A few months ago, we published one of our most loved + shared issues: A Guide to Alternative Lending.

In that issue, we showed you some real-world examples of different companies issuing debt through Percent, and talked about the risks and rewards of each type.

As the year draws to a close, we wanted to take a “temperature check” on one of our favorite markets. In this piece, we’re breaking down five charts that best explain the state of private credit today.

This issue gets a bit deep. But this can be a terrific asset class, so we’ve made it easily digestible.

Note: This issue is sponsored by our friends at Percent. As always, we think you’ll find it informative and fair.

Let’s go 👇

Table of Contents

A golden moment for private credit 🌅

The most interesting thing about the private credit market is what’s happening today.

The market is opening up to ordinary, retail, accredited investors for the first time ever. It’s a golden moment.

Percent is today’s sponsor, because they are the only platform exclusively dedicated to private credit. They provide accredited investors access to a wide variety of high-yield, short-duration offerings (9-month average).

These shorter-term investments are generally more responsive to current market conditions and interest rates. This means you can regularly calibrate your investments to meet your needs.

- Get as much as 20% APY and more

- Investment minimums as low as $500

- Alts.co readers can earn up to a $500 bonus with their first investment

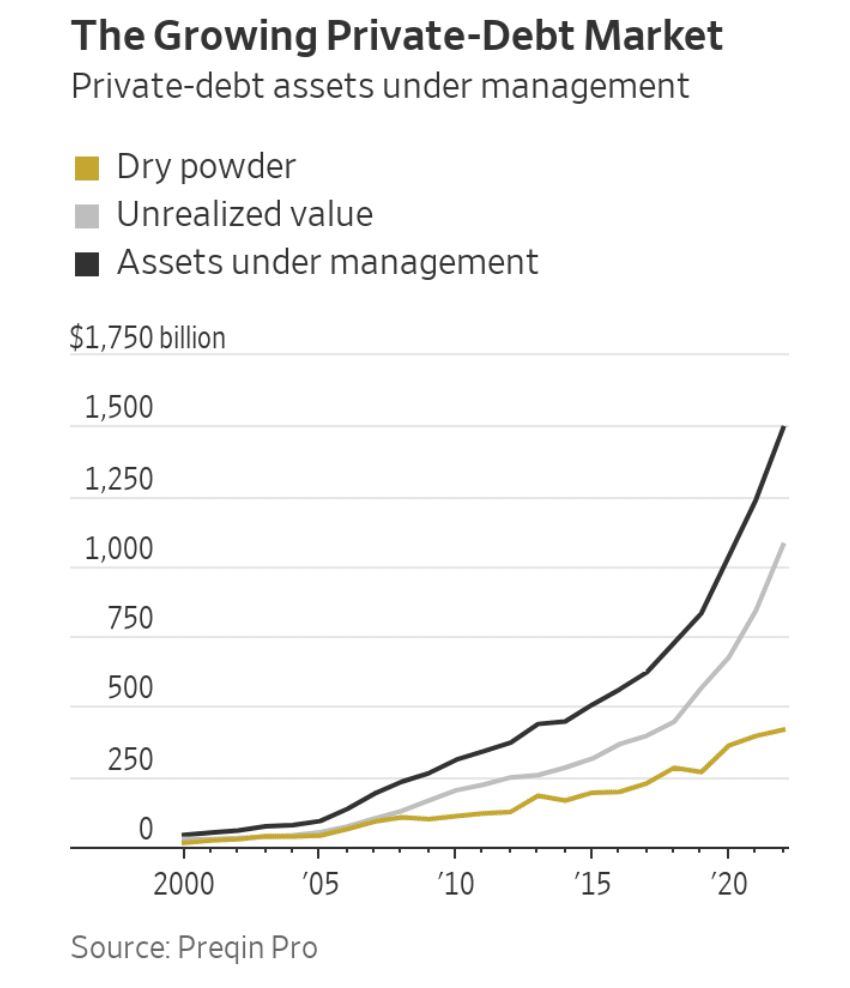

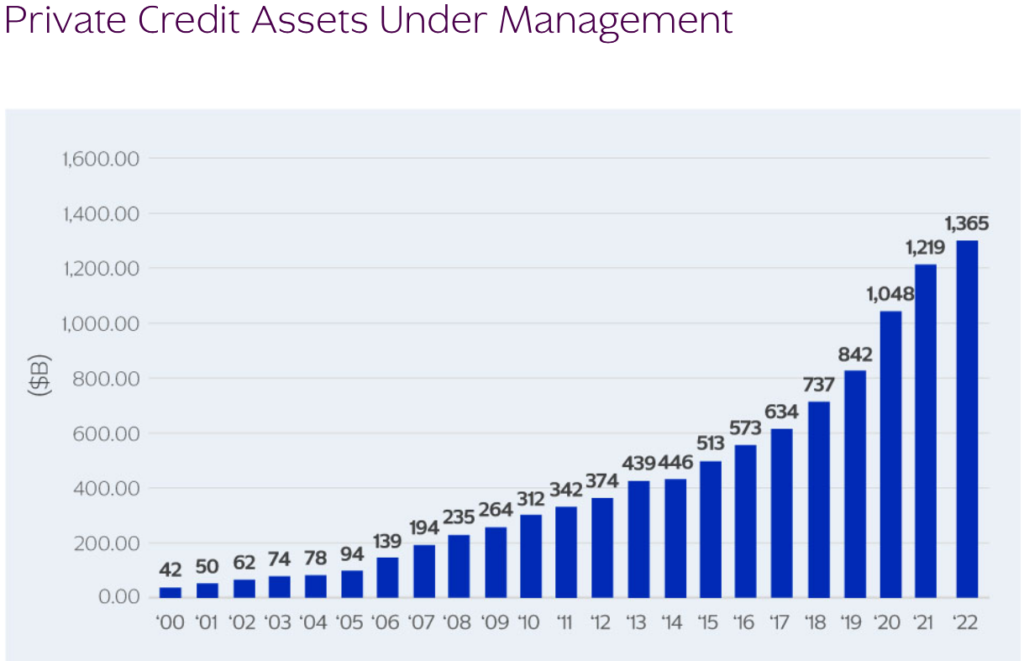

Chart #1: Private Credit has grown like crazy

Our current period has been dubbed the “golden age” of private credit for good reason. As investor money has flooded into the space, private credit has seen staggering growth.

From 2010 to 2017, private credit assets doubled to $634 billion.

Then, from 2017 to 2022, assets doubled again, reaching more than $1.3 trillion.

But why did private credit get so big?

There are two big reasons. And the name “private credit” encapsulates both of them.

