When people hear the term “alternative investments,” they often think of stuff like artwork, wine, collectibles, etc.

(If you’ve been following us, you know the world of alternatives is much larger.)

But the way I see it, alternatives fall into two buckets:

- Modern alternatives. The fun, esoteric, tangible stuff (which used to be considered “exotic”)

- Old-school alternatives. The slightly more “boring” side of alternatives, with longer histories and reliable returns. Popular with hedge funds and institutional investors

Historically, we’ve focused on bucket #1. But as we’ve matured as a company, we’ve started to get much more serious about bucket #2.

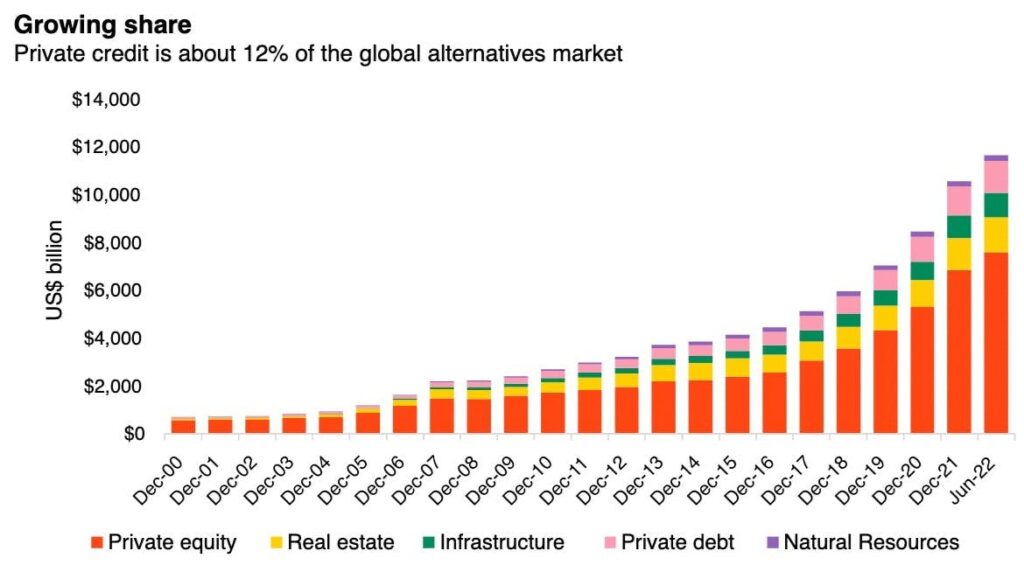

One of the biggest alternative investments in bucket #2 is private credit.

