Table of Contents

Welcome to the Big Deal.

What’s the Big Deal?

It’s one exclusive investment idea pumped straight into your inbox. It’s specific, actionable, and probably an investment idea you’ve never heard of or thought about.

If you like it, you can invest. If you hate it, you can smash the delete button.

Last time, we featured WebStreet – a company building out the future of investable websites.

This month, we’re looking at something completely different – it’s an FMCG brand called AKUA, and they’re introducing the west to something the east has known about for centuries — kelp-based food.

It’s got a super low minimum investment — just $100.

If you want to see investment opportunities specifically for accredited investors and qualified purchasers, please let me know.

Let’s get to the Big Deal

AKUA

AKUA is developing revolutionary meat + seafood alternatives made from ocean-farmed seagreens.

Deal overview

- Investment type: SAFE (what’s a SAFE?)

- Valuation: $15m

- Raising: $618k

- Minimum Investment: $100

- Alts member perks: Get 15% off AKUA products using code ALTS15

- Campaign closes: August 17, 2023

- Check it out:

- AMA Session: Three available

Dive into their super slick video to learn more.

TLDR of why I like it

I don’t usually include a team section in these pieces, but I should. Because honestly AKUA’s CEO is what I like most about the investment.

The CEO, Courtney Boyd Myers, is whip smart, persistent, and exudes competence and grit. She’s just one of those people you work with and say “yeah, she’s got it, and she’ll make it work no matter what.”

And that’s what it takes in CPG. I tried running a CPG brand, and I gave up. It’s HARD.

But beyond the CEO, AKUA has other points going for it as well:

- There’s a real need for what they make. America is fat and getting fatter. Food like this is what it takes to reverse that trend.

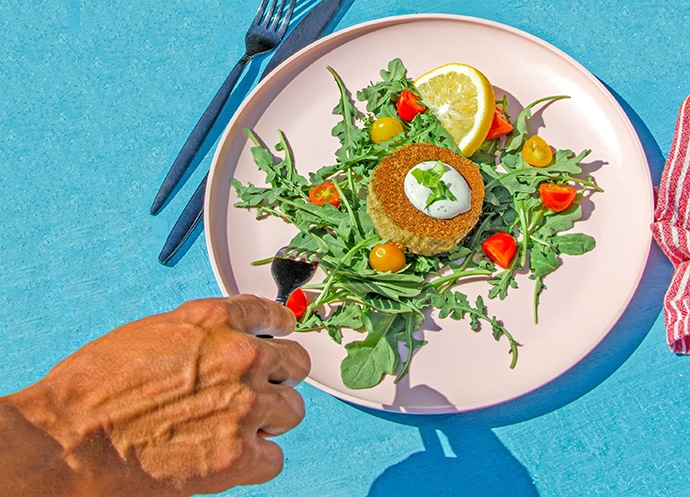

- The food tastes good!

- The market for plant-based meat is proven with a successful IPO already.

- While prices will have to come down for this market to really (really) take off, consumers have demonstrated they’re willing to pay for this kind of product.

Any bet in the CPG world is a risk, but I like the odds here.

What’s the investment?

This is an equity investment in AKUA via SAFE capped at $15 million. If you’re not familiar with how SAFEs work, it’s worth studying up.

Like a lot of crowdfunding campaigns, several potential perks come along with your investment.

Check out the AKUA funding page for a full list, but this is what you get at different price points (shipping to the continental US only):

$1k investment

- FREE Variety 6-Pack of our AKUA SpongeBob Kelp Patties & BBQ Patties

- FREE Kelp Burger Bundle

- FREE Krab Cake Bundle

- FREE Ground Meat Bundle

- 10% off code for one year

$10k investment

- FREE Variety 6-Pack of our AKUA SpongeBob Kelp Patties & BBQ Patties

- FREE Kelp Burger Bundle

- FREE Krab Cake Bundle

- FREE Ground Meat Bundle

- 30% off code for one year

- AKUA x SpongeBob Limited Edition Bucket Hat

- 1-HR Zoom Investor Call with CEO

- Invitation to a 2024 Kelp Farm Tour

$100k investment

- FREE Variety 6-Pack of our AKUA SpongeBob Kelp Patties & BBQ Patties

- FREE Kelp Burger Bundle

- FREE Krab Cake Bundle

- FREE Ground Meat Bundle

- 100% off code for one year

- AKUA x SpongeBob Limited Edition Bucket Hat

- 1-HR Zoom Investor Call with CEO

- Invitation to a 2024 Kelp Farm Tour

- 3 FREE nights at Nickelodeon’s Riviera Maya resort!