It has outperformed public credit

Part of private credit’s growth is due to its nature as a private asset class.

Twenty years ago, private investments were considered an afterthought in portfolio construction. But today, they’re increasingly taking center stage.

When compared to public markets, private markets are more opaque and less liquid. Investors need to be rewarded for these inconveniences, which drives yields on private assets higher.

Private credit has historically outperformed public credit, so naturally investors have responded by shifting their allocations accordingly.

This trend is compounded by the emergence of investor-friendly platforms like Percent. Previously, private markets were the sole domain of institutional investors. But today, with the rise of innovative investment marketplaces, individuals are increasingly being given the opportunity to participate.

To be fair, these private markets are still far smaller than public ones, but they’re also growing much more quickly.

The lenders aren’t banks

Recent changes in the credit space have also played a big role.

As we discussed back in August much of the growth in private lending has come at the expense of traditional bank lending.

This is partly because banks are conservative lenders, often incapable of offering the flexible financing solutions that small-to-medium-sized firms need.

But a bigger influence has likely been post-2008 banking regulations.

In the wake of the Global Financial Crisis, new constraints on bank lending activity were implemented. Due to greater capital and liquidity requirements (most notably as part of the Basel III framework), making direct loans to businesses became less attractive.

Because private lenders aren’t banks, they face far fewer regulatory constraints!

The final iteration of post-GFC banking regulation, known ominously as “Basel III Endgame,” will likely be phased in over the next several years.

With it, even higher capital requirements will be implemented, further disincentivizing traditional bank lending.

