Hello and welcome to Alts Cafe

Highlights from the full issue:

- Macro: JP Morgan had a record year

- Real Estate: eCommerce is changing industrial RE

- Startups: More money is flowing into Space startups

- Private Credit: David Rubenstein is bullish

- Crypto: Bitcoin ETFs had a great first week

- NFTs: Solana NFTs are still pumping

- Art: The guy who put a $75M painting on a superyacht

- Vintage Autos: They aren’t making new Camaro’s anymore

- Coins: Two dozen ancient Greek coins were discovered

- Farmland: Supply is increasing in Britain

- Luxury: The secondhand market is booming

- Wine and Spirits: Macallan celebrates 200 years

- Film & Music: A $9.9M licensing suit

- Precious Metals: China is making a ton of aluminum

- Collectibles: Star Wars toys are struggling

- Websites: It’s time to buy a .ing domain

Let’s go.

Wyatt

Table of Contents

Macro View

Because you haven’t added any specialist topics, you’ll only see this macro view today.

If you want a concise view of last week’s real estate, startups, crypto, PE, VC, luxury items, music and film investing, collectibles, art, wine and spirits, and/or vintage autos news, click this button. 👇

Bullish News

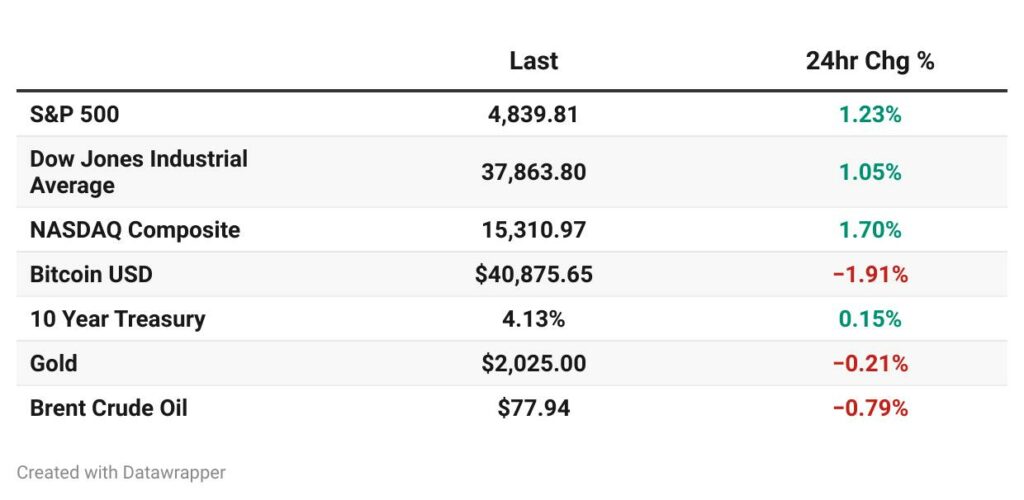

- UBS Global Research upped its S&P 500 forecast to 5,150 for 2024, an 8% increase.

- JPMorgan Chase reported a record $50 billion profit in 2024.

- Investor optimism has surged, with 60% feeling bullish, up 9 points from last quarter.

- The S&P 500 hit a new high of 4,838, a 17% rise since October, with consumer sentiment at its best since July 2021.

- Taiwan’s elections calmed global market concerns over China tensions.

Bearish News

- UK inflation rose unexpectedly.

- The Australian Home Buying Index plummeted by 40% YoY amid rate hikes and a 6% fall in household incomes.

- Corporate defaults have spiked.

- Jamie Dimon warned of U.S. economic challenges ahead, citing geopolitical tensions and tightening monetary policy.

- China issued special bonds worth $139 billion to prop up the economy.

