Today we’re exploring the world of ATM machines.

Most people don’t think much about ATMs. We all just pop in our card and withdraw cash.

But there’s fascinating stuff going on behind the scenes; common languages, alliances, and of course a web of fees up & down the chain.

If you ever wondered about the economics and “plumbing” behind ATM machines (and want to know how to invest in them), this issue is for you.

You’ll learn:

- Who invented the ATM?

- How did ATMs grow so quickly?

- How do “no-name” ATMs talk to your bank?

- What are EFT networks?

- What are the biggest EFT networks you’ve never heard of?

- How do surcharge-free ATMs make money?

- What’s an ATM alliance?

- 🎟️ What companies have the largest ATM alliances?

- 🎟️ How do you invest in ATMs?

- 🎟️ How much do ATM machines cost to buy?

- 🎟️ What’s the toughest part about ATM investing?

- 🎟️ What does the future of ATMs look like?

- 🎟️ What are ITMs and Reverse ATMs?

- 🎟️ What are “Cashless” ATMs (and are they legal?)

Note: This is a paid edition. To read the full issue you’ll need the All-Access Pass 🎟️

Table of Contents

Banking’s best ‘boring’ innovation

When we talk about financial innovation, it’s usually about things like digital banking, crypto, or new ways of fundraising (like Regulation CF or Regulation A).

But one “boring” technology has arguably had a bigger impact on financial services than any other:

The ATM.

The introduction of the ATM in 1967 fundamentally changed people’s relationship with banking.

For the first time ever, you didn’t need to be at the bank to do your banking. This revolutionary idea has now become so commonplace that it seems ancient (personally, I haven’t visited a physical bank branch in five years).

But automating “bank tellers” (and abstracting dollars away from their core physical location) was a very big deal.

Who actually invented the ATM?

It’s controversial.

The most popular narrative is that British engineer John Shepherd-Barron conceived the idea in a eureka moment —allegedly while pondering chocolate vending machines in the bathtub.

While the bathtub episode is a nice anecdote, it’s not the whole story.

The “true” inventor of the ATM is hotly contested. Entire websites are dedicated to the debate, and PR battles between competing inventors.

In reality, it wasn’t invented by a single person. The modern ATM is the offspring of a few related projects:

- The Bankograph could automatically accept cash and deposit checks. Invented in the 60s by Luther Simjian, it was shut down after a 6-month trial in NYC because nobody used it.

- In 1966, a guy named James Goodfellow patented another PIN-based automated cash machine in the UK . For his invention, he received a £10 bonus.

