New here?

Read up on our past Crypto issues to get the most from this posts.

A special thanks this issue to our friends at Coinjar, who wrote the briefing below. I’ve edited it down slightly, but all the genius is theirs.

If you’re not familiar, CoinJar is one of the longest-running cryptocurrency exchanges in the world. Since 2013, they’ve helped more than 600,000 people worldwide buy, sell, and spend billions of dollars in Bitcoin, Ethereum, and many other cryptocurrencies.

Let’s go!

If you want more crypto goodness, make sure to check out these newsletters:

- Nifty Nest: Get the top Crypto headlines before anyone else 2x a week. Join 10,000 crypto investors and founders today, completely free.

- Crypto Nutshell: A daily 5-minute Crypto newsletter that covers on-chain data, expert predictions, and any breaking news you need to know.

- Ponder Crypto: Weekly newsletter on the latest crypto news, market analysis, opinion pieces, silly memes, and more.

- Web3 Daily: Web3 and crypto news, translated into plain English.

Ready to make the most of your crypto holdings? Then DeFi yields may be the answer you’re looking for.

Table of Contents

What are DeFi yields?

DeFi yields are simply yields you can earn through different DeFi products. Ways to earn them include:

- Staking and re-staking: Fundamentally, staking requires locking up coins to secure a network. Your rewards then depend on the inflation rate of the network. With the rise of liquid staking, it has become possible to stake assets more than once, further increasing rewards.

- Liquidity Mining (DEX): Decentralized exchanges in DeFi don’t have market makers like centralized exchanges. To still source liquidity for their market maker contracts, they encourage users to deposit crypto into so-called liquidity pools and earn a share from transaction fees. Whenever a trader uses crypto from the pool you’re invested in, you earn a percentage of their trading fees.

- Borrowing & Lending Protocols: DeFi lending and borrowing protocols connect traders looking to borrow funds with those that have spare capital. Yields depend on the demand and supply of stablecoins in the protocol.

The process of chasing the highest yields is often called yield farming. It is an advanced way of earning yields as it requires closely monitoring positions and constantly moving funds around. Since it’s highly competitive, whenever you identify a good opportunity, it won’t be long for others to learn about it and dilute the rewards pool.

Nevertheless, there are still countless opportunities to earn double-digit rewards on your crypto. Before getting into these, just a few words on Risks.

What to look for before investing

“If you don’t know where the yield is coming from, you are the yield.” If the yield can’t be explained by rewards earned from fees, protocol inflation, or short-term incentive programs, it might be best to stay away.

Check lock-up times and align them with your own risk preference. The longer the lockup period, the higher the risk that something goes wrong in the meantime. The total Value Locked in a DeFi protocol is another good indicator of the health of a service. Rewards are either indicated as APR (annual percentage rate) or APY (annual percentage yield). The only difference between the two is that the latter takes compounding into account.

Don’t invest your life savings in one DeFi protocol; have some risk management in place. With that out of the way, here are some opportunities to earn decent yields in 2023 – with a focus on web3 native products.

Bravoos Lido Staking

Bravoos is a wallet app that supports Ether and Starknet. As a newer network, Starknet is still in the phase of attracting capital, providing an excellent opportunity to earn yields – nearly 30% on staked Ether.

What you need: Ether and the Bravoos Wallet app.

All you need to do is deposit your ETH into the Braavos wallet, stake it using Staking Boost, and then confirm. The staking boost is a unique feature that increases yield from staking. The ETH you stake is pooled into a smart contract and then staked via Lido. The Lido staking token (wstETH) is then bridged to Starknet and provides liquidity to pools, earning further rewards. A major benefit of using this Starknet-based product is that it cuts fees while offering similar guarantees to Ethereum.

Rhino.fi

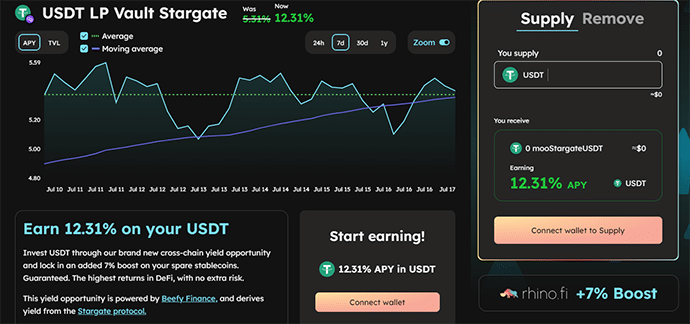

Rhino.fi calls itself the world’s best DeFi aggregator and provides a gateway to multiple chains using Layer-2 and zk technology, offering low fees and high scalability. Currently, you have access to over 500 tokens across 6 chains on Rhino, including on Ethereum, Polygon, Arbitrum, and BNB chains. Trading fees are low, sitting between 0 – 0.3%, and gas fees on its L2 are zero.

