Americans are wealthier than ever, but most of that wealth is tied up their homes.

Now, a new micro-industry is emerging to help American homeowners a) understand what they’re sitting on, and b) tap into their home equity. The industry is known as home equity management, and there are surprisingly few players.

One company leading this new space is House Numbers, and I think they have a good read on the landscape.

This issue is sponsored by House Numbers, but as always I think you’ll find it informative.

Let’s go 👇

Short on time? Click here and we’ll send you more info on House Numbers.

Table of Contents

Americans are wealthier than ever

Amidst the doom & gloom headlines these days, there’s a small but very important fact that pundits conveniently forget:

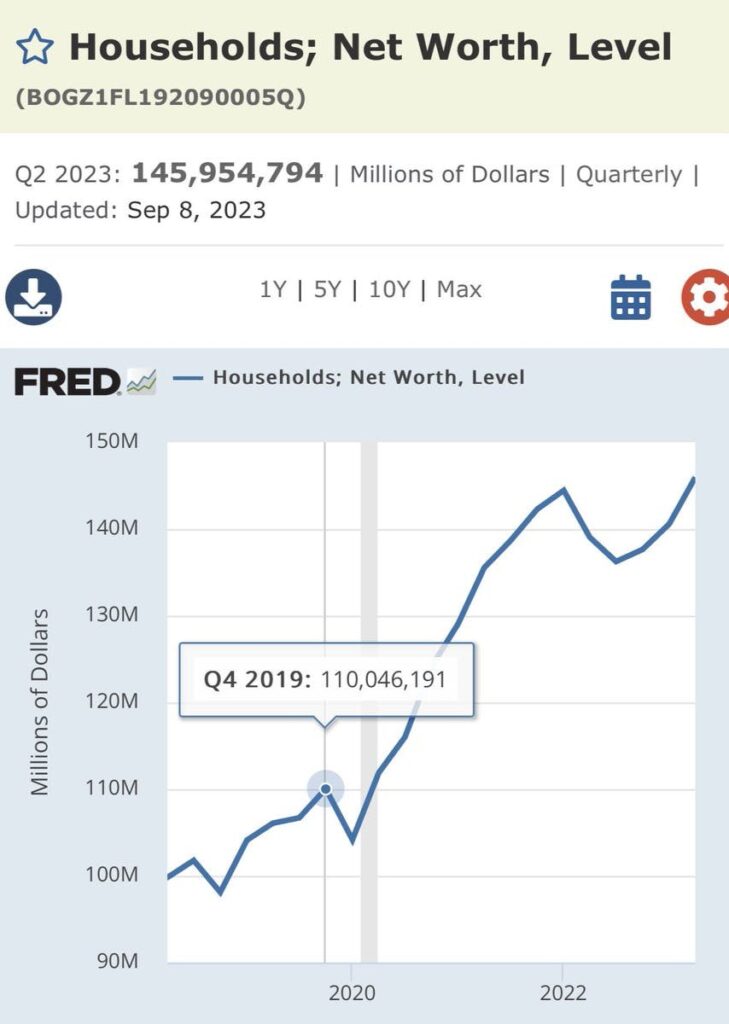

American household net worth per capita is up about 25% since 2019.

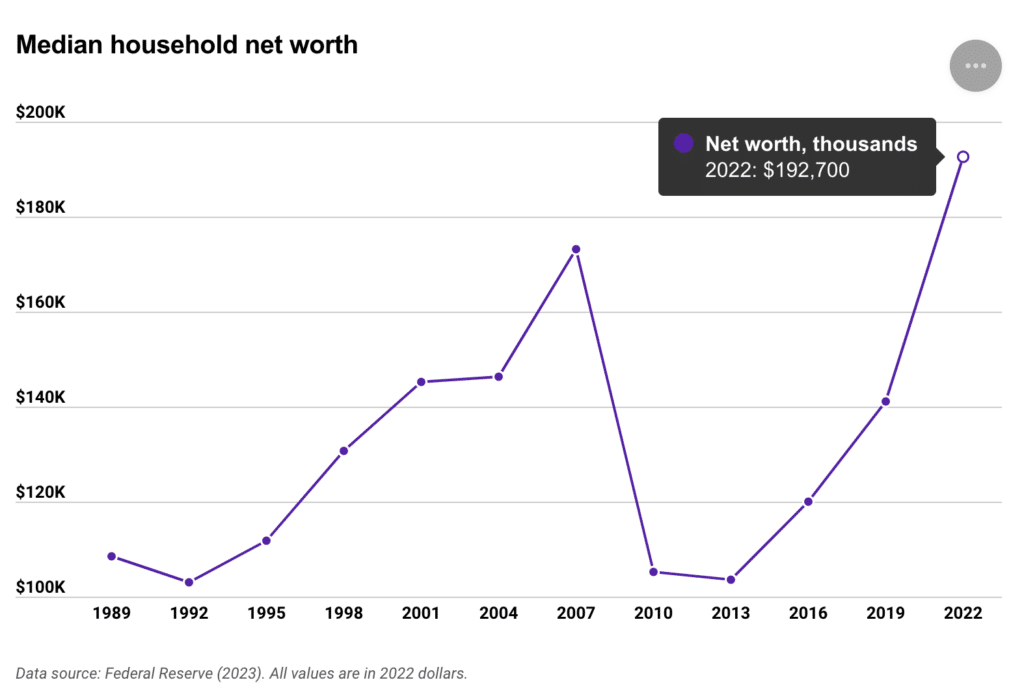

This is a very big deal. The most recent data available suggest that the median net worth of an American is roughly $192,700.

We may be in a “vibecession,” but this is the highest level recorded since the Fed began collecting data.

However, there are a few problems with this wealth.

The first is that there are huge disparities between age (boomers’ wealth is 11x higher), race (whites and especially Asians are far higher), and education (those with a college degree is 4x those without)

The second problem is that a huge amount of this wealth comes from real estate.

