Welcome to The WC — your weekly shot of awesome.

Today is the last of my three-part series looking back on 2023 and prognosticating about 2024. ICYMI:

- The best investments of 2023

- The worst investments of 2023

- Now: The best ideas for 2024 (ish)

Today, we’ve got:

- The wealth gap widens

- Invest in AI – no, not like that

- Housing discovery is a helluva drug

- A vibe shift in contemporary art

- Seed and pre-seed startups take flight

Let’s go.

Table of Contents

The wealth gap widens – and workers fight back

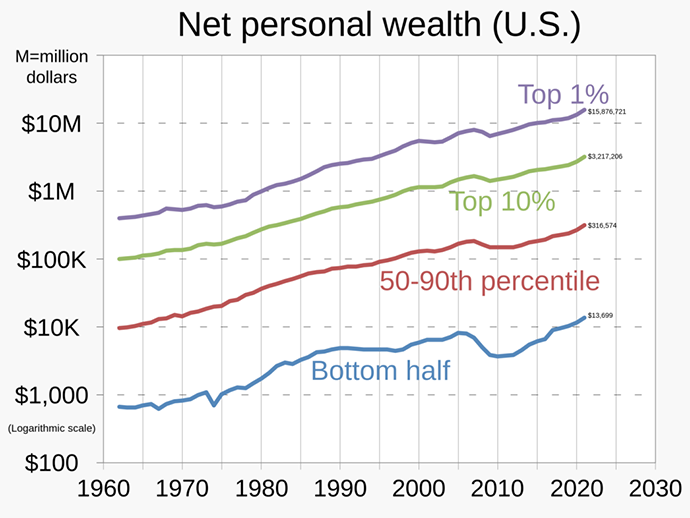

Income and wealth distribution have always followed a pareto distribution, more or less. That’s the 80 – 20 rule, which means that 20% of the people have around 80% of the cash. Putting aside whether that’s a good or bad thing, it’s as close as we have to a natural equilibrium.

But 30+ years of low interest rates, low taxes, increased automation and outsourcing, outsized executive compensation, and lower union participation have smashed the equilibrium.

Overall, the top of the table has increased its wealth by around 9% per year compared to 3% for the lower 50%. It may not sound like a big difference, but the compounding effects over three decades are significant:

- The 735 richest Americans have more than 10x more wealth than the bottom 165 million Americans.

- The three richest Americans are wealthier than the bottom 50%.

This trend will continue through 2024 and beyond.

- AI is getting better, which will continue to increase the productivity/median wage gap.

- After a year of tech layoffs, blue-collar companies are shutting down and laying off workers. Many of those jobs won’t come back when the economy recovers.

- I think Donald Trump will win this year.

Investors (the wealthy) and execs (also the wealthy) will prosper, but the bottom 50% will be out of luck.

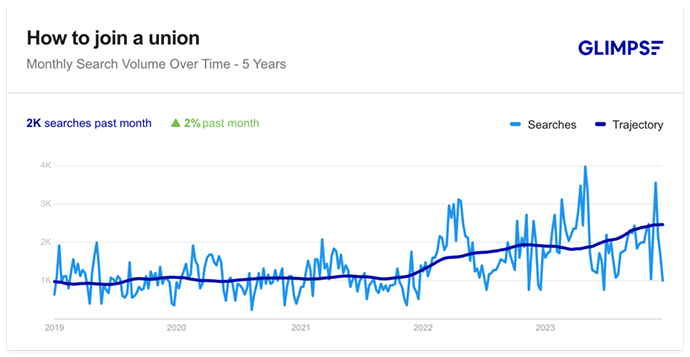

What’s a plebe to do? Organise!

High-profile strikes in the entertainment and auto industries in 2023 were just the beginning.

There’s going to be a big uptick in union activity in 2024 as workers begin to see the handwriting on the wall.

Again, there will be winners and losers here. Union leverage will degrade as the labor market erodes through 2024.

How is this actionable?

If you’re an investor, you want to do more diligence on the labor situation before you back a company.

If your job, investment, or company relies on a supply chain, check out your vendors’ labor situation before their employees go on strike.

Invest in AI – no, not like that

Working with AI right now can be super frustrating.

Uh ChatGPT has a radically different translation. pic.twitter.com/BphZt09WYj

— Wyatt Cavalier (@itiswyatt) December 26, 2023

You get hallucinations, incorrect translations, and all kinds of other nonsense.

But training yourself on AI while the eggheads are training the models themselves is a fantastic investment. Even now. Even when it’s a crap experience.

Because when the models get it right, we’re going to see a Cambrian explosion of new skills, platforms, and investment opportunities.

And you don’t want to spend six months learning how the stupid thing works while your competition — however you define that — is compounding their advantage.

I write (at least) eight newsletters a week, and I use ChatGPT (or Perplexity, or TextCortext, or, or, or) every day to help me produce the best possible content as efficiently as possible. Sometimes it helps, sometimes it doesn’t, and sometimes it makes my job harder.

But when someone gets it right, I’m going to know about it first. And I’ll be putting out the best content and introducing our community to the best investment opportunities before anyone else.

What’s your equivalent of that? And what advantage would that give you?

How is this actionable?

I’m thinking about curating and sharing my learnings with a specific focus on using AI to become a better investor.

If 100 of you commit to paying $20 a month for this, I’ll do it.

Housing price discovery will be a helluva drug

Let’s revisit the wealth gap for a moment.

The most popular counterargument to my thesis goes like this:

The wealth of a typical American household is way up since the pandemic.

Inequality is down.

Debt-to-income ratios are falling.

Racial gaps, education gaps, urban-rural gaps, and age gaps have decreased. https://t.co/jHhsHH3awk

🇺🇸🇺🇸🇺🇸🥳🥳🥳 pic.twitter.com/U31aiXe1be

— Noah Smith 🐇🇺🇸🇺🇦 (@Noahpinion) October 27, 2023

Noah is dead wrong. This is why:

First, the data ended in 2022 — America is a different place today.

But the bigger problem with believing Americans are richer than ever is that the vast majority of that wealth is locked into homes that no one will / can buy, and homeowners can’t / won’t borrow against.

It’s imaginary wealth from an asset whose value is inflated because of a lack of price discovery.

A lack of inventory has artificially propped up the residential real estate market over the last year because no one wants to dump their 2% mortgage in favor of 7%.

While I don’t know what’s going to dislocate the supply constraint, it can’t last forever.

At some point, the housing affordability index will come back to earth through a combination of decreased interest rates, increased housing supply, and reduced home valuations.

When that happens, all that imaginary wealth Noah’s applauding will evaporate.

That’s going to be a big problem for American consumers who will find themselves in breach of their mortgage covenants, out of work (see #1 above), and under the yolk of a historic amount of debt.

How is this actionable?

First, I wouldn’t go anywhere near residential real estate investments.

Second, I’d look hard at a short position in BNPL megastar Affirm. This company is a ticking time bomb.

A vibe shift in contemporary art

At the end of last year, I presented an investment opportunity to our accredited investors. (make sure to let me know if you’re accredited if you want to get similar stuff in the future).

There’s going to be more like this in 2024. Let me explain: