Welcome to The WC — your weekly shot of awesome.

Today, we’ve got:

- America’s substrate is crumbling

- The recycling supply crunch

- Saudi Arabia buys the World Cup

- How to host a banging birthday party

- A cheat code for investing in sports cards

You’ll learn:

- The pros & cons of “normal” litigation finance

- How to mitigate risk in litigation finance

- A smarter way to invest in this space (that nobody is talking about)

- How to get simple, fixed-income returns

Table of Contents

Not great, Bob

Most of the good stuff from 10-Ks comes from the notes to the financial statements rather than the tables themselves.

It’s the same thing for the Dallas Fed’s economic surveys. They speak monthly with “over 1,000 business executives in manufacturing, services, energy, and lending across Texas and the broader Eleventh Federal Reserve District.”

These surveys return quantitative data, which is helpful, but the best info is often found in the respondents’ comments.

And despite a red-hot 4.9% GDP print last quarter, there’s trouble coming.

I encourage you to read the comments yourself each month, but on the off chance you’ve got better things to do, here are some representative notes:

- “We are increasingly concerned that multifamily debt holders’ delay-and-pray approach is obfuscating the true extent of problematic loans… To make payments, apartment owners with floating rate debt are running up payables, deferring maintenance, and taking shortcuts that are undermining the value of the underlying assets and shortchanging renters.”

- “We repair trucks for small companies and owner-operators. Their business has slowed down, which affects our business.”

- “Hiring new (reliable) truck drivers is almost impossible.”

- “Market conditions continue to deteriorate. Affordability is a major concern.”

- “Things are not getting better. We wrote the fewest number of proposals in a seven-year period─even worse than during the pandemic.”

- “Most new business opportunities have dried up; work with existing clients is shrinking or moving to near-shore partners.”

- “Inflation, uncertainty about China and the U.S. political situation are the three largest distractions for business development.”

- “The labor pool continues to be tight and isn’t changing.”

- “We are seeing less generation of material available for recycling from industrial manufacturing. This indicates a slowdown in business activity.”

- “We have noticed fewer new customers, and established customers are reluctant or slow to make purchases.”

- “Overall customer projections are said to be up for 2024, but our forecasts don’t match and are down.”

- “Business is great. Our profit, great.”

- “Our premium pet food business has fallen off significantly.”

- “Business has slowed down significantly; we see no signs of improvement in business activity.”

- “Six months from now is actually quite scary.”

- “We are off by 20 percent this year so far. I don’t expect it to get better.”

- “We are still expecting the higher-for-longer rate scenario to result in economic weakness for the next one-to-two quarters. Loan demand tends to be soft in election years, so this may push economic weakness out another quarter or two.”

- “We have seen an increase in farm and ranchland loans.”

Tl;Dr:

- Prevailing uncertainty and concern due to geopolitical tensions, supply chain disruptions, and economic instability across various manufacturing sectors.

- Negative impact on customer demand, sales, profitability, and business projections observed across the board.

- A generally cautious or pessimistic outlook on near to medium-term market conditions, with sparse mentions of minor improvements or hope for a slow recovery.

Be safe out there, kids.

Practical applications for AI

Unbelieveably, increased demand for recycled materials from eco-concious manufacturers has led to a shortage of the stuff.

From cardboard to plastic to aluminum, the Amazons and Coca-Colas of the world have hoovered up the global supply of recycled cardboard boxes and soda cans.

From McKinsey, which I’ve somehow mentioned three times in a month:

“Collection levels of high-quality recycled material look set to remain almost flat, creating supply challenges for brand owners and packaging companies.”

While some countries and communities are leaning into recycling, other governments are not.

But while the supply of used Amazon packages may be flat, the recycling industry is using AI (yes, AI) to do more with less (or the same).

This WSJ video explains how optical sensors identify and classify packaging, which promts air jets to sort and separate it.

For now, the industry relies on subsidies to turn a profit, but using machine learning to do sift through rubbish is an excellent use case for the technology.