America’s wealth is largely tied up in property

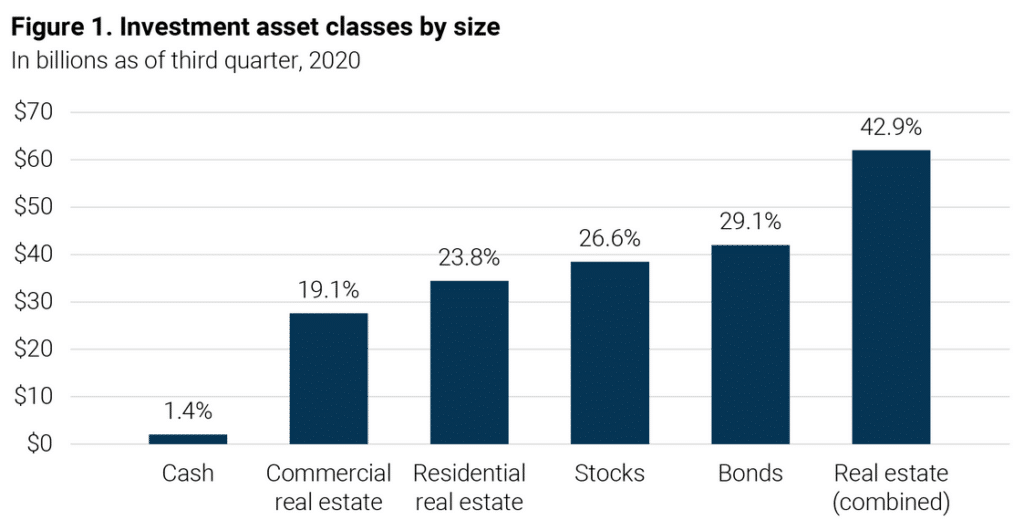

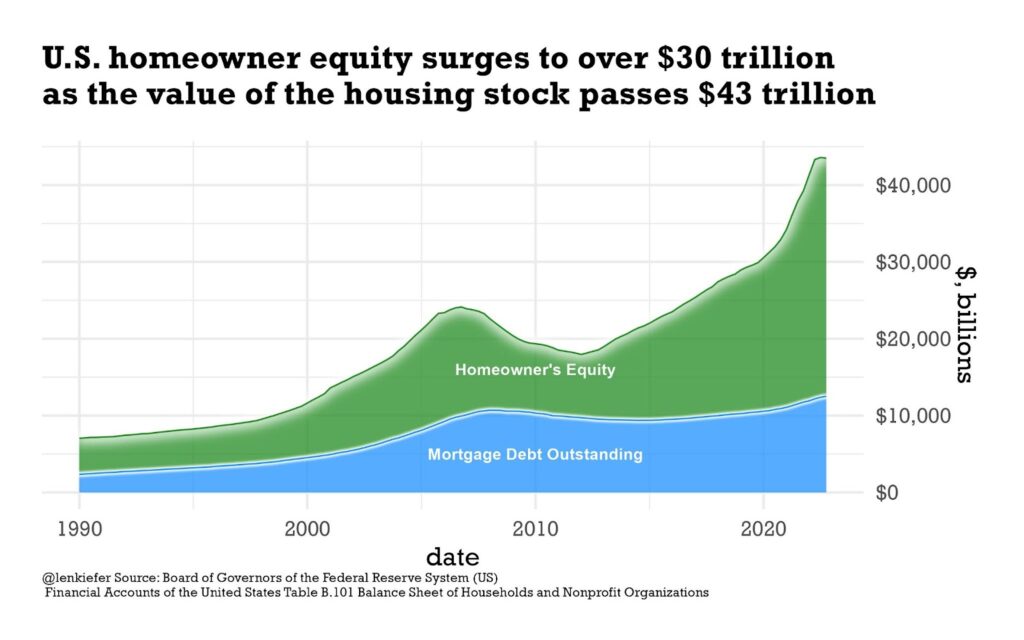

Home equity accounts for 30% of American household wealth — just shy of what’s held in retirement accounts. This is a truly phenomenal amount of wealth tied up in property.

As a whole, real estate is the nation’s largest asset class, far exceeding the value of either stocks or bonds. And within real estate, residential housing is the biggest component, currently amounting to about $47 trillion in total value.

Since most people need a mortgage to buy their house, about 39% of this value is captured by banks in the form of mortgage debt. The remaining 61% is owned by households themselves.

For the middle class, home equity is their largest financial asset, representing between 50%-70% of net worth.

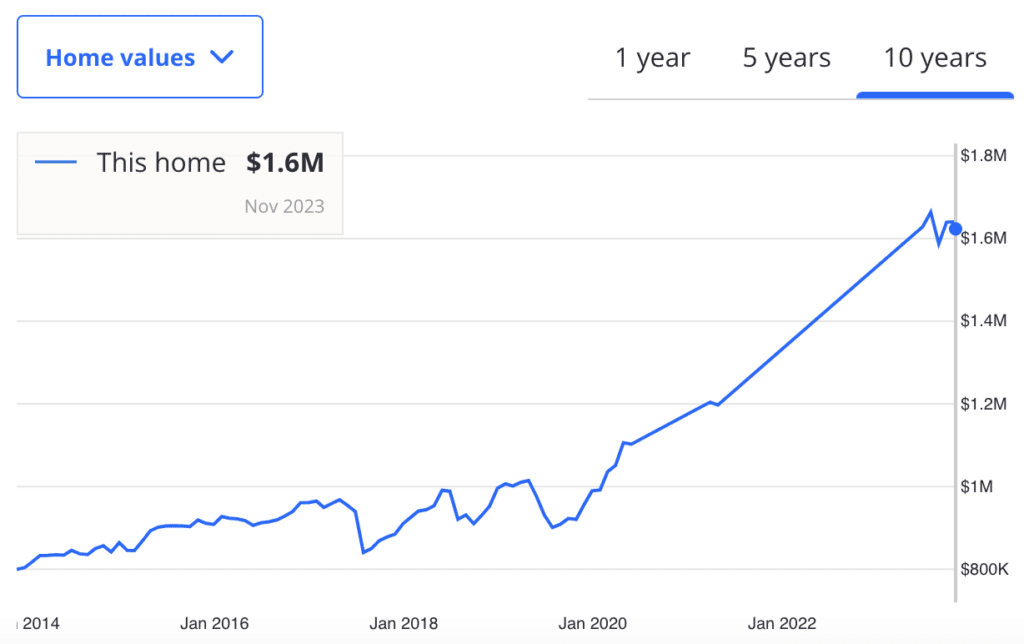

In recent years, real estate wealth has been booming. Home prices have doubled over the past 11 years, resulting in a huge “wealth effect” for homeowners, and a slew of home affordability memes for everyone else.

