What’s the Big Deal?

It’s one exclusive investment idea a month pumped straight into your inbox. It’s specific, actionable, and probably an investment idea you’ve never heard of or thought about.

If you like it, you can invest. If you hate it, you can smash the delete button.

This is a company we’ve talked about before, and they’re back for another round.

But you’ve got to be quick. The campaign closes on April 29th.

Let’s get to this month’s Big Deal

Table of Contents

Aura Health – Series A

Mental well-being is one of the most fundamental, unmet human needs today.

Already used by 8 million people, Aura is the world’s leading marketplace for mental wellness, transforming the $5.6 trillion industry.

Want to learn more?

Deal Overview

- Investment type: Series A

- Valuation: $80m

- Raising: $2 million (annual Rec CF max)

- Minimum Investment: $1,000

- Campaign closes: April 29th

- Check it out: Funding Page

- Read the offering circular: Here

Looking to invest $25k or more? We’ll get you a warm intro to Steve, the CEO.

TLDR of why I like it

This is what I said last year, and it stands:

First, mental health is the elephant in the room, and is a tremendous opportunity. It’s still stigmatized, but that’s changing. Making it easy — and anonymous — to get help is an obvious onramp to this $4.8 trillion industry.

Second, previous investors include heavyweights like Cowboy Ventures, Reach Capital, UC Berkeley, SkyDeck, and founders/executives of Spotify, Meta, Strava, Life360, WeWork, and Masterclass.

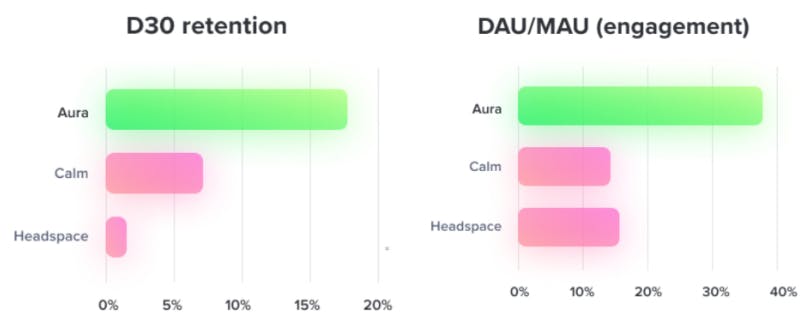

Third, the team has solid traction — over 100k paying members and over 250 million minutes spent on the app every year. Retention blows traditional meditation apps out of the water.

Finally, investing in startups right now is hard. There’s a lot of dross out there, and everyone is pulling back on everything. Finding a company that’s already profitable, is serving a massive audience in a growing industry, and is offered at a sensible valuation — that’s special.

What’s changed?

Our analysis below leans heavily on our analysis from last year. It’s the same company in the same market. So here’s an overview of what’s changed from last year, straight from Aura CEO Steve Lee:

- Internationalization: We just launched internationalization in 6 languages, marking our transition to a truly global company. As a platform company, our ability to recruit local coaches/creators

- Celebrity partnerships: Partnered with figures such as the lead actress from Twilight, Olympian 4x gold medalist, NBA star, and now working on signing A-listers

- Announcing: a quarter billion minutes spent every year

- New competitive intelligence: Aura far surpasses the competition in retention & engagement data, the most critical metrics. They’re currently valued in billions, while we’re at $80M.

The company has made good use of the last capital raise and has leveraged that ammunition into solid growth.

In addition to continuing that trajectory, Aura will soon launch Aura 3.0, which “will have a major focus on enabling coaches/celebrities to build communities.”

How it works

Check out the fundraiser video:

This is a series A investment in Aura Health, a startup focussing on remote mental health.

Aura is raising through a Reg CF campaign, which means the minimum is low ($1k), and it’s open to anyone — not just accredited investors.

Reg CF campaigns usually come with perks. Anyone who invests $10k or more gets lifetime access to the app.

Check out the Aura investment page.

What I like

Grace, my wife, is a trained psychotherapist, so I’m familiar with this topic and am super aware of the need.

As a dad who has sometimes struggled to be my best with three small boys, I’ve had firsthand experience with just how important it is to look after my own mental health. If I’m low, angry, tired, or short-tempered, I won’t be a great dad (or husband).

Opportunity size

And I’m not alone. The total addressable market for a company serving the mental health space is immense.

Aura quotes $5.6 trillion, which sounds like a helluva big number, but consider this. According to the American Center for Disease Control:

- More than 50% of Americans will be diagnosed with a mental illness or disorder at some point in their lifetime.

- 1 in 5 Americans will experience a mental illness in a given year.

- 1 in 5 children, either currently or at some point during their life, have had a seriously debilitating mental illness.

- 1 in 25 Americans lives with a serious mental illness, such as schizophrenia, bipolar disorder, or major depression.

