New here?

Read up on our past Real Estate issues to get the most from this email.

HIGHLIGHTS:

- The suburbs are growing

- California and Florida are becoming uninsurable

- Three investment ideas

Let’s go!

Table of Contents

Real estate market

Taken from this week’s Alts Cafe, here’s a wrap up of recent real estate news you’ll want on your radar.

Bullish News

- San Bernardino and Houston saw the biggest net migration gains in the US last year.

- S&P Case-Shiller says home price declines may be over due to a lack of inventory.

- U.S. suburban office markets are recovering at a faster pace than downtown markets.

- Between 2010 and 2020, the share of Americans living in the suburbs grew by 10.5%, and that number has increased since then. Some 45% of millennials expect to buy a home in the suburbs.

- Google is trying to force people back to the office.

- Rents in Manhattan are going parabolic.

Bearish News

- Real estate fundraising is off 42% YoY.

- Investment purchases were down 49% YoY. But nearly one in five sales were to investors.

- Half of big multinationals plan to cut office space in next three years.

- Many homes in CA and FL are becoming uninsurable due to wildfire and hurricane threats. More than 32 million homes are at risk of hurricane winds in the US.

- More bad news for western high-end real estate.

- New York and LA saw the biggest net migration losses in the US last year.

Real estate investment ideas

Three investment opportunities open this week.

RM Communities – Brookside Apartments

Offering at a Glance

- Name: RM Communities – Brookside Apartments

- Available: Now for funding

- Terms: 8% pref then 70% up to 16% IRR and 50% thereafter

- Estimated hold period: 4 years*

- Target IRR: 16.6%* (targeted average 7.3%* cash on cash)

- Min. investment: $20k

- Estimated first distribution: November 2023

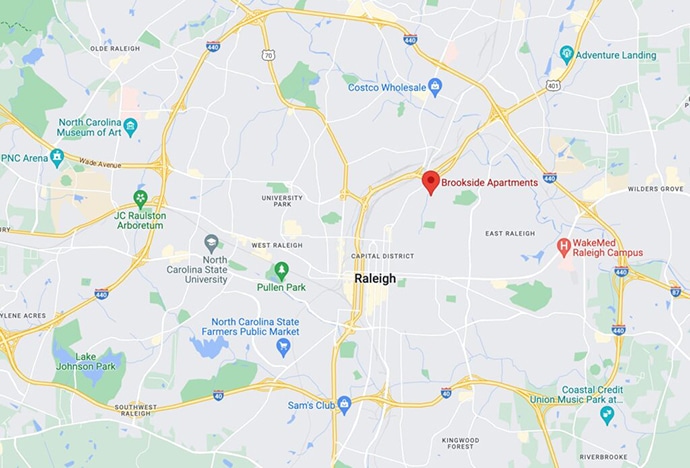

Brookside Apartments is a 1986 built, 68-unit multifamily value-add opportunity in Raleigh, NC.

Location

Raleigh is projected to be the second fastest-growing large city in the U.S. between 2015 and 2030, according to the United Nations Population Division.

The apartments are about five minutes drive to downtown and are conveniently located in a trendy area in Raleigh’s beltline.

Research Triangle Park, which is a 25 minute drive away, includes 300+ employers and $2.7B in combined annual employee salaries.

Demographics

We have two sources of income for the area in and around Brookside Apartments. Per the US census, the average household income in zip code 27604 was $89k in 2021 and is likely slightly higher today. Per CoStar, the average household income in the area surrounding the apartments is over $100k.

With target rents of $1,426 per month, the projected rent to income ratio is just under 20%, which is healthy.

The units will be positioned as a quality, more affordable alternative to the Class A newer construction a few minutes away in downtown Raleigh.

Value Add

The business plan is to spend approximately $13,500 per classic unit to upgrade appliances, flooring, countertops, and cabinetry. All units feature laundry connections and will receive new W&D appliances in each unit. The sponsor plans an exterior refresh with conversion of the existing laundry facility to a fitness center.

*No assurance of returns. Investments involve risk. See disclaimers.

Lofty.ai – 1209 Cove Ln, St. Louis, MO 63138

Offering at a Glance

- Name: 1209 Cove Ln, St. Louis, MO 63

- Available: Now

- Terms: Equity stake

- Price: $115,600

- Projected rent: $1,350 per month

- Target net IRR: 12.34% (10.34% CoC)

- Min. investment: $50

The house at 1209 Cove Ln, St. Louis, MO 63138 is a single-family residential home built in 1955 and located in the Northdale community of St. Louis County. The property is renovated and offers four bedrooms, one full bathroom, and a full basement.

The total living area is 1,176 square feet, and the lot size is 7,701 square feet. The home features a brand new kitchen cabinetry, a new roof, a new water heater, and an overall remodel. The second level is newly finished and offers additional space for various uses. The property has a large backyard, and the basement is clean and freshly painted.

HouseCanary values the home at $114k and forecasts rent at $1,300/mo — slightly less than Lofty’s estimates.

It’s one of the few four-bedroom homes in the area, which should drive slightly more revenue per sq foot but may make it more difficult to place.

HouseCanary forecasts 2% price appreciation over the next several years, which is refreshingly honest in this market.

This gives some upside potential as well, as it’s likely home (and rent) appreciation will outpace 2% over the lifetime of this investment.

Acretrader – Trinity Orchards

Offering at a Glance

- Name: Trinity Orchards

- Available: Now

- Terms: 6% pref 20%

- Term: 3 – 5 years

- Target net IRR: 10.1%

- Min. investment: $15,000

- Restrictions: Accredited investors only

Trinity Orchards is an 83 acre producing almond orchard in Fresno County, California.

It consists of 80 net acres planted to mature 11th leaf almonds, or almonds in their 11th year. A typical almond orchard has a productive lifespan of approximately 25 years.

The U.S. supplies over 75% of the world’s almonds; California is the only state that commercially produces the tree nut, and the vast majority of that production is in the San Joaquin Valley.

Over the past decade, global demand for almonds has grown by a factor of 10. California is the largest supplier for this demand, accounting for around 80% of global exports.

Water rights

Trinity Orchards is located and holds legal water rights within a historically strong irrigation district: James Irrigation District (JID). Historically, JID has not restricted allocations, including during the 2014/2015 droughts and, most recently, 2020/2021.

Insurance

Given the recent news about insurance companies’ unwillingness to insure homes in California, I was worried that could be an issue with this investment. This is what Amber from Acretrader had to say:

Our sponsor plans to take out insurance on both the property and the crop and it’s budgeted for.

This Article can show you some data about historical wildfires, there have been no fires there since records began in 1878, so we don’t expect them to have any issue with property insurance. The crop is also fully insured this year to above market pricing.

That’s all for this week.

Have you seen a real estate deal, fund, or opportunity you’d like to share with the community?

Cheers,

Wyatt

Our Disclosures:

Some deals presented above may include affiliate links. If you choose to invest, we may get a few bucks. Always DYOR.