New here? Read up on our past NFT issues to get the most from this post.

October 14, 2022 | ± 6 minutes

It’s no secret that NFTs have been in the doghouse lately. Let’s see where you can still make money.

HIGHLIGHTS:

- NFTs are undervalued on Rally & there’s a way to capitalize on that

- Using NFTs to bet on SoRare’s marketing team

- How to go big on an NFT comeback

Let’s go!

Table of Contents

NFTs in 2022

NFTs in 2022 have been a bit of a disaster.

Down more than 70% at one point, they bounced back a bit in June only to slowly bleed to death over the last three months.

Our blue chip index is currently off around 60% for the year. The worst offender, VeeFriends, is off more than 80% in 2022.

The NFTZ ETF is off 68% in 2022.

Today, I’m going to look at a few strategies that don’t suck so much.

Betting on a recovery

The correlation between NFTs and crypto is just about 1.0, and the correlation between crypto and the US equity market is almost as high. Whatever the broad US equity markets do, NFTs will do too, but more so.

So, if you think a broad bottom is in, then investing in a blue-chip NFT is a levered play on the overall markets bouncing back. If you’d prefer a basket approach, you could invest in the NFTZ ETF via a broker like Public.com*.

A 20% gain in the US equities market could easily see Punks and Apes double.

This isn’t really a bet on NFTs. It’s a strategy that will YOLO the heck out of a broad recovery. Buying call options on the S&P 500 would achieve the same thing, more or less, though there’s slightly more chance there your investment will go to zero.

Betting on a decoupling

Conventional wisdom lately (see above) is that investing in a broad basket of NFTs is only a moneymaker if you think the US stock market is going to recover.

But what if NFTs decouple from equities and/or crypto?

What if you want to triple down in NFTs specifically?

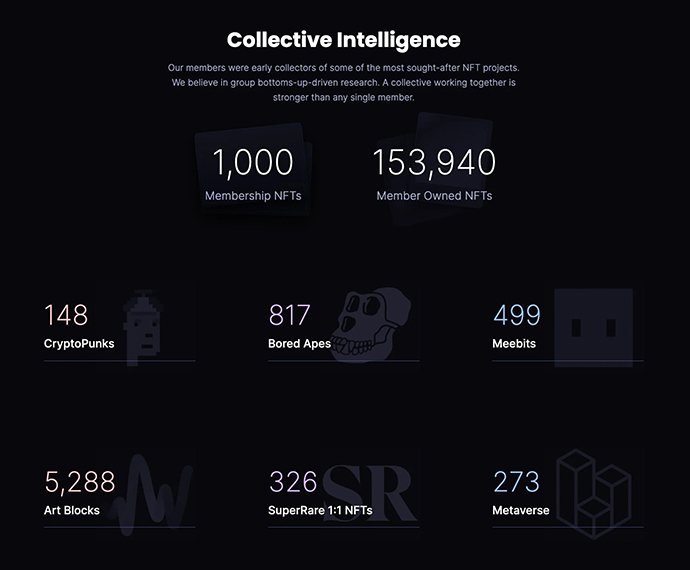

The best way to make a big bet on an NFT recovery is a PROOF Collective* pass.

PROOF Collective is a private, members-only collective of NFT enthusiasts. The 1,000-strong members list is a who’s who of NFT’ers, and the discord is full of alpha.

Members are also airdropped NFTs, which so far have included Moonbirds, Grails I, and Grails II. The Moonbirds floor is $13k at the minute, and Grails mint passes sold for $6k.

The floor for PROOF Collective NFTs went as high as $360k earlier in the year and is now down to around $54k. If and when NFTs recover, this pass could easily 4x.

So you’ve got a two-pronged bet here:

- The pass itself will appreciate

- The airdrops you receive as a pass holder will generate income

Speaking of Moonbirds, if you want in on the PROOF community but don’t have $60k to drop, Moonbirds holders get access to many of the same benefits as PROOF collective holders.

