This week you may have seen that we acquired another newsletter! This time it’s a sarcastic, cheeky publication called Inverse Cramer.

New here?

- See fund performance and holdings (SJIM and LJIM)

- Read past issues

- Sign up for the Inverse Cramer newsletter

Acquisitions are always exciting, and this marks the fifth newsletter we have acquired since founding Alts.

But this is my favorite one by far. It fits in with our brand personality and has big growth potential.

Today I’m writing a short issue on why we acquired this newsletter, and how the deal went down — and I’ll finish with a few rapid-fire thoughts on what artificial intelligence means for the future of publishing.

Let’s go 👇

Table of Contents

Newsletters = Assets

Writing about newsletters themselves as an asset class is always a bit weird. (We’re an alternative media company writing about newsletters as an alternative investment. So meta!)

But I’ve said it before, and I’ll say it again: Newsletters are assets.

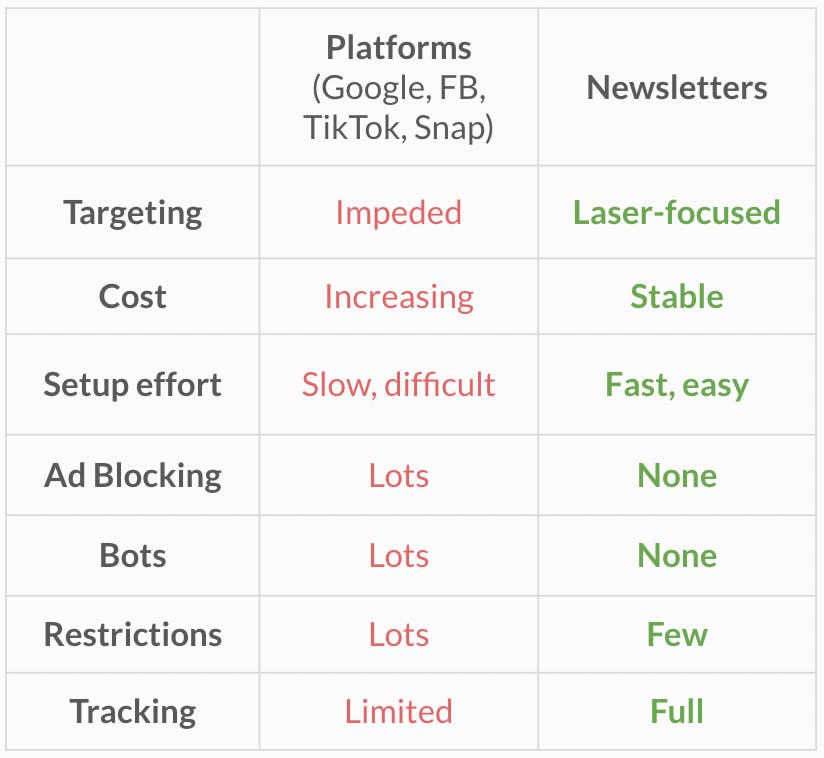

Newsletters, podcasts, websites, and even social media accounts are some of the most underrated alternative assets out there. But especially newsletters, which are extremely well-positioned for the current climate.

The reason is simple: It’s getting more difficult and expensive to reach customers through traditional digital channels!

Kneecapping the industry: Apple’s ad-vantage

We’re coming up on the 2nd anniversary of Apple’s infamous privacy changes. In April 2021, Apple gave users the choice to opt out of tracking in iOS apps. We now know that as of April 2022, 75% of iOS users are opting-out. The vast majority of these people have no idea they’re effectively helping kill hyper-targeting.

Interestingly, there is evidence to suggest consumers are getting smarter about what this means. The opt-out figure is actually down from 96% when the feature was first released! But the decrease is nowhere close to Garner’s predictions of 60% “by 2023.”

And the problem runs deeper than just Apple:

- Ad blocking is on the rise. After declining between 2018 and 2020, ad block rates rose again last year to reach 2018 levels. In 2021, desktop ad blocking increased by 5% to 290 million people using ad blockers worldwide.

- Click fraud is still a big problem. Click fraud now accounts for nearly 60% of the projected $100 billion total cost of advertising fraud. It’s Google’s “inconvenient truth.”

- Ad inflation means social media ads are more expensive than ever. Despite Facebook posting their first-ever revenue drop last year, global ad prices for Facebook rose by an average of 47% YoY. Increases on Pinterest and Snapchat have been even more severe.

- Twitter is a mess. Need I really say more?

