Welcome to Deep Dives, where we explore interesting companies in the alt investment space.

I hope you our last issue on One Call Capital — a land financing company founded by two Alts community members.

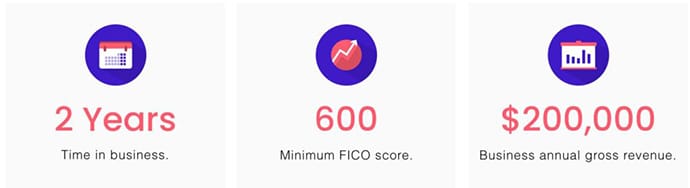

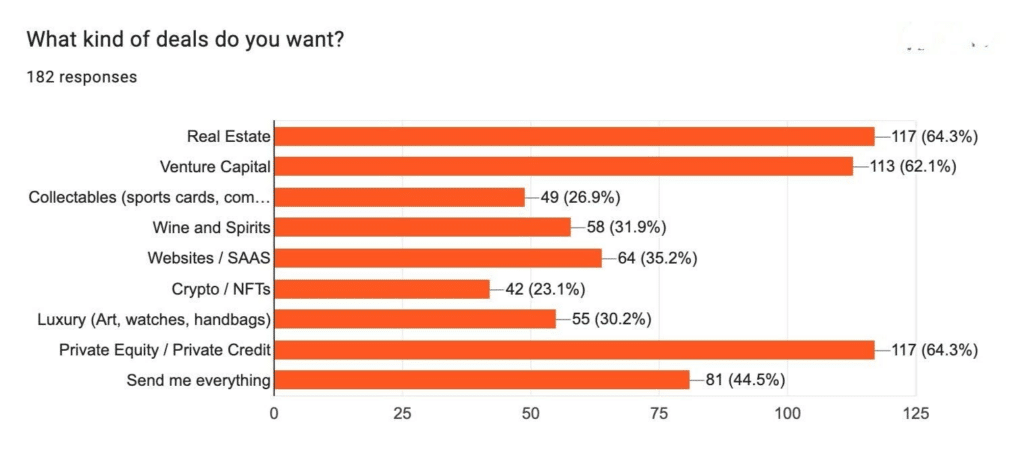

We recently put out a poll asking subscribers what kind of deals they want to see more of. The results had a few surprises, but what really stood to me out was the demand for private credit:

Private credit is going through a golden age right now. But many investors aren’t even aware of what the asset class is.

That’s because it can be a complicated, esoteric market that intimidates even seasoned professionals.

Today, we’ll show why private credit is so valuable to businesses and investors, through the lens of a company called Quiq Capital.

Let’s go

Table of Contents

Private credit 101

Let’s say you’re a successful restauranteur looking to open a new location.

You’ve got the perfect spot envisioned, from the location, to the decorations. The one thing you don’t have, though, is enough capital to get started.

Here are your typical options:

Option 1: You could take out a bank loan.

But banks tend to be very conservative. They like lending to large, stable companies with simple needs. This means they’ll probably charge you a high interest rate and offer little flexibility on the loan terms.

Option 2: You could issue a bond.

This option is very expensive. The costs of hiring investment bankers and satisfying regulatory requirements are likely too great relative to the amount of cash you actually need.

Option 3: You could take on equity investors.

For instance, you could try and convince a venture capital fund to invest in you. But you’re not exactly a startup. Private equity could be an option too, but PE deals usually come with sacrificing a lot of control of your company.

So, the bad news is that being a small, growing company with specific capital needs makes you a bad fit for traditional sources of investment.

The good news, though, is that these traits make you a perfect fit for one non-traditional investment source: private credit.

Private credit is an asset class where investors lend money to companies directly, rather than through a middleman.

In doing so, firms get the best of both worlds: the flexible, fast-moving agreements of equity paired with the non-dilutive capital source of debt. Investors, meanwhile, get access to attractive opportunities that are traditionally underserved and overlooked.

