Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- US GDP growth blew past estimates, but it could be a house of cards

- Canada is the lone bright spot for North American real estate

- Private credit continues to moon

- Likewise Sequoia

- Bitcoin ripped too

Table of Contents

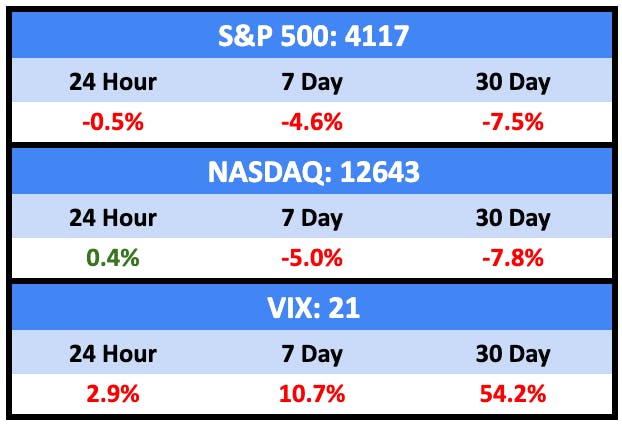

Macro View

Pretty awful week.

Bullish News

- Non-traded alternative investment fundraising totaled $50.9 billion year-to-date through September.

- The U.S. economy grew almost 5% in the third quarter.

- But the declining saving rate combined with the resumption of student loan repayments in October, which economists estimated was equal to roughly $70 billion, or around 0.3% of disposable personal income, could dent spending.

Bearish News

- Americans are falling behind on their auto loans at the highest rate in nearly three decades.

- The EU is looking to impose a global 2% wealth tax on the 2,700 richest people on earth. It would raise $250 billion annually.

Forecasts

Get $25 to play around with invest on Kalshi using this link.

📉1%

Chance of Fed hikes rates in November

📈91%

Chance credit card defaults will rise in Q3

📉2.34%

National average house price increase in 2023

The market for commercial real estate defaults has been mooning over the last few weeks. We highlighted this one a couple of months ago. Hope you bought a few shares.

Also of note, we mentioned the surprise GDP numbers above (4.9% in Q3). The market currently forecasting half that for Q4.

What are we doing?

ALTS 1 Fund news:

We’re finalizing an investment in a fantastic art bundle. If you’d like to invest alongside us (and you’re an accredited investor), please let me know.

Real Estate

Bullish News

- Canadian home prices remain surprisingly buoyant.

- The White House launched an initiative that will make more than $35 billion available from existing federal programs in the form of grants and low-interest loans to encourage developers to convert offices into residential.

- Because even free booze isn’t enough to tempt workers back to the office.

Bearish News

- Rents dropped again in September

- And renting is now more affordable than buying in almost all major markets

- And it is now 52% more expensive to buy a home than to rent one

- Architecture firms reported a sharp drop in business in September, indicating that the commercial real estate market could experience more pain soon.

- Swedish landlord Heimstaden Bostad AB is targeting a cash injection of at least $620 million by selling a chunk of its Dutch portfolio as it races to avert a credit rating downgrade.

- CBRE Group Inc., the world’s largest commercial property brokerage, says it doesn’t expect the industry to recover until at least late 2024.

How to invest in real estate right now:

Home prices and rental prices will converge. If you can’t sell your home, try renting it out.

Startups

Bullish News

- While many large VC firms have reduced the values of their portfolios over the past year, Sequoia has marked up 15 of its funds by an average of 9.2%.

- Secondary shares of The Boring Company were up 22% year over year, valuing the meme company at over $7 billion.

- One in five of the new unicorns to join The Crunchbase Unicorn Board this year is an AI company.

- And a year ago, about 16% of Sequoia Capital’s new investments were in artificial intelligence startups. So far in 2023, that number has jumped to nearly 60%.

Bearish News

- Investment in supply chain startups — so hot during the pandemic — have crashed to earth.