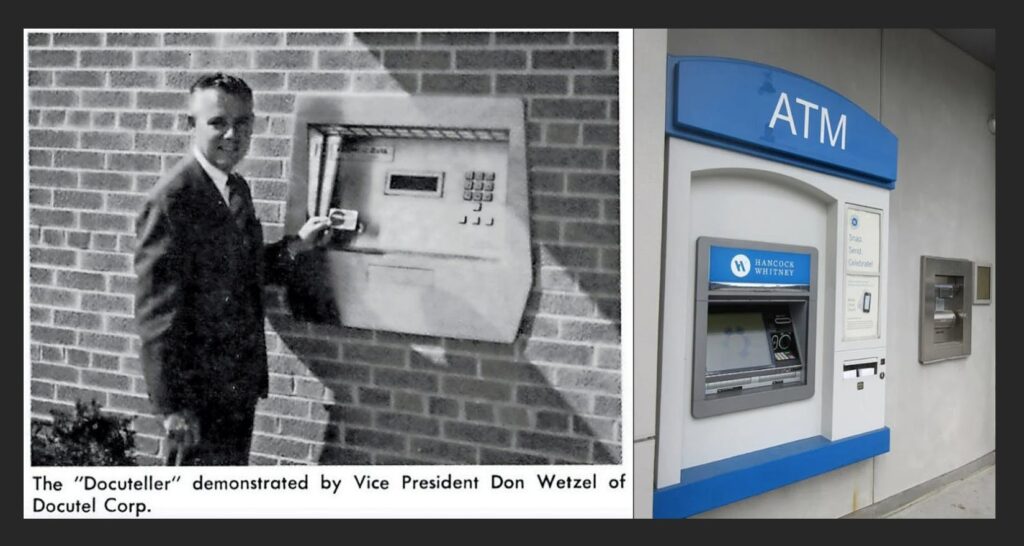

- The Docuteller, an ATM that Don Wetzel and company independently invented and deployed in New York in 1969.

What is agreed upon, however, is that John Shepherd-Barron (the British guy above) led the team that installed the first modern ATM at a Barclays branch in London in 1967.

Regardless of who created it first, the ATM had absurd growth during the 80s and 90s.

How did ATMs spread so quickly?

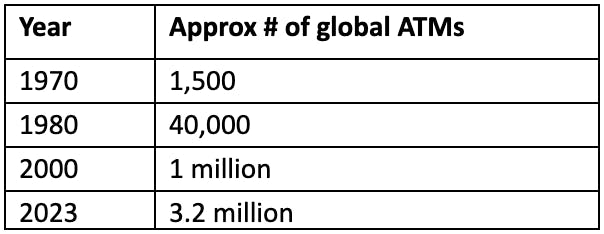

At the beginning of the 1970s, there were about 1,500 ATMs deployed globally.

This was a quick ascent for such a new technology, but nothing like the growth bomb that was about to hit:

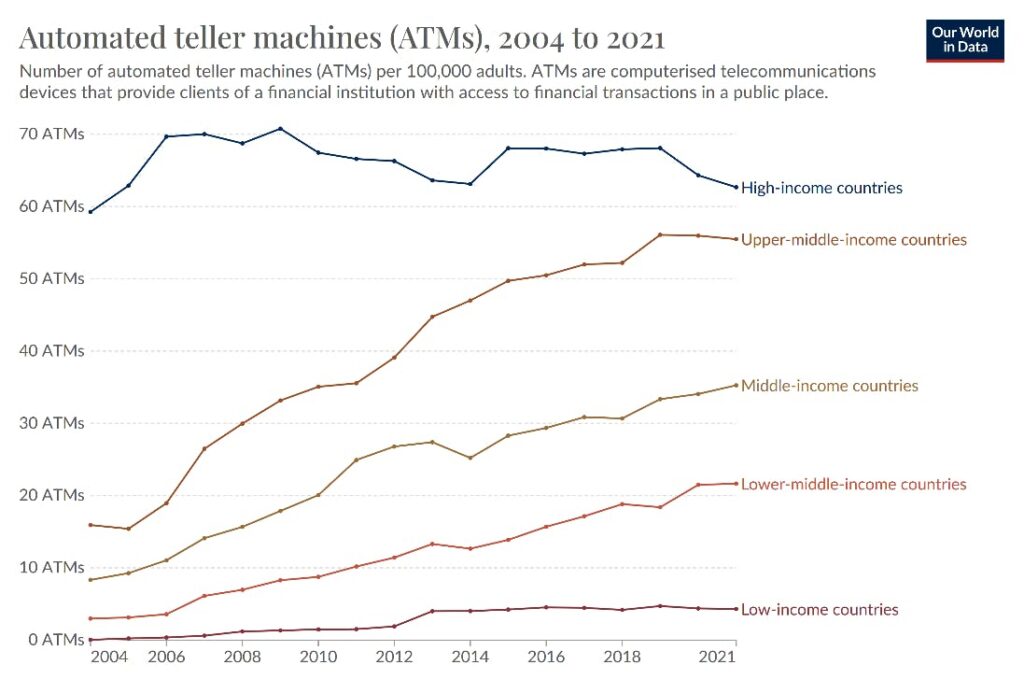

It’s easy to point to convenience as to why ATMs became so ubiquitous so quickly. But their spread was also simply because the world got richer.

