Welcome to Inverse Cramer by Alts.co.

New here?

- See fund performance and holdings (SJIM and LJIM)

- Read past issues

- Sign up for the Inverse Cramer newsletter

Last week was a short one. JC made a bunch of buy calls, then fucked off to enjoy a 5-day weekend. (That’s 3 vacations this year already — the guy knows how to live!)

On one hand, Jim has been adamant for weeks that “we’re in a bull market.”

On the other hand, he’s starting to get cold feet about interest rates.

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 2, 2023

He says “the problem right now is the weakness is all anecdotal,” and warns that investors who think rates are peaking out right now seem too bullish to him (?!)

No real rally unless rates stabilize at ANY level!

— Jim Cramer (@jimcramer) February 28, 2023

Not sure how you square a bull market with rates that won’t stop rising “until food wages housing stop going higher.”

Please, make it make sense

Table of Contents

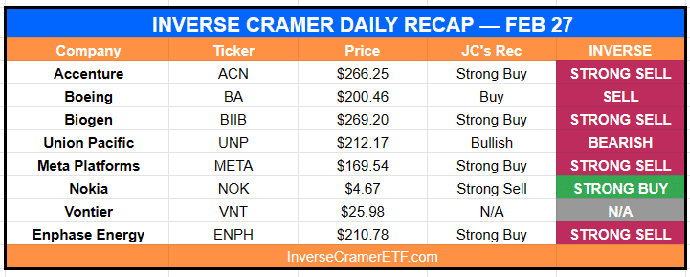

Monday Feb 27

This is their time if they don’t screw it up. – On Boeing

I think they go higher. He’s cutting back expenses, he’s gonna cut back capital expenditures, he’s doing everything he can. – On Meta

Need we remind you Jim gave up on Meta at exactly the worst possible time.

Meta is now up a remarkable 85% since Jim gave up on it. Insane. pic.twitter.com/eH1Fh5iITq

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) February 1, 2023

A rare moment when a caller asked about Vontier and Jim wasn’t familiar. Turns out they’re a mobility company.

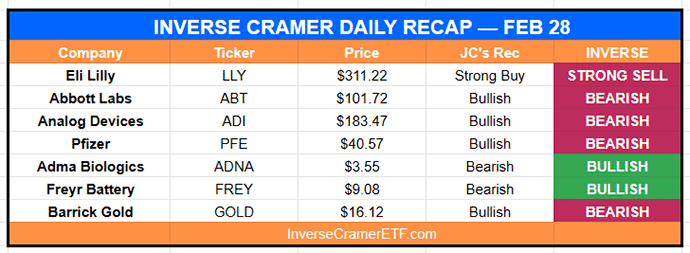

Tuesday Feb 28

It goes down everyday and is really starting to get on my nerves. I don’t care.

– On Eli Lilly

I’ve been wrong on them because the price of gold has been very bad, not because they’re bad!

– On Barrick Gold

congratz to Zoom on beating the numbers!

— Jim Cramer (@jimcramer) February 27, 2023

Congratz! Last month you said Zoom needs a merger.

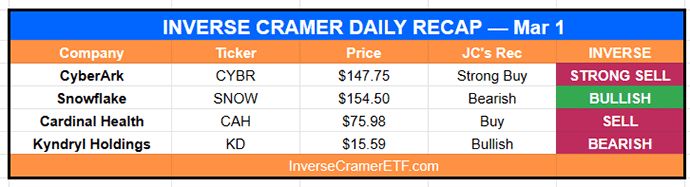

Wednesday Mar 1

It’s restructured, it’s a very good stock to own here.

-On Cardinal

Wednesday had one of the most awkward Lightning Round moments I’ve ever witnessed:

Thursday Mar 2

No calls today

Friday Mar 3

Jim telling people to buy Tesla AFTER it’s already +100% this year is why Inverse Cramer is a great strategy 😂

Could be explosive! Buy Tesla https://t.co/OWqhUYraWS

— Jim Cramer (@jimcramer) February 27, 2023

…and like clockwork:

Tesla nearly -10% since Jim said to buy just 3 days ago pic.twitter.com/67W0YNfrKz

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 2, 2023

Weekend Bonus

Cramer: buy garbage pic.twitter.com/K6IUsoUr8t

— Inverse Cramer (Not Jim Cramer) (@CramerTracker) March 1, 2023

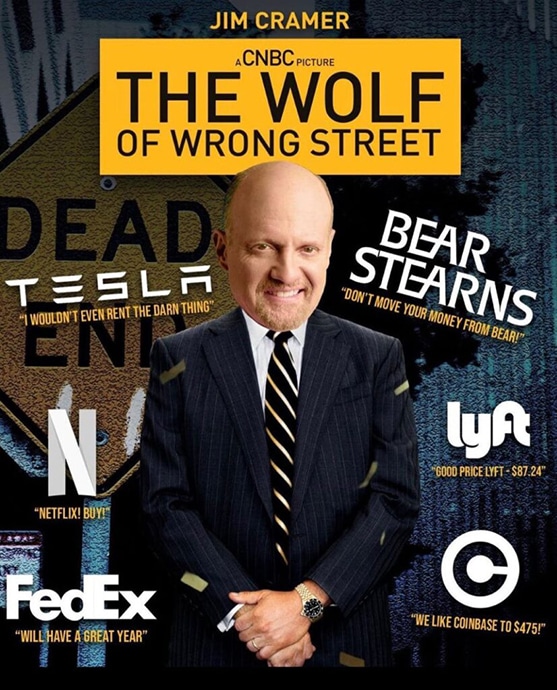

Cramer Classics

That’s a wrap. As always, we’ll be following Cramer’s every move so you can do the opposite.

Enjoy your week.

-IC