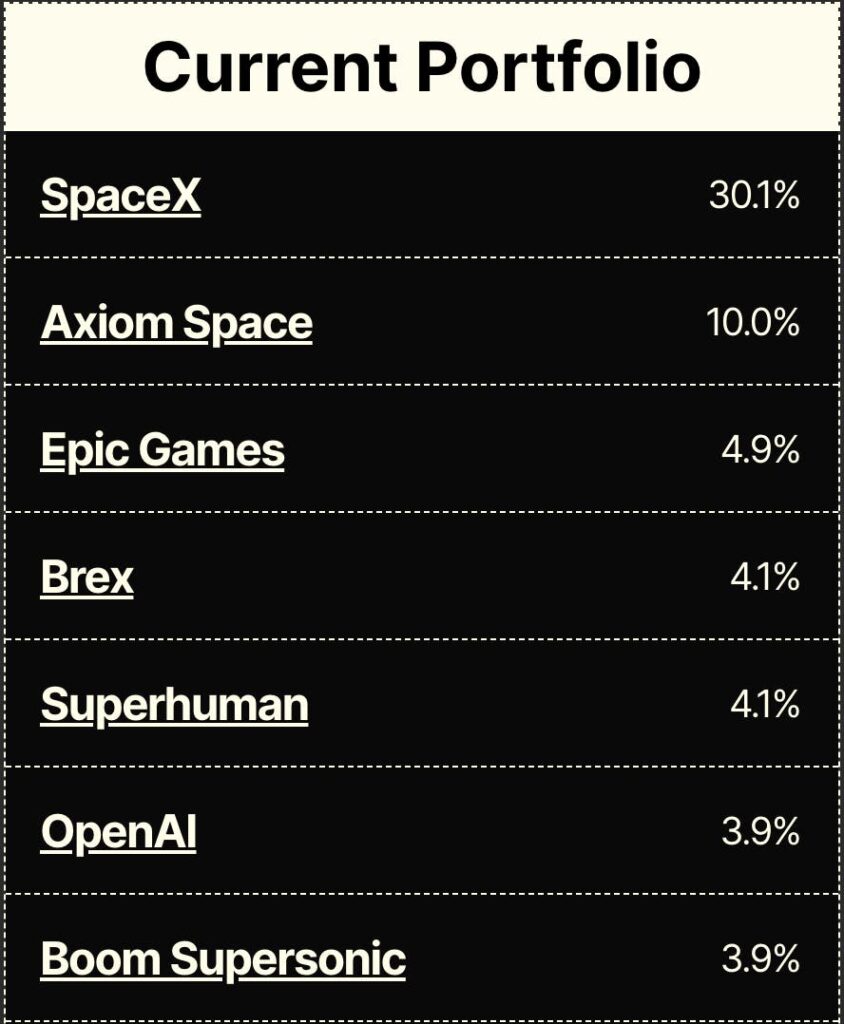

Destiny is the first publicly-traded fund for pre-IPO shares that anyone can invest in. It’ll list soon on the NYSE under the ticker DXYZ.

- The Destiny Tech 100 is designed to be a portfolio of the Top 100 high-growth companies

- Invest in private tech unicorns like OpenAI, SpaceX, and Stripe

- Anyone can invest through a brokerage account when it lists

DXYZ plans to list on the New York Stock Exchange in March.

We strongly believe in Destiny’s vision to bring secondaries to the masses, and are proud to be one of their first partners.

In the meantime, Alts subscribers can sign up to get a free share in the coming weeks.

Destiny Tech100 fund holdings are subject to change and are not recommendations to buy or sell any security. Current and future portfolio holdings are subject to risk and current as of publication date.

Table of Contents

1) The past two years have been tough

We’re pretty optimistic about the expansion of the secondaries market today.

But if you’ve been a secondaries investor for the past couple of years, we’d understand if you’re not so cheery.