- Invitation to the AKUA’s private ‘Saving Bikini Bottom: The Sandy Cheeks Movie’ Launch Party in 2024

Three nights at the Nickelodeon Riviera Maya resort costs nearly $5k — pretty good perk!

At the $100k level, you also get 100% off from the online shop for a year, so you can eat as many Krab Cakes as you want.

What’s the Big Deal?

The Problem AKUA is Solving

AKUA is focussed on solving two problems — big scale climate change and individual level health.

Climate change

From AKUA:

Raising livestock for human consumption generates nearly 15% of total global greenhouse gas emissions, which is greater than all the transportation emissions combined.

This is a worthy cause, of course, and a wholesale shift away from red meat consumption would significantly reduce carbon emissions. According to a study cited by Scientific American, “if every person in the U.S. cut their meat consumption by 25 percent, it would reduce annual greenhouse gas emissions by 1 percent.”

It would also save a lot of water and reduce the amount of pastureland significantly.

That’s great!

But I think the more compelling problem AKUA is solving is the other one.

Individual level health

Are you in the US? Look around. Odds are nearly half the people you see are obese. More than 22% of teenagers (children!) are obese.

America is the fattest country in the world that’s not either a Polynesian island or Kuwait.

This wasn’t always the case. The obesity rate in 1960 was 12%.

What’s changed? A lot of people think it’s chemicals, fertilisers, sugars, and other nasty stuff.

As a silly but helpful example, McDonalds fries in the US have 14 ingredients. There are only four ingredients in the UK. The extra ten ingredients include:

- Hydrolysed wheat

- Hydrolysed milk

- Citric acid

- Sodium Acid Pyrophosphate

- Several kinds of oil

- Dimethylpolysiloxane

Dimethylpolysiloxane is an anti-foaming agent used in silly putty.

The AKUA Solution

This is the ingredient list for an AKUA burger:

Kelp, Organic Extra Virgin Olive Oil, Crimini Mushrooms, Pea Protein, Black Beans, Quinoa, Organic Coconut Aminos (Organic Coconut Nectar, Organic Pure Coconut Blossom Sap, Natural Unrefined Sea Salt), Potato Starch, Nutritional Yeast, Tomato Powder, Chickpea Flour, Pea Starch, Spices, Konjac, Agar

I’m not a nutritionist, but that all looks pretty straightforward to me.

But does the AKUA burger taste good? Because if it doesn’t, no one is going to eat it.

The burgers are well-reviewed across a few different sites. Even notoriously Reddit posters seem to like them.

The burgers sell online for $120 for 24 x 95g patties, or $5 each. That’s pricy, but it includes overnight shipping.

The burger patties are $4 each in store compared with a standard all-beef patty at Whole Foods,which is around $1.50 each.

How does AKUA makes money

AKUA is a fairly standard consumer packaged goods (CPG) company.

They work with a contract manufacturer to produce their food. This means AKUA has hired a company that specialises in making finished food products for brands. It’s fairly standard to do this (nearly all store-brand products are made this way).

While this reduces AKUA’s ability to control every element of the production and packaging process, it is a very cost-effective way to get a CPG product off the ground.

From there, AKUA has three primary distribution channels:

- Online DTC

- Retailers like Albertsons and Vons

- Restaurants

Margins and volumes will differ for each of these, though DTC will have the highest gross margins.

Opportunity size

The total addressable market for plant-based meat is theoretically infinite. It’s a vast spectrum from “a few hippies eat it” to “world government outlaws beef and we all eat kelp burgers.”

But here are the most relevant and well-sourced market sizing stats AKUA has found:

- Plant-based product sales are growing 14x faster than total store food sales (GFI)

- The global alt-protein market will reach $290B by 2035 (BCG)

- Shoppers purchasing plant-based products spend 61% more money than the average shopper (SPINS)

- The top five US meat companies — including Tyson, JBS, Cargill, and Conagra — are all active in plant-based foods

For me, the actual total addressable market boils down to two things:

- Can it taste like beef (or better)

- Can it be produced (and sold) affordably

The entire industry has got to get past early adopters and into mass consumption if AKUA (and others) want to unlock a significant market opportunity.

Growth potential

AKUA is doing plant-based meat its own way, but they’re not blazing a trail here.

