Hello and welcome to Alts Cafe

Highlights from the full issue:

- Macro: Yellen is Bullish

- Real Estate: CRE is still struggling

- Startups: ElevenLabs hits unicorn status

- Private Credit: Oil and gas returns are hurting

- Crypto: MetaMask launches staking

- NFTs: BAYC wins a legal battle

- Art: MoMA is being sued

- Vintage Autos: Some cherry rides up for auction

- Coins: A Queen Elizabeth II Jubilee Sells For $600k

- Farmland: It could be a record year for corn

- Luxury: Retail rents in Manhattan still lag behind

- Wine and Spirits: Saudia Arabia opens its first liquor store

- Film & Music: Netflix had a record-breaking Q4

- Precious Metals: A major US Aluminum operation shuts down

- Collectibles: Several million dollar comic sales

- Websites: .ru domain sales increase

Let’s go.

Table of Contents

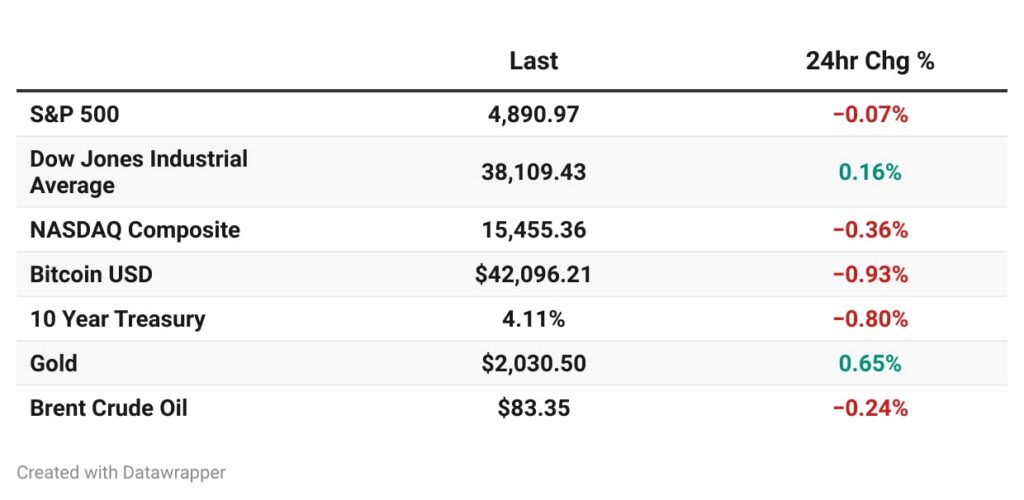

Macro View

Bullish News

- The US GDP increased by 3.3% in Q4 2024.

- Treasury Secretary Yellen is bullish on the economy in 2024.

- Both oil and gold are up as tensions in the Middle East continue to escalate.

- Historical patterns predict another better-than-average year for the S&P 500.

- Layoffs remain at historically low levels.

- Japan’s private sector is growing again.

Bearish News

- Iran bombed a US outpost in Jordan over the weekend, killing three American soldiers and wounding more than 30. Several Republican senators and representatives called for direct action against Tehran.

- Hong Kong’s Hang Seng Index hit a two-decade low.

- Over half of ECB staff rated President Christine Lagarde’s performance as negative.

- Moody’s outlook on Asia-Pacific’s sovereign credit is negative.

- Turkey’s central bank raised interest rates to 45%.

- Germany’s inflation rate soared to 5.9% in 2023, the highest since 1992.

- 2024 is not off to a strong start for Canada.

What are the odds?

Get $25 to play around with using this link.

What are we doing?

ALTS 1 Fund news:

Q4 report is out this week

Real Estate

Bullish News

- Brooklyn’s real estate market has seen a boom in sustainable development.

- Goldman Sachs predicts a 5% rise in US home prices this year.

- Zillow predicts a 3.7% increase in home values for 2024.

- Dallas led the US in commercial property sales for the third year in a row.

- Things seem to be going quite well for this tokenized real estate startup.

- Boston’s Seaport District will introduce its first all-affordable housing project.

Bearish News

- A Manhattan real estate broker agreed to a $260,000 settlement for charging excessive finder’s fees.

- The US home price-to-income ratio reached a record high of 5.6 in 2022, up from 4.1 in 2019.

- 50% of US renters now spend over 30% of their income on housing

- Nearly half pay more than 50%.

- Commercial real estate prices are expected to drop by another 10% in 2024.

- CMBS loan distress spiked in the second half of 2023.

- $100 billion was added to the watchlist, a 110% increase from the first half of 2023.

How to invest in real estate right now:

No way prices are rising 5% this year.