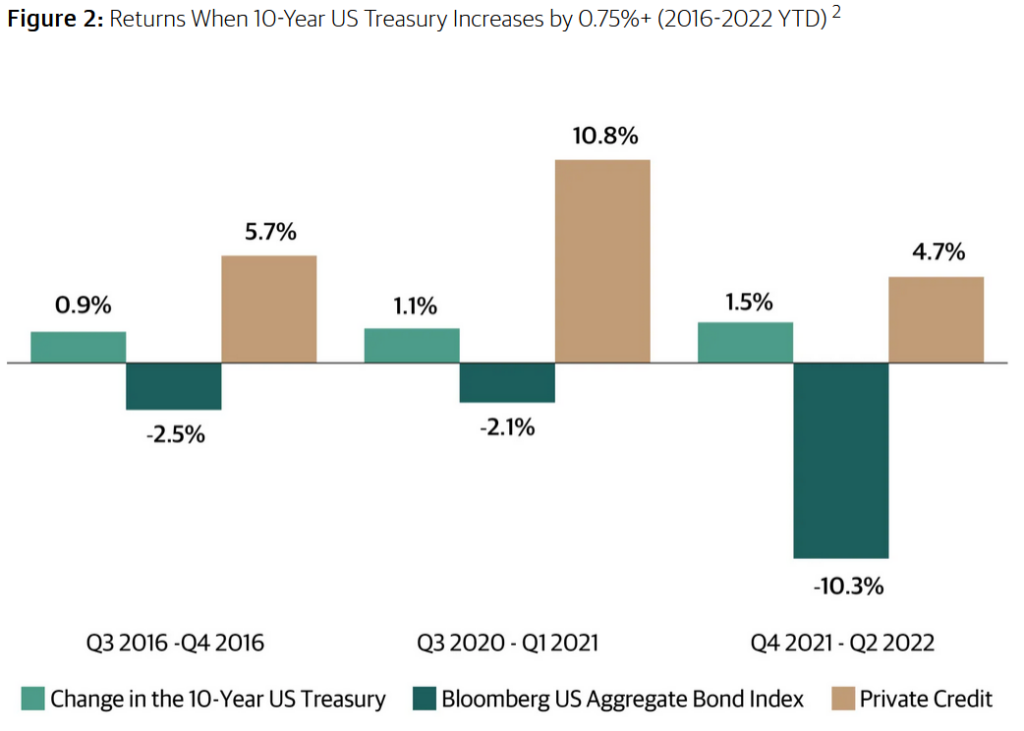

Chart #2: Rising rates are great for private credit

Over the past few years, the Fed’s aggressive interest rate increases have rocked financial markets.

As risk-free rates have gone from near-zero to over 5%, valuations on everything from equities to precious metals have experienced adjustments.

Now, in the past, conventional wisdom has said that rising rates are particularly punishing for debt instruments – but private credit shows us that this isn’t always the case. In fact, as the chart below shows, rising rates can actually be great for private credit.

There are two reasons why.

Private credit uses floating rates

The main reason that rising rates traditionally hurt debt instruments is that the coupon on the underlying investment doesn’t adjust to the new market rate.

Say you bought a bond that pays you a fixed rate of 3% per year. Well, this becomes less attractive as newer bonds pay 6% per year. The price of the 3% bond will need to fall to adjust to the new rate. Makes sense.

However, this logic breaks down if the coupon on the underlying debt rises along with the market.

This is a structure known as a floating rate, rather than a fixed rate.

This can be a double-edged sword, though. Floating rates are more challenging for companies to service their debt when rates rise. (i.e., the chances of a default go up.)

Luckily, private credit lenders can more easily help companies navigate troubled waters.

Restructuring loans is easier

When rates rise, it often becomes more expensive for companies to service existing loans and issue any new debt.

If companies can’t keep up with interest payments, they can go bankrupt – which might mean lenders don’t get paid back in full (if they get paid back at all).

As rates have risen over the past few years, debt payments are taking a greater toll, with interest coverage on newly issued loans at its lowest level since 2007. Firms are struggling, and year-to-date corporate bankruptcies have risen to their second-highest level since 2010.

But crucially, not all bankruptcies are created equal. It’s often possible for companies to work out a new payment plan with lenders in a process known as “restructuring.”

Restructuring tends to involve lenders giving up some anticipated returns to keep the indebted company from closing shop entirely. Lenders opt to take a haircut, rather than risk losing their entire investment.