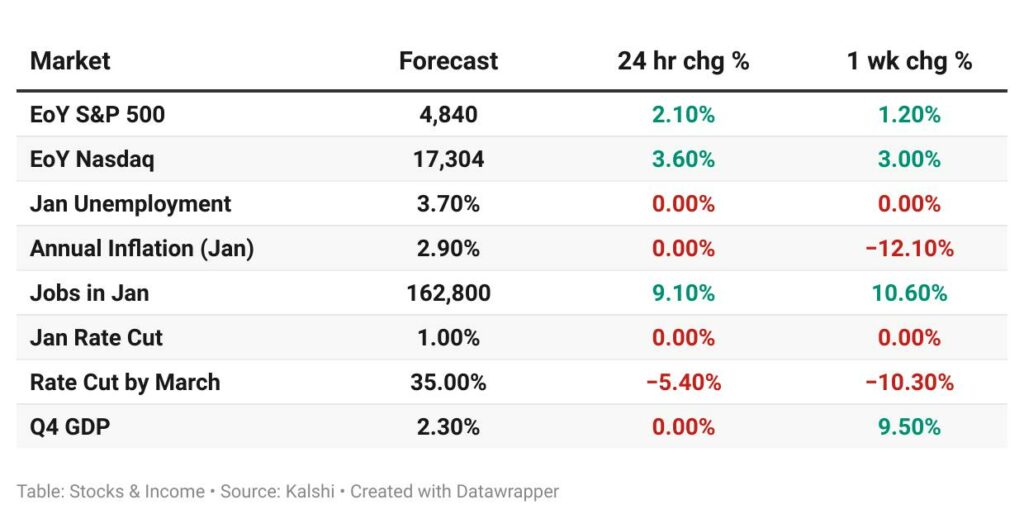

What are the odds?

Get $25 to play around with using this link.

What are we doing?

ALTS 1 Fund news:

Expect to see Q4 updates this week.

Real Estate

Bullish News

- Florida’s real estate market saw almost $200 billion in sales in 2023, surpassing pre-pandemic levels.

- The Dallas-Fort Worth retail market hit a 40-year high with a 95.2% occupancy rate, led by grocery-anchored centers.

- CBRE, predictably, forecast a 5% increase in investment volumes for CRE in 2024.

- Fundrise’s CEO, predictably, identified October 2023 as a turning point for real estate

- The UK’s housing market began 2024 with a 1.3% rise in asking prices and a 5% increase in buyer demand compared to last year.

- E-commerce growth has spurred the construction of multi-story industrial facilities, with New York adding 2.7 million square feet to meet demand.

Bearish News

- In 2023, the housing market saw its worst sales since 1995, plummeting by 6.2% YoY.

- Prices have fallen 11% across US commercial real estate since March 2022. $1.2 trillion maturing debt is threatening smaller banks.

- Office property loan delinquency rates hit 6.5% in Q4.

- 217 million square feet of office leases expire in 2024 and 2025.

- Florida’s real estate sector is in turmoil due to legal challenges over commission structures, threatening the earnings of its many agents.

- Nearly half of European investors are cutting back on real estate due to higher borrowing costs and falling property values.

How to invest in real estate right now:

Stay away from CRE.

Startups

Bullish News

- Reddit scheduled its IPO for March.

- Space startups saw a 31% funding increase in Q4 2023, with $4.6 billion invested.

- In 2024, 85% of Indian startup founders expect higher valuations in upcoming funding rounds.

- Klaviyo and The Trade Desk exemplify the ”Third Way”, raising a single funding round to build billion-dollar companies with more control.

- Venture capital in women’s health increased by 8% in the first three quarters of 2023.

Bearish News

- In 2023, cybersecurity startups saw their funding halved to $8.2 billion from $16.3 billion the previous year.

- Wayfair cut 1,650 jobs, 13% of its workforce.

- Robinhood paid $7.5 million to settle claims of manipulating novice investors through gamification.

- Nigerian fintechs are bracing for stricter regulations from the Central Bank amid a 277% rise in fraud.

- Australia’s proposed investor rule changes may disqualify 275,000 from early-stage investments.

