Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- The market had its best week in three months.

- The cost to buy a home is now 52% higher than the cost to rent, which is a record.

- Creator economy and DTC startups are getting smash hammered.

- Another fantastic week for crypto

Table of Contents

Macro View

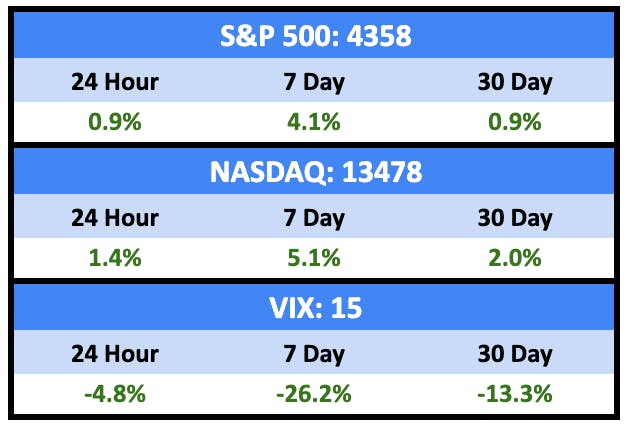

The market had its best week in three months as investors moved from fear to greed.

Bullish News

- JPow hinted he may be done hiking rates.

- “Put a fork in it – they are done,” said Jay Bryson, chief economist at Wells Fargo, inviting disaster upon himself.

- The S&P 500 had its best week in 2023.

- And a historically accurate model is forecasting a 16% return for the S&P 500 in 2024.

- Treasuries climbed across the curve, with two-year yields dropping 16 basis points to 4.83%.

- Oil sank below $81 a barrel.

Bearish News

- The dollar slid the most since July.

Forecasts

Get $25 to play around with invest on Kalshi using this link.

📉

1%

Chance of Fed hikes rates in November

📈

91%

Chance credit card defaults will rise in Q3

📉

2.34%

National average house price increase in 2023

With another government shutdown looming on 17th November, the Senate and House are at least $120 billion apart. Markets on Kalshi say there’s a 47% chance of a shutdown.

What are we doing?

ALTS 1 Fund news:

In the final stages of a major art acquisition.

Real Estate

Bullish News

- A landmark court case in Missouri ruled the National Association of Realtors and some big-time brokers are guilty of various misdeeds. The upshot could be reduced fees for buyers and sellers.

Bearish News

- Private real estate fundraising plunged in the third quarter, down 71% YoY.

- The cost to buy a home is now 52% higher than the cost to rent, a record premium (it peaked at 33% during the last housing bubble in 2006).

- And US housing affordability is actually worse today than the peak of the last housing bubble. The median American household would need to spend 44.6% of their income to afford the median-priced home, a record high.

- And 53k US home purchases were canceled in September, which equates to 16.3% of all homes under contract. That’s the highest cancellation percentage since October 2022.

- $270 billion earmarked for North American commercial real estate is on the sidelines. Perhaps it will be bullish when the recovery comes, but it leaves a big hole today.

- But it could provide a price floor in the case of distress.

- Blackstone’s REIT limited LP redemptions for the twelfth month in a row.

- There’s a $21.7 billion funding gap now in multifamily real estate.

How to invest in real estate right now:

Home prices and rental prices will converge. If you can’t sell your home, try renting it out.

Startups

Bullish News

- Mistral, a European AI startup founded by former Meta Platforms and Alphabet researchers, is raising $300 million from investors four months after raising a $113 million seed round.

- Palo Alto Networks is close to finalizing a deal for venture-backed startup Talon Cyber Security that could value the startup at between $600 million to $700 million.

- Former Meta COO Sheryl Sandberg and her husband have set up a VC fund.

- Flexport has bought shuttered trucking startup Convey’s technology.

- So far this year, nearly a billion dollars (US$) in seed through growth-stage funding has gone to Canadian startups in sustainability-focused industries.

Bearish News

- Creator economy startups are being liquidated at fire sale prices.

- DTC startup fundraising is down 97% since 2021.

- The Biden administration on Monday released an executive order laying out a broad range of safety and security requirements around the use of artificial intelligence technology. It’s sure to significantly impact the startup ecosystem significantly.

How to invest in startups right now:

Avoid anything that targets the US consumer.

Private Equity and Private Credit

Bullish News

- While many PE funds have struggled in 2023, these seven publicly traded firms have remained mostly buoyant.

Bearish News

- Private credit firms seeking to capture market share from traditional bank lenders are giving up investor protections as they snag larger financings.

How to invest in PE and Private Credit right now:

Wait, probably.

Crypto & NFTs

Here’s what you need to know:

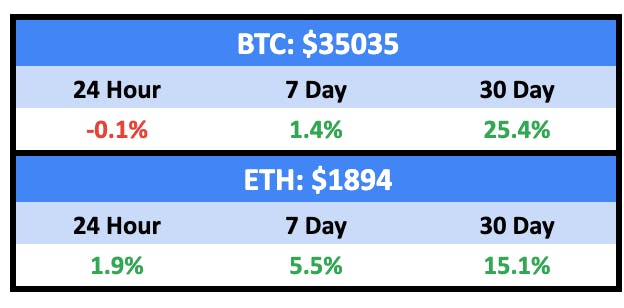

Bitcoin is up >100% YTD.

This is the greediest I’ve seen in a long time.

NFTs are piggybacking off ETH’s rise.

Bullish News

- SBF was found guilty of fraud and could face up to 115 years in prison.

- But Caroline Ellison, Gary Wang and Nishad Singh probably won’t see any jail time.

- Cathie Wood said she would prefer Bitcoin to gold or cash to safeguard against the possibility of deflation in the coming decade.

- Mark Cuban is super bullish on NFTs.

- The US SEC charged Safemoon and its founder for perpetrating an alleged $200 million fraud through unregistered token sales.

- Coinbase’s service offering crypto futures trading to eligible retail U.S. customers is now active.

- AC Milan is tokenising its pitch, and fans can buy one yard x one yard parcels, earning rewards when something happens on their patch.

- Coinbase reported its third consecutive quarter of adjusted positive EBITDA.

- Total stablecoin supply has increased since mid-October, suggesting the crypto sector is experiencing net capital inflow.

Bearish News

- OpenSea, once valued at more than $13 billion, has laid off roughly 50% of its staff.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Quick hits

Precious Metals

Hedge funds are piling into uranium stocks, which are up 125% since the end of 2020 off the back of IEA estimates that global nuclear capacity needs to double by 2050. A few options include:

That’s all for this week

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.