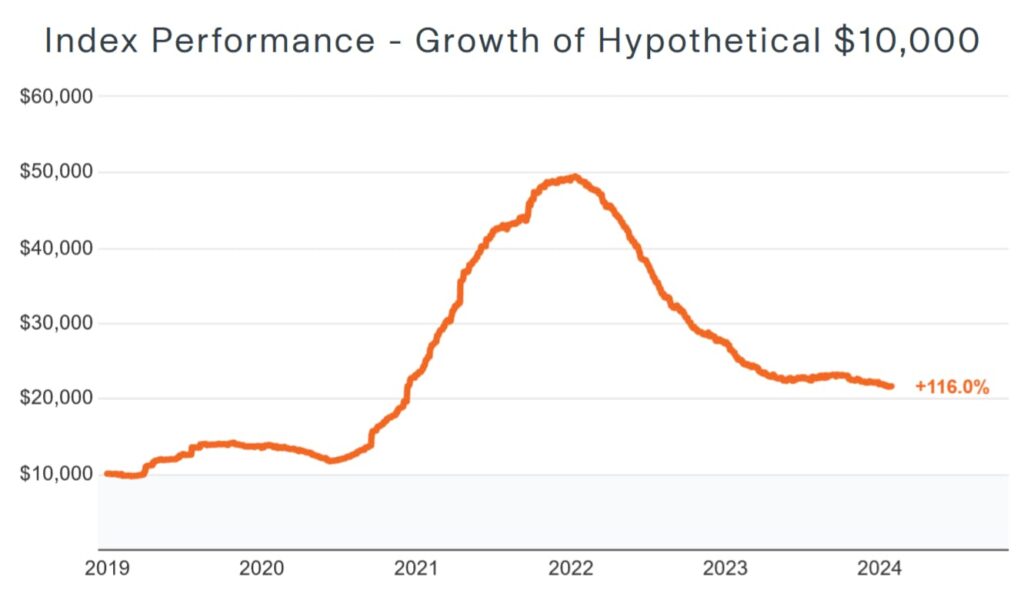

After peaking in December 2021, valuations in the secondaries market took a nosedive in 2022.

According to the Forge Private Market Index (which includes companies like Reddit, Stripe, and Chainalysis), a $10k investment made at the start of 2019 would have grown to $50k at the market’s peak — only to fall to around $22k at the start of 2024.

Overall investment performance during that time frame was still strong, with a CAGR of 17%.

But remember, these are unicorns. They’re supposed to be among the world’s fastest-growing and most valuable companies. So it’s tough to stomach prices falling so far, so fast.

The biggest factor driving the decline in secondaries over the past few years isn’t exactly a secret: interest rates.

The generational rise in interest rates made a dollar today worth more than a dollar tomorrow (figuratively speaking), and the valuations fell.

That’s really damaging to the valuations of high-growth startups, which are predicated on turning a profit far in the future.

And since shares of startups make up such a big portion of secondaries, the market was uniquely exposed to rising rates.

Recently, we spoke to Christine Healey, Head of Private Markets at D/XYZ (Destiny), one of the biggest players expanding access to secondaries.

In her view, this recent volatility has driven a flight to quality in the secondaries market. Basically, investors have seen how risky this asset class can be, which is increasing the demand for proven business models.

And with high rates enforcing greater capital discipline among investors, the bloated, unrealistic valuations for early-stage, unproven businesses have come crashing back down to earth.

But the bottom appears to be in.

Over in Altea (our new private community for accredited investors) we recently held our very first fireside chat, with private-market-indexing firm OpenVC.

Open’s Chief Commercial Officer Scott Bryant noted that the secondaries market was seeing discounts of over 60% in late Q2 2023 compared with peak prices.

But since Q3, valuations have begun to stabilize — indicating the worst is probably over.

In the long run, the turmoil of the past few years may be a good thing.

With valuations back to reality, secondaries investors should find more value in the market, and the best companies can once again start rising to the top.