Betting on marketing

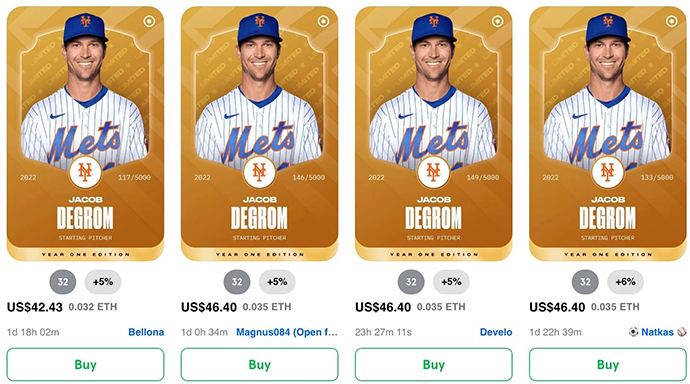

This summer, SoRare* added baseball to its staggeringly popular football (soccer) offering. The NBA is coming soon.

Launched mid-season to a mostly European market, the baseball offering hasn’t really caught on yet. Compared to the value of cards for similar players on the football side, baseball NFTs are selling for pennies on the dollar.

For example, a Mike Trout rare card goes for under $400, while a Lionel Messi rare card is closer to $10,000.

With a six-month offseason approaching and the NBA launching, I’d expect the value of baseball nfts to drop further over the next few weeks as users sell them in order to pick up basketball variants.

We’ve seen this already as Jacob deGrom cards declined over 50% when the Mets were unexpectedly knocked out of the playoffs.

SoRare spent a lot of money acquiring the rights to baseball, and there’s an excellent chance they’ll market the hell out of the MLB NFTs as the 2023 season approaches.

If SoRare are able to get baseball demand to half that of football, that’s a 10x ROI.

This has already begun — SoRare recently upped their payments to affiliates significantly.

Betting on fractional marketplaces

As far as NFTs have fallen in 2022, they’ve plunged farther on fractional platforms. Faced with the dual challenges of a bear market and a lack of liquidity, it’s been challenging to say the least. Many assets on platforms like Rally and Collectable are trading for well below their fair market value.

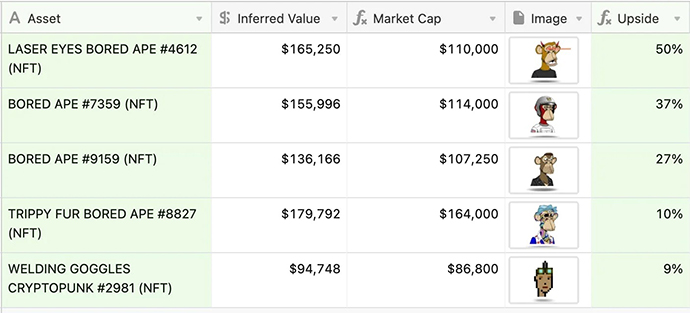

If you believe in the fractional model and are optimistic that valuations will bounce back to converge with the rest of the market, there’s money to be made snapping up undervalued nfts on Rally*.

Based on appraised value from the excellent Nefertiti, there are several Apes and Punks trading for well below their FMV.

You can either pick up individual shares of the assets or put in an offer to acquire the entire NFT (you’ll need to be within 10% of FMV for it to be considered).

If you want to hedge against NFT movements (i.e., only make a bet on the value of assets on Rally converging with FMV), you can short the NFTZ ETF in a pairs trade.

That’s it for today. If you try any of these strategies (or have better ideas) please smash the reply button to let me know.

Disclosures*

- We may try some of the above strategies in the ALTS 1 fund.

- The url to SoRare is an affiliate link.

- The link to Rally gets you and me both the opportunity to win some “crazy sh*t”.

- Our ALTS 1 fund owns a PROOF Collective NFT.

- The link to Public.com gets you and me a free share of stock.