But the real problem with all this wealth tied up in home equity is that, well, it’s all sort of intangible. The wealth effect can be powerful, but unless you know exactly how much equity you’ve built up (and more importantly, how to access that equity), it’s just another illiquid asset. A number on a screen.

Zillow makes you feel good, but this information doesn’t really do much for you.

There aren’t many tools to manage home equity

Despite the substantial wealth Americans hold in their homes, very few tools exist to effectively manage that wealth.

The wealth management industry, despite its name, focuses almost exclusively on investment and retirement accounts.

This is where companies like House Numbers come in.

House Numbers is part of the burgeoning home equity management industry (or home wealth management), which gives homeowners the tools they need to effectively utilize their largest asset.

What is home wealth management?

At first glance, “home wealth management” might appear to be a misnomer. Why does anyone need this? And how does someone “manage” wealth tied up in a home?

Because there has been an explosion of new home finance products in recent years, and it’s increasingly possible to use equity in your home to achieve your other financial goals.

For example, say you want to save money by refinancing your mortgage. Or perhaps you want to consolidate all your existing debt into a lower-interest loan.

Where do you begin? How much debt do you consolidate? How do you compare offerings?

It’s clear that homeowners need guidance now more than ever. And yet, the market seems to lack advisory software.

How do homeowners tap into home equity?

This problem becomes obvious when you realize how few Americans understand how to tap into their home equity.

For most people, mortgages are confusing enough. And unless you know exactly what you’re doing, the process of turning excess home equity into cash is even more complicated than a mortgage.

House Numbers is coming online at the perfect time. The recent rise in interest rates has caught many homeowners off-guard. People have watched in horror as their credit card payments jumped sharply (not to mention the nearly 5% of American homeowners with adjustable rate mortgages.)

The time is now. Inflation is still high, and households are feeling the pinch. Despite America’s wealth, there has never been a more important time to access home equity.

For many people, borrowing against home equity ends up being the cheapest source of financing available, allowing families to consolidate their high-interest loans and get onto a sustainable financial path.

There are five main ways to do it.

Option 1: Home equity line of credit (HELOC)

A HELOC adds new debt on top of any existing home debt you already have, and doesn’t replace your existing mortgage. This is especially important today, because the vast majority of Americans have an interest rate under 4% on their primary mortgage – well below the current 7.76% average.

Think of a HELOC like a giant credit card backed by your home. It allows you to borrow money up to a certain limit. But unlike a credit card, the amount you borrow is secured by the equity value in your home.

HELOCs offer some flexibility since you only need to borrow the amount you need (not necessarily your full credit limit).

But using this option means you have to make an additional monthly house payment.

Option 2: Home equity loan (i.e. second mortgage)

A home equity loan is similar to a HELOC, in that it adds new debt and doesn’t affect your existing mortgage. But unlike a HELOC, this debt is in the style of a traditional mortgage.

You get a lump sum of cash up front. In return, you need to make fixed monthly payments on the loan.

Due to this familiar structure, a home equity loan is often called a “second mortgage.”

Option 3: Home equity investment (HEI)

Home equity investments (HEIs) are the new offering on the block.

In exchange for a lump sum of cash up front, you agree to pay back the loan, and give up a portion of the increase in your home’s value over a set period of time.

For example, suppose you receive $100k cash in exchange for giving up 20% of the increase in your home value over the next ten years. If your home price rises by $200k during that time, you’ll owe $140k ($100k, plus 20% of the 200k gain).