- European regulation is getting intense. Just a few weeks ago, EU privacy regulators came to the (I believe misguided) decision that the way Meta processes personal data for behavioral advertising is unlawful.

Oh, and don’t forget about bots.

A comically large part of today’s online social experience is just bots showing ads to other bots. Bot numbers are hard to define, but that’s exactly the problem: It’s not in the platforms’ best interest to understand or fix the bot problem. In the meantime, advertisers are essentially paying huge sums to show their ads to bots.

Newsletter advertising solves all this.

Those who know, know. And those who don’t will realize soon enough: Newsletters are simply one of the most underrated advertising vehicles in the world.

What is Inverse Cramer?

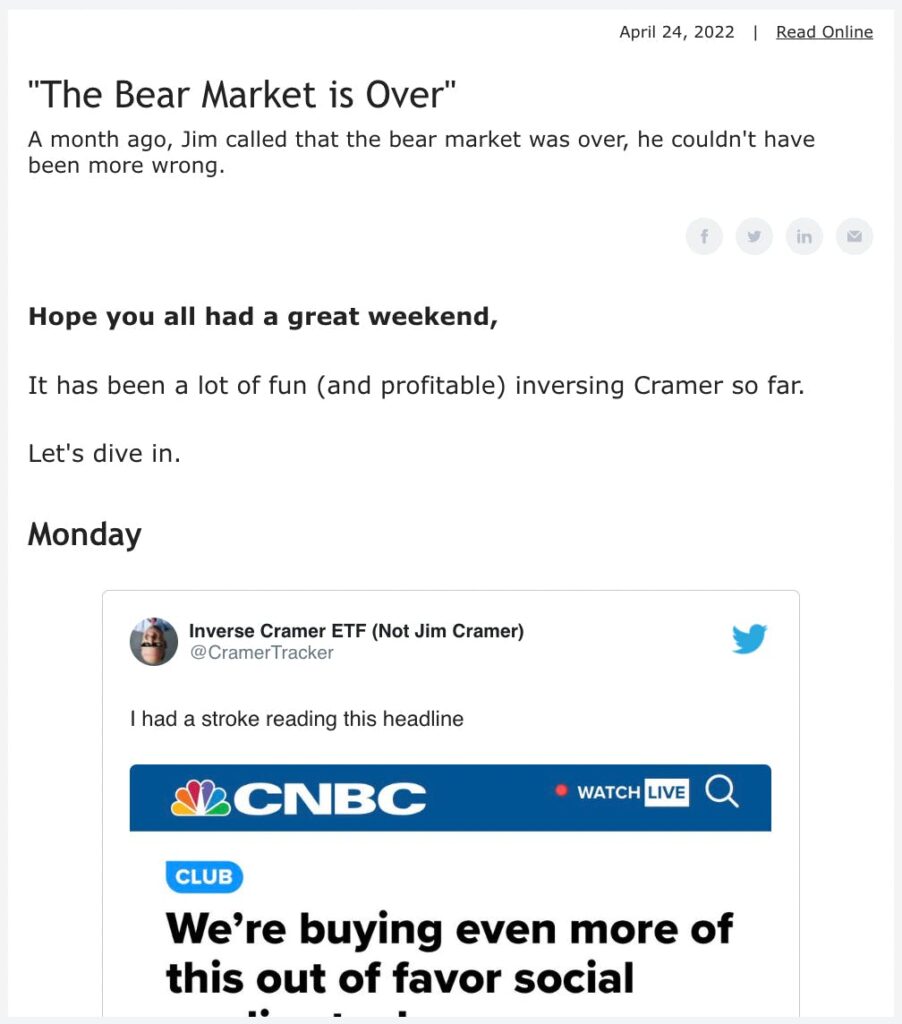

You may be familiar with @CramerTracker on Twitter: The famous parody account with 185,000 followers which tracks Jim Cramer’s stock recommendations.

For those who don’t know who Jim Cramer is, he hosts the popular finance show “Mad Money” on CNBC. Cramer is known for his loud personality and aggressive investing style. He provides advice on how to invest, what stocks are worth buying, and which are too risky. He is also an active investor and is known for founding his own hedge fund, TheStreet.com.

Cramer’s not as much of a jerk-ass as he seems. He’s extremely knowledgeable, and by all accounts, he’s a good guy. I think he’d probably be fun to knock back a few beers with. 🍻

But the problem with being as loud as he is, is that you end up getting memed into oblivion. It’s one thing to be wrong, it’s another to be repeatedly, loudly wrong.

Over the years, the Twitter account owner (who will remain anonymous) has done a fantastic job documenting all of JC’s terrible calls.