2) VC exits have fallen off a cliff

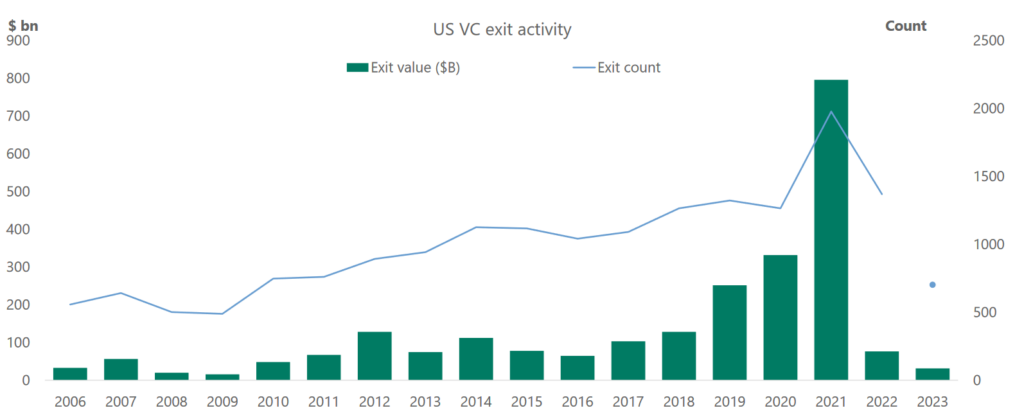

One of the biggest factors driving increased interest in secondaries right now is the fact that VC exits have collapsed.

When VCs buy shares in a startup, they don’t expect their investment to generate cash right away.

Since startup shares can’t easily be traded, VCs usually have to wait for a liquidity event to cash out — whether through the startup being acquired or going public in an IPO.

But in the past few years, activity in the “usual” exit channels has dried up like crazy.

After a red-hot 2021 which generated $774 billion in exit value (88% of which was generated by going public), the past two years have been ice-cold.

In 2022 there was a 90% decline in total US VC exit value to just $78 billion, followed by a further decline to $62 billion in 2023.

The current IPO slump is the slowest deal activity has been since 2008.

Why has the IPO market dried up?

No one’s quite sure.

While many blame depressed public equity valuations, that explanation is hard to rationalize given the market’s strong performance in 2023.

But there’s a vicious dynamic at play here. Without evidence of a hot deal market, fewer companies will take the risk of IPOing. It’s like throwing a party and having nobody show up.

This is obviously an issue for investors, who can’t realize investment returns. But it’s also a problem for startup employees, who get large volumes of stock-based compensation and expect to cash out their shares during an IPO.

All of this means secondary markets are more important than ever before. After all, if employees and investors can trade their shares now, there’s no need to wait for an exit that could take years to occur.

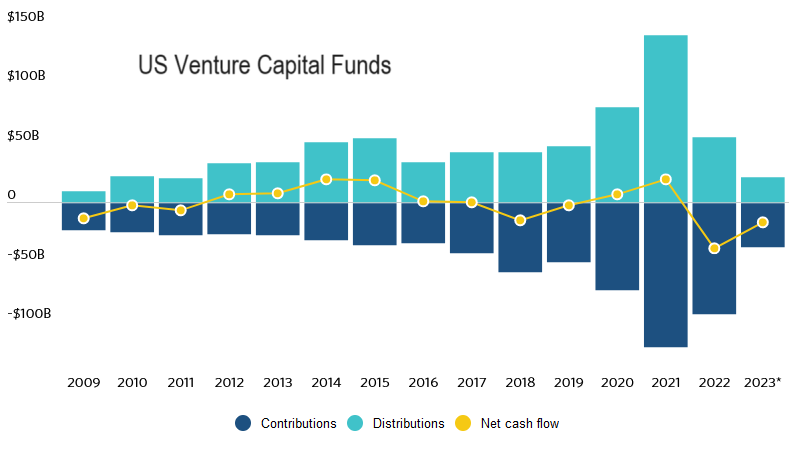

3) VC funds are struggling to generate liquidity

VC funds are increasingly struggling to generate liquidity for their investors.

In fact, 2023 was the second straight year in which VCs had negative net cash flow — meaning they took in more contributions from investors than they returned in distributions.