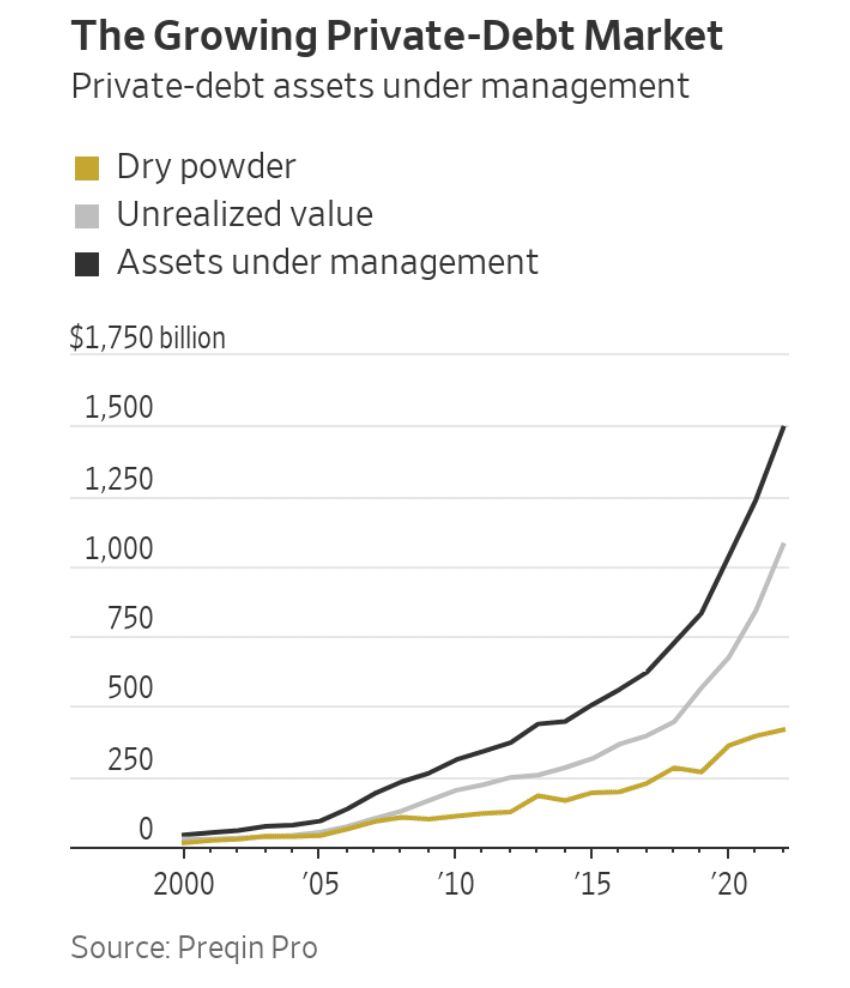

Private credit has gone from essentially non-existent in the 1970s, to a gigantic $1.3 trillion market today. But are the risks rising along with the returns?

Let’s explore 👇

Table of Contents

A golden moment for private credit

The most interesting thing about this market is what’s happening today.

The market is opening up to ordinary, retail investors for the first time ever.

It’s a golden moment. This is why Percent exists.

Percent is today’s sponsor, because they are the only platform exclusively dedicated to private credit. They provide accredited investors access to a wide variety of high-yield, short-duration offerings (9-month average).

These shorter-term investments are more responsive to current market conditions and interest rates. This means you can regularly calibrate your investments to meet your needs.

- Get as much as 20% APY and more (That’s high)

- Investment minimums as low as $500 (That’s low)

- Alts.co readers can earn up to a $500 bonus with their first investment.

Invest in private credit with Percent.

The problem with banks

Banks aren’t always that reliable.

Just in case you missed the important lesson from the Global Financial Crisis, the fact that three of the seven largest bank collapses in US history all happened this year should serve as a clear reminder.

But even though they’re not always reliable, banks are often seen as necessary to connect investors (who want to earn interest) with businesses (who need financing).

Let’s say you run a steel manufacturing company, and you need to borrow money to build a new factory.

Traditionally, you have two options to get those funds:

- Convince an investment bank to issue a bond on your behalf to the public markets, or

- Convince a commercial bank to lend you deposited money directly.

Neither of these options are simple or cheap.

In both cases, you’re actually borrowing money from investors. The bank merely serves as a conduit; a middleman.

But what if it were possible to bypass the banks entirely, and just borrow money from investors directly? 🤔

Lucky for you, (you budding Carnegie, you) the answer is yes – through what’s known as private credit.

What’s private credit all about?

Private credit is an alternative asset class where investors lend money directly to businesses (rather than through banks.) And bypassing banks significantly expands the variety of investment opportunities available.

To understand why, let’s return to our steel entrepreneur example.

As a small, growing firm, you might be plagued by poor margins and growing pains. Unfortunately, in the eyes of a bank, both of these make you an unattractive borrower. You might be able to get a loan, but the interest rate will be high.

Venture capital could be an alternative, but your company isn’t exactly a startup. You’re just trying to build a new factory. You probably don’t want to give up equity just to do it.

In this case, private credit would be an excellent option. You can get the capital you need to build the factory, and you don’t need to pay exorbitant rates to a bank or provide a pound of flesh to equity investors.

Private credit aligns the needs of both lenders and borrowers. The private credit market makes investment opportunities available that wouldn’t be possible otherwise.

Private credit tends to provide financing to smaller companies that need flexible loan structures. This means there’s a lot of room for customization here.

To really dig into private credit and understand how it works, let’s take a step back and review a short history of the asset class.

Short history of private credit

For years, banks got to pick and choose which companies got access to credit.

Sure, average investors could lend to certain companies indirectly by purchasing bonds on the secondary market. But choosing which bonds to issue (in the case of investment banks) or which firms to lend directly to (in the case of commercial banks) was totally out of investors’ hands.

Banks are conservative. They like safety. They prefer to lend to large, stable companies without complex business models or capital requirements. This makes sense, because it means their loans have terrific odds of getting paid back. But it shuts out lots of smaller companies. So for decades, banks had no real competition, and didn’t feel much pressure to change their business.

That all changed with the rise of the high-yield debt market in the 1980s. Some renegade Wall Street firms saw an opportunity for profit, and started issuing bonds from smaller and riskier firms. The credit they issued was known as junk bonds.

As the market realized these “junk bonds” could be quite profitable, investors lent more and more money (indirectly) to companies that old-school banks wouldn’t touch. Many investors earned handsome returns, while companies got access to much-needed capital.

