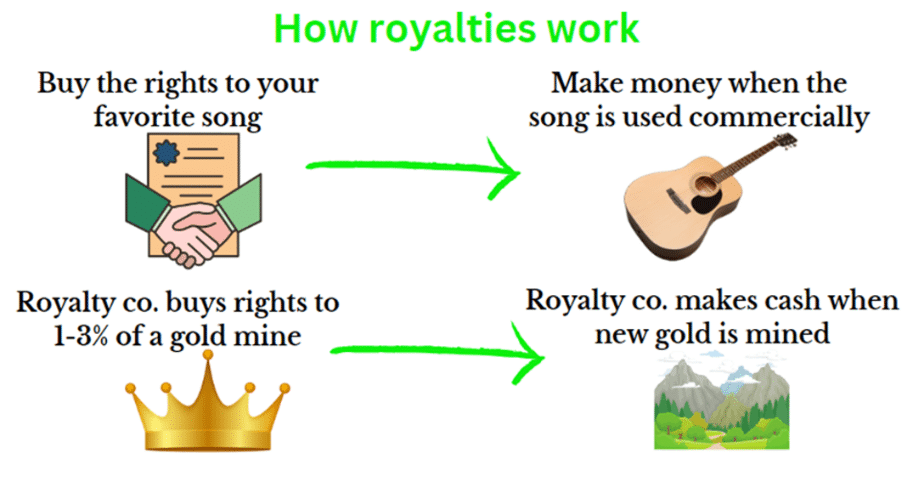

Today’s issue is on Gold Royalties. Think of it like music royalties, but for gold.

Note: To read the full issue you’ll need the All-Access Pass. 🎟️

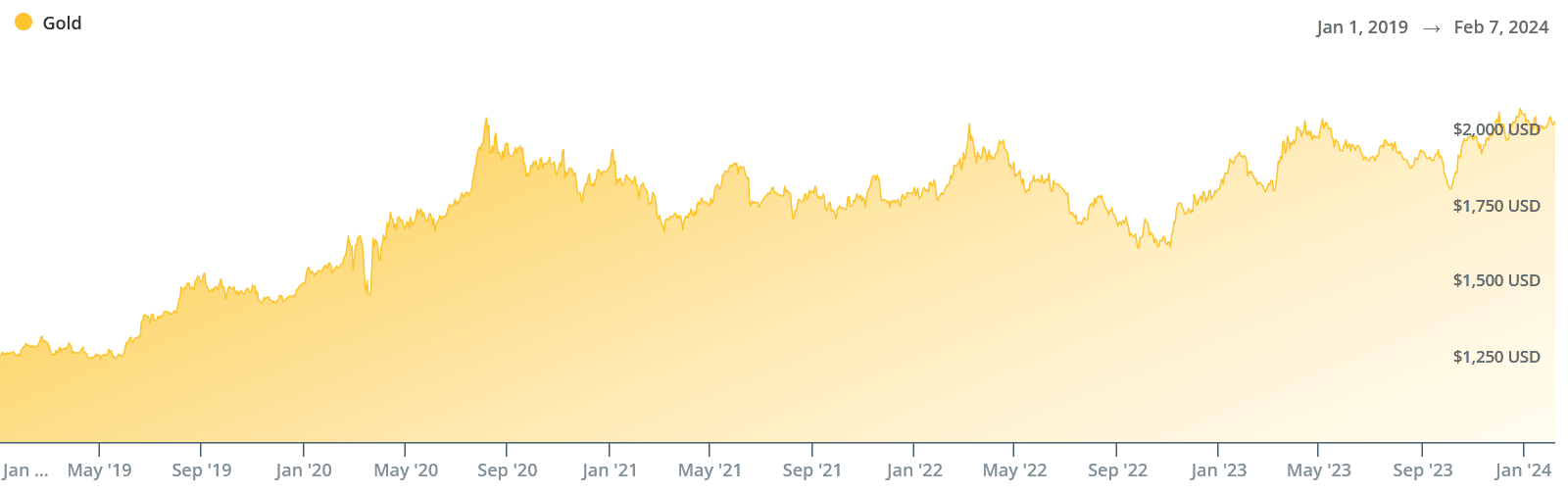

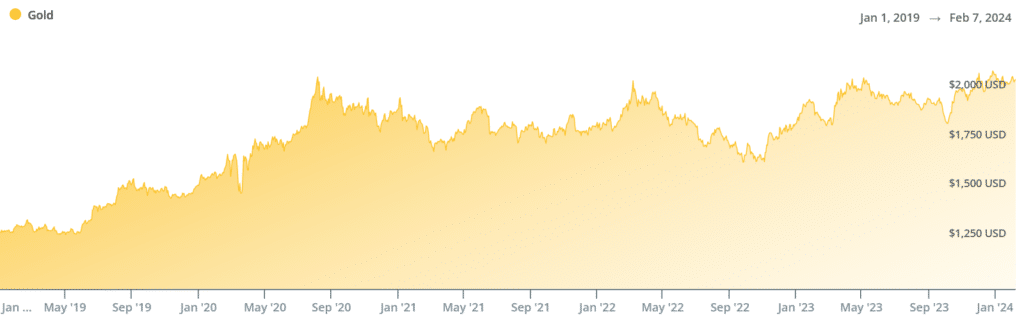

It’s no secret that gold is having a bit of a moment right now.

In the past five years, gold’s price has climbed from less than $1,300/oz to more than $2,000/oz – for an annualized return just shy of 10% over that period.

Traditionally, there are two ways to get exposure to gold during a boom:

- Buy gold (either as physical bars or as part of a fund). This offers direct price exposure, but limited upside opportunities.

- Or invest in mining companies. This allows you to participate in industry growth (like higher sale prices and new discoveries) but also introduces business risk.

But today, Gold Royalty Corp (NYSE American: GROY) is offering investors an innovative third option – gold royalties.

What are gold royalties?

In the past, we’ve explored the idea of royalty investments – especially in relation to music.

The basic idea of a royalty is that you make a single, upfront payment in exchange for the income generated by a specific asset.

This claim is usually perpetual, meaning it lasts forever – kind of like a bond that never matures.

Gold royalties follow the same basic model. A royalty company (like Gold Royalty Corp) fronts money to a mining operator, who uses the cash to expand and develop a mine.

When that mine produces gold, a portion of the revenue generated is diverted to the royalty company as payment.

At first glance, this might just seem like a roundabout way of investing in gold mines.

But for investors, there are significant advantages with the royalty route: