Hi everyone,

You may get the sense that Accreditation has been on our minds lately.

While public investments can be purchased by almost anyone, the unfortunate fact is that non-accredited investors miss out on private investing opportunities,

While the normal route for an investment to be offered to the public is through an initial public offering (IPO), it’s incredibly expensive.

But in 2015, the SEC rolled out a potential solution: A package of important amendments to an old exemption known as Regulation A.

For companies like Groundfloor, this law was groundbreaking.

In this issue, you’ll learn:

- What are the benefits of Reg A?

- What are the drawbacks?

- Why are Reg A and real estate a perfect match?

- How did Groundfloor get a big head start in Reg A?

- What are LROs and how do they work?

- What are notes, and how do they differ from LROs?

- How do you analyze LROs?

Note: This issue is free, and sponsored by our friends at Groundfloor. As always, we think you’ll find it informative and fair.

Let’s go 👇

Table of Contents

What is Reg A?

Regulation A (commonly known as “Reg A“) is like a mini-IPO.

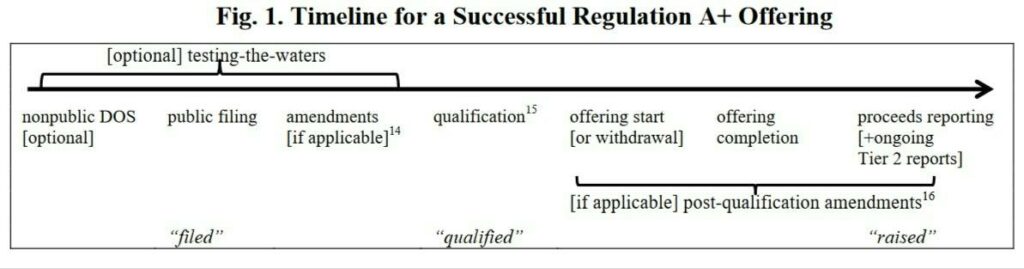

Under Reg A, companies can have their capital raises qualified by the SEC in a streamlined process, allowing them to sell to accredited and non-accredited investors.

(Note: Accreditation qualification is not an endorsement of an investment’s merit. But I digress…)

What are the benefits of Reg A?

For companies, Reg A can be a great alternative to traditional IPOs or private placements.

It’s generally faster and less expensive and faster than a traditional IPO, and it’s not limited to just selling equity investing either; companies can also issue debt and convertibles.

For investors, Reg A allows them to participate in offerings from companies that they may not have had access to before, for two big reasons:

- Accreditation isn’t required. Investors don’t have to be accredited (as we mentioned above) and

- Fractionalization. Instead of selling an entire asset, offerings can be divided into smaller, more affordable fractions, meaning investing is accessible to a broader range of investors. People can participate with lower capital outlay, benefit from appreciation, and even share the income generated from the property (such as rental income, which we’ll get into below).

What are the drawbacks?

One major drawback of Reg A is that firms can only raise a limited amount of cash, which is why it’s better suited to smaller companies.

Under Tier II (the most popular form of Reg A capital raises) companies can raise up to $75 million in a 12-month period – but need to provide audited financial statements and file ongoing reports. (Real fun stuff.)

Despite these limitations, Reg A has proved very popular. In 2022, companies raised around $1.8 billion through this process.

And one industry is particularly well-suited for Reg A, and has made widespread use of the law: real estate.

Why real estate is the perfect match for Reg A

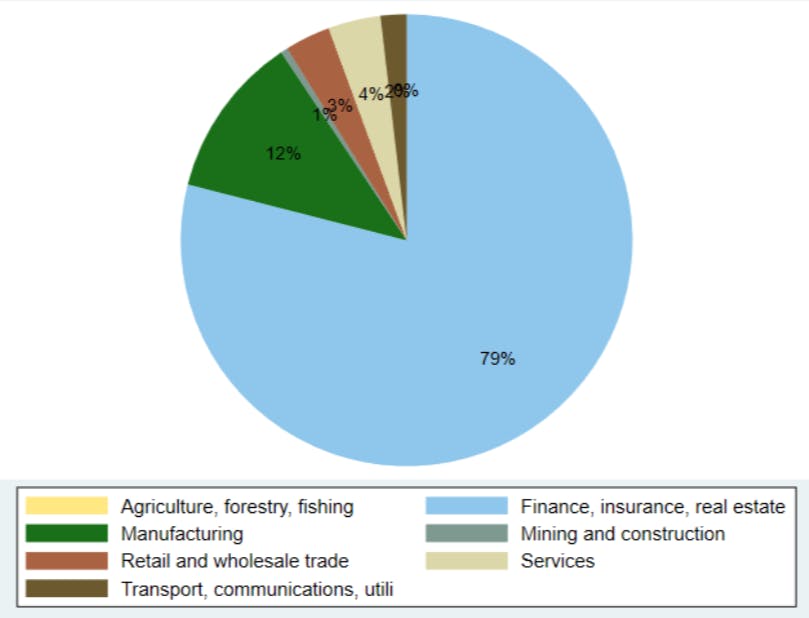

Reg A companies seem to have a particular affinity for real estate.