During the early 2000s, this process evolved with the rise of securitized products. By bundling many different types of bank loans and direct lending instruments into a single security, investors once again expanded credit availability through indirect lending.

But it would take until after the 2008 crisis for the story to come full circle. With banks weaker than ever and interest rates hitting the floor, investors started lending directly to companies, bypassing banks entirely. In fact, since banks got even more regulated after 2008 (thanks to the Glass-Steagel Act), credit dried up – and private credit filled the gap.

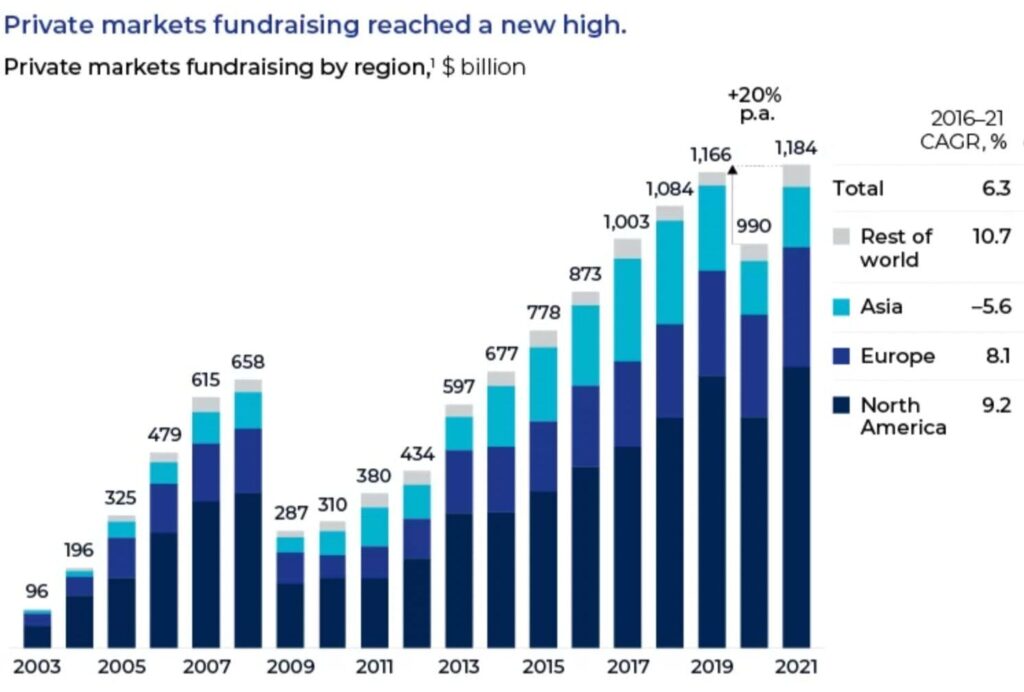

After a decade of exponential growth, the private credit market has $1.3 trillion in assets. (Compared to $4.5 trillion in assets held by hedge funds)

And for the first time, this giant market is opening up to retail investors.

What’s happening with private credit right now?

If you’ve been paying attention to the markets for the past few years, you might have noticed something pretty important: interest rates have gone up a lot.

While this has been a problem for most debt investments, the private credit market has held up remarkably well.

2022 was the worst year ever for bonds, with bond indexes dropping 13%. Some direct lending indexes (i.e., private credit indexes were up over 6%.

Now, during a credit downturn (which we are in), why would lending to smaller, riskier companies fare better than traditional lending?

It has to do with some of the unique aspects of private credit lending.

Custom lending offers protection

Lending to smaller, less-established firms is a double-edged sword. Sure, they might be riskier. But their flexibility also allows for increased loan customization which can improve investor protections.

What’s loan customization?

For example, let’s say you want to lend money to a small software business for a couple years, but you’re worried about interest rates rising in the meantime.

When rates rise, that’s usually bad for the value of existing debt. (After all, if you lend money at 5% interest, and new loans now earn 8% interest, your old loan isn’t very attractive anymore!)

But…what if you could move the interest rate up along with the market? (In what’s known as a floating interest rate)

That’s right, the interest rate risk disappears. Since the software firm you’re lending to is small, they’re more likely to be flexible in customizing the loan with a floating interest rate. This protects your investment. And this is where private credit shines.

Even for those who might not be able to negotiate floating rates, private credit has plenty of attractive short-term investment options. That includes maturities of less than a year. In certain cases, if the deal is refinanced, investors can receive principal and interest back in as little as one month.