In addition to his massive Twitter account, the owner had also started a newsletter on Beehiv. I had been a subscriber since the beginning, and always thought it was pretty cool. He’d summarize Jim’s calls for the week, show you the inverse of those calls, and add some funny/snarky commentary.

But after a while, the owner sort of stopped sending the newsletter. It turns out that CNBC had made some site changes, which made it tougher to see all of Cramer’s picks in one spot. Also, while he had a solid newsletter following (6,500+ subscribers) that paled in comparison to his 175k on Twitter, and he felt keeping up with the newsletter wasn’t really worth it — and that it might be better off in someone else’s hands.

To be clear, he didn’t want to sell his Twitter account, just the newsletter.

That’s where we came in. 💪

How we acquired the Inverse Cramer newsletter

In the past, we’ve used tools like Newsletter Spy by the legendary serial entrepreneur Jakob Greenfeld to acquire newsletters.

While I can’t get into our specific tactics, I’ll say that we’ve refined our outreach over time and have it down to a science. Our pitch is short, sweet, and very highly targeted. We’ve used these tactics to acquire four other newsletters, including Ark Watcher, an auto-generated newsletter tracking the daily moves of Ark Invest, and Nothing Fancy, a real estate & proptech newsletter with a big European following.

However, unlike other newsletters we’ve acquired, this time the owner reached out to us directly. There’s not a ton of newsletter rollups or financial micro-media buyers out there, and word travels fast in this industry.

We acquired Inverse Cramer because it fits in with our brand. The site also ranks well for Cramer-related searches, and is positioned well for future growth. During due diligence, we also realized that engagement was fantastic, so we made an offer!

(Pssst, JP Morgan, you guys clearly need help with due diligence. Call me 🤙)

Yes, it’s a bit gimmicky. This is clearly not meant to be investing advice, nor is it something that is going to make us ten million dollars.

But it’s good to understand what the “experts” are saying, and to employ a healthy skepticism and some critical thinking towards it all. Because if there’s one thing we’ve learned over the past decade, nobody is an expert!

This is what we’re all about. Alternative assets, alternative markets, alternative opportunities, alternative thinking.

A.I. and the future of newsletters

Alright look, there’s a ton of chatter about AI right now.

If you’re in the “always online” crowd (ugh), the takes are everywhere. It’s been pretty much dominating the discourse for the past few months. If you’re a normal person with a normie life (hats off to you by the way 🎩), then you’re probably starting to hear rumblings about a new technology called ChatGPT.

I hate to follow the crowd, but in the words of Joe Biden (before he was President) “this is a big f@#%ing deal.”

I’ll cut to the chase. Chat GPT is a “holy shit” moment. If you haven’t seen what this technology is capable of, here’s a collection of great examples.

It’s the kind of technology that, while flawed, is clearly a major step for humanity (not to mention Microsoft). Now, which direction that step goes will ultimately be determined by us humans, and the functional application layers we build on top of this stuff.