Startups

Bullish News

- ElevenLabs reached unicorn status after its most recent fundraising.

- Reports are out that Elon Musk’s xAI is trying to raise $6 billion, but he denies it.

- Knoxville’s clean energy startups got a lift from the DOE’s $10 million voucher program.

- Colorado’s quantum tech sector is set to expand following new tax credits and loan guarantees.

- NEXT Life Sciences raised $2.5 million in seed funding for innovative male contraception technology.

- The founders of Skype and Wise raised a $436 million fund to try to build Europe’s next tech giants.

Bearish News

- Google laid off over 1,000 employees despite record profits.

- JPMorgan downgraded Coinbase’s stock to underweight. Meanwhile, Oppenheimer upgraded it. 🤷

- The UK is doing its best to torpedo its angel investing economy.

- GitLab had a security disaster, with 5,300 servers left vulnerable for 13 days.

- Shein’s valuation dropped 30%.

How to invest in startups right now:

Short the UK startups ecosystem.

Private Equity and Private Credit

Bullish News

- 2024 has already seen quite a few megadeals.

- Private credit is expected to reach $2.7 trillion by 2027

- This is a dramatic rise from $250 billion in 2010.

- Blackstone launched a $10 billion opportunistic credit fund.

- The Asia Pacific wealth management market is set to grow from $18.50 trillion in 2023 to $33.00 trillion by 2028.

- RXR Realty and Ares Management launched a $1 billion fund to revitalize distressed Manhattan office properties.

Bearish News

- PE oil and gas investments are yielding lower returns as the shift to renewables accelerates.

- Macy’s Inc. rejected a $5.8 billion takeover offer from Arkhouse and Brigade Capital.

- Oregon’s pension fund faces pressure to divest from a $350 million LNG project based on environmental concerns.

- The risk of investors seeking clawbacks is rising.

How to invest in PE and Private Credit right now:

Move to Asia.

Crypto

Here’s what you need to know:

Bullish News

- Bakkt expanded its crypto trading to Brazil, Guatemala, Spain, Hong Kong, and Singapore.

- 70% of Grayscale GBTC investors are in profit.

- The crypto industry saw 62 million new users in 2023.

- MetaMask introduced an Ethereum staking feature with a 4% annual yield.

- Polymer Labs secured $23 million in Series A funding for their Ethereum’s interoperability solutions.

- Asia is embracing tokenized securities.

Bearish News

- Technical Analysts are bearish on Litecoin.

- A FINRA report found 70% of crypto firm communications could violate investor protection rules.

- A crypto investor lost $2.34 million to a phishing scam involving $SUPER tokens.

- Yet another major Twitter account hack…

- This time, the Algorand Foundation’s CEO had her account hacked, causing a 7% fall in trading volumes.

- OKX’s token suffered a 50% flash crash.

How to invest in Crypto right now:

Change your Twitter password.

NFTs

Bullish News

- Cristiano Ronaldo hosted his NFT holders for a friendly football match.

- NFTs are making a corporate comeback.

- Cardano NFTs are heating up.

- DEAPcoin jumped 115% in the past 3 months.

- The token is necessary for purchasing NFTs within the PlayMining platform.

- A CryptoPunk just sold for $507,617.

- The gaming NFT token PROM surged 36.3% in only 24 hours.

Bearish News

- The Full Send Metacard NFT by the NELK Boys lost 75% of its value, affecting over 7,000 holders.

- Canadian mutual funds now have new investment restrictions, including a ban on NFTs.

- The XRP community is being targeted by scammers, with fraudulent emails specifically aimed at OpenSea users.

- South Korea’s KT Corporation shut down its NFT platform.

- Bored Ape NFT copycats were ordered to pay Yuga Labs $7 million in legal fees.

How to invest in NFTs right now:

Make some degen Cardano NFT trades.

Artwork

Bullish News

- The Metropolitan Museum of Art sold a George Washington portrait for $2.8 million.

- The British Museum and V&A loaned 32 gold regalia items to Ghana, the country they were stolen from 150 years ago. the museums ain’t getting them back.

- Singapore’s annual art conference saw a 40% rise in high-net-worth attendees.

- The Georgia Museum of Art received a record $1,085,000 grant from the Elizabeth Firestone Graham Foundation.

Bearish News

- A fire in Abkhazia destroyed 4,000 artworks, including pieces by Alexander Chachba-Shervashidze.

- The Orlando Museum of Art is facing a budget deficit of up to $1 million after a fake Basquiat exhibit led to unforeseen legal expenses.

- MoMA is being sued for not preventing groping incidents during a 2010 exhibit.

- Richard Prince’s galleries settled two copyright lawsuits for using photographers’ work without permission.