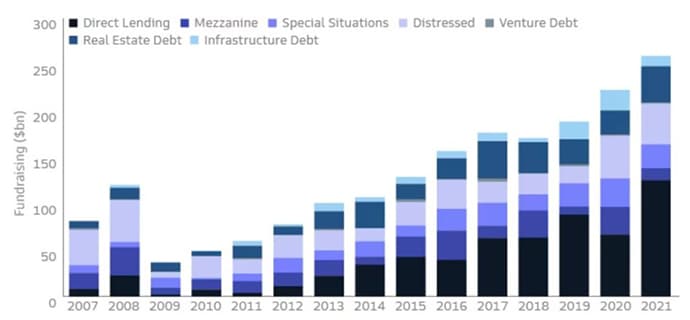

This mutual benefit has made private credit one of the hottest asset classes in recent years. In the wake of the Global Financial Crisis, fundraising for private credit strategies has shot through the roof:

For those who want to dig deeper into private credit as a whole, we’ll have an entire newsletter issue dedicated to the market this Sunday.

For now, we’re focusing on the efforts of one exciting firm in this space – Quiq Capital.

What is Quiq Capital?

On the surface, private credit sounds pretty simple. Companies want to borrow, and investors want to lend. So all they have to do is get together, agree on loan terms, and everyone goes home happy!

Of course, the real world is a bit more complicated.

Think about it: if you’re an ordinary investor, how are you going to find deals? How are you going to structure and monitor them?

It’s basically impossible to do yourself. Even if you can pool your funds with other investors, doing this stuff takes connections, experience, and expertise.

For years, these barriers to entry kept retail investors locked out of this asset class. Now, private credit is changing — all thanks to companies like Quiq Capital who are helping to democratize the market.

Quiq Capital is a private credit underwriter and syndicator. To understand what these mean, let’s take a look at the firm from the perspective of both borrowers and investors.

What they provide for businesses

Let’s return to our example from earlier, where you played the role of a successful restaurateur. As we established, private credit will likely be the best source of capital to fund your expansion.

As an underwriter, Quiq Capital is the type of private credit firm you’d turn to in order to secure the loan you need.

What’s an underwriter?

An underwriter is basically a lender. They’re a substitute for a bank.

But unlike a bank, Quiq can provide the type of custom financing agreements smaller businesses might need. (And, as their name suggests, this agreement can be made on a faster timeline than what a stodgy, slow-moving bank could pull off.)

What they provide for investors

So, as an underwriter, Quiq Capital provides financing for borrowers. But it’s in their role as a syndicator where Quiq is valuable to investors.

What’s a syndicator?

Quiq makes loans, but it doesn’t just keep those loans for itself. It syndicates (i.e. distributes) those loans in portions to everyday investors.

Think of Quiq a a company that sources, vets, and structures private credit loans on your behalf. Quiq helps you overcome those barriers to entry we talked about earlier – and grants access to deals that would otherwise be out of reach.

In other words, they do all the tough stuff.

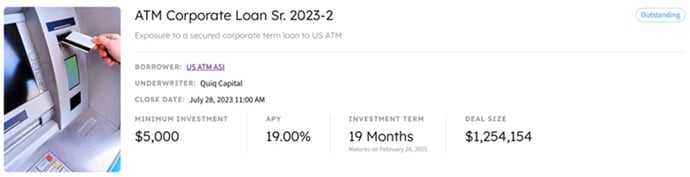

For instance, here’s a deal that recently closed on a private credit marketplace called Percent:

In this case, an ATM company (great passive income business, btw) was looking to raise money to fund its operations. They turned to Quiq Capital to provide the financing. In turn, Quiq Capital syndicated the loan to Percent.

To investors, the benefits of syndication are obvious — Quiq takes on the burden of identifying loans that have good credit risk and generate high current income, allowing investors to access deals in this space.

But borrowers benefit too. Since they distribute portions of existing loans, Quiq can use its balance sheet to make new loans, which drives the entire market forward.

The Quiq Capital team

I’ve emphasized how important experience and expertise are to success in the private credit market.

The team has these traits in spades, hailing from the world’s top institutional investing firms: DE Shaw, DoubleLine, PIMCO, and Brookfield.

Andrew Sklover (Co-Founder and CEO).

Andrew has 10+ experience in finance and was most recently a CMBS/CRE trader at DoubleLine.