A 2020 SEC report noted that from 2015 to 2019…

“offerings of real estate issuers accounted for the largest share of proceeds reported raised in Regulation A offerings.”

While that trend has slowed, real estate is still overrepresented in Reg A raises.

Of the $1.8 billion in capital raised in 2022 under Reg A, over 40% ($755m) went to real estate companies.

And this makes sense! Because if there’s one industry that’s primed to be transformed by Reg A, it’s real estate.

Why?

- Real estate is tangible and easily understood by non-accredited investors.

- Real estate is capital intensive, meaning there’s always a need for new fundraising.

- Due to extremely high barriers to entry (i.e., 20% down payments), the industry has historically been just for the wealthy (or those with rich parents). This makes it a perfect target for fractionalization.

One company has made better use of Reg A rules than almost any other, because they helped write them.

That company is Groundfloor.

What is Groundfloor?

Groundfloor is a real estate investing platform that specializes in residential real estate investing through the power of Reg A.

(In fact, Groundfloor was the America’s first company to offer a Reg A qualified real estate opportunity.)

Homeownership is equated with the American Dream (and considering the US suffers from a housing shortage of over 3 million units.) But if you wanted to invest in residential real estate on your own, you’d need millions of dollars and a lot of sweat equity to build a diversified portfolio.

Investing through a real estate fund isn’t always better, due to high fees, limited liquidity, and a lack of control. But Groundfloor lets anyone diversify into dozens of real estate projects for just $100.

They focus on high-yield debt investments (generally considered less risky than real estate equity.)

Their success is due in part to the fact that they had a bit of a head start in the world of Reg A.

How did Groundfloor get such a big head start?

Co-founder Nick Bhargava had a helping hand in the creation of the JOBS Act, the 2012 law that directed the SEC to implement new rules.

Nick’s involvement with the creation of Reg A is indicative of the firm’s extensive understanding of US securities law, and how they’ve used that knowledge to power regulatory innovation in pursuit of real estate democratization:

- Way back in 2014, Groundfloor used the little-known Invest Georgia Exemption to test out an idea of bringing real estate debt investing to a broader market. (This model had not been tried previously)

- In 2015, the firm used a Tier I qualification to get approval for the first real estate Reg A offering.

- In 2018, Groundfloor upgraded to a Tier II qualification, allowing investors nationwide to participate in their real estate debt instruments.

- Groundfloor has taken a novel approach to raising capital for itself, allowing customers to invest in the company through Regulation CF.

- Today over 30% of Groundfloor is customer-owned, which ensures the company’s incentives are aligned with their own customers, rather than being purely beholden to VCs.

What scale is Groundfloor at today?

Today, Groundfloor has built a community of ~230,000 users, with total investments on the platform surpassing $1 billion.

With this level of scale, they can offer far more options to retail investors than other alternative investment platforms.

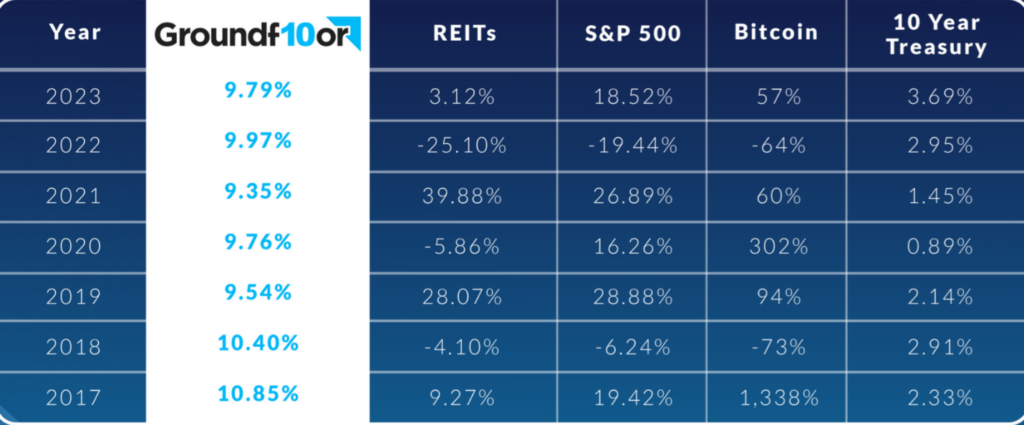

They’ve also been able to keep up an impressive string of steady, high returns. No investment is guaranteed, but Groundfloor has been averaging 10% returns since they launched, even as other asset classes swing wildly.