We talked a bit about HEIs in August. It’s a fascinating topic for sure, and one we’ll return to in the future as the market develops.

Option 4: Reverse mortgage

With this option, homeowners essentially sell equity in their home to a bank, so that they can receive monthly payments, rather than paying them out.

Reverse mortgages are designed to assist older homeowners who need more cash each month, but don’t want to sell their home (for obvious reasons.) The loans only have to be repaid if the homeowner sells the home, moves out, or passes away.

Reverse mortgages are somewhat controversial, due to the fact the home usually needs to be sold and not passed to heirs on the homeowner’s death, and only available to homeowners over the age of 55. They often require that a home has little or no existing mortgage debt.

Option 5: Cash-out refinance

Refinancing a mortgage basically means paying off your original mortgage, and replacing it with a new one at today’s interest rates (not advisable for most people today, as mentioned above). If this new mortgage is larger than the old one, it’s a “cash-out” refinance, where the excess amount goes into your pocket.

For example, let’s say you have a home worth $500k and a current mortgage balance of $200k.

- Since you have plenty of equity in your home, you can refinance and get a new mortgage for $300k.

- You use that new mortgage to repay your old one.

- The $100k in cash left is yours. This is essentially home equity converted directly to cash.

Given today’s interest rates, this would essentially be a very expensive way to borrow $100,000.

This stuff can be confusing, and I guarantee you the average American homeowner doesn’t understand it.

So what’s the solution?

Meet House Numbers

House Numbers is the first company dedicated to providing advice on how to manage home wealth.

This is a service that’s sorely needed. See, unlike the stock market, the housing market is opaque. Companies in the real estate finance industry keep their cards close, meaning even financially sophisticated people can miss out on opportunities to manage their home equity more effectively.

House Numbers is on a mission to change all that, reducing the information asymmetry that keeps homeowners from taking advantage of their best options.

What does House Numbers offer?