LPs (limited partners, the investors in VC funds) have increasingly pushed for more liquidity from GPs (general partners, the folks who run VC funds.)

And that pressure is pushing GPs to one place in particular. Yup, you guessed it — the secondaries market.

Last year, famed alternative investment manager Tiger Global attempted to sell its entire portfolio, but failed. So the GPs tapped the secondaries market to its their collection of stakes in private companies, piece by piece.

Transactions like this (where the GP attempts to sell core fund assets) are known as GP-led transactions.

In 2022, GP-led transactions made up 46% of secondaries market activity, with the rest being LP-led (where LPs sell their own fund shares).

That’s over 2x higher than the GP-led share in 2013, meaning GPs are getting more aggressive in seeking out secondary markets.

And it’s a figure that could continue to rise as the secondaries market is viewed as a competitive option with traditional exits.

In a report on GP-led transactions, alternative investment firm Hamilton Lane noted that:

As the secondary market is increasingly viewed by general partners as a viable and attractive alternative to traditional company exit paths, there is no reason why GP-led transactions can’t become amuch greater percentage of overall fund market liquidity.

With the secondaries market still growing, the challenge of startup liquidity is keeping many investors out of the market.

Take Crossover investors, for instance. As the name suggests, they invest in both public and private companies. From 2022 to 2023, they reduced their participation in VC rounds by about 50%.

Why? It’s likely because they’re struggling to generate sufficient liquidity from the private portion of their portfolios.

So as liquidity pressure from LPs pushes more investment firms to the secondaries market, expect a continued increase in GP-led activity and greater institutional adoption of this once esoteric market.

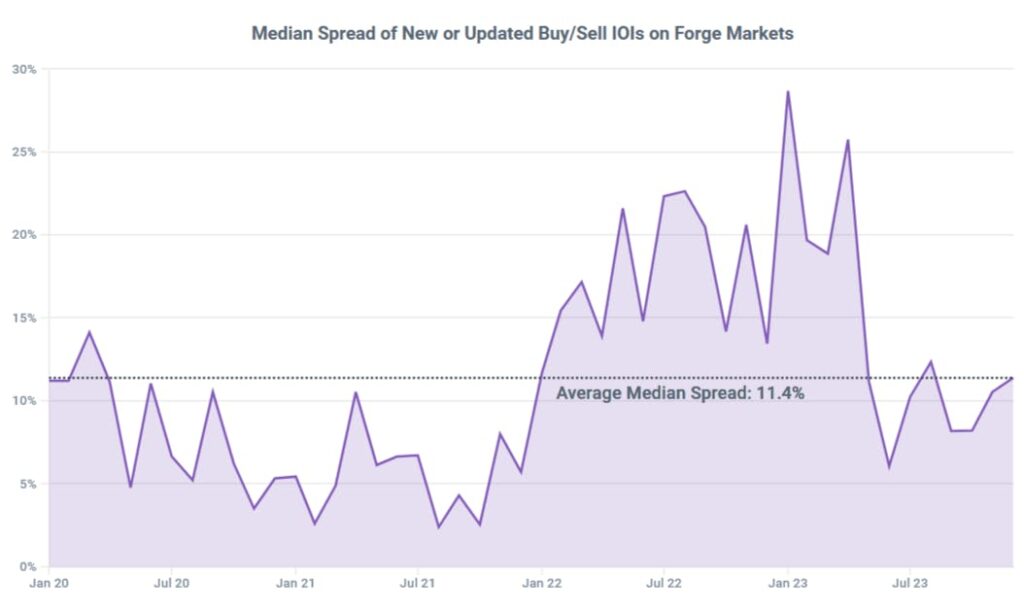

4) Bid-ask spreads are finally getting tighter

Trading shares of a stock is like trading anything else — buyers want to buy for the lowest price, and sellers want to sell for the highest price.

In technical terms, buyers bid a price for stock, and sellers ask for their own price.

When the market is calm, the gap between bids and asks (known as the bid-ask spread) usually isn’t big. Everyone is happy.