- A 2017 tax law change means startups must now amortize R&D costs, increasing immediate tax liabilities.

How to invest in startups right now:

Space is so hot right now (not really, it’s actually very cold there).

Private Equity and Private Credit

Bullish News

- Blackstone Real Estate acquired Tricon Residential at a 30% premium, promising $3.5 billion for U.S. and Canadian housing developments.

- David Rubenstein of Carlyle predictably forecasts a PE and M&A boom.

- In 2023, Luxembourg’s PE market hit a new high with 27 deals worth €1.7 billion.

- Corporate financing in the solar sector reached a 10-year peak in 2023, a 42% increase from the prior year.

- European PE deal count increased by 4.4% in 2023, with values well above pre-2021 levels.

- General Atlantic’s purchase of Actis grew its assets to $96 billion, tapping into the demand for sustainable infrastructure.

Bearish News

- In 2023, PE fundraising slumped, falling 11.5%. It was the lowest since 2017, and the fewest funds closed since at least 2015.

- PE firms are offloading assets at 10%+ haircuts.

- Mariner Finance, backed by PE, will go to trial for alleged predatory lending, accused of overcharging Pennsylvanians by $27.5 million.

- The UK watchdog is going after PE-backed firms.

- PE firms are under growing scrutiny from investors as median holding periods extend beyond a decade.

- Carl Icahn’s lawsuit against Illumina suffered a court defeat.

How to invest in PE and Private Credit right now:

It’s infrastructure season.

Crypto

Here’s what you need to know:

Bullish News

- The Sacramento Kings became the NBA team to accept Bitcoin, partnering with BitPay.

- Chainlink has integrated with Circle’s CCTP, enabling secure and compliant USDC transfers across chains.

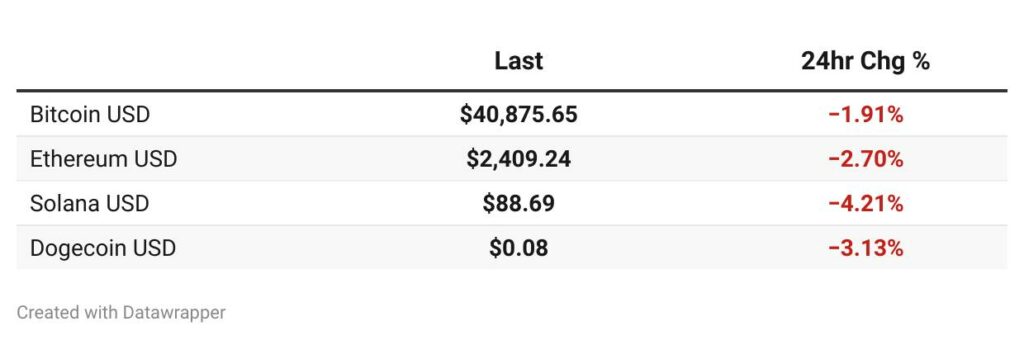

- U.S. spot Bitcoin ETFs hit over $10 billion in trading volume within their first three days.

- The launch of U.S. spot Bitcoin ETFs led to a record $17.5 billion traded in crypto products in one week.

- Hong Kong’s HashKey Group is on the brink of securing $100 million, reaching a $1.2 billion valuation and unicorn status.

- Fidelity’s report suggested a renewed institutional interest in DeFi and stablecoins.

- Anchorage Digital’s purchase of 12,103 Maker (MKR) tokens, worth $24.7 million, reflects this trend.

Bearish News

- The EU has tightened regulations on crypto firms, mandating due diligence for transactions over €1,000.

- Crypto thefts rose 42% in 2023, with 2024 losses already double that of the previous year’s same period.

- Terra Classic’s LUNC and USTC volume plummeted 10.1% and 9.5%, respectively, exiting the Top 100.

- USI Tech’s founder was charged with $150 million fraud.

- Venezuela is phasing out its Petro cryptocurrency, abandoning its economic experiment.

