Welcome to The WC — your weekly shot of awesome.

Today we’ve got:

- Student housing is at a tipping point

- Offices have already gone over the edge

- You’ll never guess which brand has generated over $5 billion in revenue

- A meteorite treasure hunt

- Korea is going to outer space

Table of Contents

The rise and fall of student housing

Six months ago, Stefan put together a fantastic briefing on the state of the student housing market.

While Covid smash hammered the industry, it’s mostly bounced back off the back of increased international enrolments. In fact, there’s not enough housing in many markets.

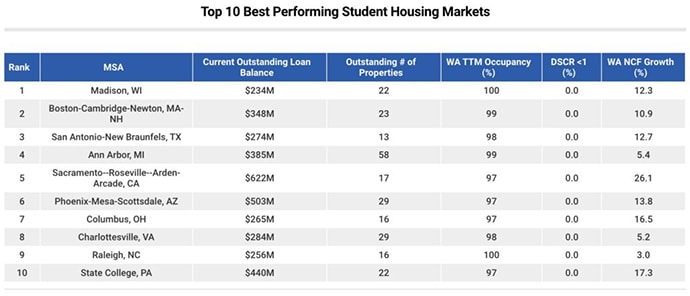

And the markets that are thriving are really full.

Each of the top ten markets has zero loans outstanding with a debt service coverage ratio (DCSR) under 1, which means there’s plenty of cash flow to support interest payments. With occupancy rates between 97% and 100% and cash flow growth rates as high as 26%, you can see why.

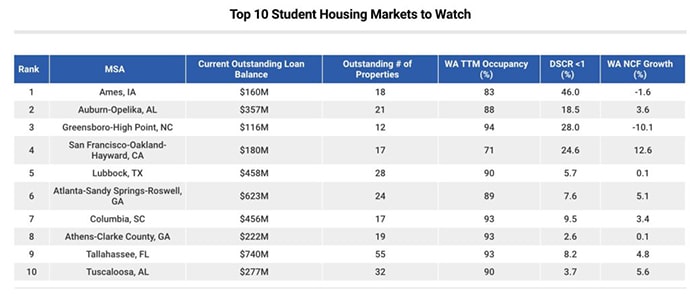

But like a lot of the US real estate market, there are losers too.

Nearly half of student housing around Iowa State University is in trouble due to overbuild during boom times. At Cal State East Bay (Hayward), freshmen enrolment was down 47% from 2015 to 2021.

Overall university enrolment in the US peaked around 2011 with over 19m students, but estimates for 2023 sit at only 14.2m. Part of that was Covid, but attendance was declining for nearly a decade before the pandemic hit. Numbers are actually up slightly since 2020 in some cases, but for many, college has just got too expensive.

There’s a lot going on under the surface, and I don’t pretend to know all the components, but the geographic spread of the universities is striking.

Eight of the ten worst performing metros are in the traditional south while only three of the best performing metros are found there.

There’s an opportunity here for someone who can figure out which universities will continue attracting students in a declining market.

Deal with it — offices are screwed

Of course it’s not just universities facing an attendance problem. It’s workplaces as well.

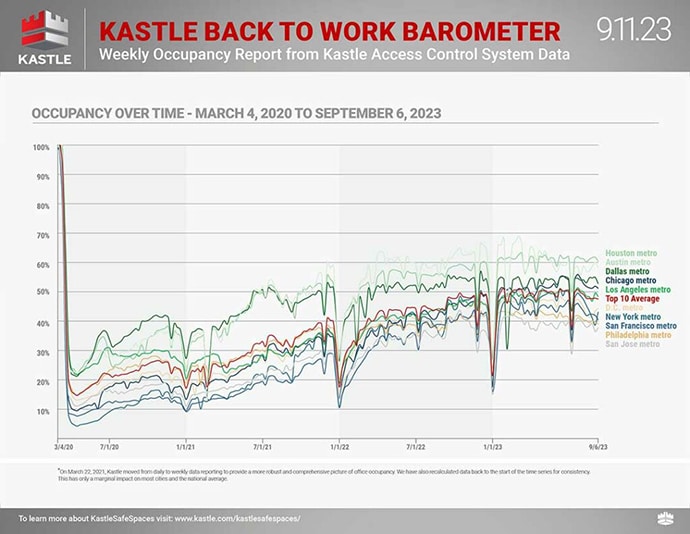

While Goldman Sachs thinks office vacancy rates will stabilise around 20% to 25% (2x pre-Covid rates), that feels optimistic.

The top ten US metros seem to have settled around 50%, and while the situation is different in smaller metros and more rural areas, estimates put 40% to 60% (by value) of commercial office space in those locations.

And because many workplaces have switched to hybrid policies, Fridays are even worse. Over 3/4 of workers stay home that day in the bay area, Philadelphia, New York, Chicago, and Washington, DC.

It’s time to accept this is here to stay in the US.

Being in the arena is dumb

ABBA, which retired 41 years ago, has generated over $5 billion worth of revenue around its brand.

According to a report by Stat Significant, the Swedish supergroup’s earnings are on par with comic book franchises and films that are both very fast and supremely furious.

And now you can watch them — or holograms of them — live in their own purpose-built London arena for around $150 per ticket.

The show, which sells out more often than not, has a seating + standing dancing capacity of 3,000, and holo ABBA puts on 30 shows per month.

You can do the maths as easily as I can, but that’s well over $150 million per year, and they’re not even in the arena.

Perhaps being in the arena is overrated.

The curious case of the missing meteorite

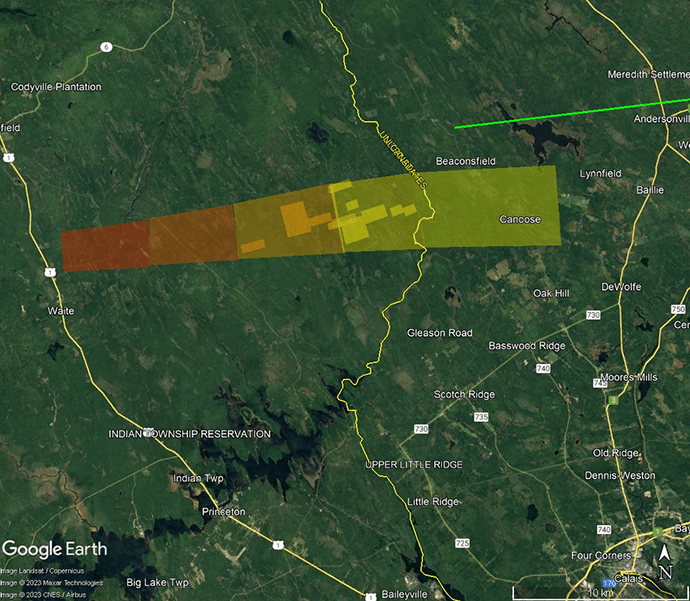

Five months ago, a fireball travelling so fast it created a sonic boom streamed to the earth in northern Maine for nearly five minutes. It sprayed more than 10kg worth of meteorites over the US – Canada border.

It’s the first time a meteorite fall has been recorded in The Pine Tree state, and a local museum put up a $25k bounty for its recovery.

But there’s a catch — it’s spread across probably 10 to 20 square miles of densely wooded land, and nearly half the strewn field estimate is in Canada.

It’s no surprise there’s such a large bounty on the space rocks. Meteorites are a big business.

Despite best efforts, no one has found any of the meteorite in five months searching, and winter is coming.

Could be this one is lost forever.

Sky rockets in flight

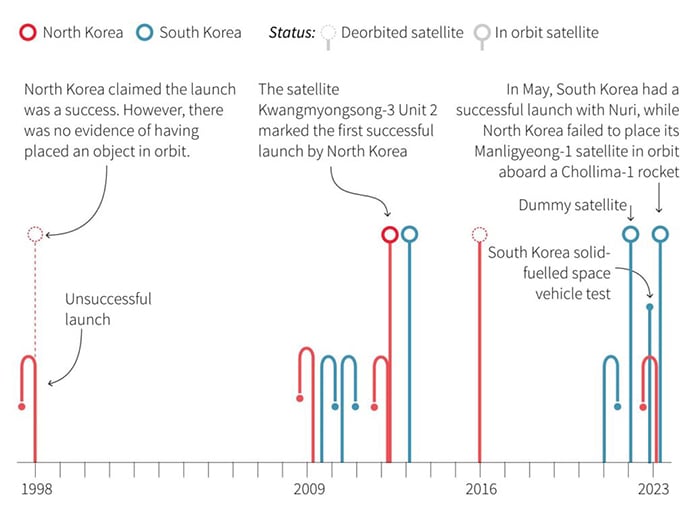

Today, Vladimir Putin and Kim Jong Un met at Russia’s Vostochny Cosmodrome to work out an arms deal.

The location and timing are notable given a recent Reuters report delving into the frantic space race between North and South Korea that’s been rumbling on for the last fifteen years.

Efforts on both sides have been mostly unsuccessful, but it seems like South Korea is getting closer to putting sustainable satellites into orbit.

Today’s meeting may have been — among other things — giving Kim a shortcut to low earth orbit in exchange for his support of Russia’s invasion of Ukraine. Neither country released details of the talks, but Kim had this to say:

“Russia has risen to a sacred fight to protect its sovereignty and security. We will always support the decisions of President Putin and the Russian leadership … and we will be together in the fight against imperialism.”

Either way, a space-capable Korean peninsula is probably bad news for everyone in the region.

That’s all for this week; I hope you enjoyed it.

Disclosures

- This issue was sponsored by our friends at Jurny.

- Our ALTS 1 Fund doesn’t have a stake in anything here.