Groundfloor offers a few different investment opportunities. Notably, none of them have fees.

Investment opportunities

LROs

Groundfloor’s classic investment opportunities are known as Limited Recourse Obligations, or LROs.

You don’t actually need to know much about LROs to invest, but LROs are basically high-yield debt investments secured by an underlying real estate asset — typically a first mortgage loan.

Nearly all of Groundfloor’s LROs are in first lien position, meaning they get repaid before any other financing. Having a tangible real estate property behind the investment makes the loan more secure.

Here’s how an LRO works:

- Groundfloor makes a loan to a carefully vetted real estate developer, usually for a fix & flip project. This loan is secured by the value of the property.

- Groundfloor issues the loan to the borrower, then packages the LRO as a security (which is qualified for sale by the SEC)

- This means individual investors can fractionally invest, with as little as $1 following an initial $100 deposit.

- With automatic diversification, your funds are fractionally deployed into dozens or even hundreds of these LROs. You’re kind of like a bank, investing in an entire portfolio of loans. (Note: Groundfloor does give you the option of picking and choosing individual loans, but this requires more real estate investment knowledge)

- As Groundfloor gets repaid for the underlying loan, payments flow through to investors in the LRO. Investors who are automatically diversified across projects see returns on their investments in as little as 7-10 days.

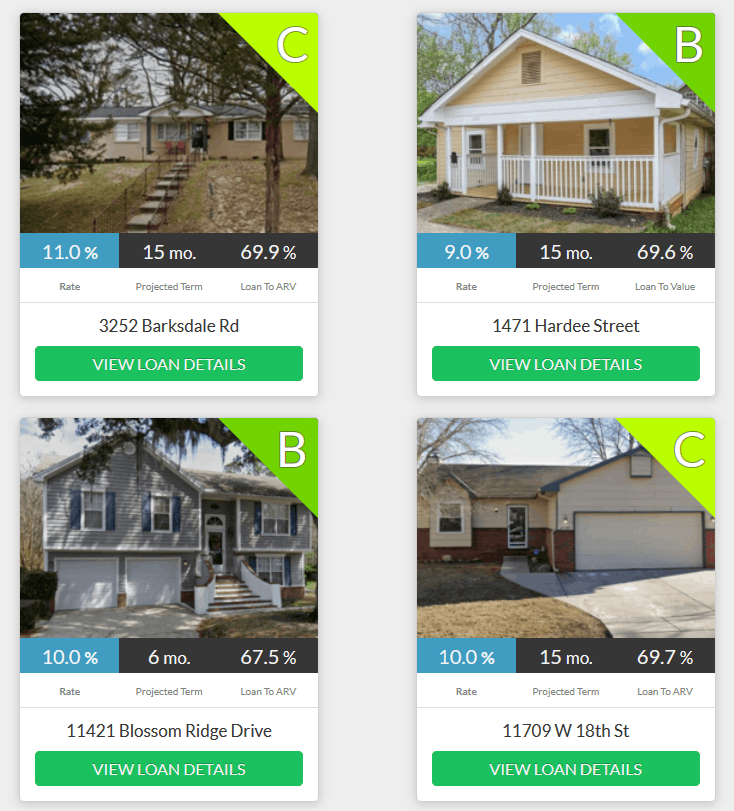

If you do want to pick and choose individual loans, Groundfloor has a risk rating system to make the LROs a bit easier to navigate.

The system rates loans from A to G, with an A rating being the least risky (but also potentially the least rewarding).

Groundfloor says that 94.7% of their loans have been repaid with full principal and interest through Q1 2023. But even that might overstate the level of risk.

The loss rate, for instance, which measures the number of loans that lost principal, is just 1.8%.

Here’s the bottom line – Groundfloor has over 10 years of operating history, and throughout that time, investors who have adequately diversified their investments have earned over 10% net (inclusive of all principal losses.)