Defaults are low (for now)

While the economy has proved surprisingly robust, there has been a recent uptick in struggling companies.

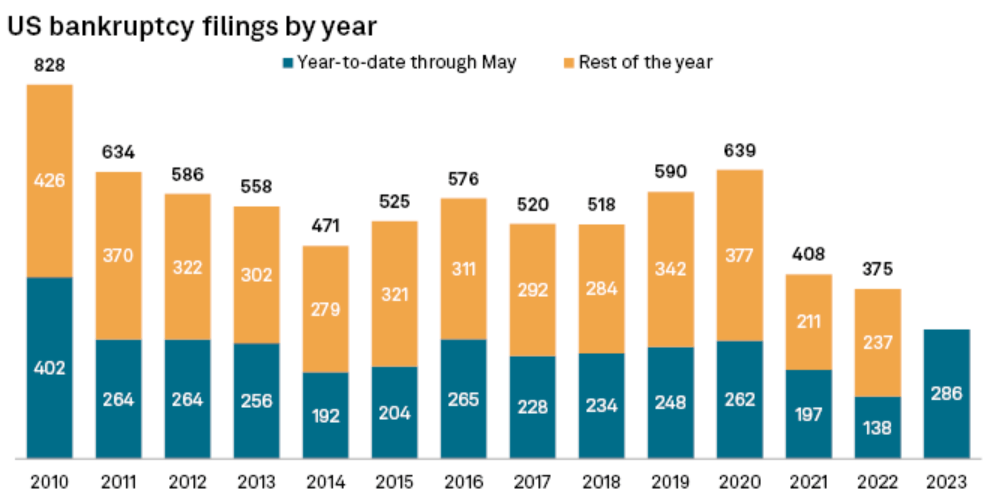

Corporate bankruptcies are currently higher this year than at any time since 2010. Since private credit sometimes deals with riskier companies, this fact might set off alarm bells.

But private credit, along with the high-yield space in general, has been more resilient than expected. Even though the price for riskier loans has shown some signs of distress, this seems to be a market overreaction.

Distress is defined by trading levels rather than fundamentals, and there have yet to be signs of widespread operational difficulties or business deterioration… Default rates are still low in high yield and leveraged loans, as well as in private credit.

One reason could be the rigorous due diligence done by investors in the private credit space. Because loans are so unique in private credit, lenders get much closer access to a firm’s accounts and management than they might in bank or public lending. This means red flags get spotted earlier, resulting in higher-quality deals being done.

Pros & cons of investing in private credit

Compared with other investment options, private credit seems really attractive right now.

Additionally, the pullback in traditional lending that started with the banking crisis in March has resulted in a huge opportunity for private credit. This is especially true with small companies, who are seeing banks tighten loan requirements like crazy.

But while high yields are certainly attractive, lending to smaller firms definitely has its drawbacks.

Pros

Higher yields

This is the main draw of private credit. We’re investing to make money, after all!

As we touched on in the last section, the market has been resilient to higher interest rates, even as other forms of debt investing have struggled.

One reason why rates are higher is the market’s lack of liquidity. It’s difficult to resell private credit loans before they mature. Investors are compensated for this lack of liquidity with a higher yield. (Liquidity and yield tend to be inversely correlated.)

Private credit returns have outclassed many comparable forms of investment. While it’s hard to get an exact overview of such an opaque industry, platforms like Percent offer yields up to 20%. (Compare that with “high-yield” bonds, which struggle to earn even half of that today.)

Customization

Since private credit deals are negotiated directly with companies, a whole host of customized features end up in these loans. Investors can basically pick and choose which loans work for them.

For instance, some investors prefer loans with floating interest rates (in case rates rise.) Others prefer a loan with an option to recall some liquidity quickly. Whatever structure you require in order to lend, chances are there’s a business that is OK with it.

Low correlation to other markets

As an alternative market, private credit has low correlation to more traditional assets. This can be seen clearly in how private credit did well during 2022 while aggregate bonds performed poorly.

Lower (perceived) volatility

Since private credit is (shocker) a private market, prices are not updated continuously like they are in public markets. This means you won’t constantly see your investments fluctuate, which should provide a smoother ride and some much-needed peace of mind.

As long as the loan is repaid, these fluctuations won’t impact your final return at all.

Of course, the risk is that the company doesn’t repay…

Cons

Riskier companies

As we’ve outlined in this piece, private credit tends to lend to smaller, less-established firms. Generally speaking, these types of businesses are riskier, and there is less certainty that investors will recoup their money.