And America isn’t unique: the numbers in Canada, the UK, Spain, and Mexico are similar. I stopped googling after those four countries, but lots of high-value countries are starting to pay attention.

India, in particular, is a massive market waking up to the topic of mental health.

But the trend is global.

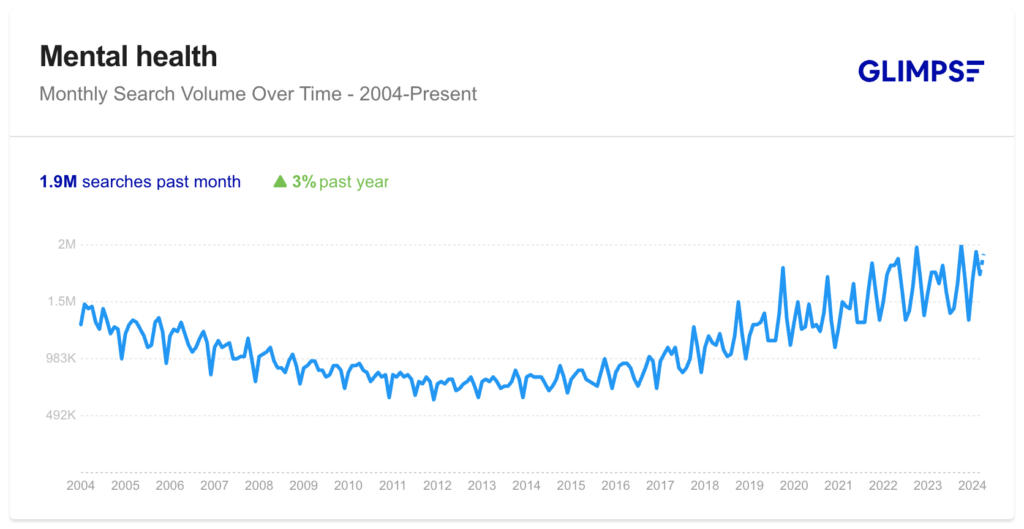

The increased focus on mental health is a trend that began ten years ago, but Covid and remote work have accelerated the industry.

Growth potential

Speaking of remote work, corporates are desperate to figure out how to (a) offer benefits employees care about and (b) keep distant employees healthy (and productive).

Among HR professionals in the US:

- 88% believe offering mental health resources can boost productivity.

- 78% said those options could increase the organizational return on investment.

- 86% said the benefits can increase employee retention.

Among employees themselves, “35% believe mental health benefits are more important than salary or higher pay.”

If you download the Aura app (iOS, Android) and go through the onboarding flow, you’ll notice a questionnaire specifically aimed at getting users to request Aura as a benefit at work. The team has identified the opportunity and is aggressively pursuing it.

Aura is already at 8m users, and there’s plenty of room to run here.

Valuation

Steve mentioned that Aura’s $80m valuation is tiny compared to better-known companies like Calm.

In his view (and mine and that of users), the Aura solution is also better than what Calm offers.

So, the ingredients are in place for Aura to displace the incumbents. From here, it’s all about increasing distribution in a capital-efficient way.

How does Aura make money?

Aura monetizes its 8m strong community in two ways.

Paid subscriptions

The annual plan is $60 per year, and of the 8 million members, 100k have opted to pay. Some percent have also opted for the more expensive family plan.

Coaching sessions

Many content creators also offer private coaching sessions, which mostly range in the $50 to $150 per month range. Aura keeps 20% here.

Gross margins are solid at 70% and increasing, which leaves a lot of money for user acquisition.

The risks

The competition

It’s a crowded market. The household name among wellness apps is Calm, which focuses on meditation, sleep, and anxiety. The meditation giant has well over 100 million downloads.

I asked Aura’s CEO, Steve Lee, how they’re going to win:

“We are in a crowded space (e.g. consumer mental wellness) with big competitors – but we believe we have a far superior product and business model that allows us to scale. What Uber and Airbnb did through the marketplace model, we’re doing the same thing in mental wellness.”

The incumbents “provide one-size-fits-all libraries created by just a few coaches. You’re stuck learning from the same people.”

“Aura is a marketplace that partners with hundreds of coaches and therapists worldwide and brings their expertise to anyone. We have a 10-100x bigger content library across any mental wellness vertical, not just meditation, and our coaches offer live events and one-on-one coaching on our platform. What Spotify did to music, Uber did to transportation, and Airbnb did to hospitality, we’re doing in mental wellness.”

For what it’s worth, I believe him. The fact that they’ve figured out the marketplace side of things—that they’re already past the chicken and egg stage—isn’t trivial. That’s a hard problem to solve.

The marketplace element gives Aura a sizeable unpaid salesforce — all the coaches and content creators. Every single one has an incentive to spread the word about the app. The platform’s biggest earners pull in over $100k a year — significant motivation to get more members on the app.