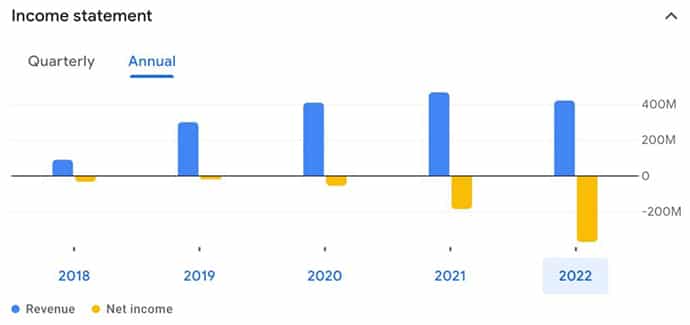

The household name in this industry is Beyond Meat, which currently has a market cap of $1.1 billion and was once valued at over $15 billion.

BYND has got to be a bit of a joke meme stock at this point as they’ve consistently proven a catastrophic inability to make “money.”

But what $BYND has done is proven that people can be convinced to spend nearly a half billion dollars a year on plant-based meat products.

That they’ve done this while spectacularly failing at “business” gives me some confidence that there’s a legitimately big opportunity here for other better-run companies to take advantage of the trail Beyond Meat has blazed.

Because of this, it’s going to be tricky for many CPG brands to exit via IPO. M&A looks much more likely going forward.

And AKUA is realistic about this. Their exit plan (at the moment) is a sale to a CPG conglomerate within the next 5 – 7 years.

Boyd Myers also points out that AKUA’s sustainability metrics will be a significant point in favour of a decent valuation as well, because a number of CPG companies have lofty 2030 sustainability commitments to meet.

Traction

AKUA gives some metrics on uptake along each of its three channels (DTC, retail, and restaurant).

DTC

Its 60% repeat customer rate is excellent, and the $100 average ticket size is great. Combined, that probably gives AKUA customers a lifetime value nearing $250, which means they can spend a lot on customer acquisition.

Restaurant

Likely the smallest channel, AKUA’s fundraising page says the burgers are in a few dozen restaurants nationwide. They’re currently signed up with Baldor, which is an east coast specialty food distributor to restaurants

Retail

AKUA’s retail footprint is around 800 stores right now, and the plan is to grow rapidly via both regional and national distributors.

AKUA has partnerships with UNFI and KEHE, two of the biggest distributors of independent food brands in the US. Partnerships and distribution are what’s going to make this thing fly.

And that’s what this round is all about — scaling up. Again, from AKUA:

The funds will be primarily used for retail launches into over 3,000 stores in 2023 including natural foods retailers and large conventional supermarkets to drive past our $1M revenue target for 2023 and set us up for a successful Series A in 2024.

Onward.

Valuation

From Courtney Boyd Myers, CEO at AKUA:

We did approximately $600k in gross revenue in 2022 and expect to do $1M in 2023. Our $15M valuation is based on our growth as a company in retail and food service (10x growth) since our $13.2M priced valuation in August 2021. We also put a lot of value on other areas of our business – like our celebrity partnership with Nickelodeon, our impact metrics as it relates to climate change, which makes us a more valuable acquisition target, as well as the high profile team members we are bringing on and announcing soon!

Further colour:

This year in 2023, we are targeting between $850-1M in revenue, with over 50% of that in retail and food service, up from 10% in 2022. We are targeting being EBITDA positive within 36 months of scale.

Both deal volume and values have fallen in the CPG acquisition space over the last few years:

Last year, an estimated 254 deals were consummated in the food and beverages sector in the U.S., compared to 304 in 2021, according to data provided by Dealogic.

While the number of deals declined by 50, the average value of a transaction last year was sharply lower at $67.5 million, versus $148.4 million in 2021.

While valuations have come down recently, I don’t expect that to be the case by the time AKUA is eyeing an exit. I’d expect something in the 3x revenue range.

AKUA is forecasting revenues of $33 million by 2027, which would suggest an exit valuation of (more or less) $100 million.

Should that go to plan, that’s roughly a 61% IRR less dilution from subsequent rounds.

The risks

And that subsequent round is the biggest risk facing AKUA. While this raise will help Boyd Myers scale into distribution for the burgers, crab cakes, and so on, it won’t get the company to profitability.

The two big dependencies around AKUA’s ability to raise a Series A next year are:

- Can the company expand its footprint enough — perhaps 3,000 retail outlets will suffice, and

- Where will the venture market for CPG companies be a year from now?

If you join the AMA session, which I suggest you do, these are questions I’d put to the CEO.

How to invest

AKUA’s funding round is open now, and you can invest with a minimum of $100.

That’s it for this week.

If you have a deal you think we should share with our 95k members, please get in touch.

See you on the beaches

Disclosures

- Participation in Big Deals is a competitive process. Investment sponsors, founders, etc submit their deal, and we choose the best of the best.

- We hold a $7,500 equity stake in AKUA. We received this equity as compensation for producing and distributing this report.

- We feel this is the best way to ensure incentives are aligned.