- The Art Institute of Chicago faces a controversy over a Schiele painting.

How to invest in Artwork right now:

Don’t display fake art.

Vintage Autos

Bullish News

- Mecum Kissimmee’s 2024 auto auction hit a record sale of $275 million, continuing a trend of surpassing $200 million for three years.

- A gorgeous 1966 Aston Martin DB6 Vantage is coming to auction.

- Meanwhile, a 1993 Jaguar XJ220, a former speed record-holder, hit the auction block with an estimated value of up to $600,000.

- A pair of neglected sportscars, including a rare AC Aceca, garnered over £100,000 at auction.

Bearish News

- A Florida classic car dealer filed for bankruptcy amid a fraud probe, with over $4 million in debts and nearly 100 creditors, including many unpaid customers.

- The collector car market has retracted to December 2019 values, with the Hagerty Market Rating falling for nine months.

- California’s classic car scene may shrink due to proposed zero-emission zones limiting classic car use.

How to invest in Vintage Autos right now:

Move your collection out of California.

Rare Coins

Bullish News

- Three different gold coins fetched more than $1 million at the recent Heritage Signature auction.

- A 7-kilogram gold coin for Queen Elizabeth II’s Platinum Jubilee sold for $660,000 at Stack’s Bowers Galleries.

- Croatia’s National Bank released limited-edition Trsat Dragon coins on January 24th, offering 100 gold and 5,000 silver pieces.

Bearish News

- Kosovo enforced a currency change, giving ethnic Serbs two weeks to drop the dinar.

- Scythian gold and other historical items were seized at the Estonian-Russian border.

- The $4 Stella coin, once aimed at international trade, never caught on and is now infamous for its link to congressmen’s scandalous activities.

How to invest in Rare Coins right now:

See if you have any Queen Elizabeth II’s lying around.

Farmland

Bullish News

- US farmers are on track for a record harvest, with corn at 15.39 billion bushels and soybeans at 4.48 billion bushels.

- Wisconsin’s farmers markets received a USDA grant of $640,000 to attract new customers to over 300 markets.

- Pennsylvania invested over $2.232 million in agriculture research, focusing on organic farming and sustainable energy.

- Vertical farming innovator Intelligent Growth Solutions raised £ 22.5 million.

Bearish News

- A verdict of $2.25 billion was reached against Bayer for Roundup’s cancer risks.

- Six California regions, including the Cuyama Valley with its basin dropping nearly 5 feet per year, are among the fastest-depleting aquifers globally.

- The expansion of crop insurance subsidies, with an annual cost of almost $600 million, faces resistance.

- Over 270 wastewater permit violations in two months were recorded at the Port of Morrow, worsening Oregon’s groundwater pollution.

- Urban-grown produce has a carbon footprint six times larger than traditional farming.

- Florida’s farmland is projected to shrink by 2.2 million acres by 2070.

- By 2026, France’s farming workforce is expected to decrease by 40% due to retirements.

How to invest in Farmland right now:

Make sure your Florida farms will still be here in 30 years.

Luxury Goods

Bullish News

- LVMH’s Q4 sales jumped by 10%, adding $70 billion to the luxury market’s value.

- Kering purchased a 115,000 sq. ft luxury property on NYC’s Fifth Avenue for $963 million.

- The Louis Vuitton and Timberland partnership released boots starting at $1,150, aiming to revitalize Timberland after a 10% revenue drop.

- Coupang’s market share in South Korea climbed to 22.5% in 2022 from 5.8% in 2017.

- Secondary luxury watch brand ChronoFinder’s annual revenue hit £5.5 million.

Bearish News

- Balenciaga continues to struggle two years after its controversial ad despite apologies and restructuring.

- In 2023, Salvatore Ferragamo’s revenues dropped by 7.6%, with retail sales down 10.8%.

- LVMH’s men’s fashion shows featured more handbags amid a luxury leather goods sales growth of just 3-4%, the lowest in ten years.

How to invest in Luxury Goods right now:

Men, it might be time to start wearing purses.

Wine and Spirits

Bullish News

- Saudi Arabia opened its first alcohol store.

- Pope Francis, speaking to 100 wine producers, declared wine “a universal gift.”

- Rye whiskey sales have doubled to $356 million in 2022, with a 1,275% volume increase since 2009.

- Former Patrón executives launched a new spirits venture.

- Vinovest introduced a Whiskey Fund.

- Kirin executives expect a Japanese Whiskey renaissance.

Bearish News

- Rhode Island is fighting to keep out-of-state wine deliveries banned.

- Illinois’ liquor tax revenue dropped last year.

- Over 30 Oregon breweries shut down in 2023.