As a country develops, the use of cash tends to fall. Critically, wage payments start to be made not by cash, but by via bank account transfer.

This means in order to get their hands on cash, people need to either visit a bank, or an ATM.

Paradoxically, a country that relies less on cash needs more ATMs.

Of course, there are limits to this dynamic.

In a society so rich that it abandons cash altogether, ATMs start to lose value.

This is why high-income countries have seen a noticeable decline in the number of ATMs in the past few years. (We’ll discuss the idea of cashless societies in more depth later on.)

How do ATMs actually work?

On the surface, an ATM withdrawal seems pretty simple. Insert your card, enter your banking info, withdraw cash, and let the bank deduct it from your account.

But this apparent simplicity hides a world of complexity underneath. After all, our simple model cannot answer a range of crucial questions:

- How is it possible that you can withdraw cash from the ATM of a bank that you don’t have an account with — including foreign banks when you’re traveling abroad?

- For that matter, many ATMs aren’t owned by banks at all. How do independently owned ATMs get access to your bank account?

- Why do some ATMs have a surcharge for withdrawals and some don’t? And how do surcharge-free ATMs make money?

To answer these questions, we need to dig into the behind-the-scenes financial infrastructure that makes it all possible.

In the process, we’ll see how what was simply a convenient service offered by your bank became a lucrative business in its own right.

EFT networks are the key to everything

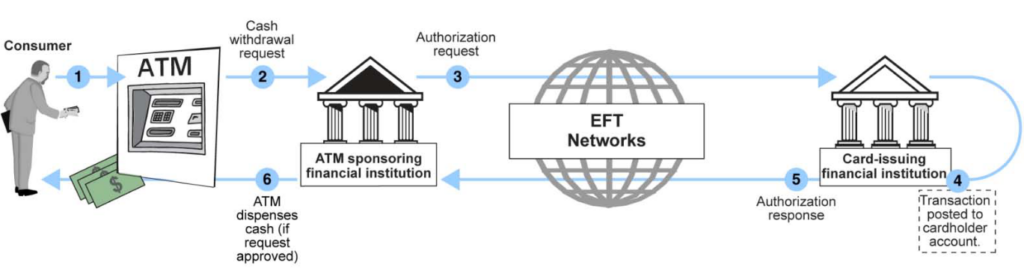

ATMs are only made possible by EFT networks (Electronic Funds Transfer). These crucial networks link banks together in order to verify and authenticate transactions.

Let’s say you have an account with “Alpha Bank,” but want to withdraw cash from an ATM operated by “Delta Bank.”

In this case, Alpha Bank simply needs to connect to an EFT network in common with Delta Bank to verify that you have enough money available to execute the transaction.

If Delta Bank signs off, you’re good to go. Alpha Bank fronts you the cash, and the two banks settle up later.

But the situation gets more complicated when you want to withdraw cash from an ATM run by a “no-name” ATM, or what’s known as an Independent ATM Deployer (IAD).

Since non-bank operators can’t use EFT networks on their own. this case, the IAD needs to get sponsored by a big bank to access EFT networks.

From here, the process works much the same as before: The sponsor bank contacts Delta Bank to verify sufficient funds for the withdrawal. But this time, the IAD fronts you the money.

Basically, EFT networks provide the common language for the world’s ATMs to communicate. Banks know how to speak that language, but IADs need a translator (a sponsor bank).

And just like the real world, there are both international languages and regional dialects:

- International networks, like Cirrus (owned by Mastercard) and Plus (owned by Visa) span the entire globe..

- …but domestic networks are focused on a country or region. In North America, these include Accel, STAR, NYCE, MoneyPass, and Allpoint.

Cirrus and Plus are two of the two largest international ATM networks. Between them, they cover millions of ATMs.