This process can be much easier to navigate in private credit, since loans are typically made by a small group of creditors. Contrast this with bank lending, where loans are often syndicated to dozens of investors, all of whom will want a say in the bankruptcy process.

This direct access means that private credit has historically had lower loss ratios than high-yield fixed-income assets, despite usually lending to smaller and more vulnerable companies.

Percent, for instance, has registered a historical private credit default rate of 1.81% as of October 31. (In comparison, the trailing 12-month default rate for high-yield bonds currently sits around 3.1%.)

In a nutshell:

- When rates rise, companies may struggle more than usual

- If they struggle, restructuring the loan becomes more important than ever.

- Private credit is more conducive to restructuring than public credit

- This means lower loss ratios in private credit than in traditional lending

- And it also means comparatively higher returns for investors.

Percent is in an interesting spot here.

They play a significant role in facilitating business lending, especially for borrowers who might not have easy access to traditional bank financing.

At the same time, they are drawing lots of new attention to that market. This means demand for deals is expected to increase (from smart investors like you) and the number of deals that come online / get funded is also expected to increase as well.

It’s the flywheel effect in action. I believe strongly in the power of this particular world of alternative investing, and we are happy to be working with Percent to help bring this market to life.

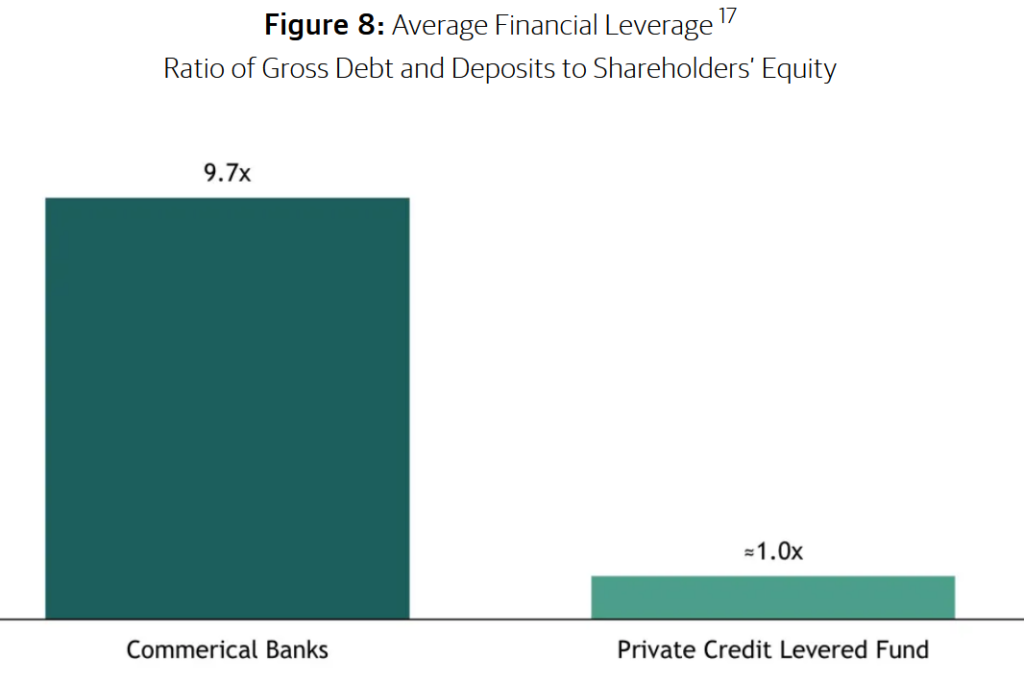

#3: Private credit uses less leverage

As private credit has grown, lots of investors and commentators have expressed concern about risks hiding in the market.

In the words of UBS Chairman Colm Kelleher, the fear is that private credit is the next debt bubble.

Given the turmoil of the past few years, this anxiety is understandable. But there’s reason to think that private credit is fundamentally less exposed to meltdown than other debt markets.

And it’s because of low leverage ratios.

Leverage just means using borrowed money to juice returns. This is the same concept as buying on margin, which is more frequently done with stocks. Buying an asset with mostly borrowed money can substantially increase returns.

Crucially, though, higher leverage also leads to higher risk. Since lenders need to get paid back regardless of how the investment performs, the investment risk is entirely concentrated among the non-borrowed funds.

Banks usually operate with enormous leverage. As the chart above indicates, banks are currently borrowing nearly $10 in debt and deposits for each $1 of their own equity. This means even a small decline in asset values can result in huge losses.

(Side note: This dynamic is exactly what we saw earlier this year with the collapse of banks like Silicon Valley Bank and First Republic. When rising rates led to investment losses, equity capital was too thin to cover the full extent of the damage, which caused a bank run.)

In comparison to traditional lenders, the private credit market uses significantly less leverage.

Further, low leverage ratios can help with the liquidity risk inherent in lending borrowed money.

As the 2023 banking crisis showed, a solvency issue can easily become a fatal liquidity issue when lenders start recalling their funds. But with enough equity capital (which can’t be recalled) liquidity events don’t have to be a death sentence.

To be clear, this is not to paint private credit as a riskless asset class! Companies can still default and leave lenders stranded.

But investors should note that the lower leverage ratios employed by private credit lenders make the type of debt disasters familiar to the world of banking much less likely to occur.

#4: Private credit adds real value

When an asset class has a history of outperformance, there are two main ways to understand that excess return.

- Higher return is because investors have taken on higher risk, which will eventually manifest as volatility or drawdowns.

- Higher return is because the market is providing real value, with investors filling a genuine financing gap that hasn’t been addressed.

These reasons aren’t mutually exclusive; if you’re outperforming benchmarks, it can be challenging to decompose that excess return into performance attributable to risk and performance attributable to value.

This dichotomy is highly relevant to private credit, an asset class that has sometimes been accused of generating outperformance simply by taking on hidden risk.

In particular, because loans are not frequently traded and therefore rarely marked-to-market, traditional volatility risk measures might not paint a full picture.

Considering that private credit often involves lending to smaller borrowers, this can be a real concern for investors. In a recent research post, JPMorgan strategists noted

the [private credit] market’s skew toward smaller borrowers (compared to the leveraged loan market) means it’s considered riskier, allowing for a potential yield premium.

Although higher risk might explain some of private credit’s performance, it’s increasingly clear that it doesn’t explain all of it.

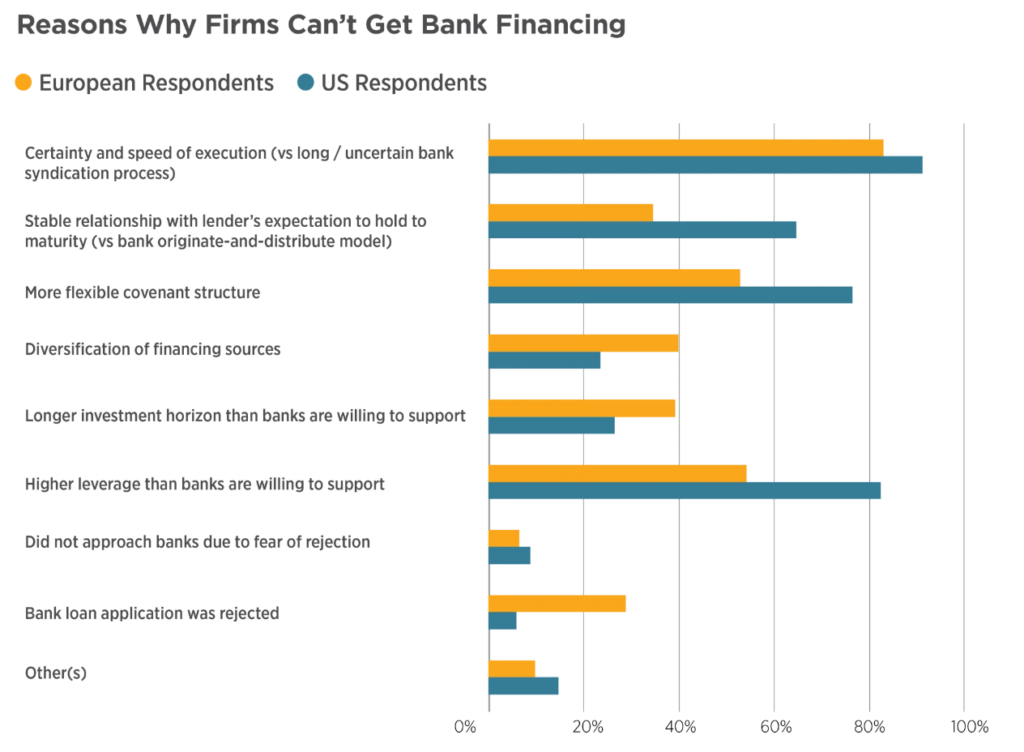

One way to see private credit’s value-add is by identifying the financing gap created by the failure of traditional lending models. As the chart below shows, this financing gap is the main reason that borrowers turn to private lenders rather than banks.