- VeChain faced a security breach, with a scam giveaway exploiting investors.

How to invest in Crypto right now:

Investors sold the BTC ETF news, and now may be a good opportunity to buy the dip.

NFTs

Bullish News

- Solana’s NFT sales hit $14 million in 24 hours.

- The Whisky Exchange launched the Whisky Exchange Cabinet, a Blockchain-based platform for trading rare spirits.

- The Vegas Golden Knights, with Theta Labs, released a collection of free NFTs offering VIP experiences and autographed memorabilia.

- GoMining introduced NFT miners, allowing individuals to mine Bitcoin without extensive infrastructure, promising a 12-18 month payback period.

- CryptoPunks and BAYC are heating back up.

- The NFT Market is projected to grow to $13.6 billion by 2027, with a CAGR of 35.0%.

- OpenSea announced upcoming upgrades to improve user experience with tailored interfaces for different NFT categories.

Bearish News

- Phishing attacks stole over $4 million from 4,000 Solana users in December.

- Cristiano Ronaldo faces a $1 billion lawsuit for promoting Binance NFTs. (Ed note: lol)

- Manta Network’s airdrop faced major backlash after NFT values crashed from over $1,000 to $132.

How to invest in NFTs right now:

Start watching Hockey.

Artwork

Bullish News

- Billionaire Joe Lewis displayed Francis Bacon’s final triptych, worth $75 million, aboard his $250 million Aviva superyacht.

- Two Egon Schiele paintings, each worth over $1 million, were returned to Holocaust victim Fritz Grünbaum’s heirs.

- Belgian officials retrieved stolen art by Chagall and Picasso, valued at $900,000, concluding a ten-year investigation with the works intact.

- A Beijing court decision ruled that AI-generated artwork can be copyrighted.

Bearish News

- New York’s Alexander and Bonin gallery closed after 30 years.

- Italy’s junior culture minister faced accusations of owning a stolen 17th-century artwork.

- Sotheby’s is under legal scrutiny for its involvement in a da Vinci sale, amidst the ongoing Rybolovlev controversy.

- Government cuts threaten the survival of Dutch cultural institutions.

How to invest in Artwork right now:

Take your AI Art to China.

Vintage Autos

Bullish News

- King Charles’ former Land Rover sparked interest at The Practical Classic Car and Restoration Show Sale.

- Auction site Bring a Trailer saw a 2% sales increase in 2023, hitting $1.4 billion and selling over 30,000 cars.

- The Amelia Auction 2024 featured two Ford GT Heritage Editions, with the 2006 model reaching up to $650,000 and the 2019 model estimated at $1.25 million.

- Razorfly Studios undertook a nostalgic restoration of the ’51 Studebaker Commander from “The Muppet Movie.”

Bearish News

- The Mullin Automotive Museum closed permanently, ending its display of 20th-century French cars.

- Thieves stole a 1962 Chevy Impala valued at $100,000.

- GM discontinued the Camaro.

- The 1962–63 Ford Thunderbird Sport Roadster lost 23% in value.

- ‘Mileage blockers’ pose safety risks for UK drivers, hiding true vehicle wear and tear.

How to invest in Vintage Autos right now:

Double check that “mileage” isn’t being misreported.

Rare Coins

Bullish News

- Excavations in Tenea unearthed over two dozen ancient Greek coins and a section of Hadrian’s aqueduct.

- A stash of 331 gold coins from Leicestershire, featuring monarchs like Queen Victoria, sold for over £118,000.

- CAC Grading entered the signature label market, boosting the collectibility of 2024 American Silver Eagles with Paul Nugget’s autograph.

- A 1797 Capped Bust gold $10 eagle sold for $16,800.

- A silver Roman denarius from 125 BC found in Herefordshire has been declared “treasure”

Bearish News

- Lincoln Wheat Pennies, despite their age, often sell for under 5 cents in bulk due to weak collector demand.