Notes

Similar to LROs, Groundfloor Notes are debt instruments. They come with

- Fixed rate of return, and

- A set maturity date.

Unlike LROs, Notes are secured by a portfolio of underlying loans, rather than just a single loan.

But importantly, Notes aren’t just a collection of LROs. Instead, they’re made up of loans originated by Groundfloor, but which haven’t been used to back LROs.

This achieves two things:

- It massively increases diversification since you’re funding a pool of loans

- It reduces the correlation between the performance of your LRO and Note investments, providing extra security

Auto Investing & Self-Directed IRAs

These offerings aren’t really different types of investments, just different ways to invest in existing Groundfloor opportunities.

Groundfloor recently launched their Auto Investor Account, which is designed to make diversification in high-yield opportunities easier than ever.

When you fund an Auto Investor Account, a proprietary Groundfloor algorithm automatically selects LROs to invest in on your behalf, aiming to reduce risk while targeting high returns.

Groundfloor also offers a self-directed IRA option, which allows gains from your LROs to accumulate tax-free.

For more on why self-directed IRAs are such a powerful tool in the world of alternative investing, check out our retirement loophole guide.

Deal Breakdown: How to analyze LROs

Again, Groundfloor allows you to deposit as little as $100 and be automatically diversified into dozens of loans at once.

But if you wanted to analyze a specific project to invest into, you can actually do that as well. Think of it like investing into an index fund versus a specific stock. Both have their rewards and risks.

The world of real estate debt investing can come with a lot of unfamiliar terms. So let’s briefly walk through this repaid LRO to understand how to effectively analyze these opportunities.

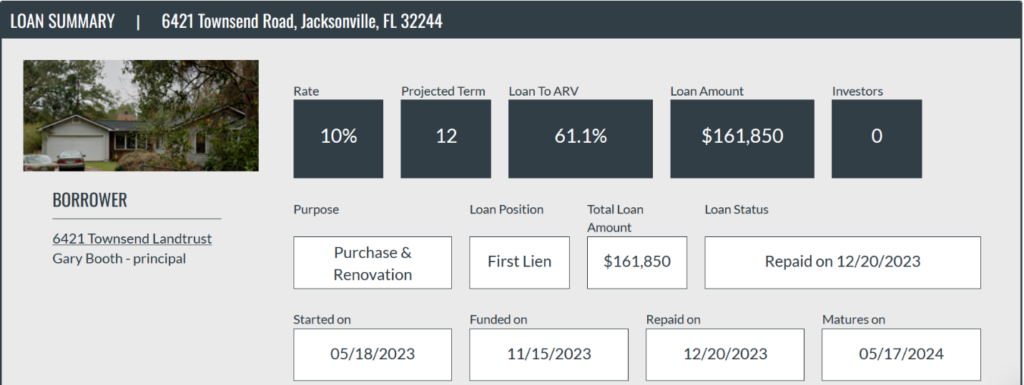

This loan for 6421 Townsend Road was repaid over a month ago.

Here’s what we can learn from the loan summary:

- 10%. This is the annualized interest rate on the loan. Crucially, this isn’t the rate investors should expect to earn, since the total interest earned depends on how long the loan is actually outstanding.

- Loan Amount: $161,850. This is simply the amount Groundfloor lent the borrower. Investors are currently listed as 0 because the loan has been fully repaid.

- 12-months. This is how many months the underlying real estate project is expected to take.

- 61.1% Loan to ARV. ARV is the “After Repair Value.” It’s the value of the property after all construction and renovation has taken place. This measures how secure the loan is, since the property serves as collateral for the loan. In this case, the loan amount ($161,850) is 61.1% of the total ARV ($265,000).

- Purpose: Purchase & Renovation. This indicates that the borrower will use the funds to buy the house, rehab it, and then sell it for more money (also known as a “fix & flip”).

- First Lien. This is a first lien (or first position) loan, meaning that this loan needs to be paid back before any other financing. If the loan enters default, then a first lien is also first in line for recovery, making it the most secure form of lending.

The dates on an LRO can be a bit confusing:

- Started on is the date that the actual construction project started.

- Funded on is the date that the LRO was funded by investors on Groundfloor.

Why the gap between these two dates?

As we discussed, Groundfloor pre-funds loans and then needs to qualify the LROs with the SEC. That creates a delay between when the projects are initiated and when investors can actually participate.

- Matures on is the date by which the borrower has to repay the loann

- Repaid on, repayment actually occurred much quicker than the planned maturity.

