Hello and welcome to Alts Cafe

This is a quick-fire look at what’s driving your alts week.

What’s on deck today:

- Remember irrational exuberance? It’s back!

- Real estate continues to get worse.

- Crypto took some profits.

- The private credit bubble is upon us.

Table of Contents

Macro View

Bullish News

- Markets everywhere ripped off the back of a rate freeze and dovish guidance from the Fed.

- Economists are now predicting a soft landing.

Bearish News

- Chicago Fed President Austan Goolsbee says the Fed’s fight against inflation isn’t over yet. NY Fed President John Williams said, “We aren’t really talking about rate cuts right now.”

- Undeterred: The CME is currently pricing in seven rate cuts in 2024.

- I note this as bearish because it’s stupid, and if that’s what the market is pricing in, we’re in for a fall.

What are the odds?

Forecasts come from Kalshi.

Get $25 to play around with using this link.

What are we doing?

ALTS 1 Fund news:

We’re wrapping up the paperwork for our art acquisition.

Real Estate

Bullish News

- Mortgage rates dipped below 7% on dovish Fed speak.

- Multi-family CRE is dead. Long live Multi-family CRE!

Bearish News

- China’s banking system is collapsing, and the country’s real estate crisis could end up wiping out $4 trillion from its financial system.

- But Zhang Yadong, chairman of property developer Greentown and a man keen not to be disappeared, says an economic recovery will help trigger a turnaround in the second half of next year.

- The median asking rent in November declined 2.1% from a year before to $1,967. It’s the biggest annual drop since February 2020.

- Rents are set to continue dropping through 2024.

- Homeowners in Florida and Pennsylvania have jumped on the realtor commission lawsuit bandwagon.

- Related, National Association of Realtors membership declined 6k in one month.

- Private equity fund manager and real estate investor Grant Cardone has bad news for real estate investors.

How to invest in real estate right now:

Don’t

Startups

Bullish News

- Legal AI startup Harvey was valued at $700 after raising a round co-led by Kleiner.

- Blue Origin will begin launching spaceships again.

- High-end pet food startup The Farmer’s Dog is working with JPMorgan and other investment banks to raise hundreds of millions of dollars by early next year.

- Last week, Artis Ventures, BoxGroup, Playground Global, and Singular all closed on funds, while Partech said it was launching a €360 million venture fund.

Bearish News

- One-click checkout company Bolt is axing more staff.

- Proptech investing was off 42% YoY and 64% from 2021.

Disgracedbaseball player Alex Rodriguez is launching a SPAC.

How to invest in startups right now:

Obviously, avoid A-Rod’s SPAC.

Private Equity and Private Credit

Bullish News

- After a banner year for private credit fundraising, almost half of investors say they plan to increase their private credit allocations in 2024.

- UBS has encouraged private wealth clients to increase exposure to alts to 22% of their portfolio.

- Germany’s Bundesliga is moving forward with its €1 billion media equity sale.

Bearish News

- European PE volume was its lowest in a decade.

- Apollo is planning a private credit product with $2,500. Once the plebes get in, the market is done.

How to invest in PE and Private Credit right now:

I feel a credit bubble.

Crypto & NFTs

Here’s what you need to know:

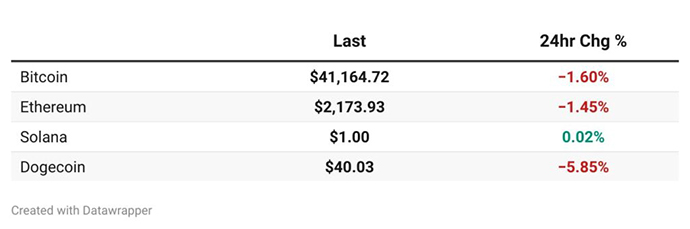

It was a tough week for crypto, but it seems to have leveled off over the weekend.

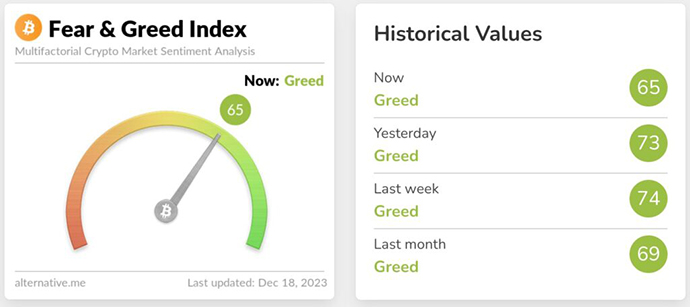

Sentiment pulled back along with prices.

As ever, NFT prices tracked Ethereum. Notably, NFTs are up 26% this year.

Bullish News

- North American investors and money managers expect the launch of spot bitcoin ETFs to drive strong institutional demand for crypto.

- Another bullish prediction for Bitcoin: $75k in 2024.

Bearish News

- US Senator Elizabeth Warren’s anti-crypto bill is gaining steam.

- Nearly $3 million worth of Bored Apes were stolen from NFT Trader. Nearly all of them were recovered.

- Venom Ventures Fund announced its arrival in January, claiming it had $1 billion to invest in web3 startups. It’s not been heard from since.

- SafeMoon filed for Chapter 7 bankruptcy on Thursday. Last month, the company’s execs were arrested on fraud, wire fraud, and money laundering charges.

How to invest in Crypto & NFTs right now:

It’s still accumulation season.

That’s all for this week

Disclosures

- This issue of Alts Cafe was brought to you by our friends at Solenic Medical.

- We hold BTC and ETH in our ALTS 1 Fund.

- There are a couple of affiliate links above. If you click them, we may get a couple of bucks.