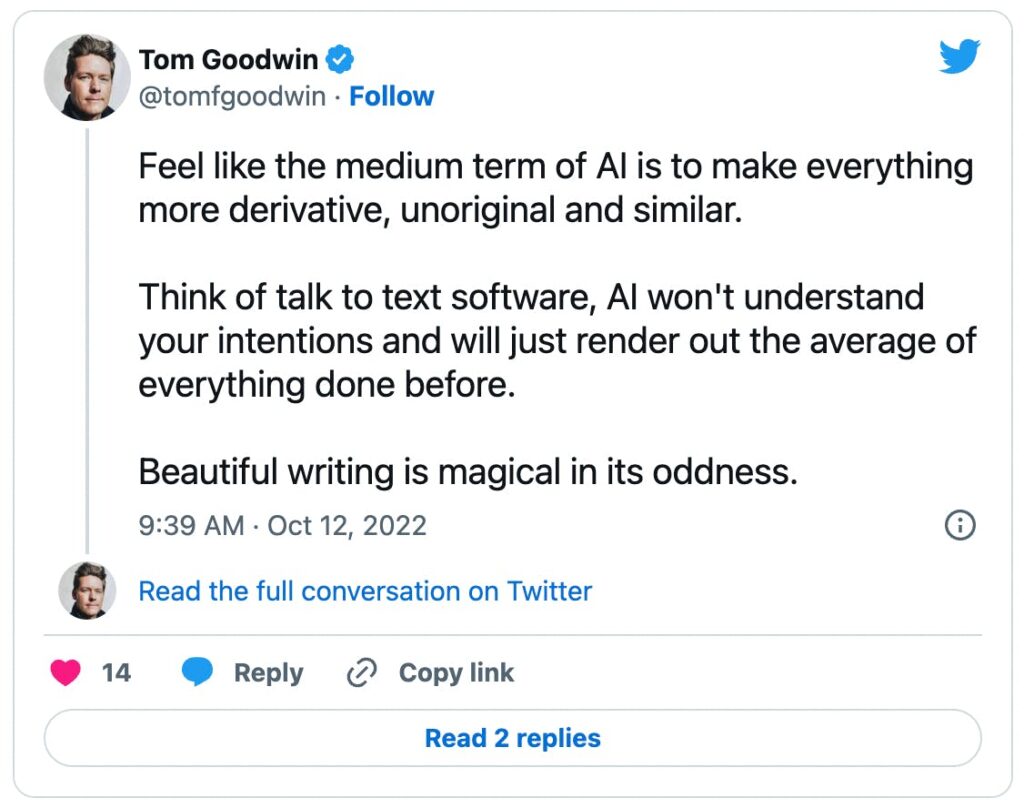

Yet at the same time, something seems to be severely lacking with ChatGPTs outputs. It’s tough to pinpoint exactly, but I think that something is personality.

The technology is impressive as hell, but after playing around with it for a while, you realize it’s got sort of a “soulless” vibe. AI sort of “averages out” all of the world’s information, and comes pre-built with every imaginable personality, which can be summoned upon request at any moment. That’s incredible stuff, truly. But it’s much different than having a unique style!

Right now is a fascinating time for newsletter writers. AI presents some terrific opportunities to augment your thinking, writing, and creativity. (And no, I’m not talking about the million newsletters that suddenly want to be “The Milk Road for AI.”)

But the key here is augmentation, not replacement.

Being a good writer is fundamentally about being a good thinker. At the risk of being callous, if you’re worried robots are going to take your writing job, then your writing (and by extension your thinking) probably isn’t very good to begin with.

Some rapid-fire thoughts on what AI means for publishing, and how writers can stay on top:

- AI doesn’t have opinions. Let that sink in for a minute. Artificial intelligence doesn’t have experiences or beliefs, and is incapable of expressing personal opinions or feelings. Hooray, score one for humanity! This alone is huge. We have opinions. But opinions are useless if they’re unconvincing, and completely useless if you don’t express them. So express them.

- AI will never be a journalist. It “reports” on stuff that’s already been reported somewhere else. But that’s regurgitation, not reporting. Someone still has to actually break the news. Journalists who conduct real-live interviews, chime in with sharp questions, and uncover things the world doesn’t know about will always be needed and valuable.

- AI is fantastic for generating ideas. This is how I use it — specifically through a tool called Lex. Lex is like a free writing assistant; it helps out with basic research, and proposes tangents and new avenues of thought. For me, it’s a “flow-unlocking solution” when I’m stuck, want fresh ideas, or have writer’s block. It’s like journaling on steroids.

- AI doesn’t add images or links. Okay, we’re on borrowed time for this one to be honest. Microsoft will almost certainly fold links & images in when they use ChatGPT to revamp Bing search. But for now, writing is about storytelling. Words, links, and images all help writers craft a narrative. Use them liberally.

But above all, you need to be original. That’s it. That’s all that matters.

If AI helps you, great! Use the technology to up your game. Do whatever it takes toa get to the next level, and stay there. But you have to bring something original to the table. a

You need to connect the dots that others don’t. Have a unique personality, tell a unique story, and express your opinions in a way that resonates. Newsletters and writers that don’t do this are, to put it bluntly, long term fucked.

Obviously I won’t give examples or name names, but I just don’t see how newsletters that recycle the same five stories over and over have a chance at standing out from the pack. They’re no better than the next guy, no better than a robot, and will soon have no reason to exist.

It’s just like investing. If you’re buying the same tech stocks and crypto as everyone else, how are you any different than the next guy? What’s your advantage? Where’s your edge?

If a robot can just average everything out, and everyone in the world has access to this robot, then to quote Tyler Cowen, “Average is Over.”

And frankly, if AI means true creativity gets revalued, and being “mid” is over, then thank God. Because the world is getting mid enough.

Technology will never go away. Use it to play the game.

But make sure you’re playing your game. 🤖

Disclosures

- We are not affiliated with Jim Cramer, CNBC, Mad Money, or the actual Inverse Cramer ETF (SJIM)

- We have no interests in any of the other companies mentioned in this issue

- This issue contains no affiliate links