- The majority of old coins are not considered rare.

How to invest in Rare Coins right now:

Don’t stake your retirement on Wheat Pennies.

Farmland

Bullish News

- Governor Hochul of New York has awarded over $5.5 million to protect 2,119 acres of farmland.

- In Western New York, 957 acres of farmland have been preserved.

- 20% more farmland has come on the market in the UK compared to last year.

- Texas Pacific Land has seen a 136% gain over five years, surpassing Berkshire Hathaway’s performance.

- The USDA has granted the Colorado Grain Chain a $9.75 million grant, enhancing the organic grain sector.

- The farmland market remained resilient last year, with Farmers National Co. reporting $600 million in sales from 700 transactions.

Bearish News

- Weed resistance to herbicides, including glyphosate and dicamba, threatens U.S. crop yields and food security.

- Illinois introduced Senate Bill 2668 to protect agricultural land from foreign ownership.

- Rising interest costs, outstripping land value gains, suggest a downturn in farmland investment and farmer profitability.

- Interest expenses for U.S. farmers jumped 43% to $34.42 billion in 2023.

- The GAO report revealed flaws in foreign-owned farmland data management, indicating oversight issues.

- A drop in farm equipment sales for seven of the past eight months signals distress in the sector.

How to invest in Farmland right now:

Be prepared for glyphosate to stop working.

Luxury Goods

Bullish News

- In 2023, the global luxury market hit a record €1.5 trillion, up 8-10% from the previous year.

- Taubman’s upscale malls, including the Mall at Short Hills, reported a 97% occupancy rate.

- China’s luxury market growth at 4-6% in 2023 outstripped its overall economic recovery.

- Sales in the secondhand luxury sector reached $49.3 billion in 2023, doubling in four years.

Bearish News

- Following Burberry and Hugo Boss warnings, luxury stocks fell over 20% and continued to sell off.

- Watches of Switzerland lowered its revenue forecast, causing shares to hit a three-year low.

- Bentley’s sales dropped 11% in 2023, with declines across Europe, the Americas, and China.

- LVMH’s earnings growth for 2024 is expected to be lower than consensus.

- Estee Lauder’s shares fell after announcing reduced sales and a third cut to its fiscal year outlook.

How to invest in Luxury Goods right now:

Luxury brands and demand are falling across the board.

Wine and Spirits

Bullish News

- Macallan marked its 200th anniversary, maintaining its position as a whisky market leader and continuing to break auction records.

- The rum market is expected to grow from $17.6 billion to $35.5 billion by 2033.

- The Global Craft Spirit Market is forecasted to hit $230 billion by 2033, with a 29% CAGR.

- Scotch whisky visitor centers attracted over two million visitors in 2022, becoming Scotland’s top tourist spots.

- Glenfiddich’s 23-Year-Old Grand Cru won Best In Show at TAG.

- A viral meme led to a rise in popularity for Josh Cellars wines.

Bearish News

- Wine sales plummeted again, marking a 2-4% drop for the third year.

- Spirits are set to surpass wine for the first time in 45 years.

- The value of fine wines tanked in 2023, with 90% of tracked wines losing value, and 25% falling over 10%.

- In Kenya, spirits imports fell from 16.3 million liters in 2020 to 13.2 million liters in 2022 due to tax increases.

How to invest in Wine and Spirits right now:

Go viral on TikTok.

There are three spots left on our investor trip to Tequila in February. Join us, won’t you?

Music and Film

Bullish News

- The European Parliament voted for fair artist pay on music streaming platforms, with 532 members supporting transparent compensation.

- HarbourView Equity Partners acquired Jeremih’s music assets, including platinum hits and a catalog with over 5.5 million album consumption units in the U.S. since 2009.

- Tune.FM raised $20 million from LDA Capital, advancing a decentralized platform where artists keep 90% of streaming revenue and monetize through NFTs.

- BandLab launched a sync licensing program for its 60 million users, enabling them to license music for TV, films, games, and ads.

