Welcome to Sports Cards Insider – the FREE version. We use Moneyball tactics to discover undervalued, mispriced, and hidden gems in Fractional Investing.

Today is a deep dive into three assets IPO’ing on Collectable, Rally Road, and Otis. One each:

- Luka Doncic 2018 Panini Signatures BGS 10 Black Label – IPOs 15th March on Rally Road

- Joe Montana 1981 Topps PSA 10 – IPOs 16th March on Collectable

- Lebron James Noble Nameplate RPA /25 BGS 9.5 – IPOs 15th March on Otis

Table of Contents

What is the Luca Doncic 2018 Panini Signatures BGS 10 Black Label?

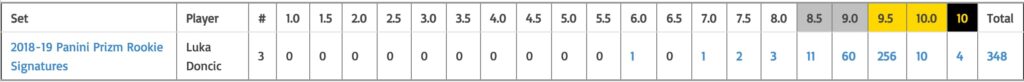

This is one of about 25 parallels Panini ran for the 2018 set. There are 348 copies of this card in the BGS grading registry of which 4 are BGS 10 Black Label.

It IPOs on Rally 15th March

Cultural Relevance

This is the third Luka parallel we’ve written up in the last couple weeks. If you missed previous write ups or want a refresher, you can learn about him here.

Inferred Value

[Detailed valuation available to insiders Only]

Category Strength

The sports cards category has returned 67% ROI so far across the entire portfolio.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

Modern NBA cards have flattened out, and they’re starting to separate out the potential Tier 1 players (Labron-esque) from the merely very very good (Pippen). It’s yet to be seen which Doncic is, but his cards have recovered where others haven’t. (his silver prizm below)

Asset Liquidity

This will have a roughly 90 day lockup period then will trade quarterly.

Platform Risk

Intangibles

I’m so bored of this guy’s parallel cards. But apparently other people aren’t.

What is a Joe Montana 1981 Topps PSA 10?