This highlights the risk of prepayment, which might cause investors to earn less in absolute interest than they originally anticipated.

Still, you’d receive principal back sooner than expected, meaning you can reinvest it and start earning interest again immediately.

Financial overview

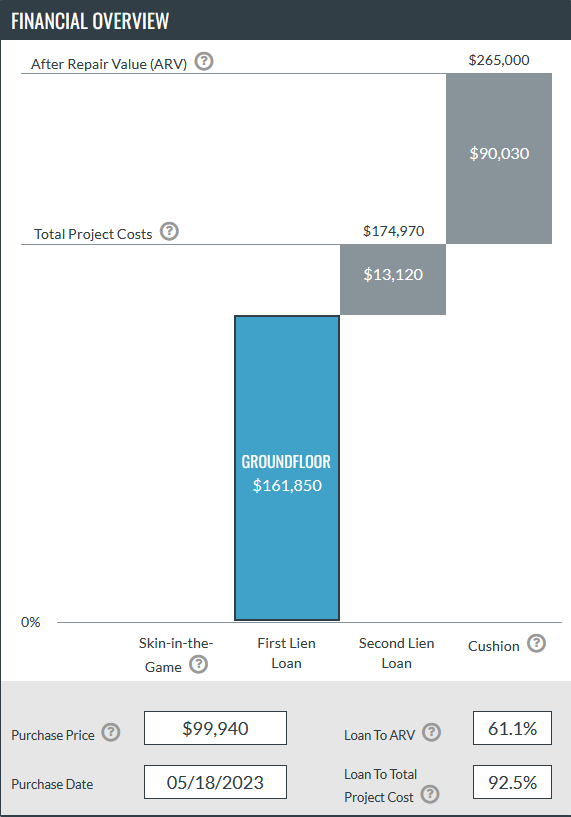

Turning to the financial overview of this loan, we can see a visualization of the capital stack for this project.

The lack of any skin-in-the-game (basically equity money) could be a red flag, as it indicates the borrower doesn’t have their own money tied up in the project.

Instead, the borrower sourced additional debt financing in the form of a second lien loan.

While the first lien LRO has a 61.1% loan to ARV ratio, the loan to total cost ratio is significantly higher at 92.5%. Moreover, total debt financing is actually 100% of the project cost.

Risk analysis

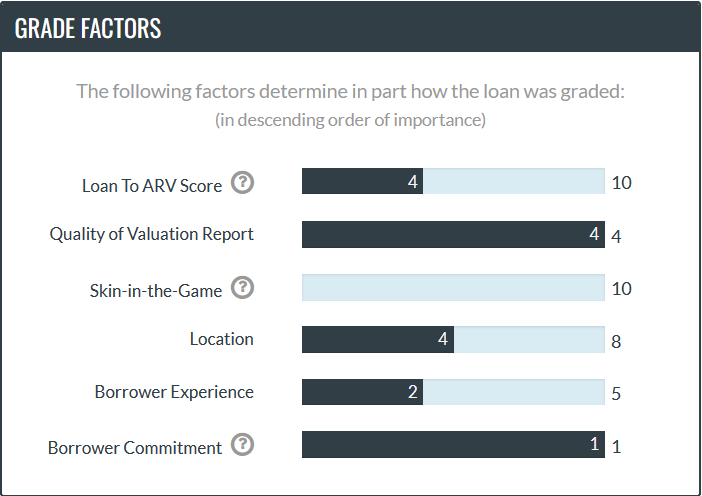

Now we can understand how Groundfloor itself evaluated this deal, assigning it a risk rating of B.

The loan was a bit of a mixed bag in terms of grading. While the loan to ARV score was a bit high, Groundfloor was very confident in the quality of the post-repair valuation.

Similarly, while the lack of skin-in-the-game was a drawback, the borrower was committed full-time to the project.

Ultimately, this loan was paid back in full and prior to maturity – but every deal is different, and understanding how to analyze each individual opportunity is key to strong performance.

Again, since Groundfloor rolled out its auto-investing feature last fall, the beauty of investing on the platform is that you are automatically diversified across hundreds of projects at once (akin to an index fund), thereby minimizing the risk if you were just to invest in one individual project.

See you next time, Brian

Disclosures from Alts

- This issue was sponsored by Groundfloor

- The ALTS 1 Fund holds no interest in any companies mentioned in this issue.

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Groundfloor and their associated markets. Groundfloor has agreed to offer an unconstrained look at its business, offerings, and operations. Groundfloor is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.