But when things get volatile, buyers and sellers start to disagree over how much shares are truly worth. This causes the bid-ask spread to widen, meaning buyers and sellers have more difficulty agreeing on a price.

As a general rule, private markets (like secondaries) have wider bid-ask spreads than public markets. There’s simply less information for private market participants to make decisions, and fewer marketplaces for buyers and sellers to negotiate.

But in 2023, the bid-ask spread in secondaries markets was even higher than usual.

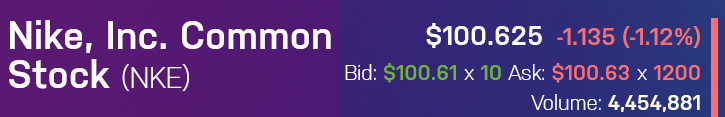

In fact, at one point the average bid was over 25% of ask prices — nearly double the ~11% long-term average (and far higher than the near-zero spread you’ll find on a blue-chip public stock like Nike).

But lately, the average spread in secondaries markets has started falling back to normal levels.

That indicates there’s far less uncertainty over valuations than we had a few years ago.

In a nutshell, while buyers and sellers still disagree on price, they disagree closer to historical levels.

This provides even more evidence that the period of greatest volatility is over, and that the secondaries market is starting to regroup.

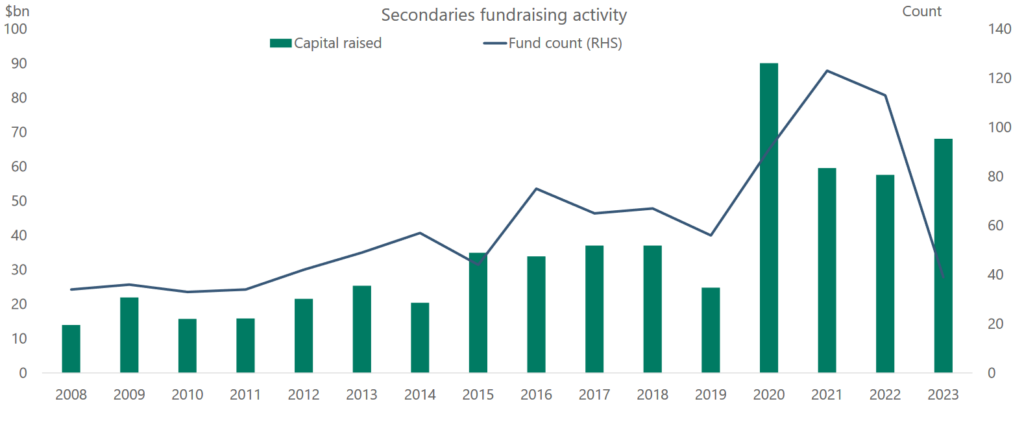

5) Fundraising for secondaries is up

The short-term and long-term decline in VC exit activity is bad news for GPs and LPs, who are struggling to generate cash from their private portfolios.

But it’s also bad news for, well, everyone.

Since investing in private companies is usually an invite-only affair, the lack of IPOs means investors are losing access to some of the most innovative, world-changing companies in world history.

Twenty years ago, you might have been able to invest in Google via public markets, at a relatively early stage in the company’s development.

But D=during the tech boom of the late 90s, that became less likely than ever. Historically, the median age of a tech company going public was 5 years. Today, it’s 10 years.

Investors have decided that if the startups won’t come to them, they’ll come to the startups. And one way they’re doing this is by allocating increasing amounts of capital to secondaries funds, which invest in a portfolio of private companies.

In 2021, secondaries funds raised $64 billion, compared with $128 billion raised in the more traditional/mature VC industry.

In fact, 2024 started with a bang, with alternative investment manager Lexington Partners completing $22.7 billion in fundraising for their latest secondaries fund — the largest fund of its kind.

Secondaries funds can come in a few different forms. Some want to hold shares in early-stage startups, while others focus on less flashy, more mature companies (similar to private equity investments).