Benefits include that you can establish spending caps, as well as maintain custody over your funds at any time. The highest APY can currently be earned when pooling assets into the BLUR – ETH pool (~39%). This is followed by their short-term initiative with boosted earnings for USDT on Beefy Finance averaging around 12.31% – beating what you could earn on USD with treasuries. Note this only applies to the first $1000 you invest.

Aura.fi

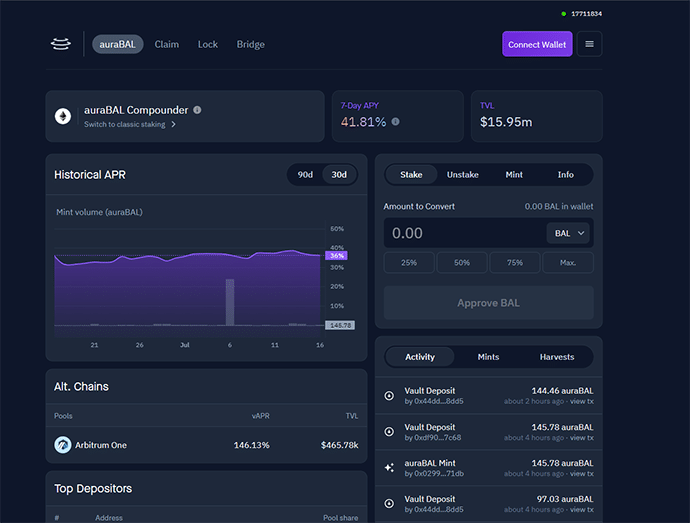

Aura’s goal is to provide the maximum incentives to boost DeFi stakeholders’ yield potential and governance power – starting with Balancer. While Balancer employs a complex gauge system that nudges people to stake to gain voting power, Aura has created an easy-to-use interface that allows traders to make the most of their stake invested.

What you need: Balancer tokens

When depositing your BAL tokens via Aura.Fi, auraBAl tokens are minted, which represent 80BAL – 20WETH locked in the Balancer voting escrow for the maximum amount of time. Stake these, and you’ll receive rewards from Balancer and a share of any Balancer earned by Aura. Because Aura already holds veBAL, anyone staking through them benefits from the rewards boosts these tokens offer.

The current 7-day APY for staking your BAL with Aura is 41.81%, and over $15 million are already staked.

SushiSwap

SushiSwap is a DEX that recently launched concentrated liquidity pools with its V3 to boost capital efficiency for liquidity providers.

As a result, LPs can expect better rewards, while traders will benefit from lower slippage and more accurate trade execution.

While there are some pools with crazy high APR, they tend to have low TVL and low volume. Here are a few pools worth checking out:

- Moon/ETH with a 72.45% APR. Note that this might be a short-term high APR pool as TVL is still fairly low, yet liquidity, volumes, and fees have been increasing over the past few days. For the more risk-affine traders.

- USDC/ETH with a 27.80% APR, including farm rewards paid out in SUSHI tokens. The benefit of this pool is that both tokens are rather established and unlikely to go to zero anytime soon. If Ethereum gas is too expensive for you, you can also use the same pool on Arbitrum.

- SUSHI/ETH has a 108% APR, but it’s worth remembering that both tokens in this pool are volatile.

Yieldmos

Yieldmos is a DeFi protocol offering automated yield strategies to save traders time while boosting their yields. This is achieved through automatically compounding rewards, which increases the rewards earned. Traders maintain custody over their funds at all times in this non-custodial protocol. Founded in 2022, Yieldmos has quickly grown into a popular Cosmos dApp supporting over 30 chains.

As of now, the protocol doesn’t charge any fees for their services.

What you need: Meta Mask or Cosmos Wallet like Keplr, and Cosmos tokens like OSMO, Juno, or whichever else you want to earn rewards on.

After connecting, you can pick different strategies, such as the yield optimizer, which automatically compounds rewards for staking, making it the most profitable. Depending on your risk aversion, you can pick a high APR with a less established chain, such as FLIX (projected APY of 337%), or go with less earnings on a more established chain like Juno (projected APY of 36%)

Even though DeFi summer might be over, there are still decent opportunities to earn rewards on your crypto. When picking more risky pools, be sure to keep an eye on the price of the assets pooled in them. You wouldn’t want to earn a high APR on a token that’s depreciating faster than you earn rewards.

Good luck, and happy exploring!

Thanks again to our friends at CoinJar, who put together this briefing for us. Make sure to check them out.

That’s it for this week’s Crypto Insider. Did you find it useful?

If you have any questions or would like to discuss anything about this issue (or about crypto/NFTs in general), feel free to respond to this email. We read everything, as always.

Thanks,

Wyatt

DISCLOSURES

Our ALTS 1 fund is long Bitcoin and ETH.