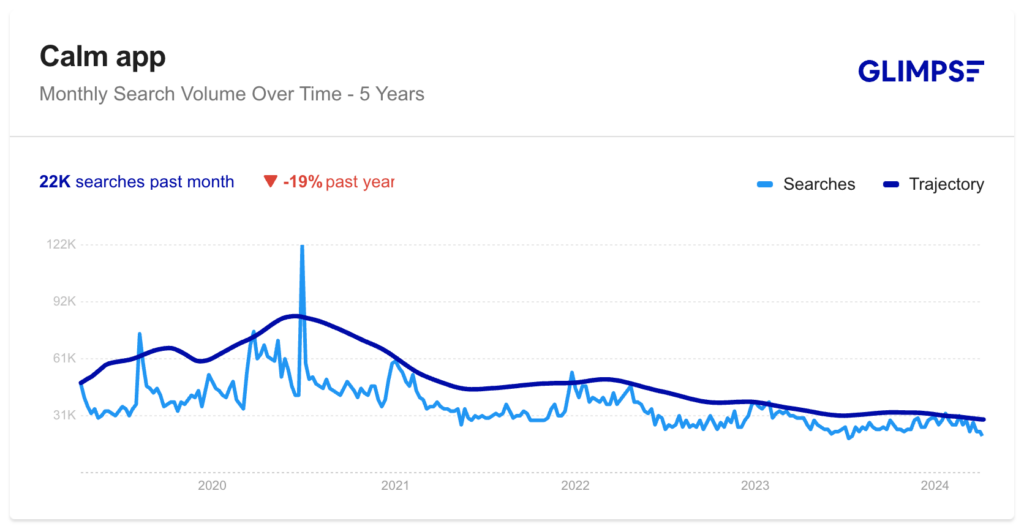

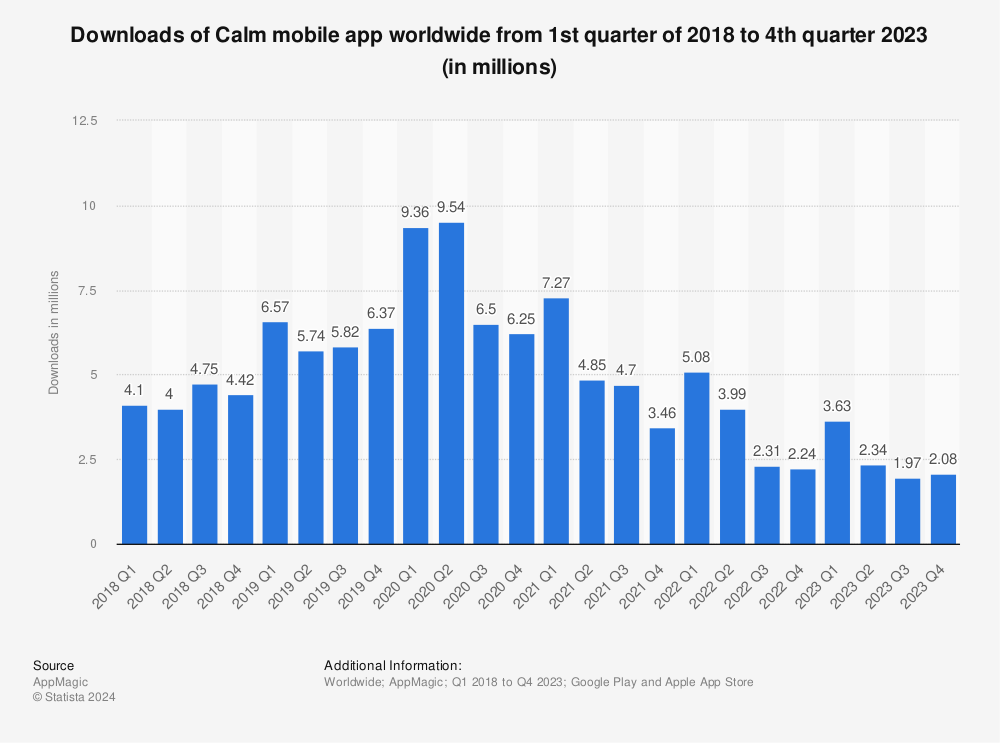

One last comment from me here. I noted declining interest in Calm in last year’s analysis, and things have worsened since then.

Search volume for the app has declined 19% year over year while interest in wellness was up 15% and search volume for their wheelhouse — meditation – was flat.

App downloads tell the same story.

I think they’re vulnerable.

How to invest

The round is open until April 30th, and you can invest with a minimum of $1k.

Looking to invest $25k or more? We’ll get you a warm intro to Steve, the CEO.

That’s it for today.

If you have a deal you think we should share with our 220k members, please get in touch.

Disclosures

- Aura is an Alts sponsor; this was a paid deep dive.

- We have not invested in Aura through ALTS 1 and do not have any personal vested interest in the company.