- The wine industry saw a 3% sales drop last year, continuing a three-year decline due to waning interest from younger generations.

- LVMH’s wine and spirits sector fell 7% to €6.602 billion in 2023, the only LVMH sector to decline.

- The Twin Cities’ craft beverage industry is shrinking.

How to invest in Wine and Spirits right now:

Start studying up on Japanese Whiskey.

There are three spots left on our investor trip to Tequila in February. Join us, won’t you?

Music and Film

Bullish News

- Two bizarre film posters cleaned up at Heritage.

- Primary Wave Music acquired Scott Weiland’s music catalog, including 16 Top 10 singles and over 40 million albums sold.

- Beatdapp secured a partnership with Universal Music Group and raised $17 million to protect music streaming revenues.

- Netflix added 13.1 million subscribers in Q4 2023, its biggest-ever fourth-quarter increase.

- Lim Young Woong donated his ‘Picnic’ royalties to charity.

- ClicknClear struck a licensing deal with Warner Chappell Music, accessing 1.3 million works for a $2.4 billion market.

- India’s music streaming market hit a trillion streams in 2023.

- Apple Music now pays up to 10% higher royalties for Spatial Audio tracks.

Bearish News

- Australians lost over $135,000 to scams involving Taylor Swift’s tour tickets.

- Hipgnosis Songs Fund’s share price fell due to the investment advisor’s call option issue.

- ZEEL’s shares dropped 20% after its $10 billion merger with Sony failed.

How to invest in Music and Film right now:

Start uploading Spatial Audio tracks.

Metals and Gems

Bullish News

- Sumitomo Metal Mining invested $14.4 million in FPX Nickel Corp. for its Baptiste Nickel Project and corporate initiatives.

- H2 Green Steel raised €6.5 billion for a sustainable green steel plant in Sweden.

- Freeport-McMoRan expects consistent demand for copper and gold in 2024.

- The metal fiber market is set to grow to $6.2 billion by 2028, driven by automotive and aerospace demand.

- Brazil’s mining royalties are expected to recover.

- 42 states have exempted gold and silver purchases from sales tax.

Bearish News

- South Dakota’s 10% lithium tax proposal may repel investors.

- The shutdown of Magnitude 7 Metals marks a downturn in US aluminum production.

- The mining supercycle driven by EV battery demand may fall short of expectations.

How to invest in Metals and Gems right now:

Might be time to take a break from EV-specific metals.

Collectibles

Bullish News

- Some massive results at Heritage’s signature auction:

- Superman #1 CGC 7.0 went for $2.3 million

- All-Star Comics #8 (origin of Wonder Woman) CGC 9.4 went for $1.5 million.

- Spider-Man #1 CGC 9.8 went for $1.4 million.

- Rubik’s Cube is celebrating 50 years.

- Generation Z’s is still obsessed with Stanley Cups, with resale prices hitting up to $400.

- Following eight Oscar nods for the Barbie film, the Barbie resale market is expected to see a surge.

- A Caitlin Clark trading card broke records with a $78,000 sale, indicating a spike in women’s sports memorabilia value.

- A signed 2pac concert ticket went for nearly $10k.

Bearish News

- Chris Kinney, a former Olympian, had his Roswell home burglarized, losing Olympic memorabilia.

- The UK saw a £200 million drop in toy sales in 2023

- eBay announced layoffs of about 1,000 employees.

- Pokémon is investigating Palworld over IP concerns.

How to invest in Collectibles right now:

Use AI to solve your Rubik’s cube.

Websites and Domains

Bullish News

- Peace.com was sold for $400,000 through Sedo. Presumably, there was no bidding war.

- Over 50,000 .ai domains were sold in three months.

- Insure.ai and dog.ai both sold for over $20,000.

- The Australian Ecommerce market is forecasted to grow at a CAGR of 6.64%.

Bearish News

- The NSA purchased web browsing data without warrants.

- Nearly 20% of UDRP complaints in 2023 were denied for reverse domain name hijacking.

- New Zealand’s .nz domain registrations saw a 1.6% drop, the largest decline on record.

- All 10 of the top English-language news websites faced declining traffic in December.

- MSN reported a 25% traffic drop,

- CNN reported a 16% drop.

- VexTrio, a malicious traffic broker, now controls over 70,000 domains.

- The rise in .ru domain registrations is attributed to sanctions, not organic growth, as Russians localize their web presence.

- A spike in fraudulent Afternic listing emails has domain investors worried about unauthorized asset sales and transfers.

How to invest in Websites and Domains right now:

Assume the NSA is watching… always.

That’s all for this week

Cheers,

Wyatt

Disclosures

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.