Still, this risk is compensated for with higher yields. In addition, private credit investors can structure covenants like cash management restrictions that decrease the likelihood of default.

These unique restrictions are not feasible in public debt markets, where a high degree of uniformity is needed (and totally impossible when investing in the stock market.)

Poor liquidity

Due to the highly individual nature of the loans and the lack of a centralized marketplace, it’s hard to resell a private credit investment prior to maturity. Because investment firms can negotiate directly with businesses, it often results in a huge variety of loan structures and formats.

This illiquidity means investors earn some extra yield, but it reduces the flexibility of the asset class.

Itching to get started in private credit?

We have two excellent companies for you that are helping move the market forward.

Private credit opportunities

Percent

First up, we have Percent, a platform that is becoming a major player in private credit investing.

Percent has historically powered around $1 billion in transaction volume with a focus on high-yield, short-duration investments.

Percent offers some very attractive opportunities, with a historical average APY of 12.83% and a current weighted average APY of 18.32% (both as of July 31, 2023.)

Investment minimums for most deals are $500 (although deals are only available to accredited investors which could limit a lot of retail participation.)

Percent offers access to various loan areas, including European real estate, US merchant cash advances, and small business lending in Latin America (which has been one of the fastest-growing regions in the world in recent years). The exact deals, though, depend on what’s available on the platform at any given time.

Let’s take a look at a specific example to understand how private credit investing through Percent works 👇

This deal recently closed on Percent. In this case, the borrower (DDP Bristow) needed money to construct a new childcare center. Instead of going to the bank, DDP Bristow turned to private lending to borrow the funds.

Percent syndication participants expect to earn 14% APY in interest, with principal repayment due in December 2025. (Of course, the loan is still outstanding. When considering a deal like this, you should dig into the provided materials and data on Percent to evaluate whether loan credit makes sense.)

One reason why DDP Bristow might have turned to the private credit market is flexibility. In fact, this loan is an example of a bullet loan. And no, this doesn’t mean making an investor an offer they can’t refuse!

With a bullet loan, businesses pay back the entire principal amount in one shot at the end of the loan. In this case, DDP Bristow pays monthly interest over the life of the loan but is only responsible for repaying the principal amount when the loan matures. (This is also known as a balloon payment).

In contrast, a bank might require an amortizing loan (like most mortgages) where the principal must be repaid over time.

As you can see on the deal details, this loan was underwritten by Quiq Capital, the second company we’re highlighting.

Quiq Capital

Quiq Capital is an underwriter and loan servicer. Think of them as a company that sources, vets, and structures private credit loans on platforms like Percent.

Businesses come to Quiq Capital to secure financing. Quiq Capital will then syndicate portions of those loans on platforms like Percent. The actual process is a bit more involved, but Quiq Capital takes on the heavy lifting of identifying loans that are good credit and often generate high income.

In a nutshell, they save platforms (and investors) from having to source these investment deals on their own.

In line with the themes we’ve discussed in this issue, many firms seem to come to Quiq Capital due to frustration with borrowing from banks. This results in a win-win for investors and borrowers — more flexible capital solutions leading to more investment opportunities.

Percent and Quiq Capital play different roles, but they are working together to expand this market for retail investors.

Closing thoughts

Sure, private credit might be a bit “old school.” But fashion shows us that trends are cyclical. Sometimes, what’s old can quickly come back into style.

This is certainly the case for private credit.

Unsurprisingly, I’m a huge fan of the development of this market. For the first time ever, average investors can participate alongside hedge funds and institutions. Expect this market to get ever more crowded as the high yields draw in new eager investors.

Of course, these returns don’t come without risk. After all, lending to unqualified borrowers is what caused the ’08 crash.

Private credit looks more resilient so far, but remember: this industry is far less regulated than banks. And while lending to businesses is generally safer than lending to individuals, there are no guarantees here.

It all comes down to due diligence. Past performance is no guarantee of future results. But the safest investments are with companies with strong track records — both those who do the borrowing, and those like Percent and Quiq who bring them to market. 🤝

Further reading

- Direct lending is the largest area of private credit, but there are others

- The Mirage was the first resort that was built using junk bonds.

- A thought-provoking discussion on the risk in private lending markets

- Our recent deep dive into Quiq Capital

- Over the past year, the percentage of US banks who are tightening loan agreements has shot up

Disclosures

- This issue was sponsored by our friends at Percent

- Our ALTS 1 Fund has no private credit investments, and no investments in any companies mentioned in this issue

- I have begun doing due diligence on a personal investment with a small loan on Percent

- This issue does not contain any affiliate links