In the wake of the banking crisis, traditional lenders have pulled away from business lending, creating an attractive value proposition for direct lenders. Private credit fund managers like us are able to now incorporate restrictive covenants, providing further downside protection alongside attractive interest rates.

Rajesh Bansal, CFA (Co-Founder and President).

Rajesh was also previously at DoubleLine, where he was a Portfolio Manager in CMBS/CRE Structured Products. Before that, he was the Senior Director of CMBS Research at TIAA.

We thrive in the current macroeconomic environment due to a lack of financing solutions for lower middle market companies. While most firms target loan sizes below $500,000 and above $10 million, the lack of institutional capital providers catering to the gap between leaves a significant inefficiency in the market and unmet business needs.

Q&A

How did your company start out? Why was the company founded?

Quiq Capital’s partners began providing loans to businesses in 2018 after observing capable lower middle market businesses struggling to obtain traditional bank financing due to arduous regulatory burdens.

With an increasingly lender-friendly market, the platform was formally rebranded as Quiq Capital in 2021.

What is the problem you’re solving? Who is your target audience?

Given the inability for many lower middle market companies to obtain traditional bank financing, our goal is to provide financing solutions to produce attractive, risk-adjusted returns for our investors.

Our target audience is retail and HNW investors looking to deploy capital into a private credit strategy run by a group of best-in-class investment professionals with decades of experience at top asset management companies.

What is the biggest value you provide for your customers? Why do they pick you over another company?

While banks can take months to underwrite a new loan, we can typically assess and fund a loan within just 60 days.

Additionally, given that we are a direct lender, we are able to structure tailor financing solutions that traditional banks cannot.

What do you offer that nobody else does? What are a few things that differentiate you from your competitors? Could you please go into some detail about the competitors and how you beat them?

Our loan terms can be flexible in amortization, duration, and extension options. We also don’t seek equity or warrants that many of our competitors require. We are focused on providing access to capital that businesses can pay back timely.

We act as a strategic partner to capitalize on strategies that traditional lenders would not invest time underwriting.

What was the tipping point in your success? When did you know you were onto something special?

We realized early on that there was substantial demand for our loan product as we were quickly sent deals from various brokers, bankers and private equity funds, all of which complained about the lack of direct lenders for lower middle market companies.

However, due to the overwhelming market demand, we are now faced with having to turn away some business.

As such, we’re actively seeking to raise additional equity to fund these attractive financing opportunities.

What are your future goals and plans?

Quiq’s primary focus will always remain on business financing.

However, our future plans include expanding into a comprehensive asset management business, inclusive of asset-backed lending, structured credit and fixed income.

Closing thoughts

This is an exciting time for private credit. Not only is the market expanding day by day, but retail investors are finally getting access to a space that was previously the sole domain of institutional interests.

That access wouldn’t be happening without the efforts of innovative companies like Quiq Capital.

Now, to be fair, there are valid criticisms of the Quiq’s model, mostly around risk:

- For instance, syndicating interest in deals to retail investors could make Quiq less concerned about ensuring loans are a good credit risk upfront.

- More importantly, the extent to which Quiq is lending to firms that banks avoid for good reason remains to be seen.

This potential risk is not lost on financial commentators:

Has there ever been an explanation for how it’s fine that the private credit market has boomed while banks get squeezed, or is it just one of those things that’s an unplanned outcome?

— Conor Sen (@conorsen) August 4, 2023

But Quiq is pretty transparent with risk. Investors can perform their own research and choose the specific deals they want to participate in.

And if you’re a business looking to raise capital, just reply to this email, or click here. I’ll make a personal introduction.

Our extended piece on the world of private credit will be out this Sunday.

See you then, -Stefan

Further reading

- Private credit’s dance with borrowers will get only wilder as new financial regulations come out in the US

- Is a rates reckoning coming for private credit?

Disclosures

- Quiq Capital is an Alts sponsor. This was a paid deep dive.

- Our ALTS 1 Fund has no private holdings, nor have we invested in Quiq Capital

- This issue contains no affiliate links.

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Quiq Capital. Quiq Capital has agreed to offer an unconstrained look at its business & operations. Quiq Capital is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.