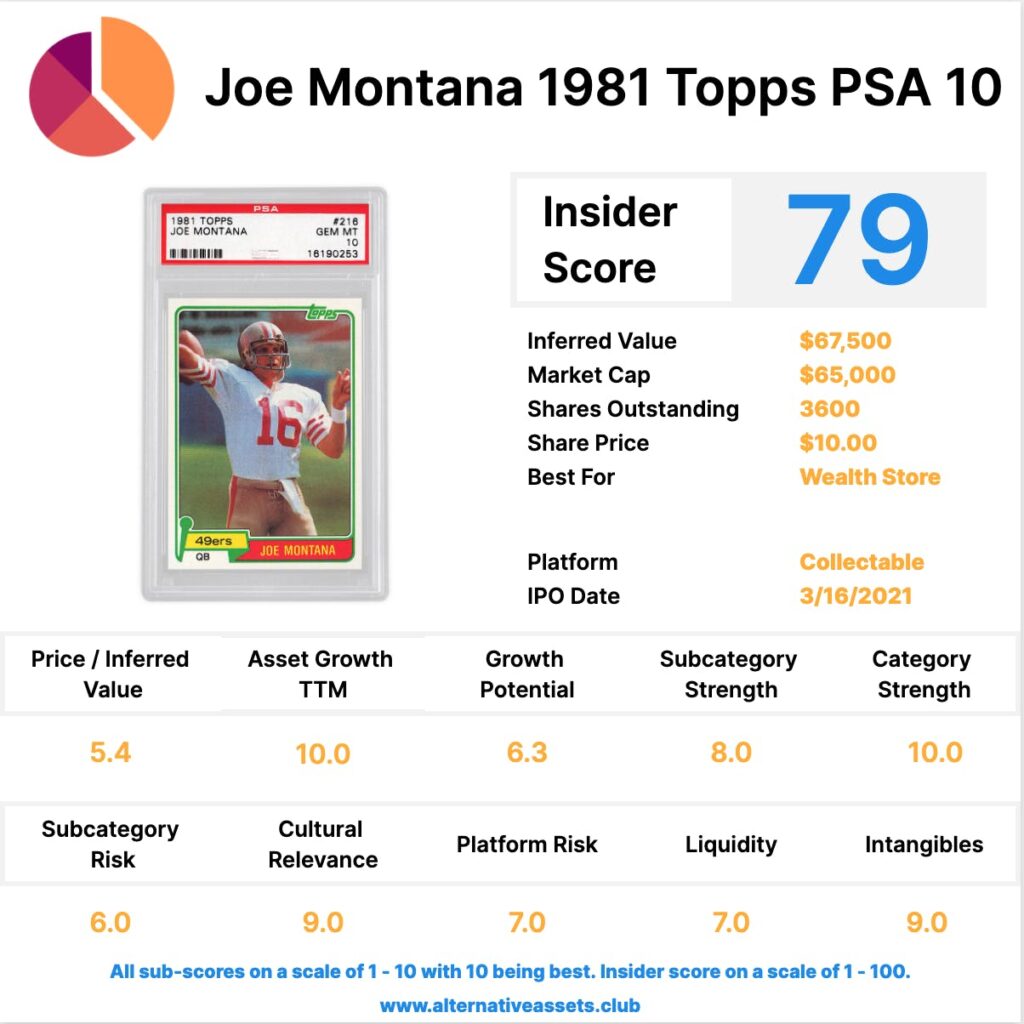

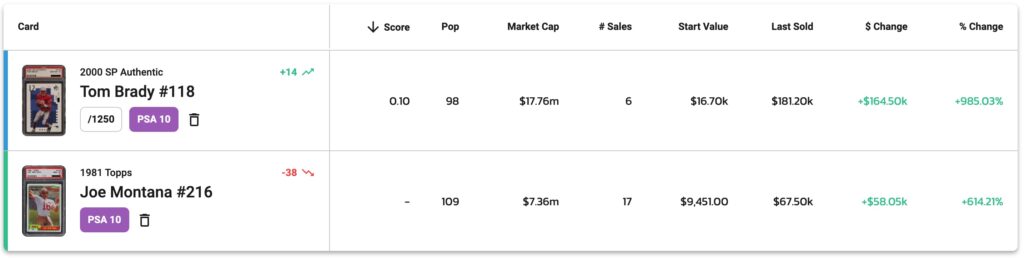

This is Joe Montana’s rookie card graded PSA 10. There are 17,343 graded copies of this card on file with PSA of which 109 are PSA 10. That puts this in the top 0.6% of available cards.

It IPOs on Collectable 16th March.

Cultural Relevance

A master of late-game comebacks, Joe Montana is widely considered the best quarterback of his generation and the best one or two quarterbacks of all time (Tom Brady the other). Collectors seem to rate Brady over Montana based on their PSA 10 rookie cards.

Brady is around 2.5x more valuable than Montana from a market cap point of view, though it’s worth noting he got a significant bump from winning the Super Bowl and has played for roughly 300 more years than Montana did.

Joe Montana redefined the way the game was played, and his (led by Bill Walsh) system was the inspiration for the book and film, Blind Side.

Inferred Value

[Detailed valuation available to insiders Only]

This same card is currently trading daily on Otis with a market cap of $66k, which is right in line. Rally Road has one of these cards in the queue with a market cap of $70k.

Worth noting this card has a retained equity element of 44%, which effectively means the seller will retain full control over the asset.

Category Strength

The sports cards category has returned 67% ROI so far across the entire portfolio.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

Montana is retired, of course, and his card has already had a decent run up. This may be an opportunity to buy the dip on a blue chip card, though.

Asset Liquidity

This will have a roughly 90 day lockup period then will trade weekly.

Platform Risk

Intangibles

His middle name is Clifford.

What is the Lebron James Noble Nameplate RPA /25 BGS 9.5?

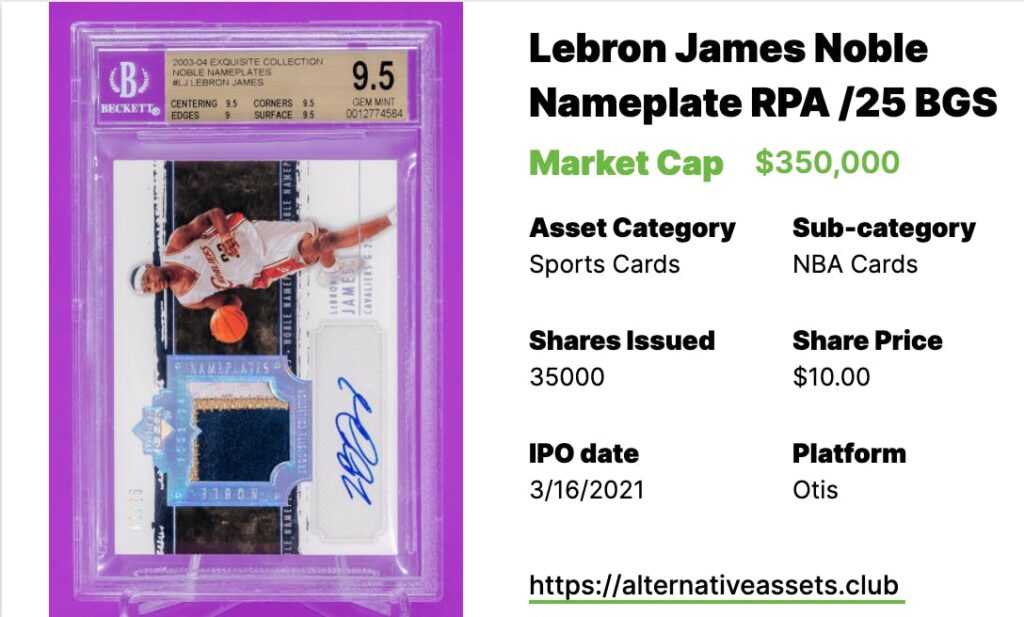

This is one of several limited run parallels from Lebron James’s rookie year. This instance is limited to 25 total and features an autograph and patch from a game-worn uniform.

It IPOs on Otis 15th March.

Cultural Relevance

You know who LeBron James is.

Inferred Value

A similar card most recently sold August 24 2020 for $131,600, though that was a half-grade lower at BGS 9. So what’s this one worth?

[Detailed valuation available to insiders Only]

Category Strength

The sports cards category has returned 67% ROI so far across the entire portfolio.

Subcategory Strength

Risk Profile

Recent Growth Trend

Growth Outlook and Future Catalysts

Lebron cards are at a premium to other modern NBA cards at the moment and should hold value better, but this card is already starting from a very high base.

Asset Liquidity

This will have a roughly 30 day lockup period then will trade daily.

Platform Risk

Intangibles

He’s the King.

Due Diligence Service

If you’re looking to make a big asset investment, we can help you perform due diligence. Stefan created and run Flippa’s Due Diligence program, and can offer the same service to you.

Facebook Group

Our Facebook Group is also now live. Request to join and we’ll let you right in.

Subscription Options

Start your free trial of Insider

Deep research and investment insights, now on thirteen alternative asset classes.