- The board of Hipgnosis Songs Fund has proposed a £20 million incentive to attract buyers.

Bearish News

- TSG Entertainment’s audit revealed a minimum $40 million shortfall in film investment returns, attributing it to Disney and 20th Century Studios’ “Hollywood Accounting.”

- Vermont Broadcast Associates was sued for $9.9 million by Global Music Rights for using music without a license.

- Music Licensing, Inc. has entered proprietary trading, risking its 7.4% market share in the U.S. public performance rights sector.

How to invest in Music and Film right now:

Blame your losses on other people’s “creative accounting”

Metals and Gems

Bullish News

- Palladium and platinum have reached price parity.

- Copper prices rebounded and China’s refined copper output rose by 13.5% in 2023.

- China’s aluminum production hit a record high of 41.59 million tons in 2023, with an expected increase to 42.7 million tons in 2024.

- Over 20 leading mining firms in the International Council on Mining and Metals pledged a nature-positive future by 2030, anticipating a 500% surge in essential mineral demand.

- The 3D printing metal market is projected to reach $2.95 billion by 2032, growing at a CAGR of 21.4%.

- Element Zero raised $10 million for its low-temperature mineral processing technology, which could cut global carbon emissions from iron and steelmaking by 8%.

Bearish News

- Gold hit a 1-month low.

- Metal prices are expected to fall 5% in 2024 after a nearly 10% drop in 2023.

- The Tardiff deposit’s rare earth elements project faces uncertainty due to fluctuating demand for Neodymium and Praseodymium.

- Commercial Metals Company’s shares dropped 9.5% over the past year amid sustained weak demand in Europe.

How to invest in Metals and Gems right now:

Buy a 3D printer.

Collectibles

Bullish News

- Asics and Ugg emerged as StockX’s top-traded and fastest-growing brands.

- The collectibles market in Southeast Asia looks strong following Toki’s $1.8 million in pre-seed fundraising.

- Christie’s auction of Sir Elton John’s collection is set to draw attention with pieces like Damien Hirst’s “Your Song,” potentially earning over $10 million.

- eBay’s Marquee Auction series launched, offering rare sports cards such as a unique Michael Jordan card.

- Unopened TY Teenie Beanie Babies from McDonald’s Happy Meals sold for £290.

Bearish News

- The CL50 index for trading cards fell 9% in 2023, adding to a 23% drop from the previous year.

- HMRC’s new requirements for digital platform data collection could result in unexpected tax bills for casual sellers.

- eBay was fined for stalking and harassment.

- Mass-produced Star Wars toys have lost significant value, with little chance of future appreciation.

- Beckett Collectibles’ manga grading service faces skepticism and concerns of market manipulation from the manga community.

How to invest in Collectibles right now:

Don’t stalk and harass your competitors.

Websites and Domains

Bullish News

- Escrow.com recorded $383.3 million in domain transactions in 2023, reflecting strong digital asset investment.

- Ethereum Name Service (ENS) is still tearing it up, jumping 70% in one week.

- New domain registrations rose by 10.24% in Q4 2023.

- My.box Inc is set to launch their public beta of .box, a blockchain-based domain system aiming to bridge Web3 and Web2 identities.

- Google’s .ing domain hit 16,000 registrations.

- James Booth brokered a record $150,000 sale of the domain 7.io, the third-largest .IO sale to date.

Bearish News

- The creator economy disappointed investors with a sharp decline in funding and numerous startups shutting down or cutting jobs.

- The Inferno Drainer used 16,000 unique domains to scam over $80 million in digital assets, exploiting over 100 crypto brands.

- Cybercriminals are purchasing cheap domains to sell questionable health products.

- Google’s Incognito mode still tracks users, despite the mode’s privacy claims.

- Google discontinued Business Profile websites.

How to invest in Websites and Domains right now:

Start shopp.ing

That’s all for this week

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at CalTier.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.