- Crunchbase has a funny-if-you-didn’t-lose-money-personally retrospective on all the trucking startups that have failed.

- Cruise lost its robo-taxi license in San Francisco after one of its robocars

attackedinjured a woman.

How to invest in startups right now:

Look at Africa.

Private Equity and Private Credit

Bullish News

- Companies in Blackstone’s Private Credit Fund (BCRED) have grown at twice the pace of the broader private credit market over the last year.

- Short on PE opportunities, LongWater Opportunities, a boutique PE shop targeting industrial companies, formed a private credit arm.

- BlackRock predicts that the global private debt market will roughly double to $3.5 trillion by 2028.

- PE firms will start targeting IRAs.

- The emerging markets-focused asset management firm Gemcorp Capital LLP is setting up a $1 billion fund to bring foreign investment into some of Saudi Arabia’s most ambitious projects.

Bearish News

- PE shops are being forced to run companies well and grow them organically in order to turn a profit.

How to invest in PE and Private Credit right now:

Wait, probably.

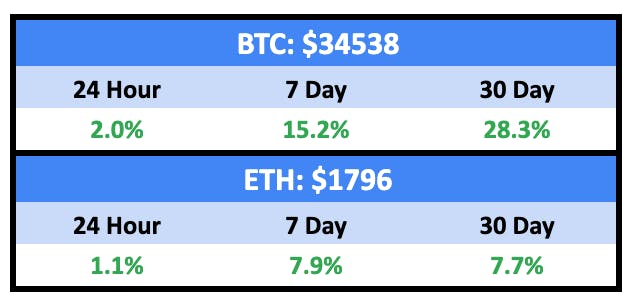

Crypto & NFTs

Here’s what you need to know:

Bitcoin hit $35k for the first time in 17 months.

Crypto’s Fear & Greed Index hit its highest level (72) since November 2021.

Even NFTs ripped last week.

Bullish News

- Bitcoin hit $35k before pulling back last week as the BTC ETF gets closer.

- Last month, Bitcoin decoupled from equities for the first time in two years.

- The supply of Bitcoin on exchanges hit a five-year low, which means:

- Lower confidence in exchanges

- More holders have no plans to sell anytime soon.

- BlockFi has emerged from bankruptcy, meaning account holders can request withdrawals until the end of 2023.

- Mastercard and MoonPay are teaming up.

- Grayscale is teaming up with FTSE Russel to launch five crypto-focused ETFs.

Bearish News

- BlockFi emerged from bankruptcy on Tuesday, saying it will wind down operations.

- The Bank of Montreal is trying to sell off its $5 billion RV portfolio, one of the last pandemic holdouts.

- The Eth Dencun upgrade won’t happen in 2023.

How to invest in Crypto & NFTs right now:

It’s accumulation season.

Quick hits

Art

Former Italian Prime Minister Silvio Berlusconi, who died in June, spent decades acquiring over 25,000 works of art.

It turns out “the 25,000 paintings are largely croste, poor quality works of little to no value.”

The paintings, stored in a 34,400 sq ft warehouse that costs nearly $1 million a year to run, are worth a total of perhaps $22 million. That’s $800 per painting.

Perhaps unsurprisingly:

“He liked to buy portraits of women he gave as gifts to friends. When he was younger, he bought at galleries and from dealers, but later in life, he bought from TV auctions,” Lampronti said.

“He knew what he was buying was worthless.”

In slightly more serious news, Saudi artist Mohammed Al-Saleem broke a world record for Saudi artists this week during Sotheby’s 20th Century Art/Middle East sale in London.

The 1986 piece, inspired by the Ryhadh skyline, went for $1.1 million — seven times the estimate. His previous record was $91k.

We’ve been following the Saudi news closely over the last couple of years. You should too.

That’s all for this week

Cheers,

Wyatt

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Fenchurch Legal and EquityMultiple.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.