Saudi Arabia gets 2034 World Cup

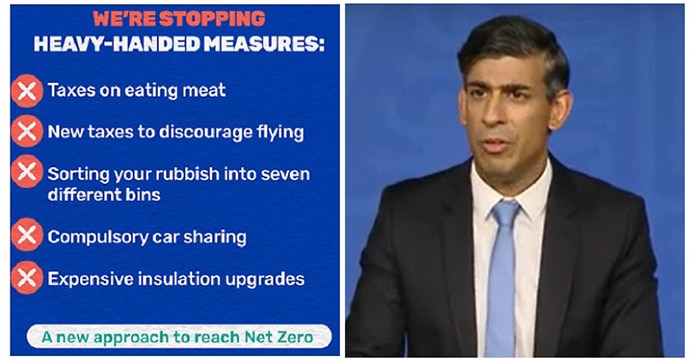

In a move that would seem bizarre if it weren’t so blatently criminal, FIFA, soccer’s global governing body, has restricted bidding for the 2034 World Cup to only countries from Asia and Oceana. It’s also requiring applications — which typically take years to complete — to be handed in by November 30th. For a tournament that’s 11 years away.

That leaves only Saudi Arabia with a hope of submitting a bid by the deadline now that Australia has dropped out.

I originally guessed Saudi Arabia’s sportwashing regime aimed to secure the 2030 World Cup, but that event has been split between Europe, Africa, and South America, which happily means those three confederations are ineligible to bid for 2034.

However much Saudi Arabia spent bribing FIFA and confederation officials is likely a drop in the bucket compared to buying the PGA, Newcastle United, and so forth, but it’ll probably have the biggest impact globally.

It’s a global stage with billion of viewers, and it’ll keep Saudi Arabia in the press for years ahead of time.

As ugly as Saudi Arabia’s sportswashing project it, it only succeeds because powerful people — athletes, officials, politicians, businespeople — can be bought.

The Kingdom’s efforts to decouple its GDP from oil are rational, and it’s taking probably the most efficient route to acheive that.

Recall Saudi Arabia’s Crown Prince Mohammed bin Salman’s interview with Fox News last month: “If sportswashing was going to increase my GDP by way of 1 percent, then I will continue doing sportwashing.”

“I don’t care. One percent growth of GDP from sport and I’m aiming for another one-and-a-half percent. Call it whatever you want, we’re going to get that one-and-a-half percent.”

So while they can and should be condemmed, the rest of the world needs to hold up a mirror as well.

Anyway, maybe consider investing in Saudi art.

#Saudi artist Mohammed Al-Saleem broke a world record for Saudi artists this week during @Sothebys 20th Century Art/Middle East sale in #London. Read more here https://t.co/zefXaAF5At pic.twitter.com/wkOoG3nDKl

— Arab News (@arabnews) October 24, 2023

You can have your cake and eat it too

Since the turn of the century, two unrelated forces have combined to change the way rich people spend, and musicians make, their money:

- Since 2000, the number of billionaires in America has tripled

- Sales of digital media — CDs, tapes — evaporated, and streaming has filled the revenue gap only slightly

And so now it’s possible to book nearly any musician–no matter how famous–for your kid’s bar mitzvah or your 50th wedding anniversary.

The musicians most in demand? “Whoever was popular with young men about twenty-five years earlier.”

Because that’s who’s rising to private-gig levels of wealth.

While the number of private gigs and the quality of performers you can book have both increased, it’s not a new phenomenon.

In 2012, after he sold Yammer for $1.2 billion, David Sacks hosted a Marie Antoinette-themed party featuring Snoop Dogg.

“Stephen Schwarzman treated himself to performances by Rod Stewart and Patti LaBelle, at a sixtieth-birthday party so lavish that it prompted what the Times called an ‘existential crisis on Wall Street about the evils of conspicuous consumption.'”

The rise of “privates” is part of a larger shift in the music industry that has made artists more accessible and record labels less essential.

If you’d like to stay on top of things, we’ve covered the industry with guides to royalty platforms, inveseting in musical instruments, and lessons learned from collecting vinyl.

A cheat code for sports card investing

Are you into collecting sports cards and trading card games (Pokemon, etc)?

If so, the guy behind Pancake Breakfast Stats is doing excellent work to put rigorous analytics behind the hobby/investments.

The language is a bit jilted, but his price movement forecast accuracies are often 80% or better.

Spoiler — Pokemon Cards are set to rise 10% in November.

That’s all for this week; I hope you enjoyed it.

Cheers,

Wyatt

Disclosures

- Our friends at Fenchurch Legal and Equity Multiple sponsored this issue

- We get a few cents if you click on affiliate links

- Interested in working for Alts? Check this job post and apply through Upwork. Or just reply to this email — better chance we’ll see it that way.