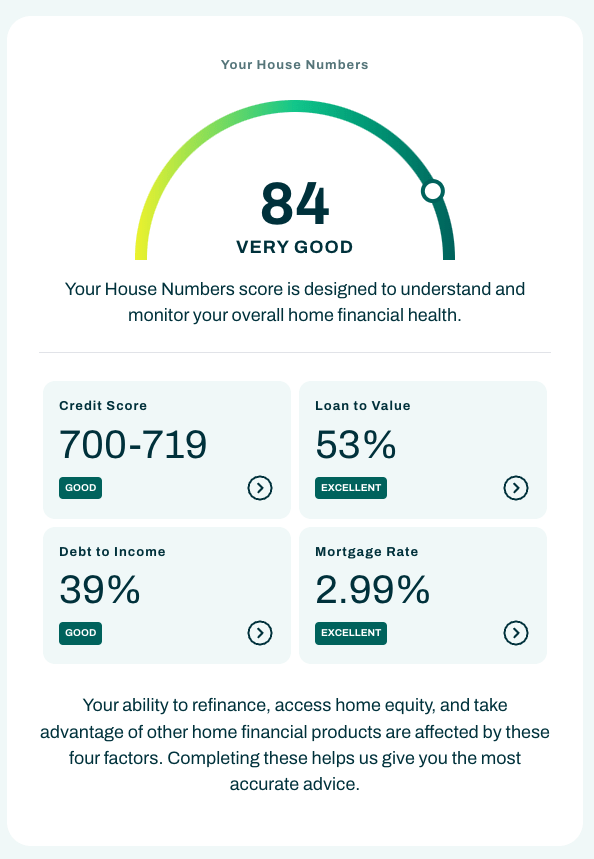

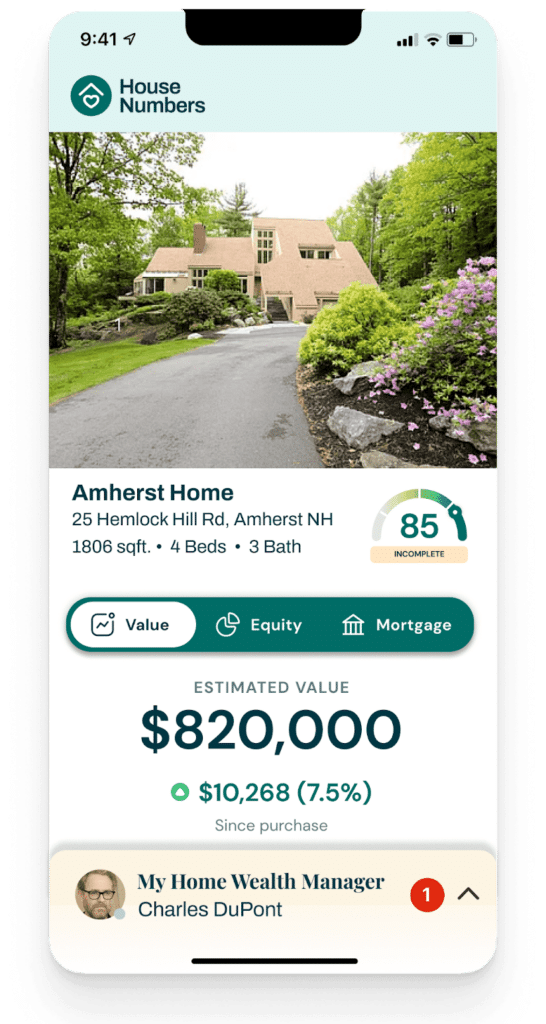

House Numbers gives users a personalized home wealth management plan based on their house and individual financial situation. This is delivered through a modernized dashboard that dynamically updates as the data evolves over time.

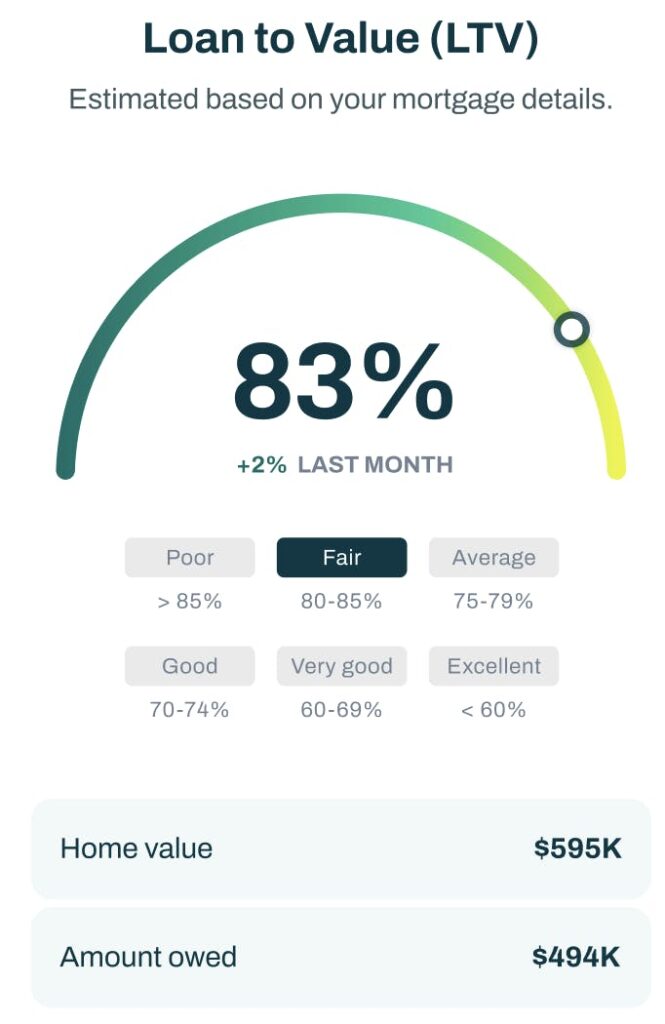

House Numbers gives everyone a personal plan based on home value, mortgage interest rate, mortgage type, outstanding principal, credit score, and debt-to-income ratio.

This homeowner wealth dashboard is comprehensive, covering both opportunities to access home equity and the key financial data points that help you qualify for those opportunities.

House Numbers offers this home wealth management software for free.

How do they make money?

If you choose to use one of the home equity product providers that House Numbers partners with, they’ll receive a small commission from the partner (but this fee is equal for all providers in the same category, meaning they have no conflict to push you toward any one opportunity).

Who is House Numbers designed for?

House Numbers is built for any homeowner that wants better insight into tracking and managing their home wealth options.

But there are a few scenarios in which having access to a home wealth management plan can really be helpful.

Homeowners with lots of unsecured debt

Unsecured debt, like credit cards or personal loans, can come with high interest rates. (20%+ is common)

By borrowing against their home equity, homeowners can pay these debts off, consolidating their monthly payments into one lower bill.

There are risks associated with this strategy (most importantly, that you can lose your house if you default on the loan). But it could potentially save thousands of dollars a month.

Homeowners making home improvements

The “shelter in place” rules of early COVID reminded many of us how much time we spend in our home.

Millions of homeowners each year want to upgrade their home, make repairs, or build an accessory dwelling unit (ADU) for additional space or income.

Reinvesting home equity in these types of projects increases its value and is the most affordable source of cash for most homeowners.

Older homeowners with limited cash

Retirees often have significant equity in their homes, as a result of having had plenty of time to pay off their mortgages. But, they can also struggle living on a fixed income. Converting home equity to cash can be an effective way to unlock their wealth for living expenses.

Homeowners with a high-rate mortgage

Mortgage rates have gone up a lot over the past two years. As home values and economic conditions fluctuate, homeowners may be able to take advantage of opportunities to refinance on more attractive terms, saving them plenty of money.

Guidance for different situations

Using the app is easy enough. Pop in your address, choose how much equity you want to access, and give a few normal financial details (debt owed, credit score, etc). The software crunches the numbers and creates a home equity plan for you that makes sense.

But what I like is they seem truly committed to being an actual advisor. Every situation is different, and for users who want a little extra guidance, they’ll meet with you directly and walk you through your house numbers.

Eventually, House Numbers wants to serve homeowners nationwide. Today, they’re available to users in just four states: California, Colorado, Florida, and Texas.

If you’re a homeowner in one of those four states and want to start keeping track of one of your biggest assets, head over to House Numbers’ website for your free home wealth management plan.

How did House Numbers get started?

Some of the most innovative firms are started when a founder experiences a personal pain point they feel compelled to solve.

That’s the case with House Numbers CEO Jeff Levinsohn.

Jeff had traditional mortgage held at Citi Private Bank, the firm’s white-glove service division. After a bunch of close friends told him that refinancing could be a good option, he finally brought it up to his banker — and was shocked at how much doing so could actually save him.

Jeff realized that traditional lenders don’t have the incentive to share this information. Banks prefer that borrowers steadily repay their original mortgage, rather than lower their interest rate through refinancing or potentially take on more risk by adding extra debt.

It’s why Jeff had to hear about a great refinancing opportunity from his friends, not his banker.

Now, Jeff and his team are dedicated to ensuring that every homeowner has transparent access to the information they need to make the best decisions.

Looking toward the future, House Numbers wants to expand the information they offer to encompass all the value-add opportunities homeowners could be missing – including home insurance, solar opportunities, energy efficiency.

Closing thoughts

According to IFAC, a lack of financial understanding cost Americans over $436 billion last year. (That’s $5,000/year for a family of four).

As you can imagine, I’m forever a fan of any company that helps people better understand financial concepts. At its heart, House Numbers does exactly this.

I think these guys have tapped into something smart, interesting and, well, untapped. Their timing is perfect, too. It’s astounding how important this stuff is becoming.

Real estate is essentially a currency. A Zestimate just doesn’t cut it. It’s as important to understand your home equity (and how to access it) as it is to understand your stock portfolio.

Disclosures

- This issue was sponsored by House Numbers

- House Numbers’ co-founder is a long-time friend of us here at Alts

- Neither the author nor our ALTS 1 Fund holds any interest in House Numbers

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of House Numbers. House Numbers has agreed to offer an unconstrained look at its business, offerings, and operations. House Numbers is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.