While these funds are one way for investors to access the secondaries market, there may be better ways.

Most secondaries funds suffer from the following:

- High fees (stemming from active management)

- Lack of control over the underlying investments

- Poor redemption liquidity offered to investors

For these reasons, a slew of new companies are working on alternative solutions to traditional secondaries funds.

Secondaries companies you should know about

Lots of companies are expanding access to the secondaries market. Here are the most interesting ones.

D/XYZ (Pronounced ‘Destiny’)

Destiny is, by far, one of the most exciting companies active in the secondaries space right now.

(Yes, they’re today’s sponsor. But this is also my opinion. What they’re doing is huge!)

As we’ve seen, the main issue with the secondaries market is that average, everyday investors simply cannot get access.

And don’t get me wrong — building an online platform to directly invest in secondaries is terrific, and there’s a lot of value in that approach. But ultimately, these platforms are restricted to accredited investors, so it’s not a universal solution.

Destiny is doing things differently, rolling out an exchange-listed portfolio of pre-IPO shares called the Destiny Tech100.

They’re starting with a current portfolio of 23 companies, including heavy hitters like SpaceX, OpenAI, and Stripe.

The ultimate goal is to have a portfolio of 100 late-stage, venture-backed technology companies – all easily accessible through a normal brokerage account.

In March, Destiny plans to list the Tech100 on the NYSE under the ticker $DXYZ.

In the meantime, Alts subscribers can sign up to get a free share in the coming weeks.

OpenVC

OpenVC is taking a similar approach to D/XYZ; albeit with a few key differences.

While OpenVC is also creating a diversified secondaries fund with low fees, they’re more focused on the passive investing.

Their Unicorn Index Fund (which is fundraising right now) will be as close to a true index fund as you can get in a market like secondaries.

You won’t find the Unicorn Index Fund trading on a public exchange. But their diversified, “buy & hold,” index-based offering might be the right fit for certain investors.

Sandhill Markets

We wrote a Deep Dive on Sandhill Markets a few months ago, discussing their plans to expand access to secondaries through SPVs and exchanges.

Sandhill’s original vision hasn’t quite panned out, demonstrating the challenges of operating in secondaries markets. This area has many stakeholders, from investors to regulators and the companies themselves. Navigating all of it isn’t easy!

In line with that, Sandhill (formerly known as Stonks) has pivoted to focus on its newsletter and investor community, sharing exciting exclusive secondaries deals.

If you’re interested in investing directly in secondaries opportunities, Sandhill is definitely a community to consider joining.

Upmarket

I just discovered Upmarket this week, so there isn’t much to say here yet. But they seem to have a good selection of pre-IPO companies, including Neuralink and Anthropic.

Upmarket also has a Pre-IPO Portfolio Fund, designed to gain exposure to “10-25 private, late stage, high-growth companies.”

They also have some cool alternative fixed-income funds. Keep your eyes on these guys. 👀

Closing thoughts

Considering how much stronger pre-IPO returns are than post-IPO returns, it’s no surprise that the secondaries market is growing.

What is surprising, though, is that companies themselves aren’t always happy to see their shares trading on the secondaries market.

Startups and privately held firms often have a right of first refusal when it comes to their own shares, meaning they have some power to restrict trading (usually motivated by cap table management).

Moreover, traditional VCs have hesitated to tap the secondaries market to sell startup shares, where valuations can be lower than IPOs & traditional exits.

But they cannot keep taking LP funds without delivering returns for much longer. The constant investor demand for liquidity leaves the VCs little choice!

All in all, Silicon Valley hasn’t always made trading startup shares easy.

But the turmoil of the past couple of years appears to be ending. And with investors knocking down the door salivating for returns, the secondaries market is poised to expand significantly in the near future.

See you next time, Brian

Disclosures

- This issue was sponsored by Destiny.

- None of the other companies mentioned in this issue are current sponsors, nor did they pay to be included in this issue.

- The ALTS 1 Fund holds no interest in any companies mentioned in this issue.

- This issue contains no affiliate links.