If your debit card has a Mastercard or Visa logo (which most do), then congratulations: You can seamlessly withdraw cash from almost anywhere in the world.

In days gone by, networks were satisfied just being networks; sitting in the background, facilitating transactions, and earning fees for doing so.

But lately, networks have stepped out of the background, helping spark the rise of fee-free ATMs.

Money for nothing: The rise of surcharge-free ATMs

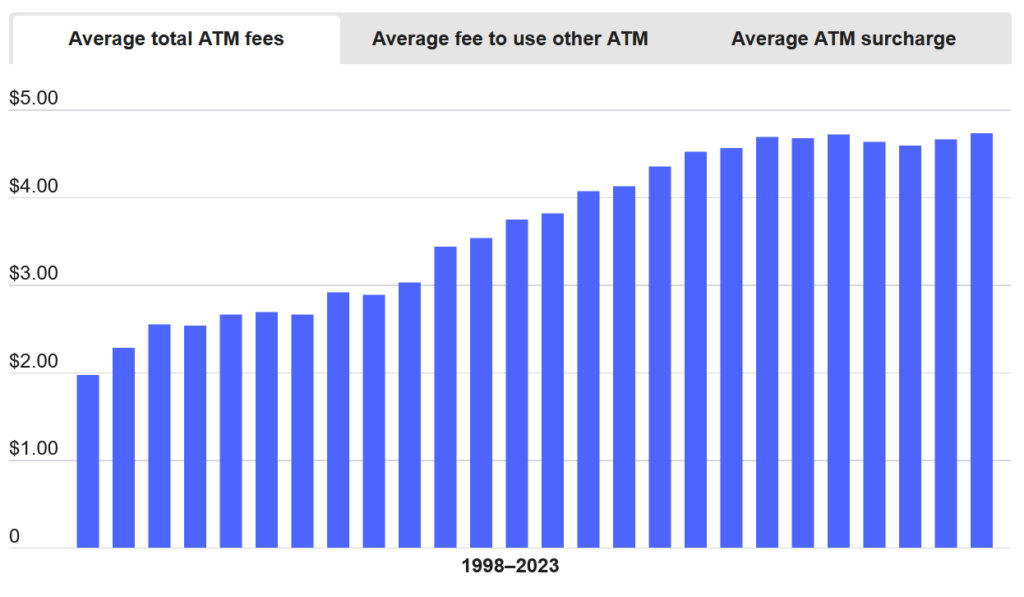

Here’s the thing about ATM fees: users hate paying them.

Almost 80% of people will do anything they can to avoid paying ATM fees — a feeling that has likely intensified as fees have continued to rise.

Generally speaking, banks offer ATMs to their account holders as a perk, while IADs offer ATMs as a business.

That’s why you don’t get a fee for using your own bank’s ATM, but you’ll probably get smacked with one for using the unbranded ATM at your local bar.

What’s an ATM alliance?

But here’s the problem: While rolling out a nationwide fleet of bank-owned ATMs might be possible for JPMorgan Chase, it’s way too expensive for smaller banks.

The solution? Get a bunch of banks to form an ATM alliance, where account holders at all the participating banks can use the alliance’s ATMs for free.

And who better to fill the alliance role than the EFT networks themselves, which already link the banks together in the background!

- Allpoint used to be just a network, but they now own or operate 43,000 fee-free ATMs in the US (with about 2,000 member banks).

- Similarly, Moneypass was originally formed from two regional networks, and now has about 40,000 fee-free ATMs in the US (and about 1,000 member banks).

In total, Moneypass and Allpoint account for about 16% of all ATMs in the US.

Instead of charging users directly, these companies get paid by the banks themselves (usually on a per-transaction basis).

Still, there are plenty of fee-charging ATMs around the world. And, if you get access to a good location, they can potentially be a lucrative business opportunity.

How do you invest in ATMs?