Risk-based considerations are obviously another big reason. The second biggest reason companies go to private markets is the fact that banks were unwilling to support high leverage ratios.

Banks are slow and highly regulated. In the eyes of businesses, this makes private credit a very attractive option.

#5: Private credit is going global

One of the big draws of private credit is getting exposure to borrowers that traditional lenders overlook.

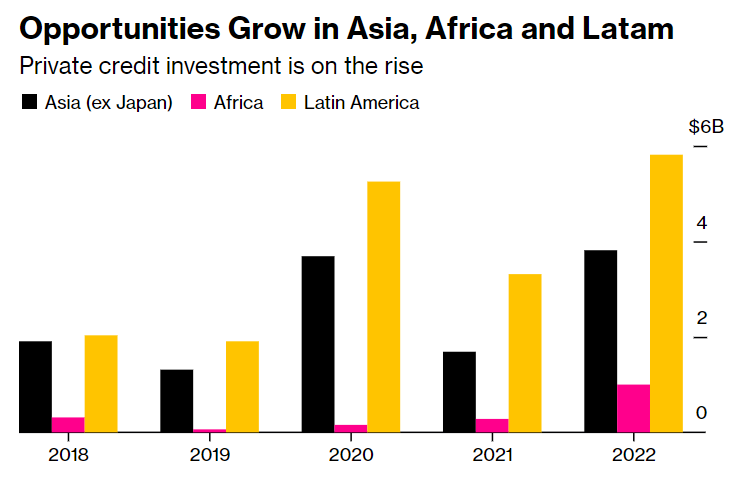

To that end, one of the most exciting trends in private credit now is the industry’s global spread.

Banks often struggle to provide financing internationally, either due to external regulatory constraints or internal compliance factors. Investment firms, on the other hand, tend to be much more willing to cross borders in pursuit of good deals.

This international exposure is important for investors because emerging markets tend to grow much more quickly than developed ones. As such, there can be ample opportunity to benefit from that high growth to generate strong returns.

It’s estimated that emerging markets already contribute nearly 75% of global growth, a figure that’s expected to increase as developed countries slow down.

One of the most economically exciting areas right now is Latin America, which has been one of the fastest-growing regions in the world. To that end, it’s no surprise that it’s one of the strongest markets for international private credit investing.

Private credit will be crucial to the region’s growth, especially due to reports that traditional lenders are pulling back from Latin America. Moreover, the diversity of lending that private credit can offer (like loans to startups or individuals) should power economic growth more than bank lending ever could.

One Mexico-based business lender, for instance, was able to lower their cost of capital by partnering with Percent to create a flexible financing program. That’s the type of deal that just wouldn’t be possible with traditional bank lending.

(Side note: We’re so excited by the opportunities in Latam that we’re organizing an investor field trip to Mexico. Five spots left. Come join us!)

See you next time, Stefan

Disclaimer from Percent

Alternative investments are speculative and possess a level of high level of risk. No assurance can be given that investors will receive a return of their capital. Those investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and those investors who cannot hold an investment an indefinite term should not invest.

Disclosures from Alts

- This issue was sponsored by Percent

- Our ALTS 1 Fund has not done any private credit or debt financing deals with Percent

- The authors of this article does not have any personal holdings with Percent

- This issue contains no affiliate links

This issue is a sponsored deep dive, meaning Alts has been paid to write an independent analysis of Percent and their associated markets. Percent has agreed to offer an unconstrained look at its business, offerings, and operations. Percent is also a sponsor of Alts, but our research is neutral and unbiased. This should not be considered financial, legal, tax, or investment advice, but rather an independent analysis to help readers make their own investment decisions. All opinions expressed here are ours, and ours alone. We hope you find it informative and fair.